|

Mu'amalat

''Muamalat'' (also ''muʿāmalāt,'' ar, , literally "transactions" TBE, "CHAPTER A1, INTRODUCTION TO ISLAMIC MUAMALAT", 2012: p.6 or "dealings") is a part of Islamic jurisprudence, or ''fiqh''. Sources agree that ''muamalat'' includes Islamic "rulings governing commercial transactions" and Majallah al-Ahkam al-Adliyyah). JALIL, et. al., ''FOUR INTRODUCTORY THEORIES OF FIQH MUAMALAT'': p.8 However, other sources (Oxford Islamic Studies Online, Brian Kettell, and Wahbah al-Zuhayli’) give it a broader definition including civil acts and in general all aspects of fiqh that are not ''Ibadat'' (acts of ritual worship such as prayer or fasting). (See organizational chart of the structure of Islam below in "Principles" section.) Chik, ''Shariah in Islamic Finance'': p.5 Lee, "Islamic Banking Law", 2015: p.29 ''Mu'amalat'' provides much of the basis for Islamic economics, and the instruments of Islamic financing, and deals not only with Islamic legality but also social and econ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Islamic Economics

Islamic economics ( ar, الاقتصاد الإسلامي) refers to the knowledge of economics or economic activities and processes in terms of Islamic principles and teachings. Islam has a set of special moral norms and values about individual and social economic behavior. Therefore, it has its own economic system, which is based on its philosophical views and is compatible with the Islamic organization of other aspects of human behavior: social and political systems. Is a term used to refer to Islamic commercial jurisprudence ( ar, فقه المعاملات, '' fiqh al-mu'āmalāt''), and also to an ideology of economics based on the teachings of Islam that is mostly similar to the labour theory of value, which is "labour-based exchange and exchange-based labour".. Islamic commercial jurisprudence entails the rules of transacting finance or other economic activity in a '' Shari'a'' compliant manner, i.e., a manner conforming to Islamic scripture (Quran and sunnah). Islamic ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Maqasid

''Maqasid'' ( ar, مقاصد, lit. goals, purposes) or ''maqāṣid al-sharīʿa'' (goals or objectives of ''sharia'') is an Islamic legal doctrine. Together with another related classical doctrine, '' maṣlaḥa'' (welfare or public interest), it has come to play an increasingly prominent role in modern times. The notion of ''maqasid'' was first clearly articulated by al-Ghazali (d. 1111), who argued that ''maslaha'' was God's general purpose in revealing the divine law, and that its specific aim was preservation of five essentials of human well-being: religion, life, intellect, lineage, and property. Although most classical-era jurists recognized ''maslaha'' and ''maqasid'' as important legal principles, they held different views regarding the role they should play in Islamic law. Some jurists viewed them as auxiliary rationales constrained by scriptural sources (Quran and hadith) and ''qiyas'' (analogical reasoning). Others regarded them as an independent source of law, whose ge ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Arabic Words And Phrases

Arabic (, ' ; , ' or ) is a Semitic language spoken primarily across the Arab world.Semitic languages: an international handbook / edited by Stefan Weninger; in collaboration with Geoffrey Khan, Michael P. Streck, Janet C. E.Watson; Walter de Gruyter GmbH & Co. KG, Berlin/Boston, 2011. Having emerged in the 1st century, it is named after the Arab people; the term "Arab" was initially used to describe those living in the Arabian Peninsula, as perceived by geographers from ancient Greece. Since the 7th century, Arabic has been characterized by diglossia, with an opposition between a standard prestige language—i.e., Literary Arabic: Modern Standard Arabic (MSA) or Classical Arabic—and diverse vernacular varieties, which serve as mother tongues. Colloquial dialects vary significantly from MSA, impeding mutual intelligibility. MSA is only acquired through formal education and is not spoken natively. It is the language of literature, official documents, and formal written medi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Islamic Practices

Islam (; ar, ۘالِإسلَام, , ) is an Abrahamic monotheistic religion centred primarily around the Quran, a religious text considered by Muslims to be the direct word of God (or ''Allah'') as it was revealed to Muhammad, the main and final Islamic prophet.Peters, F. E. 2009. "Allāh." In , edited by J. L. Esposito. Oxford: Oxford University Press. . (See alsoquick reference) " e Muslims' understanding of Allāh is based...on the Qurʿān's public witness. Allāh is Unique, the Creator, Sovereign, and Judge of mankind. It is Allāh who directs the universe through his direct action on nature and who has guided human history through his prophets, Abraham, with whom he made his covenant, Moses/Moosa, Jesus/Eesa, and Muḥammad, through all of whom he founded his chosen communities, the 'Peoples of the Book.'" It is the world's second-largest religion behind Christianity, with its followers ranging between 1-1.8 billion globally, or around a quarter of the world's pop ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Islamic Banking

Islamic banking, Islamic finance ( ar, مصرفية إسلامية), or Sharia-compliant finance is banking or financing activity that complies with Sharia (Islamic law) and its practical application through the development of Islamic economics. Some of the modes of Islamic banking/finance include ''Mudarabah'' (profit-sharing and loss-bearing), ''Wadiah'' (safekeeping), ''Musharaka'' (joint venture), ''Murabahah'' (cost-plus), and ''Ijara'' ( leasing). Sharia prohibits ''riba'', or usury, defined as interest paid on all loans of money (although some Muslims dispute whether there is a consensus that interest is equivalent to ''riba''). Investment in businesses that provide goods or services considered contrary to Islamic principles (e.g. pork or alcohol) is also ''haram'' ("sinful and prohibited"). These prohibitions have been applied historically in varying degrees in Muslim countries/communities to prevent un-Islamic practices. In the late 20th century, as part of the revi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

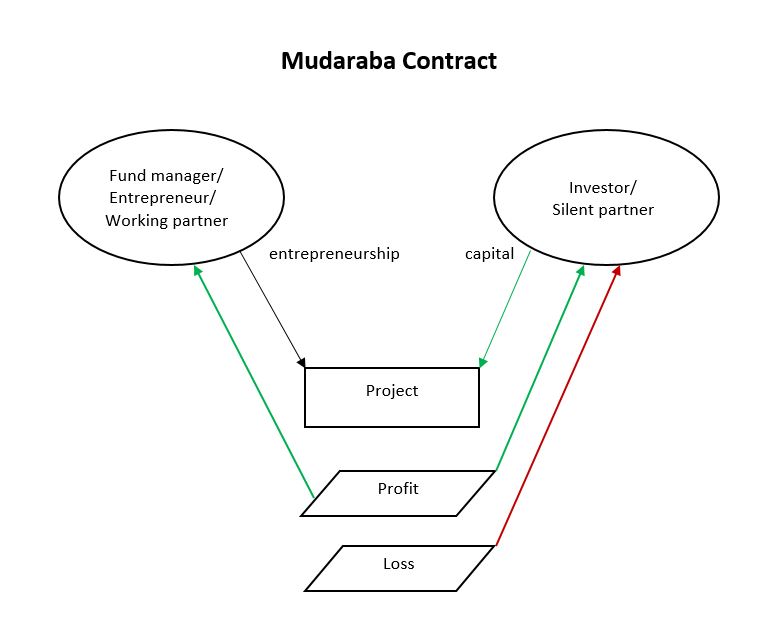

Profit And Loss Sharing

Profit and Loss Sharing (also called PLS or participatory banking) refers to Sharia-compliant forms of equity financing such as mudarabah and musharakah. These mechanisms comply with the religious prohibition on interest on loans that most Muslims subscribe to. ''Mudarabah'' (مضاربة) refers to "trustee finance" or passive partnership contract, while ''Musharakah'' (مشاركة or مشركة) refers to equity participation contract. Other sources include sukuk (also called "Islamic bonds") and direct equity investment (such as purchase of common shares of stock) as types of PLS. Khan, ''Islamic Banking in Pakistan'', 2015: p.91 The profits and losses shared in PLS are those of a business enterprise or person which/who has obtained capital from the Islamic bank/financial institution (the terms "debt", "borrow", "loan" and "lender" are not used). As financing is repaid, the provider of capital collects some agreed upon percentage of the profits (or deducts if there are losses) ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Murabahah

''Murabaḥah'', ''murabaḥa'', or ''murâbaḥah'' ( ar, مرابحة, derived from ''ribh'' ar, ربح, meaning profit) was originally a term of ''fiqh'' (Islamic jurisprudence) for a sales contract where the buyer and seller agree on the markup (profit) or "cost-plus" price for the item(s) being sold. In recent decades it has become a term for a very common form of Islamic (i.e., "shariah compliant") financing, where the price is marked up in exchange for allowing the buyer to pay over time—for example with monthly payments (a contract with deferred payment being known as ''bai-muajjal''). ''Murabaha'' financing is similar to a rent-to-own arrangement in the non-Muslim world, with the intermediary (e.g., the lending bank) retaining ownership of the item being sold until the loan is paid in full. There are also Islamic investment funds and ''sukuk'' (Islamic bonds) that use ''murabahah'' contracts. Jamaldeen, ''Islamic Finance For Dummies'', 2012:188-9, 220-1 The purpose o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gharar

''Gharar'' ( ar, غرر) literally means uncertainty, hazard, chance or risk. It is a negative element in ''mu'amalat'' ''fiqh'' (transactional Islamic jurisprudence), like ''riba'' (usury) and '' maysir'' (gambling). One Islamic dictionary (''A Concise Dictionary of Islamic Terms'') describes it as "the sale of what is not present" — such as fish not yet caught, crops not yet harvested. Similarly, author Muhammad Ayub says that "in the legal terminology of jurists", ''gharar'' is "the sale of a thing which is not present at hand, or the sale of a thing whose ''aqibah'' (consequence) is not known, or a sale involving hazard in which one does not know whether it will come to be or not". Definitions, fiqh According to Sami Al-Suwailem, "researchers in Islamic finance" do not agree on the "precise meaning" of gharar, although there is not necessarily great difference among the Islamic schools of jurisprudence (madhab) in the term's definition. The ''Hanafi'' legal school defines ' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Maisir

In Islam, gambling ( ar, ميسر, translit=maisîr, maysir, maisira or ''qimâr'') is absolutely forbidden ( ar, harām, script=Latn). ''Maisir'' is totally prohibited by Islamic law (''shari'a'') on the grounds that "the agreement between participants is based on immoral inducement provided by entirely wishful hopes in the participants' minds that they will gain by mere chance, with no consideration for the possibility of loss". Definitions Both ''qimar'' and ''maisir'' refer to games of chance, but ''qimar'' is a kind (or subset) of ''maisir''. Author Muhammad Ayub defines ''maisir'' as "wishing something valuable with ease and without paying an equivalent compensation for it or without working for it, or without undertaking any liability against it by way of a game of chance", Another source, Faleel Jamaldeen, defines it as "the acquisition of wealth by chance (not by effort)". Ayub defines ''qimar'' as "also mean ngreceipt of money, benefit or usufruct at the cost of othe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Riba

The Royal Institute of British Architects (RIBA) is a professional body for architects primarily in the United Kingdom, but also internationally, founded for the advancement of architecture under its royal charter granted in 1837, three supplemental charters and a new charter granted in 1971. Founded as the Institute of British Architects in London in 1834, the RIBA retains a central London headquarters at 66 Portland Place as well as a network of regional offices. Its members played a leading part in promotion of architectural education in the United Kingdom; the RIBA Library, also established in 1834, is one of the three largest architectural libraries in the world and the largest in Europe. The RIBA also played a prominent role in the development of UK architects' registration bodies. The institute administers some of the oldest architectural awards in the world, including RIBA President's Medals Students Award, the Royal Gold Medal, and the Stirling Prize. It also manages ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Haram

''Haram'' (; ar, حَرَام, , ) is an Arabic term meaning 'Forbidden'. This may refer to either something sacred to which access is not allowed to the people who are not in a state of purity or who are not initiated into the sacred knowledge; or, in direct contrast, to an evil and thus "sinful action that is forbidden to be done". The term also denotes something "set aside", thus being the Arabic equivalent of the Hebrew concept he, , ḥērem, label=none and the concept of (cf. sacred) in Roman law and religion. In Islamic jurisprudence, ''haram'' is used to refer to any act that is forbidden by God and is one of the five Islamic commandments ( ar, الأحكام الخمسة, al-ʾAḥkām al-Ḵamsa) that define the morality of human action. Acts that are haram are typically prohibited in the religious texts of the Quran, and the category of haram is the highest status of prohibition. If something is considered haram, it remains prohibited no matter how good the i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)