|

Monetary Policy Of Sweden

The monetary policy of Sweden is decided by Sveriges Riksbank, the central bank of Sweden. The monetary policy is instrumental in determining how the Swedish currency is valued. History The main events in the monetary history of the '' Krona'' are: *Introduction of the Krona, based on the gold standard on 5 May 1873. (1 kg of gold = 2480 Kronor) *The tie to gold is abolished on 2 August 1914. *The tie to gold is ''de facto'' re-established in November 1922. *The tie to gold is ''de jure'' re-established on 1 April 1924 *The tie to gold is abolished once more on 27 September 1931. Floating exchange rate. *A tie to the British pound is introduced in June 1933. (1 GBP = 19.40 SEK) *Tied to the US dollar on 28 August 1939. (1 USD = 4.20 SEK) *A controlled appreciation of 14.3%, against all other currencies and gold on 13 July 1946. (1 USD = 3.60 SEK) *A controlled depreciation of 30.5% against the USD on 19 September 1949. (1 USD = 5.17 SEK) *Membership of the International Monet ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sveriges Riksbank

Sveriges Riksbank, or simply the ''Riksbank'', is the central bank of Sweden. It is the world's oldest central bank and the fourth oldest bank in operation. Etymology The first part of the word ''riksbank'', ''riks'', stems from the Swedish word ''rike'', which means ''realm'', ''kingdom'', ''empire'' or ''nation'' in English. A literal English translation of the bank's name could thus be ''Sweden's Realm's Bank''. The bank, however, doesn't translate its name to English but uses its Swedish name ''the Riksbank'' also in its English communications. History The Riksbank began operations in 1668. Previously, Sweden was served by the Stockholms Banco (also known as the Bank of Palmstruch), founded by Johan Palmstruch in 1656. Although the bank was private, it was the king who chose its management: in a letter to Palmstruch, he gave permission to its operations according to stated regulations. But Stockholms Banco collapsed as a result of the issuing of too many notes without th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Currency Basket

A currency basket is a portfolio of selected currencies with different weightings. A currency basket is commonly used by investors to minimize the risk of currency fluctuations and also governments when setting the market value of a country’s currency. An example of a currency basket is the European Currency Unit that was used by the European Community member states as the unit of account before being replaced by the euro. Another example is the special drawing rights of the International Monetary Fund. A well-known measure is the U.S. dollar index, which is used by Forex traders. There are six currencies forming the index: five major currencies – Euro, Japanese yen, British pound, Canadian dollar, and Swiss franc – and the Swedish krona. History and current use After major world currencies began to float in 1973, small countries in reaction decided to peg their currencies to one of the major currencies (e.g. U.S. Dollar, Pound Sterling). This led to a greater flu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monetary Policy By Country

Money is any item or verifiable record that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular country or socio-economic context. The primary functions which distinguish money are as a medium of exchange, a unit of account, a store of value and sometimes, a standard of deferred payment. Money was historically an emergent market phenomenon that possess intrinsic value as a commodity; nearly all contemporary money systems are based on unbacked fiat money without use value. Its value is consequently derived by social convention, having been declared by a government or regulatory entity to be legal tender; that is, it must be accepted as a form of payment within the boundaries of the country, for "all debts, public and private", in the case of the United States dollar. Contexts which erode public confidence, such as the circulation of counterfeit money or domestic hyperinflation, can cause good money to lose its value. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

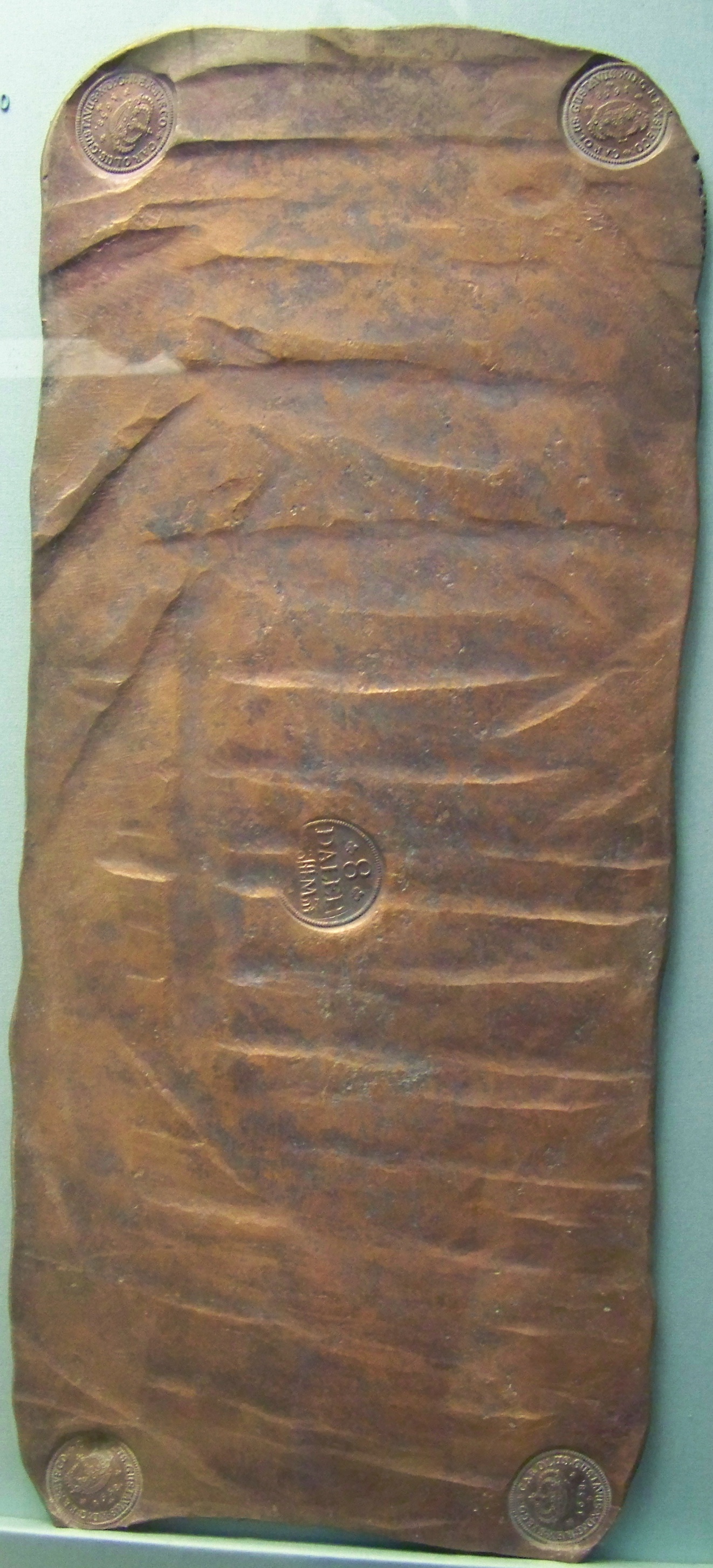

History Of Copper Currency In Sweden

The Swedish Empire had the greatest and most numerous copper mines in Europe as it entered into its pre-eminence in the early 17th century as an emerging Great Power. Through poor fiscal policies and in part the First Treaty of Älvsborg, Sweden lost control of its reserves of precious metals, primarily silver, of which most had fled to the burgeoning trade economy of Amsterdam. In 1607 the Swedish King Charles IX attempted to persuade the populace to exchange their silver-based currency for a copper-based coin of equal face value, though this offer was not generally taken up. Sweden's large army of the time were paid entirely in copper currency, further issued in large numbers by Gustavus II to finance his war against Ferdinand II of Germany. The face value of the copper coins in circulation now greatly exceeded the reserves of the state and production of the national economy, and quickly the value of the currency fell to its commodity value, which in a country where copper w ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economy Of Sweden

The economy of Sweden is a highly developed export-oriented economy, aided by timber, hydropower, and iron ore. These constitute the resource base of an economy oriented toward foreign trade. The main industries include motor vehicles, telecommunications, pharmaceuticals, industrial machines, precision equipment, chemical goods, home goods and appliances, forestry, iron, and steel. Traditionally, Sweden relied on a modern agricultural economy that employed over half the domestic workforce. Today Sweden further develops engineering, mine, steel, and pulp industries, which are competitive internationally, as evidenced by companies like Ericsson, ASEA/ABB, SKF, Alfa Laval, AGA, and Dyno Nobel. Sweden is a competitive open mixed economy. The vast majority of Swedish enterprises are privately owned and market-oriented. There is also a strong welfare state, with public-sector spending accounting up to three-fifths of GDP. In 2014, the percent of national wealth owned by the government w ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Scandinavian Monetary Union

__NOTOC__ The Scandinavian Monetary Union was a monetary union formed by Denmark and Sweden on 5 May 1873, with Norway joining in 1875. It established a common currency unit, the Crown (currency), krone/krona, based on the gold standard. It was one of the few tangible results of the Scandinavism, Scandinavian political movement of the 19th century. The union ended during World War I. Overview The original Scandinavian currencies were based on the silver Reichsthaler, defined by the :de:Hamburger Bank, Hamburg Bank as 25.28 grams fine silver, which was equal to one Norwegian speciedaler or two Danish rigsdaler. Sweden's ''riksdaler specie'' was slightly heavier at 25.5 g and was equal to four Swedish riksdaler ''riksgalds''. The Scandinavian switch to the gold standard was triggered by Germany's adoption of the German gold mark in 1873 and of the consequent disturbance in the silver market. The monetary union established the gold krone (''krona'' in Swedish) replacing the legacy ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Marginal Rate

A marginal value is #a value that holds true given particular constraints, #the ''change'' in a value associated with a specific change in some independent variable, whether it be of that variable or of a dependent variable, or # hen underlying values are quantifiedthe ''ratio'' of the change of a dependent variable to that of the independent variable. (This third case is actually a special case of the second). In the case of differentiability, at the limit, a marginal change is a mathematical differential, or the corresponding mathematical derivative. These uses of the term “marginal” are especially common in economics, and result from conceptualizing constraints as ''borders'' or as ''margins''. Wicksteed, Philip Henry; ''The Common Sense of Political Economy'' (1910),] Bk I Ch 2 and elsewhere. The sorts of marginal values most common to economic analysis are those associated with ''unit'' changes of resources and, in mainstream economics, those associated with ''infinitesi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Funds Rate

In the United States, the federal funds rate is the interest rate at which depository institutions (banks and credit unions) lend reserve balances to other depository institutions overnight on an uncollateralized basis. Reserve balances are amounts held at the Federal Reserve to maintain depository institutions' reserve requirements. Institutions with surplus balances in their accounts lend those balances to institutions in need of larger balances. The federal funds rate is an important benchmark in financial markets. The effective federal funds rate (EFFR) is calculated as the effective median interest rate of overnight federal funds transactions during the previous business day. It is published daily by the Federal Reserve Bank of New York. The federal funds target range is determined by a meeting of the members of the Federal Open Market Committee (FOMC) which normally occurs eight times a year about seven weeks apart. The committee may also hold additional meetings an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Exchange Rate Mechanism

The European Exchange Rate Mechanism (ERM II) is a system introduced by the European Economic Community on 1 January 1999 alongside the introduction of a single currency, the euro (replacing ERM 1 and the euro's predecessor, the ECU) as part of the European Monetary System (EMS), to reduce exchange rate variability and achieve monetary stability in Europe. After the adoption of the euro, policy changed to linking currencies of EU countries outside the eurozone to the euro (having the common currency as a central point). The goal was to improve the stability of those currencies, as well as to gain an evaluation mechanism for potential eurozone members. As of July 2021, three currencies participate in ERM II: the Danish krone, the Croatian kuna and the Bulgarian lev. Intent and operation of the ERM II The ERM is based on the concept of fixed currency exchange rate margins, but with exchange rates variable within those margins. This is also known as a semi-pegged system. Be ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Black Wednesday

Black Wednesday (or the 1992 Sterling crisis) occurred on 16 September 1992 when the UK Government was forced to withdraw sterling from the European Exchange Rate Mechanism (ERM), after a failed attempt to keep its exchange rate above the lower limit required for the ERM participation. At that time, the United Kingdom held the Presidency of the Council of the European Union. The crisis damaged the credibility of the second Major ministry in handling of economic matters. The ruling Conservative Party suffered a landslide defeat five years later at the 1997 United Kingdom general election and did not return to power until 2010. The rebounding of the UK economy in the years after Black Wednesday has been attributed to the fall in the value of sterling and the replacement of the ERM with an inflation targeting monetary stability policy. Prelude When the ERM was set up in 1979, the United Kingdom declined to join. This was a controversial decision, as the Chancellor of the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

2003 Swedish Euro Referendum

A non-binding referendum on introduction of the euro was held in Sweden on 14 September 2003. The majority voted not to adopt the euro, and thus Sweden decided in 2003 not to adopt the euro for the time being. Had they voted in favour, the plan was that Sweden would have adopted the euro on 1 January 2006. The ballot text was "Do you think that Sweden should introduce the euro as currency?" ( sv, Anser du att Sverige skall införa euron som valuta?). Sweden in Europe was the main umbrella group campaigning for a Yes vote. The No vote campaign was led by two organisations, representing left () and right wing politicians respectively. The political parties were divided, with the Centre Party, Left Party and Green Party being against, and the Moderates, Christian Democrats and Liberal People's Party being for. The Social Democrats did not take a position due to internal disagreements. Background Sweden joined the European Union in 1995 and its accession treaty has since obli ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

European Currency Unit

The European Currency Unit (, ; , ECU, or XEU) was a unit of account used by the European Economic Community and composed of a basket of member country currencies. The ECU came in to operation on 13 March 1979 and was assigned the ISO 4217 code. The ECU replaced the European Unit of Account (EUA) at parity in 1979, and it was later replaced by the euro (EUR) at parity on 1 January 1999. As a unit of account, the ECU was not a circulating currency and did not replace or override the value of the currency of EEC member countries. However, it was used to price some international financial transactions and capital transfers. Exchange rate Using a mechanism known as the "snake in the tunnel", the European Exchange Rate Mechanism was an attempt to minimize fluctuations between member state currencies—initially by managing the variance of each against its respective ECU reference rate—with the aim to achieve fixed ratios over time, and so enable the European Single Cu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |