|

Marginal Revenue Productivity Theory Of Wages

The marginal revenue productivity theory of wages is a model of wage levels in which they set to match to the marginal revenue product of labor, MRP (the value of the marginal product of labor), which is the increment to revenues caused by the increment to output produced by the last laborer employed. In a model, this is justified by an assumption that the firm is profit-maximizing and thus would employ labor only up to the point that marginal labor costs equal the marginal revenue generated for the firm.Daniel S. Hamermesh. 1986. The demand for labor in the long run. ''Handbook of Labor Economics'' (Orley Ashenfelter and Richard Layard, ed.) p. 429. This is a model of the neoclassical economics type. The marginal revenue product (MRP) of a worker is equal to the product of the marginal product of labour (MP) (the increment to output from an increment to labor used) and the marginal revenue (MR) (the increment to sales revenue from an increment to output): MRP = MP \times MR. The t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Wage

A wage is payment made by an employer to an employee for work done in a specific period of time. Some examples of wage payments include compensatory payments such as ''minimum wage'', ''prevailing wage'', and ''yearly bonuses,'' and remunerative payments such as ''prizes'' and ''tip payouts.'' Wages are part of the expenses that are involved in running a business. It is an obligation to the employee regardless of the profitability of the company. Payment by wage contrasts with salaried work, in which the employer pays an arranged amount at steady intervals (such as a week or month) regardless of hours worked, with commission which conditions pay on individual performance, and with compensation based on the performance of the company as a whole. Waged employees may also receive tips or gratuity paid directly by clients and employee benefits which are non-monetary forms of compensation. Since wage labour is the predominant form of work, the term "wage" sometimes refers to a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

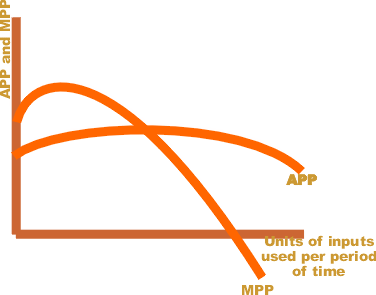

Marginal Product

In economics and in particular neoclassical economics, the marginal product or marginal physical productivity of an input (factor of production) is the change in output resulting from employing one more unit of a particular input (for instance, the change in output when a firm's labor is increased from five to six units), assuming that the quantities of other inputs are kept constant. The marginal product of a given input can be expressed as: :MP = \frac where \Delta X is the change in the firm's use of the input (conventionally a one-unit change) and \Delta Y is the change in quantity of output produced (resulting from the change in the input). Note that the quantity Y of the "product" is typically defined ignoring external costs and benefits. If the output and the input are infinitely divisible, so the marginal "units" are infinitesimal, the marginal product is the mathematical derivative of the production function with respect to that input. Suppose a firm's output ''Y'' is ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Neoclassical Economics

Neoclassical economics is an approach to economics in which the production, consumption and valuation (pricing) of goods and services are observed as driven by the supply and demand model. According to this line of thought, the value of a good or service is determined through a hypothetical maximization of utility by income-constrained individuals and of profits by firms facing production costs and employing available information and factors of production. This approach has often been justified by appealing to rational choice theory, a theory that has come under considerable question in recent years. Neoclassical economics historically dominated macroeconomics and, together with Keynesian economics, formed the neoclassical synthesis which dominated mainstream economics as "neo-Keynesian economics" from the 1950s to the 1970s.Clark, B. (1998). ''Principles of political economy: A comparative approach''. Westport, Connecticut: Praeger. Nadeau, R. L. (2003). ''The Wealth of Na ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

John Bates Clark

John Bates Clark (January 26, 1847 – March 21, 1938) was an American neoclassical economist. He was one of the pioneers of the marginalist revolution and opponent to the Institutionalist school of economics, and spent most of his career as professor at Columbia University. Biography Clark was born and raised in Providence, Rhode Island, and graduated from Amherst College, in Massachusetts, at the age of 25. From 1872 to 1875, he attended the University of Zurich and the University of Heidelberg where he studied under Karl Knies (a leader of the German Historical School). He taught as a professor of economics at Carleton College from 1875 to 1881 before moving east to teach at Smith College. He subsequently taught at Amherst College, Johns Hopkins University, and Columbia University. Early in his career Clark's writings reflected his German Socialist background and showed him as a critic of capitalism. During his time as a professor at Columbia University however, his views ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Knut Wicksell

Johan Gustaf Knut Wicksell (December 20, 1851 – May 3, 1926) was a leading Swedish economist of the Stockholm school. His economic contributions would influence both the Keynesian and Austrian schools of economic thought. He was married to the noted feminist Anna Bugge. Early life Wicksell was born in Stockholm on December 20, 1851. His father was a relatively successful businessman and real estate broker. He lost both his parents at a relatively early age. His mother died when he was only six, and his father died when he was fifteen. His father's considerable estate allowed him to enroll at the University of Uppsala in 1869 to study mathematics and physics. Education He received his first degree in two years, and he engaged in graduate studies until 1885, when he received his doctorate in mathematics. In 1887, Wicksell received a scholarship to study on the Continent, where he heard lectures by the economist Carl Menger in Vienna. In the following years, his interests beg ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Perfect Competition

In economics, specifically general equilibrium theory, a perfect market, also known as an atomistic market, is defined by several idealizing conditions, collectively called perfect competition, or atomistic competition. In Economic model, theoretical models where conditions of perfect competition hold, it has been demonstrated that a Market (economics), market will reach an Economic equilibrium, equilibrium in which the quantity supplied for every Goods and services, product or service, including Workforce, labor, equals the quantity demanded at the current price. This equilibrium would be a Pareto optimum. Perfect competition provides both allocative efficiency and productive efficiency: * Such markets are ''allocatively efficient'', as output will always occur where marginal cost is equal to average revenue i.e. price (MC = AR). In perfect competition, any Profit maximization, profit-maximizing producer faces a market price equal to its marginal cost (P = MC). This implies that ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Price Taker

In economics, market power refers to the ability of a firm to influence the price at which it sells a product or service by manipulating either the supply or demand of the product or service to increase economic profit. In other words, market power occurs if a firm does not face a perfectly elastic demand curve and can set its price (P) above marginal cost (MC) without losing revenue.Syverson, C. (2019). Macroeconomics and Market Power. The Journal of Economic Perspectives, 33(3), 23-43. https://doi.org/10.1257/jep.33.3.23 This indicates that the magnitude of market power is associated with the gap between P and MC at a firm's profit maximising level of output. Such propensities contradict perfectly competitive markets, where market participants have no market power, P = MC and firms earn zero economic profit. Market participants in perfectly competitive markets are consequently referred to as 'price takers', whereas market participants that exhibit market power are referred to as ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Demand Curve

In economics, a demand curve is a graph depicting the relationship between the price of a certain commodity (the ''y''-axis) and the quantity of that commodity that is demanded at that price (the ''x''-axis). Demand curves can be used either for the price-quantity relationship for an individual consumer (an individual demand curve), or for all consumers in a particular market (a market demand curve). It is generally assumed that demand curves slope down, as shown in the adjacent image. This is because of the law of demand: for most goods, the quantity demanded falls if the price rises. Certain unusual situations do not follow this law. These include Veblen goods, Giffen goods, and speculative bubbles where buyers are attracted to a commodity if its price rises. Demand curves are used to estimate behaviour in competitive markets and are often combined with supply curves to find the equilibrium price (the price at which sellers together are willing to sell the same amount as bu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monopoly

A monopoly (from Greek language, Greek el, μόνος, mónos, single, alone, label=none and el, πωλεῖν, pōleîn, to sell, label=none), as described by Irving Fisher, is a market with the "absence of competition", creating a situation where a specific person or company, enterprise is the only supplier of a particular thing. This contrasts with a monopsony which relates to a single entity's control of a Market (economics), market to purchase a good or service, and with oligopoly and duopoly which consists of a few sellers dominating a market. Monopolies are thus characterized by a lack of economic Competition (economics), competition to produce the good (economics), good or Service (economics), service, a lack of viable substitute goods, and the possibility of a high monopoly price well above the seller's marginal cost that leads to a high monopoly profit. The verb ''monopolise'' or ''monopolize'' refers to the ''process'' by which a company gains the ability to raise ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Imperfect Competition

In economics, imperfect competition refers to a situation where the characteristics of an economic market do not fulfil all the necessary conditions of a perfectly competitive market. Imperfect competition will cause market inefficiency when it happens, resulting in market failure. Imperfect competition is a term usually used to describe the seller's position, meaning that the level of competition between sellers falls far short of the level of competition in the market under ideal conditions. The structure of a market can significantly impact the financial performance and conduct of the firms competing within it. There is a causal relationship between structure, behaviour and performance paradigm. The characteristics of market structure can be measured by evaluating the degree of seller's market concentration to determine the nature of market competition. The degree of market power refers to the firms' ability to affect the price of a good and thus, raise the market price of the go ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Microeconomic Theories

Microeconomics is a branch of mainstream economics that studies the behavior of individuals and firms in making decisions regarding the allocation of scarce resources and the interactions among these individuals and firms. Microeconomics focuses on the study of individual markets, sectors, or industries as opposed to the national economy as whole, which is studied in macroeconomics. One goal of microeconomics is to analyze the market mechanisms that establish relative prices among goods and services and allocate limited resources among alternative uses. Microeconomics shows conditions under which free markets lead to desirable allocations. It also analyzes market failure, where markets fail to produce efficient results. While microeconomics focuses on firms and individuals, macroeconomics focuses on the sum total of economic activity, dealing with the issues of growth, inflation, and unemployment and with national policies relating to these issues. Microeconomics also deals ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |