|

Missing Market

A missing market is a situation in microeconomics where a competitive market allowing the exchange of a commodity would be Pareto-efficient, but no such market exists. Examples A variety of factors can lead to missing markets: A classic example of a missing market is the case of an externality like pollution, where decision makers are not responsible for some of the consequences of their actions. When a factory discharges polluted water into a river, that pollution can hurt people who fish in or get their drinking water from the river downstream, but the factory owner may have no incentive to consider those consequences. Coordination failure can also prevent market formation. Again considering the pollution example, downstream residents might seek to be paid by the factory owner who pollute their water, but because of the free rider problem it may be difficult to coordinate. Another barrier to pollution markets could be technology. If the river has several factories along ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Microeconomics

Microeconomics is a branch of mainstream economics that studies the behavior of individuals and firms in making decisions regarding the allocation of scarce resources and the interactions among these individuals and firms. Microeconomics focuses on the study of individual markets, sectors, or industries as opposed to the national economy as whole, which is studied in macroeconomics. One goal of microeconomics is to analyze the market mechanisms that establish relative prices among goods and services and allocate limited resources among alternative uses. Microeconomics shows conditions under which free markets lead to desirable allocations. It also analyzes market failure, where markets fail to produce efficient results. While microeconomics focuses on firms and individuals, macroeconomics focuses on the sum total of economic activity, dealing with the issues of growth, inflation, and unemployment and with national policies relating to these issues. Microeconomics also deal ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Complementary Commodities

A complement is something that completes something else. Complement may refer specifically to: The arts * Complement (music), an interval that, when added to another, spans an octave ** Aggregate complementation, the separation of pitch-class collections into complementary sets * Complementary color, in the visual arts Biology and medicine *Complement system (immunology), a cascade of proteins in the blood that form part of innate immunity *Complementary DNA, DNA reverse transcribed from a mature mRNA template *Complementarity (molecular biology), a property whereby double stranded nucleic acids pair with each other *Complementation (genetics), a test to determine if independent recessive mutant phenotypes are caused by mutations in the same gene or in different genes Grammar and linguistics * Complement (linguistics), a word or phrase having a particular syntactic role ** Subject complement, a word or phrase adding to a clause's subject after a linking verb * Phonetic comp ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Welfare Economics

Welfare economics is a branch of economics that uses microeconomic techniques to evaluate well-being (welfare) at the aggregate (economy-wide) level. Attempting to apply the principles of welfare economics gives rise to the field of public economics, the study of how government might intervene to improve social welfare. Welfare economics also provides the theoretical foundations for particular instruments of public economics, including cost–benefit analysis, while the combination of welfare economics and insights from behavioral economics has led to the creation of a new subfield, behavioral welfare economics. The field of welfare economics is associated with two fundamental theorems. The first states that given certain assumptions, competitive markets produce ( Pareto) efficient outcomes; it captures the logic of Adam Smith's invisible hand. The second states that given further restrictions, any Pareto efficient outcome can be supported as a competitive market equilibrium. Th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Two Sided Markets

A two-sided market, also called a two-sided network, is an intermediary economic platform having two distinct user groups that provide each other with network benefits. The organization that creates value primarily by enabling direct interactions between two (or more) distinct types of affiliated customers is called a multi-sided platform. This concept of two-sided markets has been mainly theorised by the French economists Jean Tirole and Jean-Charles Rochet and Americans Geoffrey G Parker and Marshall Van Alstyne. Two-sided networks can be found in many industries, sharing the space with traditional product and service offerings. Example markets include credit cards (composed of cardholders and merchants); health maintenance organizations (patients and doctors); operating systems (end-users and developers); yellow pages (advertisers and consumers); video-game consoles (gamers and game developers); recruitment sites (job seekers and recruiters); search engines (advertisers and u ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Futures Markets

A futures exchange or futures market is a central financial exchange where people can trade standardized futures contracts defined by the exchange. Futures contracts are derivatives contracts to buy or sell specific quantities of a commodity or financial instrument at a specified price with delivery set at a specified time in the future. Futures exchanges provide physical or electronic trading venues, details of standardized contracts, market and price data, clearing houses, exchange self-regulations, margin mechanisms, settlement procedures, delivery times, delivery procedures and other services to foster trading in futures contracts. Futures exchanges can be organized as non-profit member-owned organizations or as for-profit organizations. Futures exchanges can be integrated under the same brand name or organization with other types of exchanges, such as stock markets, options markets, and bond markets. Non-profit member-owned futures exchanges benefit their members, who earn c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Coase Theorem

In law and economics, the Coase theorem () describes the economic efficiency of an economic allocation or outcome in the presence of externalities. The theorem states that if trade in an externality is possible and there are sufficiently low transaction costs, bargaining will lead to a Pareto efficient outcome regardless of the initial allocation of property. In practice, obstacles to bargaining or poorly defined property rights can prevent Coasean bargaining. This 'theorem' is commonly attributed to Nobel Prize laureate Ronald Coase. This 1960 paper, along with his 1937 paper on the nature of the firm (which also emphasizes the role of transaction costs), earned Ronald Coase the 1991 Nobel Memorial Prize in Economic Sciences. In this 1960 paper, Coase argued that real-world transaction costs are rarely low enough to allow for efficient bargaining and hence the theorem is almost always inapplicable to economic reality. In his later writings, Coase expressed frustration that his th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Property Rights

The right to property, or the right to own property (cf. ownership) is often classified as a human right for natural persons regarding their possessions. A general recognition of a right to private property is found more rarely and is typically heavily constrained insofar as property is owned by legal persons (i.e. corporations) and where it is used for production rather than consumption. A right to property is recognised in Article 17 of the Universal Declaration of Human Rights, but it is not recognised in the International Covenant on Civil and Political Rights or the International Covenant on Economic, Social and Cultural Rights. The European Convention on Human Rights, in Protocol 1, article 1, acknowledges a right for natural and legal persons to "peaceful enjoyment of his possessions", subject to the "general interest or to secure the payment of taxes." Definition The right to property is one of the most controversial human rights, both in terms of its existence and inte ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Prisoner's Dilemma

The Prisoner's Dilemma is an example of a game analyzed in game theory. It is also a thought experiment that challenges two completely rational agents to a dilemma: cooperate with their partner for mutual reward, or betray their partner ("defect") for individual reward. This dilemma was originally framed by Merrill Flood and Melvin Dresher while working at RAND in 1950. Albert W. Tucker appropriated the game and formalized it by structuring the rewards in terms of prison sentences and named it "prisoner's dilemma". William Poundstone in his 1993 book ''Prisoner's Dilemma'' writes the following version:Two members of a criminal gang are arrested and imprisoned. Each prisoner is in solitary confinement with no means of speaking to or exchanging messages with the other. The police admit they don't have enough evidence to convict the pair on the principal charge. They plan to sentence both to two years in prison on a lesser charge. Simultaneously, the police offer each prisoner a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Nash Equilibrium

In game theory, the Nash equilibrium, named after the mathematician John Nash, is the most common way to define the solution of a non-cooperative game involving two or more players. In a Nash equilibrium, each player is assumed to know the equilibrium strategies of the other players, and no one has anything to gain by changing only one's own strategy. The principle of Nash equilibrium dates back to the time of Cournot, who in 1838 applied it to competing firms choosing outputs. If each player has chosen a strategy an action plan based on what has happened so far in the game and no one can increase one's own expected payoff by changing one's strategy while the other players keep their's unchanged, then the current set of strategy choices constitutes a Nash equilibrium. If two players Alice and Bob choose strategies A and B, (A, B) is a Nash equilibrium if Alice has no other strategy available that does better than A at maximizing her payoff in response to Bob choosing B, and Bob ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market (economics)

In economics, a market is a composition of systems, institutions, procedures, social relations or infrastructures whereby parties engage in exchange. While parties may exchange goods and services by barter, most markets rely on sellers offering their goods or services (including labour power) to buyers in exchange for money. It can be said that a market is the process by which the prices of goods and services are established. Markets facilitate trade and enable the distribution and allocation of resources in a society. Markets allow any tradeable item to be evaluated and priced. A market emerges more or less spontaneously or may be constructed deliberately by human interaction in order to enable the exchange of rights (cf. ownership) of services and goods. Markets generally supplant gift economies and are often held in place through rules and customs, such as a booth fee, competitive pricing, and source of goods for sale (local produce or stock registration). Markets can dif ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

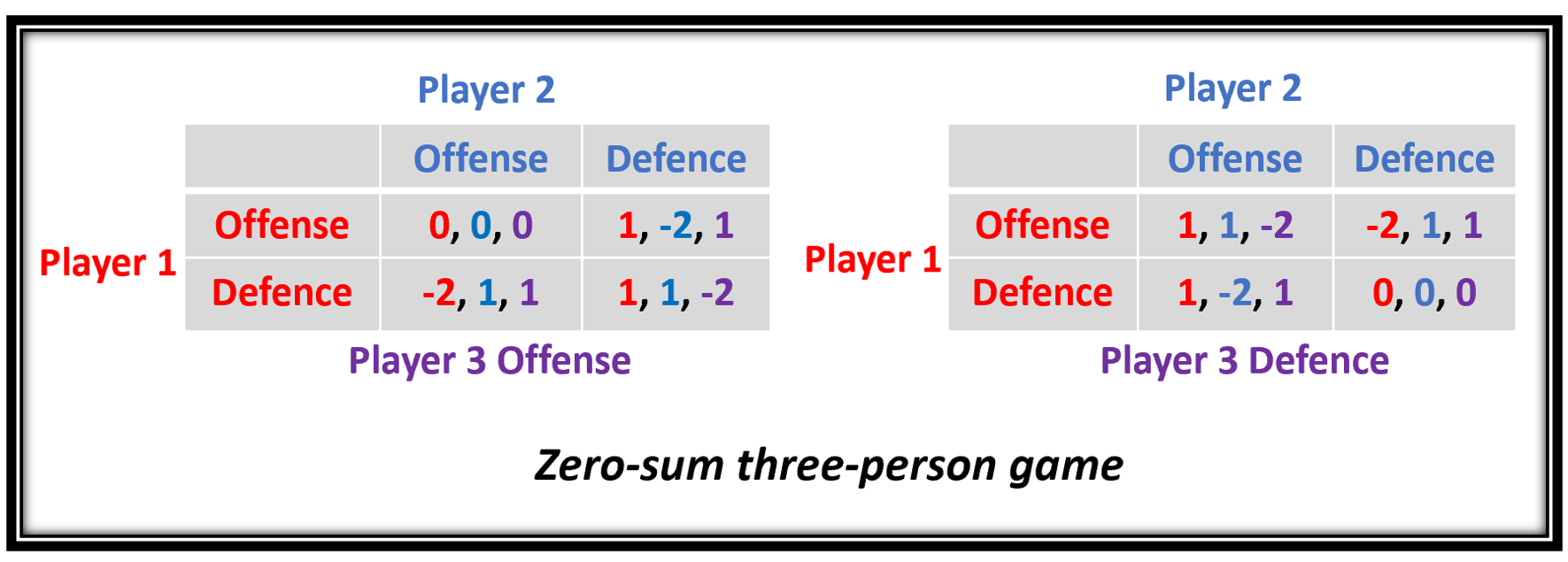

Zero-sum

Zero-sum game is a mathematical representation in game theory and economic theory of a situation which involves two sides, where the result is an advantage for one side and an equivalent loss for the other. In other words, player one's gain is equivalent to player two's loss, therefore the net improvement in benefit of the game is zero. If the total gains of the participants are added up, and the total losses are subtracted, they will sum to zero. Thus, cutting a cake, where taking a more significant piece reduces the amount of cake available for others as much as it increases the amount available for that taker, is a zero-sum game if all participants value each unit of cake equally. Other examples of zero-sum games in daily life include games like poker, chess, and bridge where one person gains and another person loses, which results in a zero-net benefit for every player. In the markets and financial instruments, futures contracts and options are zero-sum games as well. In c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Transaction Costs

In economics and related disciplines, a transaction cost is a cost in making any economic trade when participating in a market. Oliver E. Williamson defines transaction costs as the costs of running an economic system of companies, and unlike production costs, decision-makers determine strategies of companies by measuring transaction costs and production costs. Transaction costs are the total costs of making a transaction, including the cost of planning, deciding, changing plans, resolving disputes, and after-sales. Therefore, the transaction cost is one of the most significant factors in business operation and management. Oliver E. Williamson's ''Transaction Cost Economics'' popularized the concept of transaction costs. Douglass C. North argues that institutions, understood as the set of rules in a society, are key in the determination of transaction costs. In this sense, institutions that facilitate low transaction costs, boost economic growth.North, Douglass C. 1992. “Transac ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |