|

Markov Perfect Equilibrium

A Markov perfect equilibrium is an equilibrium concept in game theory. It has been used in analyses of industrial organization, macroeconomics, and political economy. It is a refinement of the concept of subgame perfect equilibrium to extensive form games for which a pay-off relevant state space can be identified. The term appeared in publications starting about 1988 in the work of economists Jean Tirole and Eric Maskin. Definition In extensive form games, and specifically in stochastic games, a Markov perfect equilibrium is a set of mixed strategies for each of the players which satisfy the following criteria: * The strategies have the Markov property of memorylessness, meaning that each player's mixed strategy can be conditioned only on the ''state'' of the game. These strategies are called ''Markov reaction functions''. * The ''state'' can only encode payoff-relevant information. This rules out strategies that depend on non-substantive moves by the opponent. It excludes str ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

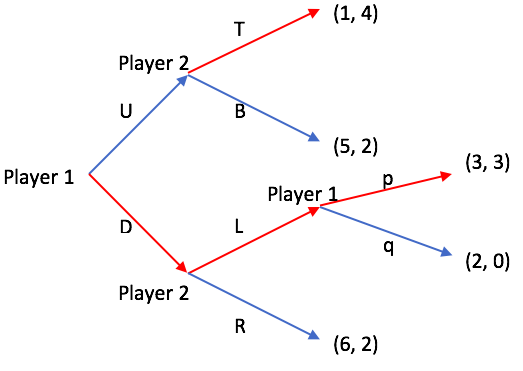

Subgame Perfect Equilibrium

In game theory, a subgame perfect equilibrium (SPE), or subgame perfect Nash equilibrium (SPNE), is a refinement of the Nash equilibrium concept, specifically designed for dynamic games where players make sequential decisions. A strategy profile is an SPE if it represents a Nash equilibrium in every possible subgame of the original game. Informally, this means that at any point in the game, the players' behavior from that point onward should represent a Nash equilibrium of the continuation game (i.e. of the subgame), no matter what happened before. This ensures that strategies are credible and rational throughout the entire game, eliminating non-credible threats. Every finite extensive game with complete information (all players know the complete state of the game) and perfect recall (each player remembers all their previous actions and knowledge throughout the game) has a subgame perfect equilibrium. A common method for finding SPE in finite games is backward induction, wher ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Proper Subgame

In game theory, a subgame is any part (a subset) of a game that meets the following criteria (the following terms allude to a game described in extensive form): #It has a single initial node that is the only member of that node's information set (i.e. the initial node is in a singleton information set). #If a node is contained in the subgame then so are all of its successors. #If a node in a particular information set is in the subgame then all members of that information set belong to the subgame. It is a notion used in the solution concept of subgame perfect Nash equilibrium, a refinement of the Nash equilibrium that eliminates non-credible threats. The key feature of a subgame is that it, when seen in isolation, constitutes a game in its own right. When the initial node of a subgame is reached in a larger game, players can concentrate only on that subgame; they can ignore the history of the rest of the game (provided they know what subgame they are playing). This is the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Best Response

In game theory, the best response is the strategy (or strategies) which produces the most favorable outcome for a player, taking other players' strategies as given. The concept of a best response is central to John Nash's best-known contribution, the Nash equilibrium, the point at which each player in a game has selected the best response (or one of the best responses) to the other players' strategies. Correspondence Reaction correspondences, also known as best response correspondences, are used in the proof of the existence of mixed strategy Nash equilibria. Reaction correspondences are not "reaction functions" since functions must only have one value per argument, and many reaction correspondences will be undefined, i.e., a vertical line, for some opponent strategy choice. One constructs a correspondence , for each player from the set of opponent strategy profiles into the set of the player's strategies. So, for any given set of opponent's strategies , represents player ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sunk Investments

In economics and business decision-making, a sunk cost (also known as retrospective cost) is a cost that has already been incurred and cannot be recovered. Sunk costs are contrasted with '' prospective costs'', which are future costs that may be avoided if action is taken. In other words, a sunk cost is a sum paid in the past that is no longer relevant to decisions about the future. Even though economists argue that sunk costs are no longer relevant to future rational decision-making, people in everyday life often take previous expenditures in situations, such as repairing a car or house, into their future decisions regarding those properties. Bygones principle According to classical economics and standard microeconomic theory, only prospective (future) costs are relevant to a rational decision. At any moment in time, the best thing to do depends only on ''current'' alternatives. The only things that matter are the ''future'' consequences. Past mistakes are irrelevant. Any costs ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

General Equilibrium

In economics, general equilibrium theory attempts to explain the behavior of supply, demand, and prices in a whole economy with several or many interacting markets, by seeking to prove that the interaction of demand and supply will result in an overall general equilibrium. General equilibrium theory contrasts with the theory of ''partial'' equilibrium, which analyzes a specific part of an economy while its other factors are held constant. General equilibrium theory both studies economies using the model of equilibrium pricing and seeks to determine in which circumstances the assumptions of general equilibrium will hold. The theory dates to the 1870s, particularly the work of French economist Léon Walras in his pioneering 1874 work ''Elements of Pure Economics''. The theory reached its modern form with the work of Lionel W. McKenzie (Walrasian theory), Kenneth Arrow and Gérard Debreu (Hicksian theory) in the 1950s. Overview Broadly speaking, general equilibrium tries to give a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Frequent-flyer Program

A frequent-flyer programme (FFP) is a loyalty program offered by an airline. Many airlines have frequent-flyer programmes designed to encourage airline customers enrolled in the programme to accumulate points (also called miles, kilometres, or segments) which may then be redeemed for air travel or other rewards. Points earned under FFPs may be based on the class of fare, distance flown on that airline or its partners, or the amount paid. There are other ways to earn points. For example, in recent years, more points have been earned by using co-branded credit and debit cards than by air travel. Another way to earn points is spending money at associated retail outlets, car hire companies, hotels, or other associated businesses. Points can be redeemed for air travel, other goods or services, or for increased benefits, such as travel class upgrades, airport lounge access, fast-track access, or priority bookings. Frequent-flyer programs can be seen as a certain type of vir ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Demand Function

In economics, an inverse demand function is the mathematical relationship that expresses price as a function of quantity demanded (it is therefore also known as a price function). Historically, the economists first expressed the price of a good as a function of demand (holding the other economic variables, like income, constant), and plotted the price-demand relationship with demand on the x (horizontal) axis (the demand curve). Later the additional variables, like prices of other goods, came into analysis, and it became more convenient to express the demand as a multivariate function (the demand function): = f(, , ...), so the original demand curve now depicts the ''inverse'' demand function = f^() with extra variables fixed. Definition In mathematical terms, if the demand function is = f(), then the inverse demand function is = f^(). The value of the inverse demand function is the highest price that could be charged and still generate the quantity demanded. This is useful ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

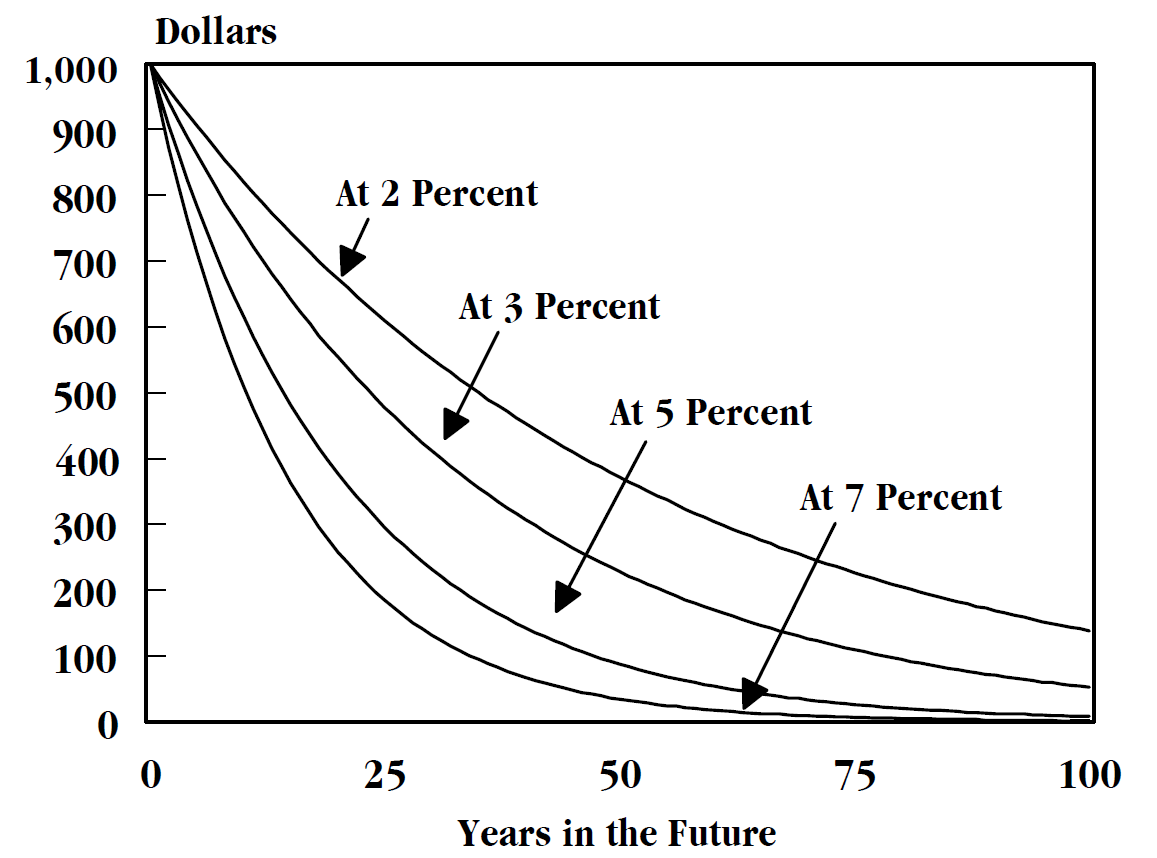

Discounted Value

In finance, discounting is a mechanism in which a debtor obtains the right to delay payments to a creditor, for a defined period of time, in exchange for a charge or fee.See "Time Value", "Discount", "Discount Yield", "Compound Interest", "Efficient Market", "Market Value" and "Opportunity Cost" in Downes, J. and Goodman, J. E. ''Dictionary of Finance and Investment Terms'', Baron's Financial Guides, 2003. Essentially, the party that owes money in the present purchases the right to delay the payment until some future date.See "Discount", "Compound Interest", "Efficient Markets Hypothesis", "Efficient Resource Allocation", "Pareto-Optimality", "Price", "Price Mechanism" and "Efficient Market" in Black, John, ''Oxford Dictionary of Economics'', Oxford University Press, 2002. This transaction is based on the fact that most people prefer current interest to delayed interest because of mortality effects, impatience effects, and salience effects. The discount, or charge, is the diffe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Production Capacity

Productive capacity is the maximum possible output of an economy. According to the United Nations Conference on Trade and Development (UNCTAD), no agreed-upon definition of maximum output exists. UNCTAD itself proposes: "the productive ''resources'', entrepreneurial ''capabilities'' and production ''linkages'' which together determine the capacity of a country to produce goods and services." The term may also be applied to individual resources or assets; for instance the productive capacity of an area of farmland. Definition in more depth Productive capacity has a lot in common with a production possibility frontier (PPF) that is an answer to the question what the maximum production capacity of a certain economy is which means using as many economy’s resources to make the output as possible. In a standard PPF graph, two types of goods’ quantities are set. PPF expresses all the possibilities of a combination of these goods that can be maximally produced by a certain economy du ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Focal Point (game Theory)

In game theory, a focal point (or Schelling point) is a solution that people tend to choose by default in the absence of communication in order to avoid Coordination game#Experimental results, coordination failure. The concept was introduced by the American economist Thomas Schelling in his book ''The Strategy of Conflict'' (1960). Schelling states that "[p]eople ''can'' often concert their intentions or expectations with others if each knows that the other is trying to do the same" in a cooperative situation (p. 57), so their action would converge on a focal point which has some kind of prominence compared with the environment. However, the conspicuousness of the focal point depends on time, place and people themselves. It may not be a definite solution. Existence The existence of the focal point is first demonstrated by Schelling with a series of questions. Here is one example: to determine the time and place to meet a stranger in New York City, but without being able to communi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |