|

Markowitz Model

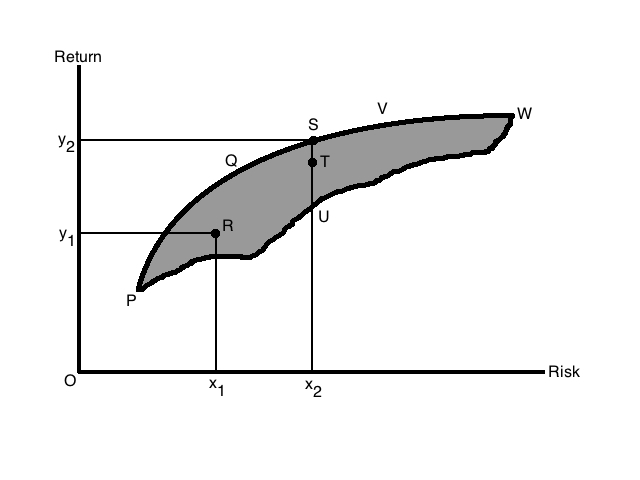

In finance, the Markowitz model ─ put forward by Harry Markowitz in 1952 ─ is a portfolio optimization model; it assists in the selection of the most efficient portfolio by analyzing various possible portfolios of the given securities. Here, by choosing securities that do not 'move' exactly together, the HM model shows investors how to reduce their risk. The HM model is also called mean-variance model due to the fact that it is based on expected returns (mean) and the standard deviation (variance) of the various portfolios. It is foundational to Modern portfolio theory. Assumptions Markowitz made the following assumptions while developing the HM model: # Risk of a portfolio is based on the variability of returns from said portfolio. # An investor is risk averse. # An investor prefers to increase consumption. # The investor's utility function is concave and increasing, due to their risk aversion and consumption preference. # Analysis is based on single period model of inv ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Finance

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of financial economics bridges the two). Finance activities take place in financial systems at various scopes, thus the field can be roughly divided into personal, corporate, and public finance. In a financial system, assets are bought, sold, or traded as financial instruments, such as currencies, loans, bonds, shares, stocks, options, futures, etc. Assets can also be banked, invested, and insured to maximize value and minimize loss. In practice, risks are always present in any financial action and entities. A broad range of subfields within finance exist due to its wide scope. Asset, money, risk and investment management aim to maximize value and minimize volatility. Financial analysis is viability, stability, and profitabili ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Indifference Curve

In economics, an indifference curve connects points on a graph representing different quantities of two goods, points between which a consumer is ''indifferent''. That is, any combinations of two products indicated by the curve will provide the consumer with equal levels of utility, and the consumer has no preference for one combination or bundle of goods over a different combination on the same curve. One can also refer to each point on the indifference curve as rendering the same level of utility (satisfaction) for the consumer. In other words, an indifference curve is the locus of various points showing different combinations of two goods providing equal utility to the consumer. Utility is then a device to represent preferences rather than something from which preferences come. The main use of indifference curves is in the representation of potentially observable demand patterns for individual consumers over commodity bundles. There are infinitely many indifference curves: o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Economics

Financial economics, also known as finance, is the branch of economics characterized by a "concentration on monetary activities", in which "money of one type or another is likely to appear on ''both sides'' of a trade". William F. Sharpe"Financial Economics", in Its concern is thus the interrelation of financial variables, such as share prices, interest rates and exchange rates, as opposed to those concerning the real economy. It has two main areas of focus:Merton H. Miller, (1999). The History of Finance: An Eyewitness Account, ''Journal of Portfolio Management''. Summer 1999. asset pricing, commonly known as "Investments", and corporate finance; the first being the perspective of providers of capital, i.e. investors, and the second of users of capital. It thus provides the theoretical underpinning for much of finance. The subject is concerned with "the allocation and deployment of economic resources, both spatially and across time, in an uncertain environment".See Fama ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Journal Of Finance

''The Journal of Finance'' is a peer-reviewed academic journal published by Wiley-Blackwell on behalf of the American Finance Association. It was established in 1946 and is considered to be one of the premier finance journals. The editor-in-chief is Antoinette Schoar. According to the ''Journal Citation Reports'', the journal has a 2020 impact factor of 7.544. It is listed as one of the 50 journals used by the ''Financial Times'' to compile its business-school research ranking and ''Bloomberg Businessweek''s Top 20 Journals. Editors The editorial board The editorial board is a group of experts, usually at a publication, who dictate the tone and direction the publication's editorial policy will take. Mass media At a newspaper, the editorial board usually consists of the editorial page editor, ... of the journal of finance consists of the editor, co-editors and associate editors. The executive editor is Antoinette Schoar ( MIT), the first female in the position. The following ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Joint Probability Distribution

Given two random variables that are defined on the same probability space, the joint probability distribution is the corresponding probability distribution on all possible pairs of outputs. The joint distribution can just as well be considered for any given number of random variables. The joint distribution encodes the marginal distributions, i.e. the distributions of each of the individual random variables. It also encodes the conditional probability distributions, which deal with how the outputs of one random variable are distributed when given information on the outputs of the other random variable(s). In the formal mathematical setup of measure theory, the joint distribution is given by the pushforward measure, by the map obtained by pairing together the given random variables, of the sample space's probability measure. In the case of real-valued random variables, the joint distribution, as a particular multivariate distribution, may be expressed by a multivariate cum ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

CML And Risk-free Lending And Borrowing

CML may refer to: Computing * Chemical Markup Language, a representation of chemistry using XML * Column Managed Lengths, a representation of data in columns * Concurrent Mapping and Localization, a technique for building and utilizing maps by autonomous robots * Concurrent ML, a high-level language for concurrent programming * Configuration Menu Language, a language and system for compiling the Linux kernel * Conversation Markup Language, a language for building chatbots * Coupled Map Lattices, an extended method of cellular automaton Electronics * Current mode logic, a differential digital logic family * Commercial microwave link, a communication channel between neighbouring towers in mobile networks Organizations * Centre for Missional Leadership, the Watford campus of the London School of Theology * Cinematography Mailing List, a long established and renowned website for professional cinematographers * Classical Marimba League, an organization promoting the marim ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market (economics)

In economics, a market is a composition of systems, institutions, procedures, social relations or infrastructures whereby parties engage in Exchange (economics), exchange. While parties may exchange goods and services by barter, most markets rely on sellers offering their goods or services (including labour power) to buyers in exchange for money. It can be said that a market is the process by which the prices of goods and services are established. Markets facilitate trade and enable the distribution and allocation of resources in a society. Markets allow any tradeable item to be evaluated and priced. A market emergence, emerges more or less spontaneous order, spontaneously or may be constructed deliberately by human interaction in order to enable the exchange of rights (cf. ownership) of services and goods. Markets generally supplant gift economies and are often held in place through rules and customs, such as a booth fee, competitive pricing, and source of goods for sale (local p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Interest

In finance and economics, interest is payment from a borrower or deposit-taking financial institution to a lender or depositor of an amount above repayment of the principal sum (that is, the amount borrowed), at a particular rate. It is distinct from a fee which the borrower may pay the lender or some third party. It is also distinct from dividend which is paid by a company to its shareholders (owners) from its profit or reserve, but not at a particular rate decided beforehand, rather on a pro rata basis as a share in the reward gained by risk taking entrepreneurs when the revenue earned exceeds the total costs. For example, a customer would usually pay interest to borrow from a bank, so they pay the bank an amount which is more than the amount they borrowed; or a customer may earn interest on their savings, and so they may withdraw more than they originally deposited. In the case of savings, the customer is the lender, and the bank plays the role of the borrower. Interes ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Market

A capital market is a financial market in which long-term debt (over a year) or equity-backed securities are bought and sold, in contrast to a money market where short-term debt is bought and sold. Capital markets channel the wealth of savers to those who can put it to long-term productive use, such as companies or governments making long-term investments. Financial regulators like Securities and Exchange Board of India (SEBI), Bank of England (BoE) and the U.S. Securities and Exchange Commission (SEC) oversee capital markets to protect investors against fraud, among other duties. Transactions on capital markets are generally managed by entities within the financial sector or the treasury departments of governments and corporations, but some can be accessed directly by the public. As an example, in the United States, any American citizen with an internet connection can create an account with TreasuryDirect and use it to buy bonds in the primary market, though sales to indiv ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Market Line

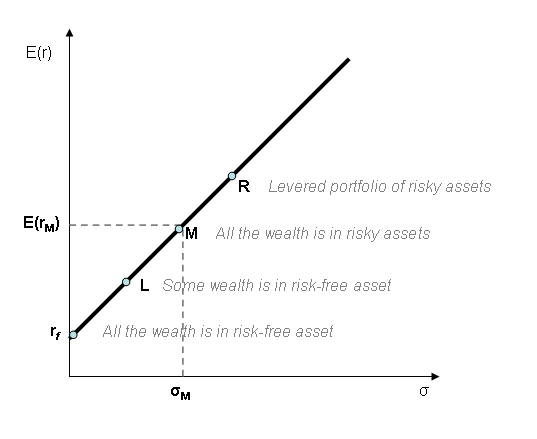

Capital market line (CML) is the tangent line drawn from the point of the risk-free asset to the feasible region for risky assets. The tangency point M represents the market portfolio, so named since all rational investors (minimum variance criterion) should hold their risky assets in the same proportions as their weights in the market portfolio. Formula :\mathrm : \sigma_p \mapsto R_f +\sigma_p \cdot\frac The CML results from the combination of the market portfolio and the risk-free asset (the point L). All points along the CML have superior risk-return profiles to any portfolio on the efficient frontier, with the exception of the Market Portfolio, the point on the efficient frontier to which the CML is the tangent. From a CML perspective, the portfolio M is composed entirely of the risky asset, the market, and has no holding of the risk free asset, i.e., money is neither invested in, nor borrowed from the money market account. Points to the left of and above the CML are infeasib ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government

A government is the system or group of people governing an organized community, generally a state. In the case of its broad associative definition, government normally consists of legislature, executive, and judiciary. Government is a means by which organizational policies are enforced, as well as a mechanism for determining policy. In many countries, the government has a kind of constitution, a statement of its governing principles and philosophy. While all types of organizations have governance, the term ''government'' is often used more specifically to refer to the approximately 200 independent national governments and subsidiary organizations. The major types of political systems in the modern era are democracies, monarchies, and authoritarian and totalitarian regimes. Historically prevalent forms of government include monarchy, aristocracy, timocracy, oligarchy, democracy, theocracy, and tyranny. These forms are not always mutually exclusive, and m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Combination Of Risk-Free Securities With The Efficient Frontier And CML

''The'' () is a grammatical article in English, denoting persons or things that are already or about to be mentioned, under discussion, implied or otherwise presumed familiar to listeners, readers, or speakers. It is the definite article in English. ''The'' is the most frequently used word in the English language; studies and analyses of texts have found it to account for seven percent of all printed English-language words. It is derived from gendered articles in Old English which combined in Middle English and now has a single form used with nouns of any gender. The word can be used with both singular and plural nouns, and with a noun that starts with any letter. This is different from many other languages, which have different forms of the definite article for different genders or numbers. Pronunciation In most dialects, "the" is pronounced as (with the voiced dental fricative followed by a schwa) when followed by a consonant sound, and as (homophone of the archaic p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.png)