|

Mothers (Tokyo Stock Exchange)

Mothers () is one of Tokyo Stock Exchange's sections or markets, where the shares of startup companies are listed and traded. Its name is said to come from an acronym of "Market of the high-growth and emerging stocks". TSE also has JASDAQ for a similar purpose but with different requirements, which it acquired when it merged with Osaka Stock Exchange to form Japan Exchange Group in 2013. History Mothers was established in November 1999 in Tokyo Stock Exchange, as an ante to NASDAQ Japan of Osaka Stock Exchange. In December 1999, it had its start by trading shares of two emerging companies, one of which is already delisted. As of March 2013, the shares of 185 companies were listed in Mothers, of which 138 companies (74%) were from Tokyo; and 37.7% of all companies were in the IT industry, and 21.1% from the Service industry. As of March 31, 2018, 245 companies' shares were listed in Mothers, against 701 companies in JASDAQ. See also * Japan Exchange Group * Tokyo Stock Exchan ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tokyo Stock Exchange

The , abbreviated as Tosho () or TSE/TYO, is a stock exchange located in Tokyo, Japan. It is the third largest stock exchange in the world by aggregate market capitalization of its listed companies, and the largest in Asia. It had 2,292 listed companies with a combined market capitalization of US$5.67 trillion as of February 2019. The exchange is owned by the Japan Exchange Group (JPX), a holding company that it also lists (). JPX was formed from its merger with the Osaka Exchange; the merger process began in July 2012, when said merger was approved by the Japan Fair Trade Commission. JPX itself was launched on January 1, 2013. Overview The TSE is incorporated as a ''kabushiki gaisha'' (joint-stock company) with nine directors, four auditors and eight executive officers. Its headquarters are located at 2-1 Nihonbashi- Kabutochō, Chūō, Tokyo which is the largest financial district in Japan. The main indices tracking the stock market of TSE are the Nikkei 225 index of compa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Share (finance)

In finance, financial markets, a share is a unit of Equity (finance), equity ownership in the capital stock of a corporation, and can refer to units of mutual funds, limited partnerships, and real estate investment trusts. Share capital refers to all of the shares of an enterprise. The owner of shares in a company is a shareholder (or stockholder) of the corporation. A share is an indivisible unit of capital, expressing the ownership relationship between the company and the shareholder. The denominated value of a share is its face value, and the total of the face value of issued shares represent the capital of a company, which may not reflect the market value of those shares. The income received from the ownership of shares is a dividend. There are different types of shares such as equity shares, preference shares, deferred shares, redeemable shares, bonus shares, right shares, and employee stock option plan shares. Valuation Shares are valued according to the various principle ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

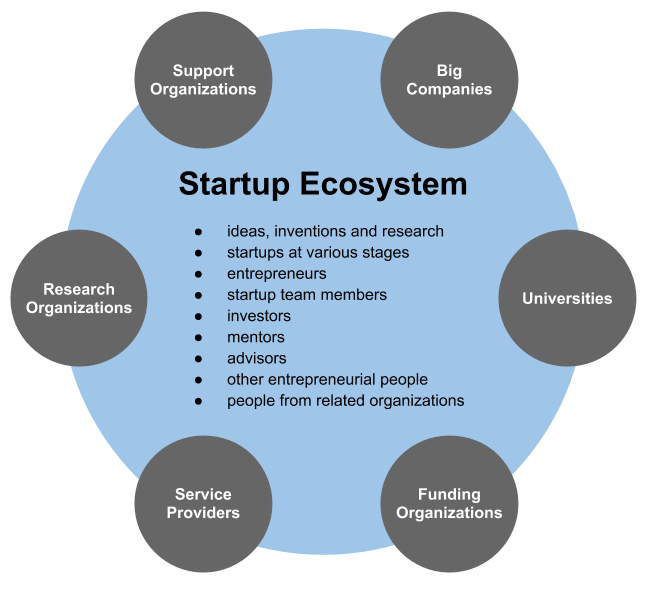

Startup Companies

A startup or start-up is a company or project undertaken by an entrepreneur to seek, develop, and validate a scalable business model. While entrepreneurship refers to all new businesses, including self-employment and businesses that never intend to become registered, startups refer to new businesses that intend to grow large beyond the solo founder. At the beginning, startups face high uncertainty and have high rates of failure, but a minority of them do go on to be successful and influential.Erin Griffith (2014)Why startups fail, according to their founders Fortune.com, 25 September 2014; accessed 27 October 2017 Actions Startups typically begin by a founder (solo-founder) or co-founders who have a way to solve a problem. The founder of a startup will begin market validation by problem interview, solution interview, and building a minimum viable product (MVP), i.e. a prototype, to develop and validate their business models. The startup process can take a long period of time (by so ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

JASDAQ

, formerly the is one of the sections of the Tokyo Stock Exchange. It was formerly an independent stock exchange. JASDAQ is not related to NASDAQ in the United States, but has operated an electronic trading system similar to NASDAQ. History In 1963, the set up an over-the-counter registration system for trading securities. This system was placed under the management of a private company, in 1976. The JASDAQ automated quotation system became operational in 1991. In 2004, JASDAQ received a permit from the Prime Minister to reorganize as a securities exchange. It became the first new securities exchange in Japan in almost fifty years. On April 1, 2010, the Osaka Securities Exchange acquired the JASDAQ Securities Exchange, and merged it with OSE's NEO and Nippon New Market-Hercules markets to form the "new" JASDAQ market. Hours The exchange has pre-market sessions from 08:00am to 09:00am and normal trading sessions from 09:00am to 03:00pm on all days of the week except Saturdays ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Osaka Stock Exchange

, renamed from , is the largest derivatives exchange in Japan, in terms of amount of business handled. , the Osaka Securities Exchange had 477 listed companies with a combined market capitalization of $212 billion. The Nikkei 225 Futures, introduced at the Osaka Securities Exchange in 1988, is now an internationally recognized futures index. In contrast to the Tokyo Stock Exchange, which mainly deals in spot trading, the Osaka Securities Exchange's strength is in derivative products. The OSE is the leading Derivatives Exchange in Japan and it was the largest futures market in the world in 1990 and 1991. According to statistics from 2003, the Osaka Securities Exchange handled 59% of the stock price index futures market in Japan, and almost 100% of trading in the options market. Osaka Securities Exchange Co., which listed on its Hercules market for startups in April 2004 is the only Japanese securities exchange which went public on its own market. In July 2006 OSE launched their n ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Japan Exchange Group

, abbreviated as JPX or Nippon Torihikijo, is a Japanese "financial instruments exchange holding company" subject to the regulations of the Financial Instruments and Exchange Act enforced by the Financial Services Agency. JPX owns three licensed "financial instruments exchange" corporations: Tokyo Stock Exchange, Inc. (TSE), Osaka Exchange, Inc. (OSE), and Tokyo Commodity Exchange, Inc. (TOCOM). It was formed by the merger of TSE and OSE on January 1, 2013. As a result of this merger and market reorganization, TSE became the sole securities exchange of JPX and OSE became the largest derivatives exchange of JPX. In 2019, JPX acquired TOCOM to expand derivatives trading business in the commodity market. It also has an IT services and research arm, JPX Market Innovation & Research, Inc. (JPXI), a self-regulatory body, Japan Exchange Regulation (JPX-R), and a clearing house, Japan Securities Clearing Corporation (JSSC). As of June 2021, it is the world's fifth-largest stock exchange ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |