|

Motus, LLC

Motus is a workforce management company headquartered in Boston, Massachusetts, that offers vehicle reimbursement, fleet management and business intelligence solutions. This includes mileage reimbursement, BYO programs, Managed Mobility Services and living cost intelligence. Motus supplies the Internal Revenue Service (IRS) with data on business vehicle use to inform the business mileage reimbursement rate. History Motus was founded in 2004 as Corporate Reimbursement Services, Inc. (CRS) by Gregg Darish, and changed its name to Motus in 2014. Craig Powell (businessman and entrepreneur) led the Company for 9 years through accelerated growth. He retired from his role as the President and CEO in January of 2022, after scaling the business from roughly $10 million in revenues to $150M and selling the business. He currently serves as an advisor to the Board of Directors. In August 2014, Motus released an integration with American cloud computing company Salesforce.com to in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Boston

Boston (), officially the City of Boston, is the state capital and most populous city of the Commonwealth of Massachusetts, as well as the cultural and financial center of the New England region of the United States. It is the 24th- most populous city in the country. The city boundaries encompass an area of about and a population of 675,647 as of 2020. It is the seat of Suffolk County (although the county government was disbanded on July 1, 1999). The city is the economic and cultural anchor of a substantially larger metropolitan area known as Greater Boston, a metropolitan statistical area (MSA) home to a census-estimated 4.8 million people in 2016 and ranking as the tenth-largest MSA in the country. A broader combined statistical area (CSA), generally corresponding to the commuting area and including Providence, Rhode Island, is home to approximately 8.2 million people, making it the sixth most populous in the United States. Boston is one of the oldest ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

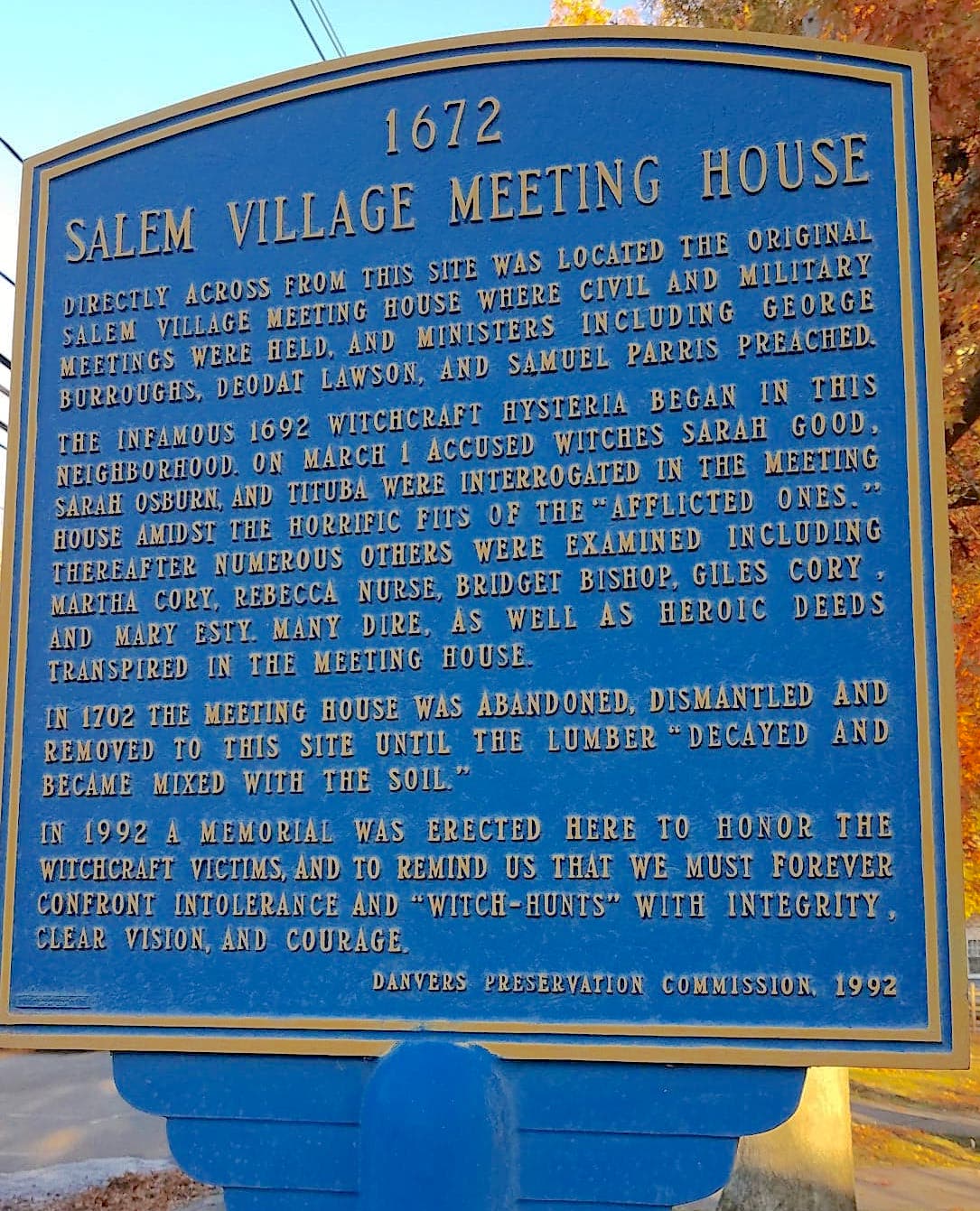

Danvers, Massachusetts

Danvers is a town in Essex County, Massachusetts, United States, located on the Danvers River near the northeastern coast of Massachusetts. The suburb is a fairly short ride from Boston and is also in close proximity to the renowned beaches of Gloucester and Revere. Originally known as Salem Village, the town is most widely known for its association with the 1692 Salem witch trials. It was also the site of Danvers State Hospital, one of the state's 19th-century psychiatric hospitals. Danvers is a local center of commerce, hosting many car dealerships and the Liberty Tree Mall. As of the 2020 United States Census, the town's population was 28,087. History Pre-Columbian era The area was long settled by indigenous cultures of Native Americans. In the historic period, the Massachusett, a tribe of the Pequot language family, dominated the area. The land that is now Danvers was once owned by the Naumkeag branch of the Massachusett tribe. Salem Village Around 1630, English colonists im ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

2018 Mergers And Acquisitions

Eighteen or 18 may refer to: * 18 (number), the natural number following 17 and preceding 19 * one of the years 18 BC, AD 18, 1918, 2018 Film, television and entertainment * ''18'' (film), a 1993 Taiwanese experimental film based on the short story ''God's Dice'' * ''Eighteen'' (film), a 2005 Canadian dramatic feature film * 18 (British Board of Film Classification), a film rating in the United Kingdom, also used in Ireland by the Irish Film Classification Office * 18 (''Dragon Ball''), a character in the ''Dragon Ball'' franchise * "Eighteen", a 2006 episode of the animated television series ''12 oz. Mouse'' Music Albums * ''18'' (Moby album), 2002 * ''18'' (Nana Kitade album), 2005 * '' 18...'', 2009 debut album by G.E.M. Songs * "18" (5 Seconds of Summer song), from their 2014 eponymous debut album * "18" (One Direction song), from their 2014 studio album ''Four'' * "18", by Anarbor from their 2013 studio album '' Burnout'' * "I'm Eighteen", by Alice Cooper commonly ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Software Companies Based In Massachusetts

Software is a set of computer programs and associated software documentation, documentation and data (computing), data. This is in contrast to Computer hardware, hardware, from which the system is built and which actually performs the work. At the low level language, lowest programming level, executable code consists of Machine code, machine language instructions supported by an individual Microprocessor, processor—typically a central processing unit (CPU) or a graphics processing unit (GPU). Machine language consists of groups of Binary number, binary values signifying Instruction set architecture, processor instructions that change the state of the computer from its preceding state. For example, an instruction may change the value stored in a particular storage location in the computer—an effect that is not directly observable to the user. An instruction System call, may also invoke one of many Input/output, input or output operations, for example displaying some text on ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Human Resource Management Software

Humans (''Homo sapiens'') are the most abundant and widespread species of primate, characterized by bipedalism and exceptional cognitive skills due to a large and complex brain. This has enabled the development of advanced tools, culture, and language. Humans are highly social and tend to live in complex social structures composed of many cooperating and competing groups, from families and kinship networks to political states. Social interactions between humans have established a wide variety of values, social norms, and rituals, which bolster human society. Its intelligence and its desire to understand and influence the environment and to explain and manipulate phenomena have motivated humanity's development of science, philosophy, mythology, religion, and other fields of study. Although some scientists equate the term ''humans'' with all members of the genus ''Homo'', in common usage, it generally refers to ''Homo sapiens'', the only extant member. Anatomically modern huma ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Business Software Companies

Business is the practice of making one's living or making money by producing or buying and selling products (such as goods and services). It is also "any activity or enterprise entered into for profit." Having a business name does not separate the business entity from the owner, which means that the owner of the business is responsible and liable for debts incurred by the business. If the business acquires debts, the creditors can go after the owner's personal possessions. A business structure does not allow for corporate tax rates. The proprietor is personally taxed on all income from the business. The term is also often used colloquially (but not by lawyers or by public officials) to refer to a company, such as a corporation or cooperative. Corporations, in contrast with sole proprietors and partnerships, are a separate legal entity and provide limited liability for their owners/members, as well as being subject to corporate tax rates. A corporation is more complicated and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Companies Based In Boston

A company, abbreviated as co., is a legal entity representing an association of people, whether natural, legal or a mixture of both, with a specific objective. Company members share a common purpose and unite to achieve specific, declared goals. Companies take various forms, such as: * voluntary associations, which may include nonprofit organizations * business entities, whose aim is generating profit * financial entities and banks * programs or educational institutions A company can be created as a legal person so that the company itself has limited liability as members perform or fail to discharge their duty according to the publicly declared incorporation, or published policy. When a company closes, it may need to be liquidated to avoid further legal obligations. Companies may associate and collectively register themselves as new companies; the resulting entities are often known as corporate groups. Meanings and definitions A company can be defined as an "artificial per ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Software Companies Established In 2004

Software is a set of computer programs and associated documentation and data. This is in contrast to hardware, from which the system is built and which actually performs the work. At the lowest programming level, executable code consists of machine language instructions supported by an individual processor—typically a central processing unit (CPU) or a graphics processing unit (GPU). Machine language consists of groups of binary values signifying processor instructions that change the state of the computer from its preceding state. For example, an instruction may change the value stored in a particular storage location in the computer—an effect that is not directly observable to the user. An instruction may also invoke one of many input or output operations, for example displaying some text on a computer screen; causing state changes which should be visible to the user. The processor executes the instructions in the order they are provided, unless it is instructed to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

2004 Establishments In Massachusetts

4 (four) is a number, numeral and digit. It is the natural number following 3 and preceding 5. It is the smallest semiprime and composite number, and is considered unlucky in many East Asian cultures. In mathematics Four is the smallest composite number, its proper divisors being and . Four is the sum and product of two with itself: 2 + 2 = 4 = 2 x 2, the only number b such that a + a = b = a x a, which also makes four the smallest squared prime number p^. In Knuth's up-arrow notation, , and so forth, for any number of up arrows. By consequence, four is the only square one more than a prime number, specifically three. The sum of the first four prime numbers two + three + five + seven is the only sum of four consecutive prime numbers that yields an odd prime number, seventeen, which is the fourth super-prime. Four lies between the first proper pair of twin primes, three and five, which are the first two Fermat primes, like seventeen, which is the third. On the other hand, t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Vehicle Miles Traveled Tax

A vehicle miles traveled tax, also frequently referred to as a VMT tax, VMT fee, mileage-based fee, or road user charge, is a policy of charging motorists based on how many miles they have traveled. It has been proposed in various states in the United States including Illinois who are currently following through with implementing this tax, and elsewhere as an infrastructure funding mechanism to replace, or supplement the fuel tax, which has been generating billions less in revenue each year due to increasingly fuel efficient vehicles. In the United States, a VMT fee currently exists as part of a limited program for 5,000 volunteers in Oregon and for trucks in Illinois. Internationally, Germany, Austria, Slovakia, the Czech Republic, Poland, Hungary, Belgium, Russia and Switzerland have implemented various forms of VMT fees, limited to trucks. New Zealand also has such a system applying to all heavy vehicles and diesel-powered cars, known locally as a Road User Charge. Bulgaria ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Deduction

Tax deduction is a reduction of income that is able to be taxed and is commonly a result of expenses, particularly those incurred to produce additional income. Tax deductions are a form of tax incentives, along with exemptions and tax credits. The difference between deductions, exemptions, and credits is that deductions and exemptions both reduce taxable income, while credits reduce tax. Above and below the line Above and below the line refers to items above or below adjusted gross income, which is item 37 on the tax year 2017 1040 tax form. Tax deductions above the line lessen adjusted gross income, while deductions below the line can only lessen taxable income if the aggregate of those deductions exceeds the standard deduction, which in tax year 2018 in the U.S., for example, was $12,000 for a single taxpayer and $24,000 for married couple. Limitations Often, deductions are subject to conditions, such as being allowed only for expenses incurred that produce current benefits. C ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Business Mileage Reimbursement Rate

The business mileage reimbursement rate is an optional standard mileage rate used in the United States for purposes of computing the allowable business deduction, for Federal income tax purposes under the Internal Revenue Code, at , for the business use of a vehicle. Under the law, the taxpayer for each year is generally entitled to deduct either the actual expense amount, or an amount computed using the standard mileage rate, whichever is greater. The business mileage reimbursement rate is used by some employers for computing employee reimbursement amounts when an employee operates a motor vehicle not owned by the employer for the employer's business purposes. The General Services Administration (GSA) sets the rate for federal jobs. In general, the GSA rate matches the annual rate set by the IRS, although by law the government employee reimbursement rate cannot exceed the mileage rate set by the IRS for business deductions.''Travel and Subsistence Expenses; Mileage Allowances'', 5 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |