|

Metropolitan Bank Of Zimbabwe

Metbank, formerly known as Metropolitan Bank of Zimbabwe, is a commercial bank in Zimbabwe. It is licensed by the Reserve Bank of Zimbabwe, the central bank and national banking regulator. Location The headquarters and main branch of Metbank are located in Metropolitan House, at 3 Central Avenue, in Harare the capital and largest city of Zimbabwe. The geographical coordinates of the bank's headquarters are: 17°49'31.0"S, 31°03'02.0"E (Latitude:-17.825278; Longitude:31.050556). Overview Metbank serves large corporations, small to medium enterprises (SMEs), as well as individuals. The bank partners with MasterCard to issue debit and credit cards. , Metbank was a medium-sized financial services provider, with an asset base of US$200.7 million, with shareholders' equity of US$55.9 million. Metbank Limited has been involved with the introduction of digital banking, branchless banking, and internet banking and agency banking, while keeping the number of brick-and-mortar branches lo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Harare

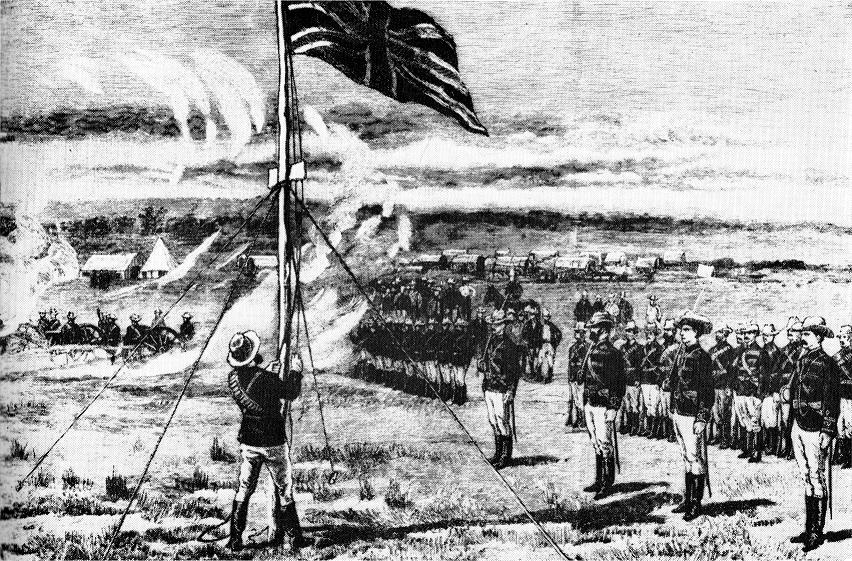

Harare (; formerly Salisbury ) is the capital and most populous city of Zimbabwe. The city proper has an area of 940 km2 (371 mi2) and a population of 2.12 million in the 2012 census and an estimated 3.12 million in its metropolitan area in 2019. Situated in north-eastern Zimbabwe in the country's Mashonaland region, Harare is a metropolitan province, which also incorporates the municipalities of Chitungwiza and Epworth. The city sits on a plateau at an elevation of above sea level and its climate falls into the subtropical highland category. The city was founded in 1890 by the Pioneer Column, a small military force of the British South Africa Company, and named Fort Salisbury after the UK Prime Minister Lord Salisbury. Company administrators demarcated the city and ran it until Southern Rhodesia achieved responsible government in 1923. Salisbury was thereafter the seat of the Southern Rhodesian (later Rhodesian) government and, between 1953 and 1963, th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Small To Medium Enterprises

Small and medium-sized enterprises (SMEs) or small and medium-sized businesses (SMBs) are businesses whose personnel and revenue numbers fall below certain limits. The abbreviation "SME" is used by international organizations such as the World Bank, the European Union, the United Nations, and the World Trade Organization (WTO). In any given national economy, SMEs sometimes outnumber large companies by a wide margin and also employ many more people. For example, Australian SMEs makeup 98% of all Australian businesses, produce one-third of the total GDP (gross domestic product) and employ 4.7 million people. In Chile, in the commercial year 2014, 98.5% of the firms were classified as SMEs. In Tunisia, the self-employed workers alone account for about 28% of the total non-farm employment, and firms with fewer than 100 employees account for about 62% of total employment. The United States' SMEs generate half of all U.S. jobs, but only 40% of GDP. Developing countries tend to have a lar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banks Of Zimbabwe

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. Because banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of regulation over banks. Most countries have institutionalized a system known as fractional reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but in many ways functioned as a continuation of ideas and concepts of credit and lending that had their roots in the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economy Of Zimbabwe

The economy of Zimbabwe mainly relies on the tertiary sector of the economy, also known as the service sector of the economy, which makes up to 60% of total GDP as of 2017. Zimbabwe has the second biggest Informal economy in the world as a percentage of its economy, with a score of 60.6%.https://www.herald.co.zw/zim-has-worlds-second-largest-informal-economy-imf/ /ref> Agriculture and mining largely contribute to exports. After continuous negative growth between 1999 and 2008, the economy of Zimbabwe grew at a meteoric annual rate of 34% from 2008 to 2013, rendering it the fastest-growing economy in the world. Its economy then stagnated again through 2020, before seeing another extremely sharp increase (45%) in the most recent year. The country has reserves of metallurgical-grade Chromite. Other commercial mineral deposits include Coal, asbestos, copper, nickel, gold, platinum and Iron ore. Current economic conditions In 2000, Zimbabwe planned a land redistribution act to co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

List Of Banks In Zimbabwe

This is a list of "Operating Banking Institutions" in Zimbabwe. # Agricultural Development Bank of Zimbabwe # BancABC Zimbabwe # CABS # CBZ Bank Limited # First Capital Bank Limited # Ecobank Zimbabwe Limited # FBC Bank Limited # Nedbank Zimbabwe Limited # Metbank # NMB Bank Limited # Stanbic Bank Zimbabwe Limited # Standard Chartered Bank Zimbabwe Limited # Steward Bank # ZB Bank Limited # Tetrad Investment Bank Limited # FBC Building Society # National Building Society # ZB Building Society # People's Own Savings Bank # Infrastructure Development Bank of Zimbabwe # Small and Medium Enterprises Development Corporation. # Time Bank See also *Economy of Zimbabwe *List of banks in Africa *Reserve Bank of Zimbabwe References External linksZimbabwe Banking Banking Sector Profits Double {{Economy of Zimbabw ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Managing Director

A chief executive officer (CEO), also known as a central executive officer (CEO), chief administrator officer (CAO) or just chief executive (CE), is one of a number of corporate executives charged with the management of an organization especially an independent legal entity such as a company or nonprofit institution. CEOs find roles in a range of organizations, including public and private corporations, non-profit organizations and even some government organizations (notably state-owned enterprises). The CEO of a corporation or company typically reports to the board of directors and is charged with maximizing the value of the business, which may include maximizing the share price, market share, revenues or another element. In the non-profit and government sector, CEOs typically aim at achieving outcomes related to the organization's mission, usually provided by legislation. CEOs are also frequently assigned the role of main manager of the organization and the highest-ranking offic ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Board Of Directors

A board of directors (commonly referred simply as the board) is an executive committee that jointly supervises the activities of an organization, which can be either a for-profit or a nonprofit organization such as a business, nonprofit organization, or a government agency. The powers, duties, and responsibilities of a board of directors are determined by government regulations (including the jurisdiction's corporate law) and the organization's own constitution and by-laws. These authorities may specify the number of members of the board, how they are to be chosen, and how often they are to meet. In an organization with voting members, the board is accountable to, and may be subordinate to, the organization's full membership, which usually elect the members of the board. In a stock corporation, non-executive directors are elected by the shareholders, and the board has ultimate responsibility for the management of the corporation. In nations with codetermination (such as Germ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mutare

Mutare (formerly Umtali) is the most populous city in the province of Manicaland, and the third most populous city in Zimbabwe, having surpassed Gweru in the 2012 census, with an urban area, urban population of 224,802 and approximately 260,567 in the surrounding districts giving the wider metropolitan area a total population of over 500,000 people.http://www.zimstat.co.zw/wp-content/uploads/publications/Population/population/census-2012-national-report.pdf Mutare is also the capital of Manicaland province and the largest city in Eastern Zimbabwe. Located near the border with Mozambique, Mutare has long been a centre of trade and a key terminus en route to the port of Beira (in Beira, Mozambique). Mutare is hub for trade with railway links, pipeline transport and highways linking the coast with Harare and the interior. Other traditional industries include timber, papermaking, commerce, food processing, telecommunications, and transportation. In addition the city serves as a gat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gweru

Gweru is a city in central Zimbabwe. Near the geographical centre of the country. It is on the centre of Midlands Province. Originally an area known to the Northern Ndebele people, Ndebele as "The Steep Place" because of the Gweru River's high Bank (geography), banks, in 1894 it became the site of a military outpost established by Leander Starr Jameson. In 1914 it attained Municipality, municipal status, and in 1971 it became a city. The city has a population of 158,200 as of the 2022 census. Gweru is known for farming activities in beef cattle, crop farming, and commercial gardening of crops for the export market. It is also home to a number of colleges and universities, most prominently Midlands State University and Mkoba Teachers College. The city was nicknamed City of Progress. History Gweru used to be named Gwelo. Matabele settlement was named iKwelo (“The Steep Place”), after the river’s high banks. The modern town, founded in 1894 as a military outpost, develop ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bulawayo

Bulawayo (, ; Ndebele: ''Bulawayo'') is the second largest city in Zimbabwe, and the largest city in the country's Matabeleland region. The city's population is disputed; the 2022 census listed it at 665,940, while the Bulawayo City Council claimed it to be about 1.2 million. Bulawayo covers an area of about in the western part of the country, along the Matsheumhlope River. Along with the capital Harare, Bulawayo is one of two cities in Zimbabwe that is also a province. Bulawayo was founded by a group led by Gundwane Ndiweni around 1840 as the kraal of Mzilikazi, the Ndebele king and was known as Gibixhegu. His son, Lobengula, succeeded him in the 1860s, and changed the name to kobulawayo and ruled from Bulawayo until 1893, when the settlement was captured by British South Africa Company soldiers during the First Matabele War. That year, the first white settlers arrived and rebuilt the town. The town was besieged by Ndebele warriors during the Second Matabele War. Bulawayo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock

In finance, stock (also capital stock) consists of all the shares by which ownership of a corporation or company is divided.Longman Business English Dictionary: "stock - ''especially AmE'' one of the shares into which ownership of a company is divided, or these shares considered together" "When a company issues shares or stocks ''especially AmE'', it makes them available for people to buy for the first time." (Especially in American English, the word "stocks" is also used to refer to shares.) A single share of the stock means fractional ownership of the corporation in proportion to the total number of shares. This typically entitles the shareholder (stockholder) to that fraction of the company's earnings, proceeds from liquidation of assets (after discharge of all senior claims such as secured and unsecured debt), or voting power, often dividing these up in proportion to the amount of money each stockholder has invested. Not all stock is necessarily equal, as certain classe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Digital Banking

Digital banking is part of the broader context for the move to online banking, where banking services are delivered over the internet. The shift from traditional to digital banking has been gradual and remains ongoing, and is constituted by differing degrees of banking service digitization. Digital banking involves high levels of process automation and web-based services and may include APIs enabling cross-institutional service composition to deliver banking products and provide transactions. It provides the ability for users to access financial data through desktop, mobile and ATM services. Description A digital bank represents a virtual process that includes online banking and beyond. As an end-to-end platform, digital banking must encompass the front end that consumers see, back end that bankers see through their servers and admin control panels and the middleware that connects these nodes. Ultimately, a digital bank should facilitate all functional levels of banking on all s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

_respondents_in_East_Africa.png)