|

Mello-Roos

Community Facilities Districts (CFDs), more commonly known as Mello-Roos, are special districts established by local governments in California as a means of obtaining additional public funding. Counties, cities, special districts, joint powers authority, and school districts in California use these financing districts to pay for public works and some public services. History The Community Facilities Act was a law enacted by the California State Legislature in 1982. The name ''Mello-Roos'' is derived from its co-authors, Senator Henry J. Mello (D-Watsonville) and Assemblyman Mike Roos (D-Los Angeles). When Proposition 13 passed in California in 1978, it limited the property tax rate and the ability of local governments to increase the assessed value of real property by not more than an annual inflation factor. As a result, the budget for public services and for the construction of public facilities could not continue unabated. New ways to fund local public improvements and service ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

California Proposition 218 (1996) Local Initiative Power

Proposition 218 is an adopted initiative constitutional amendment in the state of California that appeared on the November 5, 1996, statewide election ballot. Proposition 218 revolutionized local and regional government finance in California. Called the “Right to Vote on Taxes Act,” Proposition 218 was sponsored by the Howard Jarvis Taxpayers Association as a constitutional follow-up to the landmark Proposition 13 property tax revolt initiative constitutional amendment approved by California voters on June 6, 1978. Proposition 218 was drafted by constitutional attorneys Jonathan Coupal and Jack Cohen. One of the most significant provisions of Proposition 218 constitutionally reserves to local voters the exercise of the initiative power to reduce or repeal any local tax, assessment, fee, or charge. This includes a significantly reduced signature requirement making ballot qualification easier for local voters. Proposition 218 was the first successful initiative measu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Parcel Tax

The parcel tax is a form of real estate tax. or a land value tax, it is not directly based on property value. It funds K–12 public education and community facilities districts, which are usually known as " Mello-Roos" districts. The California parcel tax, in its typical form as a flat tax, is regressive. Most parcel taxes are a fixed amount per parcel, but some are based on the size of the parcel or its improvements. Origin Parcel taxes originated in response to California's Proposition 13 (1978), a state initiative constitutional amendment approved by California voters in June 1978. Proposition 13 limited the property tax rate based on the assessed value of real estate to 1% per year. However, a parcel tax circumvents the property tax rate limits of Proposition 13 because it does not vary according to the assessed value of the property. As a result, a parcel tax does not violate the ad valorem property tax rate limits of Proposition 13. Operation Voter approval S ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

California Proposition 13 (1978)

Proposition 13 (officially named the People's Initiative to Limit Property Taxation) is an amendment of the Constitution of California enacted during 1978, by means of the initiative process. The initiative was approved by California voters on June 6, 1978. It was upheld as constitutional by the United States Supreme Court in the case of ''Nordlinger v. Hahn'', . Proposition 13 is embodied in Article XIII A of the Constitution of the State of California. The most significant portion of the act is the first paragraph, which limits the tax rate for real estate: The proposition decreased property taxes by assessing values at their 1976 value and restricted annual increases of assessed value to an inflation factor, not to exceed 2% per year. It prohibits reassessment of a new base year value except in cases of (a) change in ownership, or (b) completion of new construction. These rules apply equally to all real estate, residential and commercial—whether owned by individuals or c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Parcel Tax

The parcel tax is a form of real estate tax. or a land value tax, it is not directly based on property value. It funds K–12 public education and community facilities districts, which are usually known as " Mello-Roos" districts. The California parcel tax, in its typical form as a flat tax, is regressive. Most parcel taxes are a fixed amount per parcel, but some are based on the size of the parcel or its improvements. Origin Parcel taxes originated in response to California's Proposition 13 (1978), a state initiative constitutional amendment approved by California voters in June 1978. Proposition 13 limited the property tax rate based on the assessed value of real estate to 1% per year. However, a parcel tax circumvents the property tax rate limits of Proposition 13 because it does not vary according to the assessed value of the property. As a result, a parcel tax does not violate the ad valorem property tax rate limits of Proposition 13. Operation Voter approval S ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Local Government In California

California has an extensive system of local government that manages public functions throughout the state. Like most states, California is divided into counties, of which there are 58 (including San Francisco)San Francisco is a consolidated city–county, and its government has the powers of both. covering the entire state. Most urbanized areas are incorporated as cities,Twenty-two cities in California style themselves "town" but this distinction has no legal significance. though not all of California is within the boundaries of a city. School districts, which are independent of cities and counties, handle public education. Many other functions, especially in unincorporated areas, are handled by special districts, which include municipal utility districts, transit districts, health care districts, vector control districts, and geologic hazard abatement districts. Due to geographical variations in property tax and sales tax revenue (the primary revenue source for cities and count ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mike Roos

Michael Roos (born August 6, 1945) is an American political strategist and former legislative leader in the California State Assembly, which he served for over 14 years (1977-1991). Career Early career Before his election to the California State Assembly, he was Chief Deputy to Los Angeles City Councilmember, Marvin Braude, and served as Executive Director of the Coro Foundation, a leadership training program for future leaders in government and public affairs. In 1976, he served as a member of the State Finance Committee for Jimmy Carter's presidential campaign. President Carter named him to the position of State Director of his 1980 presidential campaign in California. In 1988, he was the California Co-chair for U.S. Senator Paul Simon’s presidential campaign. State Assembly In 1977, he ran during a special election as the Democratic candidate for Assembly to succeed Charles Warren, who Carter appointed to head the Council on Environmental Quality in Washingto ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Special District (United States)

Special districts (also known as special service districts, special district governments, limited purpose entities, or special-purpose districts) are independent, special-purpose governmental units that exist separately from local governments such as County (United States), county, Municipality, municipal, and Township (United States), township governments, with substantial administrative and fiscal independence. They are formed to perform a single function or a set of related functions. The term ''special district governments'' as defined by the U.S. Census Bureau excludes school districts. In 2017, the U.S. had more than 51,296 special district governments. Census definition The United States Census counts government units across all States. This includes "special districts." To count the special districts the Census must define the special districts so as to address all such governmental entities across the broad spectrum of 50 states' definitions and interpretations. The Cen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

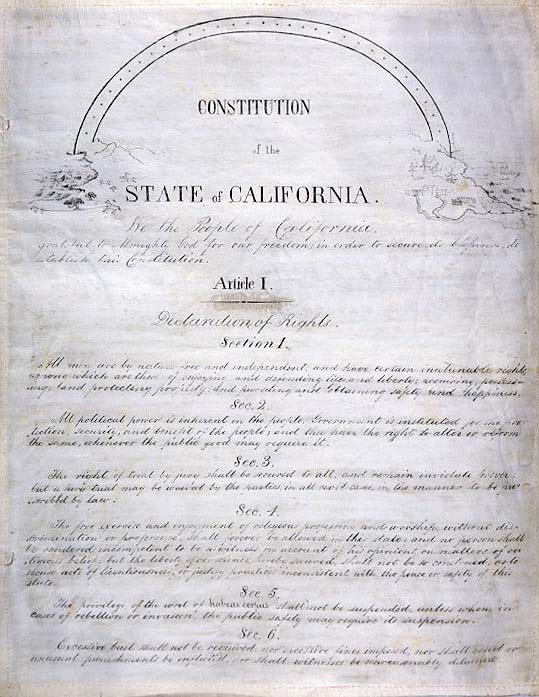

California Law

The law of California consists of several levels, including constitutional, statutory, and regulatory law, as well as case law. The California Codes form the general statutory law, and most state agency regulations are available in the California Code of Regulations. Sources of law The Constitution of California is the foremost source of state law. Legislation is enacted within the California Statutes, which in turn have been codified into the 29 California Codes. State agencies promulgate regulations with the California Regulatory Notice Register, which are in turn codified in the California Code of Regulations. California's legal system is based on common law, which is interpreted by case law through the decisions of the Supreme Court of California, California Courts of Appeal, and Appellate Divisions of the Superior Courts of California, and published in the ''California Reports'', '' California Appellate Reports'', and ''California Appellate Reports Supplement'', respective ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Property Tax

A property tax or millage rate is an ad valorem tax on the value of a property.In the OECD classification scheme, tax on property includes "taxes on immovable property or net wealth, taxes on the change of ownership of property through inheritance or gift and taxes on financial and capital transactions" (see: ), but this article only covers taxes on realty. The tax is levied by the governing authority of the jurisdiction in which the property is located. This can be a national government, a federated state, a county or geographical region or a municipality. Multiple jurisdictions may tax the same property. Often a property tax is levied on real estate. It may be imposed annually or at the time of a real estate transaction, such as in real estate transfer tax. This tax can be contrasted to a rent tax, which is based on rental income or imputed rent, and a land value tax, which is a levy on the value of land, excluding the value of buildings and other improvements. Under ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Community Development District

A community development district (CDD) is a local, special-purpose government framework authorized by Chapter 190 of the Florida Statutes as amended, and is an alternative to municipal incorporation for managing and financing infrastructure required to support development of a community. History Authority for CDDs was established by Florida's Uniform Community Development District Act of 1980. The legislation was considered a major advancement in managing growth efficiently and effectively. Although CDDs provided a new mechanism for the financing and management of new communities, their operation was consistent with the regulations and procedures of local governments, including state ethics and financial disclosure laws for CDD supervisors. All meetings and records must comply with the Florida Sunshine Law, and an annual audit is also required. As of 2012, Florida had over 600 CDDs with municipal bonds totalling $6.5 billion. Nearly three-quarters of them were establis ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Counsel

A counsel or a counsellor at law is a person who gives advice and deals with various issues, particularly in legal matters. It is a title often used interchangeably with the title of ''lawyer''. The word ''counsel'' can also mean advice given outside of the context of the legal profession. UK and Ireland The legal system in England uses the term ''counsel'' as an approximate synonym for a barrister-at-law, but not for a solicitor, and may apply it to mean either a single person who pleads a cause, or collectively, the body of barristers engaged in a case. The difference between "Barrister" and "Counsel" is subtle. "Barrister" is a professional title awarded by one of the four Inns of Court, and is used in a barrister's private, academic or professional capacity. "Counsel" is used to refer to a barrister who is instructed on a particular case. It is customary to use the third person when addressing a barrister instructed on a case: "Counsel is asked to advise" rather than ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

California Proposition 218 (1996)

Proposition 218 is an adopted initiative constitutional amendment which revolutionized local and regional government finance and taxation in California.California Secretary of State, Statement of Vote November 5, 1996, p. xii. Named the "Right to Vote on Taxes Act," it was sponsored by the Howard Jarvis Taxpayers Association as a constitutional follow-up to the landmark property tax reduction initiative constitutional amendment, Proposition 13, approved in 1978. Proposition 218 was approved and adopted by California voters during the November 5, 1996, statewide general election. Proposition 218 amended the California Constitution by adding Article XIII C and Article XIII D. Article XIII C added constitutional voter approval requirements for all local government taxes which previously did not exist. Also included in Article XIII C is a provision significantly expanding the constitutional local initiative power by voters to reduce or repeal any local government tax, assessment ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |