|

Making Home Affordable

The Making Home Affordable program of the United States Treasury was launched in 2009 as part of the Troubled Asset Relief Program. The main activity under MHA is the Home Affordable Modification Program. Other programs under MHA include: * Principal Reduction Alternative (PRA), assists homeowners with a loan-to-value ratio exceeding 115 percent. * Home Affordable Unemployment Program (UP), temporary forbearance for unemployed homeowners. * Second Lien Modification Program (2MP) provides a mechanism for servicers to modify second liens when a homeowner receives a first lien modification through HAMP. * Home Affordable Foreclosure Alternatives Program (HAFA), helps homeowners exit their homes and transition to a more affordable living situation through a short sale or deed-in-lieu of foreclosure. Background The subprime mortgage crisis was triggered by a large decline in home prices after the collapse of a housing bubble, leading to mortgage delinquencies, foreclosures, and the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Department Of The Treasury

The Department of the Treasury (USDT) is the national treasury and finance department of the federal government of the United States, where it serves as an executive department. The department oversees the Bureau of Engraving and Printing and the U.S. Mint. These two agencies are responsible for printing all paper currency and coins, while the treasury executes its circulation in the domestic fiscal system. The USDT collects all federal taxes through the Internal Revenue Service; manages U.S. government debt instruments; licenses and supervises banks and thrift institutions; and advises the legislative and executive branches on matters of fiscal policy. The department is administered by the secretary of the treasury, who is a member of the Cabinet. The treasurer of the United States has limited statutory duties, but advises the Secretary on various matters such as coinage and currency production. Signatures of both officials appear on all Federal Reserve notes. The depart ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

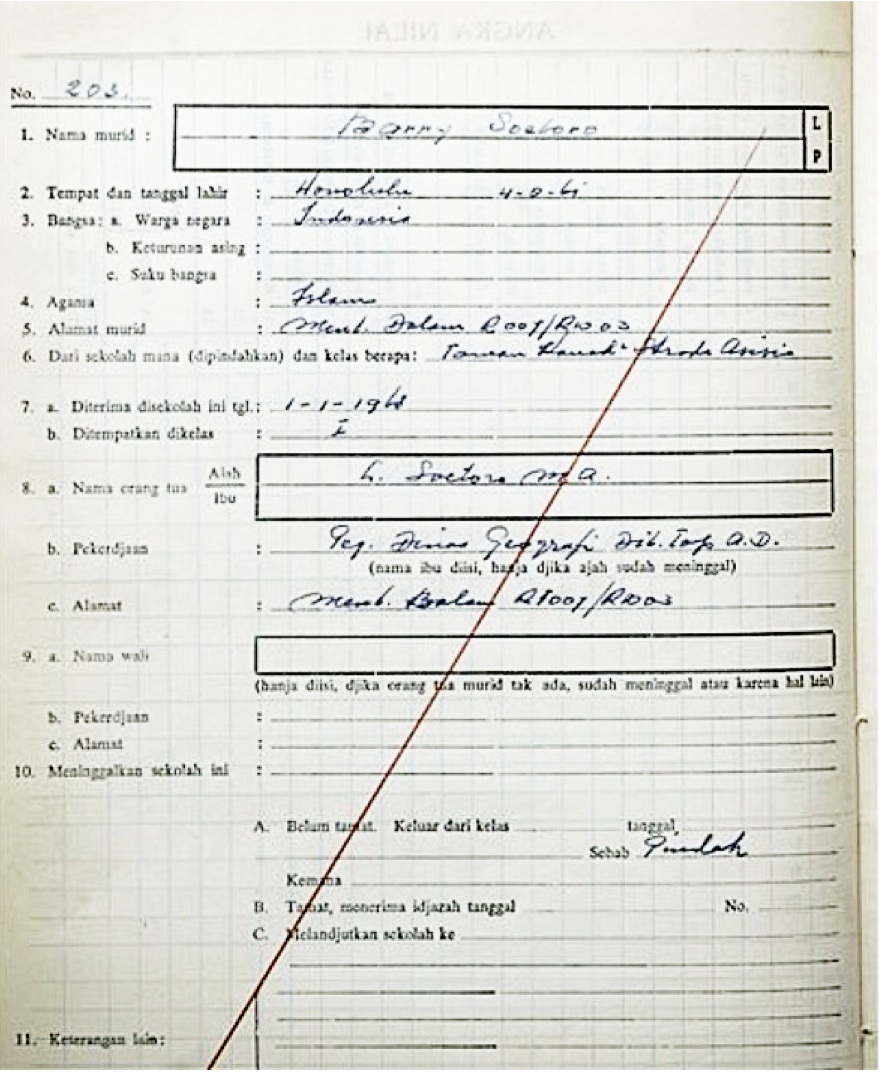

Barack Obama

Barack Hussein Obama II ( ; born August 4, 1961) is an American politician who served as the 44th president of the United States from 2009 to 2017. A member of the Democratic Party, Obama was the first African-American president of the United States. He previously served as a U.S. senator from Illinois from 2005 to 2008 and as an Illinois state senator from 1997 to 2004, and previously worked as a civil rights lawyer before entering politics. Obama was born in Honolulu, Hawaii. After graduating from Columbia University in 1983, he worked as a community organizer in Chicago. In 1988, he enrolled in Harvard Law School, where he was the first black president of the '' Harvard Law Review''. After graduating, he became a civil rights attorney and an academic, teaching constitutional law at the University of Chicago Law School from 1992 to 2004. Turning to elective politics, he represented the 13th district in the Illinois Senate from 1997 until 2004, when he ran for the U ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Home Affordable Refinance Program

The Home Affordable Refinance Program (HARP) is a federal program of the United States, set up by the Federal Housing Finance Agency in March 2009, to help underwater and near-underwater homeowners refinance their mortgages. Unlike the Home Affordable Modification Program (HAMP), which assists homeowners who are in danger of foreclosure, this program benefits homeowners whose mortgage payments are current, but who cannot refinance due to dropping home prices in the wake of the U.S. housing market correction. Background Millions of borrowers found themselves in a difficult predicament after the U.S. housing bubble burst in 2008. As inventories soared nationwide, home prices plummeted. Many new homeowners saw the value of their homes drop below the balance of their mortgages, or nearly so. Later, these same homeowners were prevented from taking advantage of lower interest rates through refinancing, since banks traditionally require a loan-to-value ratio (LTV) of 80% or less to qu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Loan Modification In The United States

Loan modification is the systematic alteration of mortgage loan agreements that help those having problems making the payments by reducing interest rates, monthly payments or principal balances. Lending institutions could make one or more of these changes to relieve financial pressure on borrowers to prevent the condition of foreclosure. Loan modifications have been practiced in the United States since the 1930s. During the Great Depression, loan modification programs took place at the state level in an effort to reduce levels of loan foreclosures. During the Subprime mortgage crisis, loan modification became a matter of national policy, with various actions taken to alter mortgage loan terms to prevent further economic destabilization. United States 1930s During the Great Depression in the United States a number of mortgage modification programs were enacted by the states to limit foreclosure sales and subsequent homelessness and its economic impact. Because of the shrinkag ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

JPMorgan Chase

JPMorgan Chase & Co. is an American multinational investment bank and financial services holding company headquartered in New York City and incorporated in Delaware. As of 2022, JPMorgan Chase is the largest bank in the United States, the world's largest bank by market capitalization, and the fifth largest bank in the world in terms of total assets, with total assets of US$3.774 trillion. Additionally, JPMorgan Chase is ranked 24th on the Fortune 500 list of the largest United States corporations by total revenue. It is considered a systemically important bank by the Financial Stability Board. As a " Bulge Bracket" bank, it is a major provider of various investment banking and financial services. It is one of America's Big Four banks, along with Bank of America, Citigroup, and Wells Fargo. JPMorgan Chase is considered to be a universal bank and a custodian bank. The J.P. Morgan brand is used by the investment banking, asset management, private banking, wealth man ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Citigroup

Citigroup Inc. or Citi (Style (visual arts), stylized as citi) is an American multinational investment banking, investment bank and financial services corporation headquartered in New York City. The company was formed by the merger of banking giant #Citicorp, Citicorp and financial conglomerate Travelers Group in 1998; Travelers was subsequently spun off from the company in 2002. Citigroup owns Citicorp, the holding company for Citibank, as well as several international subsidiaries. Citigroup is Delaware General Corporation Law, incorporated in Delaware. Citigroup is the List of largest banks in the United States, third largest banking institution in the United States; alongside JPMorgan Chase, Bank of America, and Wells Fargo, it is one of the Big Four (banking)#United States, Big Four banking institutions of the United States. It is considered a Systemically important financial institution, systemically important bank by the Financial Stability Board and is commonly cited as ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Congress

The United States Congress is the legislature of the federal government of the United States. It is bicameral, composed of a lower body, the House of Representatives, and an upper body, the Senate. It meets in the U.S. Capitol in Washington, D.C. Senators and representatives are chosen through direct election, though vacancies in the Senate may be filled by a governor's appointment. Congress has 535 voting members: 100 senators and 435 representatives. The U.S. vice president has a vote in the Senate only when senators are evenly divided. The House of Representatives has six non-voting members. The sitting of a Congress is for a two-year term, at present, beginning every other January. Elections are held every even-numbered year on Election Day. The members of the House of Representatives are elected for the two-year term of a Congress. The Reapportionment Act of 1929 establishes that there be 435 representatives and the Uniform Congressional Redistricting Act requires ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tim Geithner

Timothy Franz Geithner (; born August 18, 1961) is a former American central banker who served as the 75th United States Secretary of the Treasury under President Barack Obama from 2009 to 2013. He was the President of the Federal Reserve Bank of New York from 2003 to 2009, following service in the Clinton administration. Since March 2014, he has served as president and managing director of Warburg Pincus, a private equity firm headquartered in New York City. As President of the New York Fed and Secretary of the Treasury, Geithner had a key role in government efforts to recover from the financial crisis of 2007–08 and the Great Recession. At the New York Fed, Geithner helped manage crises involving Bear Stearns, Lehman Brothers, and the American International Group; as Treasury Secretary, he oversaw allocation of $350 billion under the Troubled Asset Relief Program, enacted during the previous administration in response to the subprime mortgage crisis. Geithner also managed the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Secretary Of The Treasury

The United States secretary of the treasury is the head of the United States Department of the Treasury, and is the chief financial officer of the federal government of the United States. The secretary of the treasury serves as the principal advisor to the president of the United States on all matters pertaining to economic and fiscal policy. The secretary is a statutory member of the Cabinet of the United States, and is fifth in the United States presidential line of succession, presidential line of succession. Under the Appointments Clause of the United States Constitution, the officeholder is nominated by the president of the United States, and, following a confirmation hearing before the United States Senate Committee on Finance, Senate Committee on Finance, is confirmed by the United States Senate. The United States Secretary of State, secretary of state, the secretary of the treasury, the United States Secretary of Defense, secretary of defense, and the United States Att ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Neil Barofsky

Neil M. Barofsky (born 1970), a partner in the Litigation Department of national law firm Jenner & Block LLP, focuses his practice on white collar investigations, complex commercial litigation, monitorships and examinerships. Immediately before joining Jenner & Block, Mr. Barofsky was Senior Fellow at New York University School of Law’s Center on the Administration of Criminal Law, an adjunct professor at the law school and affiliated with the Mitchell Jacobson Leadership Program on Law and Business. He was SIGTARP, the Special United States Treasury Department Inspector General overseeing the Troubled Assets Relief Program (TARP), from late 2008 until his resignation at the end of March 2011, previous to which he was Assistant United States Attorney for the Southern District of New York from 2000 to 2008. Education Barofsky went to Spanish River High School in Boca Raton, Florida and completed his undergraduate studies at the University of Pennsylvania, earning a bachelor ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Greenlining Institute

The Greenlining Institute is a public policy, research, and advocacy non-profit organization based in Oakland, California. It seeks to advance economic opportunity and empowerment for people of color through advocacy, community and coalition building, research and leadership development. History The Greenlining Institute was established by African American, Asian American, and Latino American community leaders in 1993 to fight injustice, increase the participation of people of color in policymaking, and encourage successful investment by corporate America into these communities. Rather than just fighting redlining, the illegal practice of denying services to certain communities, greenlining is the proactive effort of bringing profitable investments and services to communities that have been left behind. The Greenlining Institute was founded on the principle of wealth creation, with a strong belief that diversity makes business sense and leads to greater effectiveness. Policy Issu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Unpaid Principal Balance

Unpaid principal balance (UPB) is the portion of a loan (e.g. a mortgage loan) at a certain point in time that has not yet been remitted to the lender. For a typical consumer loan such as a home mortgage or automobile loan, the original unpaid principal balance is the amount borrowed, and therefore the amount the borrower owes the lender on the origination date of the loan. The unpaid principal balance will decrease as time goes on for the loans that are structured with level payments. For these common loans, each monthly payment includes both interest and principal. The unpaid principal balance at the beginning of a given month is reduced by that portion of the level payment that is designated principal for that month; so that the unpaid principal balance at the end of the month is the beginning UPB less the principal paid for the month. Hence, the UPB decreases over time. Example Showing how UPB decreases each month A $100,000 loan with an original UPB with a nominal ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |