|

Meltdown (Woods Book)

''Meltdown: A Free-Market Look at Why the Stock Market Collapsed, the Economy Tanked, and the Government Bailout Will Make Things Worse'' is a book on the global financial crisis of 2007–2008 by historian Thomas Woods, with a foreword by Ron Paul. The book was published on February 9, 2009 by Regnery Publishing. Overview Woods is a follower of the Austrian School of economics and believes in allowing the market to freely compete in currency, which he believes would lead to mostly gold-based currency. The book is dedicated to Murray Rothbard and Ron Paul. The book debuted at #16 on the "Hardcover, non-fiction" ''New York Times'' Best Seller list, and advanced to the #11 spot in its second week on the list. According to the author's official website, ''Meltdown'' was on the ''NYT'' Best Seller list for 10 week Woods' thesis maintains that: deflation of prices neither causes nor prolongs depressions; deflation may be necessary to prevent depressions or to bring depressions to a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

WikiProject Novels

A WikiProject, or Wikiproject, is a Wikimedia movement affinity group for contributors with shared goals. WikiProjects are prevalent within the largest wiki, Wikipedia, and exist to varying degrees within sister projects such as Wiktionary, Wikiquote, Wikidata, and Wikisource. They also exist in different languages, and translation of articles is a form of their collaboration. During the COVID-19 pandemic, CBS News noted the role of Wikipedia's WikiProject Medicine in maintaining the accuracy of articles related to the disease. Another WikiProject that has drawn attention is WikiProject Women Scientists, which was profiled by '' Smithsonian'' for its efforts to improve coverage of women scientists which the profile noted had "helped increase the number of female scientists on Wikipedia from around 1,600 to over 5,000". On Wikipedia Some Wikipedia WikiProjects are substantial enough to engage in cooperative activities with outside organizations relevant to the field at issue. For e ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Money Supply

In macroeconomics, the money supply (or money stock) refers to the total volume of currency held by the public at a particular point in time. There are several ways to define "money", but standard measures usually include Circulation (currency), currency in circulation (i.e. physical cash) and demand deposits (depositors' easily accessed assets on the books of financial institutions). The central bank of a country may use a definition of what constitutes legal tender for its purposes. Money supply data is recorded and published, usually by a government agency or the central bank of the country. Public sector, Public and private sector analysts monitor changes in the money supply because of the belief that such changes affect the price levels of Security (finance), securities, inflation, the exchange rates, and the business cycle. The relationship between money and prices has historically been associated with the quantity theory of money. There is some empirical evidence of a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Finance Books

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of financial economics bridges the two). Finance activities take place in financial systems at various scopes, thus the field can be roughly divided into personal, corporate, and public finance. In a financial system, assets are bought, sold, or traded as financial instruments, such as currencies, loans, bonds, shares, stocks, options, futures, etc. Assets can also be banked, invested, and insured to maximize value and minimize loss. In practice, risks are always present in any financial action and entities. A broad range of subfields within finance exist due to its wide scope. Asset, money, risk and investment management aim to maximize value and minimize volatility. Financial analysis is viability, stability, and profitability assess ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Failures

A bank failure occurs when a bank is unable to meet its obligations to its depositors or other creditors because it has become insolvent or too illiquid to meet its liabilities. A bank usually fails economically when the market value of its assets declines to a value that is less than the market value of its liabilities. The insolvent bank either borrows from other solvent banks or sells its assets at a lower price than its market value to generate liquid money to pay its depositors on demand. The inability of the solvent banks to lend liquid money to the insolvent bank creates a bank panic among the depositors as more depositors try to take out cash deposits from the bank. As such, the bank is unable to fulfill the demands of all of its depositors on time. A bank may be taken over by the regulating government agency if its shareholders' equity are below the regulatory minimum. The failure of a bank is generally considered to be of more importance than the failure of other types of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

2009 Non-fiction Books

9 (nine) is the natural number following and preceding . Evolution of the Arabic digit In the beginning, various Indians wrote a digit 9 similar in shape to the modern closing question mark without the bottom dot. The Kshatrapa, Andhra and Gupta started curving the bottom vertical line coming up with a -look-alike. The Nagari continued the bottom stroke to make a circle and enclose the 3-look-alike, in much the same way that the sign @ encircles a lowercase ''a''. As time went on, the enclosing circle became bigger and its line continued beyond the circle downwards, as the 3-look-alike became smaller. Soon, all that was left of the 3-look-alike was a squiggle. The Arabs simply connected that squiggle to the downward stroke at the middle and subsequent European change was purely cosmetic. While the shape of the glyph for the digit 9 has an ascender in most modern typefaces, in typefaces with text figures the character usually has a descender, as, for example, in . The mod ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Politically Incorrect Guide To American History

''The Politically Incorrect Guide to American History'' is a work of paleoconservative literature covering various issues in U.S. history by Thomas E. Woods, published in December 2004. This book was the first in the '' Politically Incorrect Guide'' series published by Regnery Publishing, who view the series as covering topics without consideration for political correctness. The book was present on ''The New York Times'' best-seller list for many weeks.''New York Times'' "Bestseller List" (Paperback non-fiction), 9 January 200/ref> Background and contents The book challenges modern notions of History of the United States, American history; the author argues, among other viewpoints, that America's founding fathers were conservatives, the War on Poverty made poverty worse and that hundreds of American liberals had ties to the Soviet Union during the McCarthy Era. It also contests the cost-effectiveness of government projects, especially the Transcontinental Railroad. Woods ack ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Great Recession In The United States

The Great Recession in the United States was a severe financial crisis combined with a deep recession. While the recession officially lasted from December 2007 to June 2009, it took many years for the economy to recover to pre-crisis levels of employment and output Output may refer to: * The information produced by a computer, see Input/output * An output state of a system, see state (computer science) * Output (economics), the amount of goods and services produced ** Gross output in economics, the value of .... This slow recovery was due in part to households and financial institutions paying off debts accumulated in the years preceding the crisis along with restrained government spending following initial stimulus efforts. It followed the bursting of the United States housing bubble, housing bubble, the United States housing market correction, housing market correction and subprime mortgage crisis. According to the United States Department of Labor, Department of Labor, rou ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

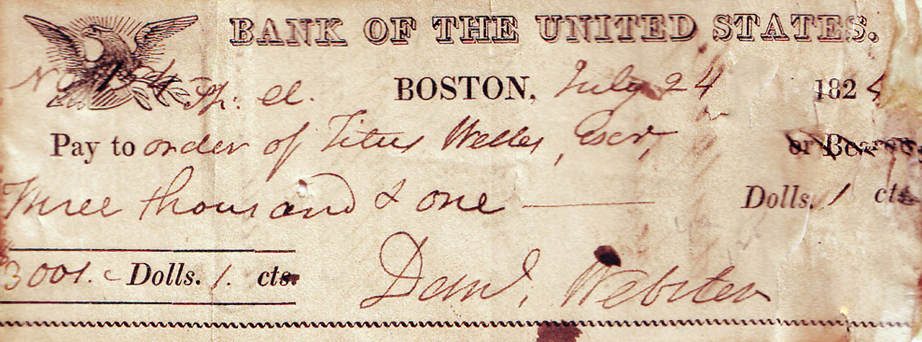

Second Bank Of The United States

The Second Bank of the United States was the second federally authorized Hamiltonian national bank in the United States. Located in Philadelphia, Pennsylvania, the bank was chartered from February 1816 to January 1836.. The Bank's formal name, according to section 9 of its charter as passed by Congress, was "The President Directors and Company of the Bank of the United States". While other banks in the US were chartered by and only allowed to have branches in a single state, it was authorized to have branches in multiple states and lend money to the US government. A private corporation with public duties, the Bank handled all fiscal transactions for the U.S. Government, and was accountable to Congress and the U.S. Treasury. Twenty percent of its capital was owned by the federal government, the Bank's single largest stockholder.. Four thousand private investors held 80 percent of the Bank's capital, including three thousand Europeans. The bulk of the stocks were held by a few hundr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Liquidation

Liquidation is the process in accounting by which a company is brought to an end in Canada, United Kingdom, United States, Ireland, Australia, New Zealand, Italy, and many other countries. The assets and property of the company are redistributed. Liquidation is also sometimes referred to as winding-up or dissolution, although dissolution technically refers to the last stage of liquidation. The process of liquidation also arises when customs, an authority or agency in a country responsible for collecting and safeguarding customs duties, determines the final computation or ascertainment of the duties or drawback accruing on an entry. Liquidation may either be compulsory (sometimes referred to as a ''creditors' liquidation'' or ''receivership'' following bankruptcy, which may result in the court creating a "liquidation trust") or voluntary (sometimes referred to as a ''shareholders' liquidation'', although some voluntary liquidations are controlled by the creditors). The ter ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Too Big To Fail Policy

"Too big to fail" (TBTF) and "too big to jail" is a theory in banking and finance that asserts that certain corporations, particularly financial institutions, are so large and so interconnected that their failure would be disastrous to the greater economic system, and that they therefore must be supported by governments when they face potential failure. The colloquial term "too big to fail" was popularized by U.S. Congressman Stewart McKinney in a 1984 Congressional hearing, discussing the Federal Deposit Insurance Corporation's intervention with Continental Illinois. The term had previously been used occasionally in the press, and similar thinking had motivated earlier bank bailouts. The term emerged as prominent in public discourse following the global financial crisis of 2007–2008. Critics see the policy as counterproductive and that large banks or other institutions should be left to fail if their risk management is not effective. Some critics, such as economist Alan Gre ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Money Creation

Money creation, or money issuance, is the process by which the money supply of a country, or of an economic or monetary region,Such as the Eurozone or ECCAS is increased. In most modern economies, money creation is controlled by the central banks. Money issued by central banks is termed base money. Central banks can increase the quantity of base money directly, by engaging in open market operations. However, the majority of the money supply is created by the commercial banking system in the form of bank deposits. Bank loans issued by commercial banks that practice fractional reserve banking expands the quantity of broad money to more than the original amount of base money issued by the central bank. Central banks monitor the amount of money in the economy by measuring monetary aggregates (termed broad money), consisting of cash and bank deposits. Money creation occurs when the quantity of monetary aggregates increase.For example, in the United States, money supply measured as M2 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bailout

A bailout is the provision of financial help to a corporation or country which otherwise would be on the brink of bankruptcy. A bailout differs from the term ''bail-in'' (coined in 2010) under which the bondholders or depositors of global systemically important financial institutions (G-SIFIs) are forced to participate in the recapitalization process, but taxpayers are not. Some governments also have the power to participate in the insolvency process: for instance, the U.S. government intervened in the General Motors bailout of 2009–2013. A bailout can, but does not necessarily, avoid an insolvency process. The term ''bailout'' is maritime in origin and describes the act of removing water from a sinking vessel using a bucket. Overview A bailout could be done for profit motives, such as when a new investor resurrects a floundering company by buying its shares at firesale prices, or for social objectives, such as when, hypothetically speaking, a wealthy philanthropist reinven ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.png)