|

Marriner Stoddard Eccles

Marriner Stoddard Eccles (September 9, 1890 – December 18, 1977) was an American economist and banker who served as the 7th chairman of the Federal Reserve from 1934 to 1948. After his term as chairman, Eccles continued to serve as a member of the Federal Reserve Board of Governors until 1951. Eccles was known during his lifetime chiefly as having been the Chairman of the Federal Reserve under President Franklin D. Roosevelt. He has been remembered for having anticipated and supporting the theories of John Maynard Keynes relative to "inadequate aggregate spending" in the economy which appeared during his tenure. Timberlake, Richard"The Tale of Another Chairman:... e legacy of W.M. Martin and Marriner Eccles, former Fed chairmen", ''The Region'' (Federal Reserve Bank of Minneapolis magazine), June 1999. Retrieved March 29, 2012. As Eccles wrote in his memoir ''Beckoning Frontiers'' (1951): As mass production has to be accompanied by mass consumption, mass consumption, in tur ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Chair Of The Federal Reserve

The chair of the Board of Governors of the Federal Reserve System is the head of the Federal Reserve, and is the active executive officer of the Board of Governors of the Federal Reserve System. The chair shall preside at the meetings of the Board. The chair serves a four-year term after being nominated by the President of the United States and confirmed by the United States Senate; the officeholder serves concurrently as member of the Board of Governors. The chair may serve multiple terms, pending a new nomination and confirmation at the end of each term, with William McChesney Martin as the longest serving chair from 1951 to 1970 and Alan Greenspan as a close second. The chairs cannot be dismissed by the president before the end of their term. The current chair is Jerome Powell, who was sworn in on February 5, 2018. He was nominated to the position by President Donald Trump on November 2, 2017, and later confirmed by the Senate. He was subsequently nominated to a second term b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

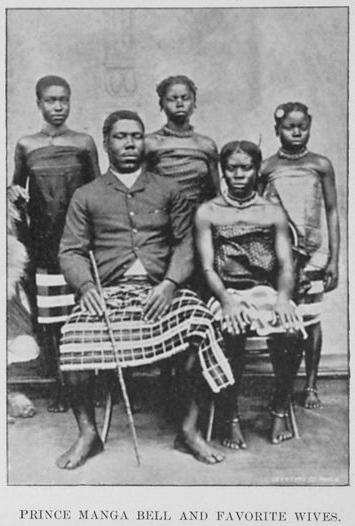

Polygamist

Crimes Polygamy (from Late Greek (') "state of marriage to many spouses") is the practice of marrying multiple spouses. When a man is married to more than one wife at the same time, sociologists call this polygyny. When a woman is married to more than one husband at a time, it is called polyandry. In contrast to polygamy, monogamy is marriage consisting of only two parties. Like "monogamy", the term "polygamy" is often used in a ''de facto'' sense, applied regardless of whether a state recognizes the relationship.For the extent to which states can and do recognize potentially and actual polygamous forms as valid, see Conflict of marriage laws. In sociobiology and zoology, researchers use ''polygamy'' in a broad sense to mean any form of multiple mating. Worldwide, different societies variously encourage, accept or outlaw polygamy. In societies which allow or tolerate polygamy, in the vast majority of cases the form accepted is polygyny. According to the ''Ethnographic At ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Board Of Governors Of The Federal Reserve

The Board of Governors of the Federal Reserve System, commonly known as the Federal Reserve Board, is the main governing body of the Federal Reserve System. It is charged with overseeing the Federal Reserve Banks and with helping implement the monetary policy of the United States. Governors are appointed by the president of the United States and confirmed by the Senate for staggered 14-year terms.See Statutory description By law, the appointments must yield a "fair representation of the financial, agricultural, industrial, and commercial interests and geographical divisions of the country". As stipulated in the Banking Act of 1935, the Chair and Vice Chair of the Board are two of seven members of the Board of Governors who are appointed by the President from among the sitting governors of the Federal Reserve Banks. The terms of the seven members of the Board span multiple presidential and congressional terms. Once a member of the Board of Governors is appointed by the president ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Chairman Of The Federal Reserve

The chair of the Board of Governors of the Federal Reserve System is the head of the Federal Reserve, and is the active executive officer of the Federal Reserve Board of Governors, Board of Governors of the Federal Reserve System. The chair shall preside at the meetings of the Board. The chair serves a four-year term after being nominated by the President of the United States and confirmed by the United States Senate; the officeholder serves concurrently as member of the Board of Governors. The chair may serve multiple terms, pending a new nomination and confirmation at the end of each term, with William McChesney Martin as the longest serving chair from 1951 to 1970 and Alan Greenspan as a close second. The chairs cannot be dismissed by the president before the end of their term. The current chair is Jerome Powell, who was sworn in on February 5, 2018. He was nominated to the position by President Donald Trump on November 2, 2017, and later confirmed by the Senate. He was subse ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Henry Morgenthau, Jr

Henry Morgenthau Jr. (; May 11, 1891February 6, 1967) was the United States Secretary of the Treasury during most of the administration of Franklin D. Roosevelt. He played a major role in designing and financing the New Deal. After 1937, while still in charge of the Treasury, he played the central role in financing United States participation in World War II. He also played an increasingly major role in shaping foreign policy, especially with respect to Lend-Lease, support for China, helping Jewish refugees, and proposing (in the "Morgenthau Plan") measures to deindustrialise Germany. Morgenthau was the father of Robert M. Morgenthau, who was district attorney of Manhattan for 35 years and Henry Morgenthau III, an American author and television producer. He continued as Treasury secretary through the first few months of Harry Truman's presidency, and from June 27, 1945, to July 3, 1945, following the resignation of Secretary of State Edward Stettinius Jr., was next in line to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Department Of The Treasury

The Department of the Treasury (USDT) is the national treasury and finance department of the federal government of the United States, where it serves as an executive department. The department oversees the Bureau of Engraving and Printing and the U.S. Mint. These two agencies are responsible for printing all paper currency and coins, while the treasury executes its circulation in the domestic fiscal system. The USDT collects all federal taxes through the Internal Revenue Service; manages U.S. government debt instruments; licenses and supervises banks and thrift institutions; and advises the legislative and executive branches on matters of fiscal policy. The department is administered by the secretary of the treasury, who is a member of the Cabinet. The treasurer of the United States has limited statutory duties, but advises the Secretary on various matters such as coinage and currency production. Signatures of both officials appear on all Federal Reserve notes. The depart ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Deposit Insurance Corporation

The Federal Deposit Insurance Corporation (FDIC) is one of two agencies that supply deposit insurance to depositors in American depository institutions, the other being the National Credit Union Administration, which regulates and insures credit unions. The FDIC is a United States government corporation supplying deposit insurance to depositors in American commercial banks and savings banks. The FDIC was created by the Banking Act of 1933, enacted during the Great Depression to restore trust in the American banking system. More than one-third of banks failed in the years before the FDIC's creation, and bank runs were common. The insurance limit was initially US$2,500 per ownership category, and this was increased several times over the years. Since the enactment of the Dodd–Frank Wall Street Reform and Consumer Protection Act in 2010, the FDIC insures deposits in member banks up to $250,000 per ownership category. FDIC insurance is backed by the full faith and credit of the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Emergency Banking Act

__NOTOC__ The Emergency Banking Act (EBA) (the official title of which was the Emergency Banking Relief Act), Public Law 73-1, 48 Stat. 1 (March 9, 1933), was an act passed by the United States Congress in March 1933 in an attempt to stabilize the banking system. Bank holiday Beginning on February 14, 1933, Michigan, an industrial state that had been hit particularly hard by the Great Depression in the United States, declared a four-day bank holiday. Fears of other bank closures spread from state to state as people rushed to withdraw their deposits while they still could do so. Within weeks, all other states held their own bank holidays in an attempt to stem the bank runs, with Delaware becoming the 48th and last state to close its banks on March 4. Following his inauguration on March 4, 1933, President Franklin Roosevelt set out to rebuild confidence in the nation's banking system and to stabilize America's banking system. On March 6, he declared a four-day ''national'' bank ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Great Depression

The Great Depression (19291939) was an economic shock that impacted most countries across the world. It was a period of economic depression that became evident after a major fall in stock prices in the United States. The economic contagion began around September and led to the Wall Street stock market crash of October 24 (Black Thursday). It was the longest, deepest, and most widespread depression of the 20th century. Between 1929 and 1932, worldwide gross domestic product (GDP) fell by an estimated 15%. By comparison, worldwide GDP fell by less than 1% from 2008 to 2009 during the Great Recession. Some economies started to recover by the mid-1930s. However, in many countries, the negative effects of the Great Depression lasted until the beginning of World War II. Devastating effects were seen in both rich and poor countries with falling personal income, prices, tax revenues, and profits. International trade fell by more than 50%, unemployment in the U.S. rose to 23% and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Run

A bank run or run on the bank occurs when many clients withdraw their money from a bank, because they believe the bank may cease to function in the near future. In other words, it is when, in a fractional-reserve banking system (where banks normally only keep a small proportion of their assets as cash), numerous customers withdraw cash from deposit accounts with a financial institution at the same time because they believe that the financial institution is, or might become, insolvent; they keep the cash or transfer it into other assets, such as government bonds, precious metals or gemstones. When they transfer funds to another institution, it may be characterized as a capital flight. As a bank run progresses, it may become a self-fulfilling prophecy: as more people withdraw cash, the likelihood of default increases, triggering further withdrawals. This can destabilize the bank to the point where it runs out of cash and thus faces sudden bankruptcy. To combat a bank run, a bank ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Conglomerate (company)

A conglomerate () is a multi-industry company – i.e., a combination of multiple business entities operating in entirely different industries under one corporate group, usually involving a parent company and many subsidiaries. Conglomerates are often large and multinational. United States The conglomerate fad of the 1960s During the 1960s, the United States was caught up in a "conglomerate fad" which turned out to be a form of speculative mania. Due to a combination of low interest rates and a repeating bear-bull market, conglomerates were able to buy smaller companies in leveraged buyouts (sometimes at temporarily deflated values). Famous examples from the 1960s include Ling-Temco-Vought,. ITT Corporation, Litton Industries, Textron, and Teledyne. The trick was to look for acquisition targets with solid earnings and much lower price–earnings ratios than the acquirer. The conglomerate would make a tender offer to the target's shareholders at a princely premium to the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

David Eccles (businessman)

David Eccles (May 12, 1849 – December 6, 1912) was an American businessman and industrialist who founded many businesses throughout the western United States and became Utah's first multimillionaire. Biography Eccles was born in Paisley, Scotland, to William and Sarah Hutchinson Eccles. In 1863 his family moved from Glasgow to the United States of America, sailing on the ''Cynosure'' , June 5, 2014. Retrieved November 2, 2017. and eventually settling in |

.jpg)

.jpg)

.jpg)