|

Merger Control

Merger control refers to the procedure of reviewing mergers and acquisitions under antitrust / competition law. Over 130 nations worldwide have adopted a regime providing for merger control. National or supernational competition agencies such as the EU European Commission, the UK Competition and Markets Authority, or the US Department of Justice or Federal Trade Commission are normally entrusted with the role of reviewing mergers. Merger control regimes are adopted to prevent anti-competitive consequences of concentrations (as mergers and acquisitions are also known). Accordingly, most merger control regimes normally provide for one of the following substantive tests: * Does the concentration significantly impede effective competition? ( EU, Germany) * Does the concentration substantially lessen competition? ( US, UK) * Does the concentration lead to the creation or strengthening of a dominant position? (Switzerland, Russia) In practice most merger control regimes are based ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mergers And Acquisitions

Mergers and acquisitions (M&A) are business transactions in which the ownership of a company, business organization, or one of their operating units is transferred to or consolidated with another entity. They may happen through direct absorption, a merger, a tender offer or a hostile takeover. As an aspect of strategic management, M&A can allow enterprises to grow or downsize, and change the nature of their business or competitive position. Technically, a is the legal consolidation of two business entities into one, whereas an occurs when one entity takes ownership of another entity's share capital, equity interests or assets. From a legal and financial point of view, both mergers and acquisitions generally result in the consolidation of assets and liabilities under one entity, and the distinction between the two is not always clear. Most countries require mergers and acquisitions to comply with antitrust or competition law. In the United States, for example, the Cl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Differentiated Bertrand Competition

As a solution to the Bertrand paradox in economics, it has been suggested that each firm produces a somewhat differentiated product, and consequently faces a demand curve that is downward-sloping for all levels of the firm's price. An increase in a competitor's price is represented as an increase (for example, an upward shift) of the firm's demand curve. As a result, when a competitor raises price, generally a firm can also raise its own price and increase its profits. Calculating the differentiated Bertrand model *q1 = firm 1's demand, *q1≥0 *q2 = firm 2's demand, *q1≥0 *A1 = Constant in equation for firm 1's demand *A2 = Constant in equation for firm 2's demand *a1 = slope coefficient for firm 1's price *a2 = slope coefficient for firm 2's price *p1 = firm 1's price level pr unit *p2 = firm 2's price level pr unit *b1 = slope coefficient for how much firm 2's price affects firm 1's demand *b2 = slope coefficient for how much firm 1's price affects firm 2's demand *q1=A1-a1* ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Competition Law

Competition law is the field of law that promotes or seeks to maintain market competition by regulating anti-competitive conduct by companies. Competition law is implemented through public and private enforcement. It is also known as antitrust law (or just antitrust), anti-monopoly law, and trade practices law; the act of pushing for antitrust measures or attacking monopolistic companies (known as trusts) is commonly known as trust busting. The history of competition law reaches back to the Roman Empire. The business practices of market traders, guilds and governments have always been subject to scrutiny, and sometimes severe sanctions. Since the 20th century, competition law has become global. The two largest and most influential systems of competition regulation are United States antitrust law and European Union competition law. National and regional competition authorities across the world have formed international support and enforcement networks. Modern competition law ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mergers And Acquisitions

Mergers and acquisitions (M&A) are business transactions in which the ownership of a company, business organization, or one of their operating units is transferred to or consolidated with another entity. They may happen through direct absorption, a merger, a tender offer or a hostile takeover. As an aspect of strategic management, M&A can allow enterprises to grow or downsize, and change the nature of their business or competitive position. Technically, a is the legal consolidation of two business entities into one, whereas an occurs when one entity takes ownership of another entity's share capital, equity interests or assets. From a legal and financial point of view, both mergers and acquisitions generally result in the consolidation of assets and liabilities under one entity, and the distinction between the two is not always clear. Most countries require mergers and acquisitions to comply with antitrust or competition law. In the United States, for example, the Cl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

SSNIP

In competition law, before deciding whether companies have significant market power which would justify government intervention, the test of small but significant and non-transitory increase in price (SSNIP) is used to define the relevant market in a consistent way. It is an alternative to ad hoc determination of the relevant market by arguments about product similarity. The SSNIP test is crucial in competition law cases accusing abuse of dominance and in approving or blocking mergers. Competition regulating authorities and other actuators of antitrust law intend to prevent market failure caused by cartel, oligopoly, monopoly, or other forms of market dominance. History In 1982 the U.S. Department of Justice Merger Guidelines introduced the SSNIP test as a new method for defining markets and for measuring market power directly. In the EU it was used for the first time in the ''Nestlé/Perrier'' case in 1992 and has been officially recognized by the European Commission in i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Competition Law

Competition law is the field of law that promotes or seeks to maintain market competition by regulating anti-competitive conduct by companies. Competition law is implemented through public and private enforcement. It is also known as antitrust law (or just antitrust), anti-monopoly law, and trade practices law; the act of pushing for antitrust measures or attacking monopolistic companies (known as trusts) is commonly known as trust busting. The history of competition law reaches back to the Roman Empire. The business practices of market traders, guilds and governments have always been subject to scrutiny, and sometimes severe sanctions. Since the 20th century, competition law has become global. The two largest and most influential systems of competition regulation are United States antitrust law and European Union competition law. National and regional competition authorities across the world have formed international support and enforcement networks. Modern competition law ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Merger Guidelines

Merger guidelines in the United States are a set of internal rules promulgated by the Antitrust Division of the Department of Justice (DOJ) in conjunction with the Federal Trade Commission (FTC). These rules have been revised over the past four decades. They govern the process by which these two regulatory bodies scrutinize and/or challenge a potential merger. Grounds for challenges include increased market concentration and threat to competition within a relevant market. The merger guidelines have sections governing both horizontal integration and vertical integration. History The first merger guidelines set forth by the DOJ were the 1968 Merger Guidelines. The guidelines were developed by former U.S. Assistant Attorney General Dr. Donald Turner, an economist and lawyer with expertise in the field of industrial organization. [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Regulatory Economics

Regulatory economics is the application of law by government or regulatory agencies for various economics-related purposes, including remedying market failure, protecting the environment and economic management. Regulation Regulation is generally defined as legislation imposed by a government on individuals and private sector firms in order to regulate and modify economic behaviors. Conflict can occur between public services and commercial procedures (e.g. maximizing profit), the interests of the people using these services (see market failure), and also the interests of those not directly involved in transactions ( externalities). Most governments, therefore, have some form of control or regulation to manage these possible conflicts. The ideal goal of economic regulation is to ensure the delivery of a safe and appropriate service, while not discouraging the effective functioning and development of businesses. For example, in most countries, regulation controls the sale and co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Honeywell

Honeywell International Inc. is an American publicly traded, multinational conglomerate corporation headquartered in Charlotte, North Carolina. It primarily operates in four areas of business: aerospace, building automation, industrial automation, and energy and sustainability solutions (ESS). Honeywell also owns and operates Sandia National Laboratories under contract with the U.S. Department of Energy. Honeywell is a Fortune 500 company, ranked 115th in 2023. In 2024, the corporation had a global workforce of approximately 102,000 employees. As of 2023, the current chairman and chief executive officer is Vimal Kapur. The corporation's name, Honeywell International Inc., is a product of the merger of Honeywell Inc. and AlliedSignal in 1999. The corporation headquarters were consolidated with AlliedSignal's headquarters in Morristown, New Jersey. The combined company chose the name "Honeywell" because of the considerable brand recognition. Honeywell was a component of the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Relevant Market

In competition law, a relevant market is a market in which a particular product or service is sold. It is the intersection of a relevant product market and a relevant geographic market. The European Commission defines a relevant market and its product and geographic components as follows: #A relevant product market comprises all those products and/or services which are regarded as interchangeable or substitutable by the consumer by reason of the products' characteristics, their prices and their intended use; #A relevant geographic market comprises the area in which the firms concerned are involved in the supply of products or services and in which the conditions of competition are sufficiently homogeneous. Definition and use The notion of relevant market is used in order to identify the products and undertakings which are directly competing in a business. Therefore, the relevant market is the market where the competition takes place. The enforcement of the provisions of competitio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Airtours

MyTravel Group plc was a British, global travel group headquartered in Rochdale, England. It was founded in 1972 as Airtours Group. The group included two in-house airlines, MyTravel Airways UK and MyTravel Airways Scandinavia, and various tour operators around the world. On 19 June 2007, the group merged with Thomas Cook AG to form the Thomas Cook Group plc. The successor to MyTravel Group: Thomas Cook Group, entered Compulsory liquidation on 23 September 2019. History The group was founded under the ''Airtours'' brand in 1972, when David Crossland purchased a series of small travel agencies in Lancashire, United Kingdom. The group began operating package holidays and launched its own in-house charter airline, in the early 1990's. It offered their first charter flights to the Caribbean at that time for just £299. In 1994, Airtours purchased Scandinavian Leisure Group and in 1996 it bought Simon Spies Holding, a Danish rival. In 2002, Airtours Group plc, rebranded unde ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Coordination Game

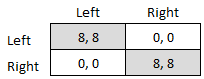

A coordination game is a type of simultaneous game found in game theory. It describes the situation where a player will earn a higher payoff when they select the same course of action as another player. The game is not one of pure conflict, which results in multiple pure strategy Nash equilibrium, Nash equilibria in which players choose matching strategies. Figure 1 shows a 2-player example. Both (Up, Left) and (Down, Right) are Nash equilibria. If the players expect (Up, Left) to be played, then player 1 thinks their payoff would fall from 2 to 1 if they deviated to Down, and player 2 thinks their payoff would fall from 4 to 3 if they chose Right. If the players expect (Down, Right), player 1 thinks their payoff would fall from 2 to 1 if they deviated to Up, and player 2 thinks their payoff would fall from 4 to 3 if they chose Left. A player's optimal move depends on what they expect the other player to do, and they both do better if they coordinate than if they played an off-e ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |