|

Matheson (law Firm)

Matheson (previously Matheson Ormsby Prentice), is an Irish law firm partnership based in the IFSC in Dublin, which specialises in multinational tax schemes (e.g. for clients in Ireland such as Microsoft, Google and Abbot), and tax structuring of special purpose vehicles (e.g. Section 110 securitisation SPVs). Matheson is estimated to be Ireland's largest corporate law firm. Matheson state in the International Tax Review that their tax department is: "significantly the largest tax practice group amongst Irish law firms". Development While Matheson's website traces their history back to 1825 and notes that their offices were burnt in the Irish Easter Rising of 1916, it wasn't until after the creation and initial development of Dublin's International Financial Services Centre (or IFSC) that Matheson emerged as a small but standalone law firm with 14 partners and over 50 solicitors (or lawyers) in 1991. It moved to its current IFSC offices, 70 Sir John Rogerson's Quay ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Matheson Company Logo

Matheson may refer to: People *Matheson (surname) *Clan Matheson, Scottish clan of that name *Matheson baronets, two baronetcies in the Baronetage of the United Kingdom *Matheson family, a political family in Utah, USA *Matheson Bayley, a British entertainer *Matheson Lang, a Canadian actor and playwright Companies *Matheson (automobile), defunct US automobile manufacturer * Matheson (compressed gas & equipment), manufacturer of industrial, specialty, and electronics gases *Matheson (law firm), Ireland's largest corporate tax law firm * Matheson & Company, London correspondents for Jardine Matheson Holdings Places Canada Manitoba *Matheson Island, Manitoba, a community in Canada ** Matheson Island Airport, Manitoba, Canada Ontario * Matheson, Ontario, a town in Canada **Matheson Fire, a 1916 forest fire **Matheson railway station, Black River-Matheson, Ontario, Canada *Matheson House (Perth), a historic house in Perth, Ontario, Canada *Matheson Boulevard, a boulevard in Toronto S ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Securitisation

Securitization is the financial practice of pooling various types of contractual debt such as residential mortgages, commercial mortgages, auto loans or credit card debt obligations (or other non-debt assets which generate receivables) and selling their related cash flows to third party investors as securities, which may be described as bonds, pass-through securities, or collateralized debt obligations (CDOs). Investors are repaid from the principal and interest cash flows collected from the underlying debt and redistributed through the capital structure of the new financing. Securities backed by mortgage receivables are called mortgage-backed securities (MBS), while those backed by other types of receivables are asset-backed securities (ABS). The granularity of pools of securitized assets can mitigate the credit risk of individual borrowers. Unlike general corporate debt, the credit quality of securitized debt is non- stationary due to changes in volatility that are time- and stru ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Maples And Calder

Maples Group (previously Maples and Calder) is a multi-jurisdictional firm providing legal and financial services, headquartered in the Cayman Islands. It has offices in many financial centres around the world, including several tax neutral jurisdictions. Its law firm is a member of the offshore magic circle, and specialises in advising on the laws of the Cayman Islands, Ireland, Luxembourg, Jersey and the British Virgin Islands, across a range of legal services including commercial litigation, intellectual property, sport, and finance, in which the firm has a focus on the structuring of tax efficient legal structures (or vehicles). History MacDonald and Maples was founded by Jim MacDonald and John Maples. MacDonald later retired and Douglas Calder joined as a partner, resulting in the name of the firm being changed to Maples and Calder. Today it is referred to simply as Maples and is headquartered in Ugland House in the Cayman Islands. The Cayman Islands office was opened in t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporation Tax In The Republic Of Ireland

Ireland's Corporate Tax System is a central component of Ireland's economy. In 2016–17, foreign firms paid 80% of Irish corporate tax, employed 25% of the Irish labour force (paid 50% of Irish salary tax), and created 57% of Irish OECD non-farm value-add. As of 2017, 25 of the top 50 Irish firms were U.S.–controlled businesses, representing 70% of the revenue of the top 50 Irish firms. By 2018, Ireland had received the most U.S. in history, and Apple was over one–fifth of Irish GDP. Academics rank Ireland as the largest tax haven; larger than the Caribbean tax haven system. Ireland's "headline" corporation tax rate is 12.5%, however, foreign multinationals pay an aggregate of 2.2–4.5% on global profits "shifted" to Ireland, via Ireland's global network of bilateral tax treaties. These lower effective tax rates are achieved by a complex set of Irish base erosion and profit shifting ("BEPS") tools which handle the largest BEPS flows in the world (e.g. the Double Ir ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Abbott Laboratories

Abbott Laboratories is an American multinational medical devices and health care company with headquarters in Abbott Park, Illinois, United States. The company was founded by Chicago physician Wallace Calvin Abbott in 1888 to formulate known drugs; today, it sells medical devices, diagnostics, branded generic medicines and nutritional products. It split off its research-based pharmaceuticals business into AbbVie in 2013. The firm has also been present in India for over 100 years through its subsidiary Abbott India Limited, and it is currently India's largest healthcare products company. Among its well-known products across the medical devices, diagnostics, and nutrition product divisions are Pedialyte, Similac, BinaxNOW, Ensure, Glucerna, ZonePerfect, FreeStyle Libre, i-STAT and MitraClip. History Foundation and early history In 1888 at the age of 30, Wallace Abbott (1857–1921), an 1885 graduate of the University of Michigan, founded the Abbott Alkaloidal Company in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

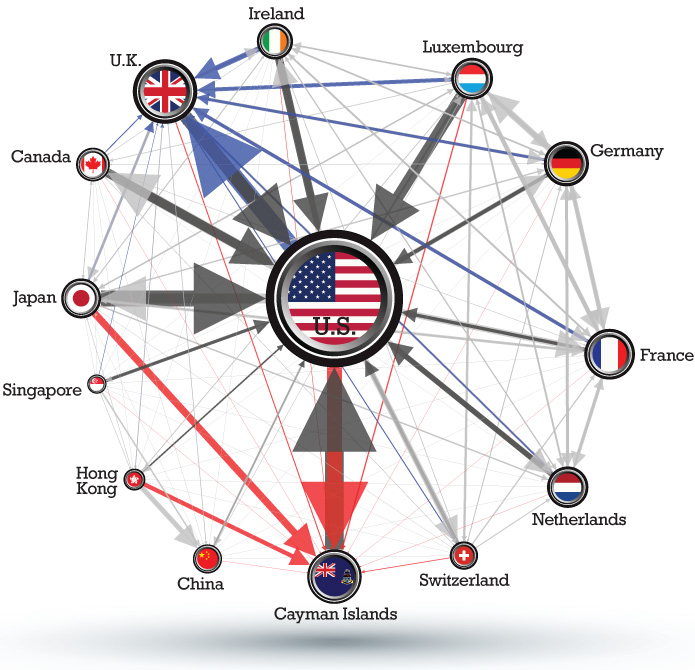

Corporate Tax Haven

Corporate haven, corporate tax haven, or multinational tax haven is used to describe a jurisdiction that multinational corporations find attractive for establishing subsidiaries or incorporation of regional or main company headquarters, mostly due to favourable tax regimes (not just the headline tax rate), and/or favourable secrecy laws (such as the avoidance of regulations or disclosure of tax schemes), and/or favourable regulatory regimes (such as weak data-protection or employment laws). Unlike traditional tax havens, modern corporate tax havens reject they have anything to do with near-zero effective tax rates, due to their need to encourage jurisdictions to enter into bilateral tax treaties which accept the haven's base erosion and profit shifting (BEPS) tools. CORPNET show each corporate tax haven is strongly connected with specific traditional tax havens (via additional BEPS tool "backdoors" like the double Irish, the dutch sandwich, and single malt). Corporate tax h ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Justice Network

The Tax Justice Network (or TJN) is an advocacy group consisting of a coalition of researchers and activists with a shared concern about tax avoidance, tax competition, and tax havens. Empirical results The TJN has reported on the OECD Base erosion and profit shifting (BEPS) projects and conducted their own research that the scale of corporate taxes being avoided by multinationals is an estimated $660bn in 2012 (a quarter of US multinationals’ gross profits), which is equivalent to 0.9% of World GDP. In July 2012, following a study into wealthy individuals with offshore accounts, the Tax Justice Network published claims regarding deposits worth at least $21 trillion (£13 trillion), potentially even $32 trillion, in secretive tax havens. As a result, governments suffer a lack of income taxes of up to $280 billion. In November 2020, the TJN published "The State of Tax Justice 2020" report. It claims $427 billion is lost every year to tax abuse. Focus Financial Secrecy Index ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Wall Street Journal

''The Wall Street Journal'' is an American business-focused, international daily newspaper based in New York City, with international editions also available in Chinese and Japanese. The ''Journal'', along with its Asian editions, is published six days a week by Dow Jones & Company, a division of News Corp. The newspaper is published in the broadsheet format and online. The ''Journal'' has been printed continuously since its inception on July 8, 1889, by Charles Dow, Edward Jones, and Charles Bergstresser. The ''Journal'' is regarded as a newspaper of record, particularly in terms of business and financial news. The newspaper has won 38 Pulitzer Prizes, the most recent in 2019. ''The Wall Street Journal'' is one of the largest newspapers in the United States by circulation, with a circulation of about 2.834million copies (including nearly 1,829,000 digital sales) compared with ''USA Today''s 1.7million. The ''Journal'' publishes the luxury news and lifestyle magazine ' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

BEPS

Base erosion and profit shifting (BEPS) refers to corporate tax planning strategies used by multinationals to "shift" profits from higher-tax jurisdictions to lower-tax jurisdictions or no-tax locations where there is little or no economic activity, thus "eroding" the "tax-base" of the higher-tax jurisdictions using deductible payments such as interest or royalties. For the government, the tax base is a company's income or profit. Tax is levied as a percentage on this income/profit. When that income / profit is transferred to another country or tax haven, the tax base is eroded and the company does not pay taxes to the country that is generating the income. As a result, tax revenues are reduced and the government is detained. The Organization for Economic Co-operation and Development (OECD) define BEPS strategies as "exploiting gaps and mismatches in tax rules". While some of the tactics are illegal, the majority are not. Corporate tax havens offer BEPS tools to "shift" pr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Times

The ''Financial Times'' (''FT'') is a British daily newspaper printed in broadsheet and published digitally that focuses on business and economic current affairs. Based in London, England, the paper is owned by a Japanese holding company, Nikkei, with core editorial offices across Britain, the United States and continental Europe. In July 2015, Pearson sold the publication to Nikkei for £844 million (US$1.32 billion) after owning it since 1957. In 2019, it reported one million paying subscriptions, three-quarters of which were digital subscriptions. The newspaper has a prominent focus on financial journalism and economic analysis over generalist reporting, drawing both criticism and acclaim. The daily sponsors an annual book award and publishes a " Person of the Year" feature. The paper was founded in January 1888 as the ''London Financial Guide'' before rebranding a month later as the ''Financial Times''. It was first circulated around metropolitan London by James Sherid ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

ITR (magazine)

''ITR'', previously known as ''International Tax Review'', is a business-to-business publication focused on news analysis of tax policy and tax advice from around the world. This remit includes transfer pricing, corporate tax and indirect tax, particularly VAT and sales tax. The magazine provides in-depth and strategic coverage of policy developments at the EU and the OECD, particularly the latter's BEPS project. History and content ''International Tax Review'' was launched in London in November 1989 to cater to the tax services industry, publishing academic papers and covering court judgments on tax law. Over the years ''ITR'' has interviewed numerous politicians, including European commissioners Margrethe Vestager and Pierre Moscovici, as well as top tax professionals from companies such as Philip Morris, Microsoft and Johnson & Johnson. ITR follows the debate on tax avoidance, inequality and wealth distribution, often reporting on the Tax Justice Network and scandals ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Haven

Corporate haven, corporate tax haven, or multinational tax haven is used to describe a jurisdiction that multinational corporations find attractive for establishing subsidiaries or incorporation of regional or main company headquarters, mostly due to favourable tax regimes (not just the headline tax rate), and/or favourable secrecy laws (such as the avoidance of regulations or disclosure of tax schemes), and/or favourable regulatory regimes (such as weak data-protection or employment laws). Unlike traditional tax havens, modern corporate tax havens reject they have anything to do with near-zero effective tax rates, due to their need to encourage jurisdictions to enter into bilateral tax treaties which accept the haven's base erosion and profit shifting (BEPS) tools. CORPNET show each corporate tax haven is strongly connected with specific traditional tax havens (via additional BEPS tool "backdoors" like the double Irish, the dutch sandwich, and single malt). Corporate tax ha ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)