|

MT4 ECN Bridge

MT4 ECN Bridge is a technology that allows a user to access the interbank foreign exchange market through the MetaTrader 4 (MT4) electronic trading platform. MT4 was designed to allow trading between a broker and its clients, so it did not provide for passing orders through to wholesale forex market via electronic communication networks (ECNs). In response, a number of third-party software companies developed Straight-through processing bridging softwareMichael Gorham, Nidhi Signh. Electronic Exchanges: The Global trandformation from Pits to Bids. – Elsevier Inc. – 2009. – . – p.18. to allow the MT4 server to pass orders placed by clients directly to an ECN and feed trade confirmations back automatically. Background Retail foreign exchange brokers in general are divided into two categories: * Dealing desk brokers or market makers that execute orders and keep the position in that broker's inner liquidity pool. A DD broker is a specific broker who employs dealers that may ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Interbank Foreign Exchange Market

The interbank market is the top-level foreign exchange market where banks exchange different currencies. The banks can either deal with one another directly, or through electronic brokering platforms. The Electronic Broking Services (EBS) and Thomson Reuters Dealing are the two competitors in the electronic brokering platform business and together connect over 1000 banks. The currencies of most developed countries have floating exchange rates. These currencies do not have fixed values but, rather, values that fluctuate relative to other currencies. The interbank market is an important segment of the foreign exchange market. It is a wholesale market through which most currency transactions are channeled. It is mainly used for trading among bankers. The three main constituents of the interbank market are: * the spot market * the forward market * SWIFT (Society for World-Wide Interbank Financial Telecommunications) The interbank market is unregulated and decentralized. There is no ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Markets

A financial market is a market in which people trade financial securities and derivatives at low transaction costs. Some of the securities include stocks and bonds, raw materials and precious metals, which are known in the financial markets as commodities. The term "market" is sometimes used for what are more strictly ''exchanges'', organizations that facilitate the trade in financial securities, e.g., a stock exchange or commodity exchange. This may be a physical location (such as the New York Stock Exchange (NYSE), London Stock Exchange (LSE), JSE Limited (JSE), Bombay Stock Exchange (BSE) or an electronic system such as NASDAQ. Much trading of stocks takes place on an exchange; still, corporate actions (merger, spinoff) are outside an exchange, while any two companies or people, for whatever reason, may agree to sell the stock from the one to the other without using an exchange. Trading of currencies and bonds is largely on a bilateral basis, although some bonds trade o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Software

Financial software or financial system software is special application software that records all the financial activity within a business organization. Basic features of this system not only includes all the modules of accounting software like accounts payable, accounts receivable, ledger, reporting modules and payroll but also to explore alternative investment choices and calculate statistical relationships. Features of the system may vary depending on what type of business it is being used for. Primarily, the goal of the financial software is to record, categorize, analyze, compile, interpret and then present an accurate and updated financial dates for every transaction of the business. Features of financial software Pipeline tracking Pipeline tracking is one of the key features of an accounting system and software for asset management. This provides summarized information on all the details pertaining to the potential investments that are being monitored. The system and software ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Direct Access Trading

In finance, an electronic trading platform also known as an online trading platform, is a computer software program that can be used to place orders for financial products over a network with a financial intermediary. Various financial products can be traded by the trading platform, over a communication network with a financial intermediary or directly between the participants or members of the trading platform. This includes products such as stocks, bonds, currencies, commodities, derivatives and others, with a financial intermediary, such as brokers, market makers, Investment banks or stock exchanges. Such platforms allow electronic trading to be carried out by users from any location and are in contrast to traditional floor trading using open outcry and telephone based trading. Sometimes the term trading platform is also used in reference to the trading software alone. Electronic trading platforms typically stream live market prices on which users can trade and may pro ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Foreign Exchange Market

The foreign exchange market (Forex, FX, or currency market) is a global decentralized or over-the-counter (OTC) market for the trading of currencies. This market determines foreign exchange rates for every currency. It includes all aspects of buying, selling and exchanging currencies at current or determined prices. In terms of trading volume, it is by far the largest market in the world, followed by the credit market. The main participants in this market are the larger international banks. Financial centers around the world function as anchors of trading between a wide range of multiple types of buyers and sellers around the clock, with the exception of weekends. Since currencies are always traded in pairs, the foreign exchange market does not set a currency's absolute value but rather determines its relative value by setting the market price of one currency if paid for with another. Ex: USD 1 is worth X CAD, or CHF, or JPY, etc. The foreign exchange market works thro ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Volatility (finance)

In finance, volatility (usually denoted by ''σ'') is the degree of variation of a trading price series over time, usually measured by the standard deviation of logarithmic returns. Historic volatility measures a time series of past market prices. Implied volatility looks forward in time, being derived from the market price of a market-traded derivative (in particular, an option). Volatility terminology Volatility as described here refers to the actual volatility, more specifically: * actual current volatility of a financial instrument for a specified period (for example 30 days or 90 days), based on historical prices over the specified period with the last observation the most recent price. * actual historical volatility which refers to the volatility of a financial instrument over a specified period but with the last observation on a date in the past **near synonymous is realized volatility, the square root of the realized variance, in turn calculated using the sum of squ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

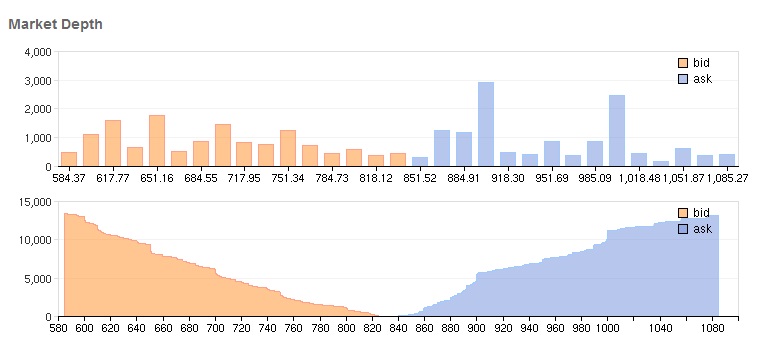

Market Depth

In finance, market depth is a real-time list displaying the quantity to be sold versus unit price. The list is organized by price level and is reflective of real-time market activity. Mathematically, it is the size of an order needed to move the market price by a given amount. If the market is ''deep'', a large order is needed to change the price. Factors influencing market depth * Tick size. This refers to the minimum price increment at which trades may be made on the market. The major stock markets in the United States went through a process of decimalisation in April 2001. This switched the minimum increment from a sixteenth to a one hundredth of a dollar. This decision improved market depth.Market Depth Investopedia *Price movement restrictions. Most major financial markets do not allow completely free exchange of the product ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ask Price

Ask price, also called offer price, offer, asking price, or simply ask, is the price a seller states they will accept. The seller may qualify the stated asking price as firm or negotiable. Firm means the seller is implying that the price is fixed and will not change. In bid and ask, the term ask price is used in contrast to the term bid price. The difference between the bid price and the ask price is called the spread. Stock exchange In the context of stock trading on a stock exchange, the ask price is the lowest price a seller of a stock is willing to accept for a share of that given stock. For over-the-counter stocks, the asking price is the best quoted price at which a market maker is willing to sell a stock. Mutual funds For mutual funds, the asking price is the net asset value plus any sales charges. It is also called asked price or offering price or ask. Commodities The ask price is the lowest price a seller of a commodity is willing to accept for that commodity. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bid Price

A bid price is the highest price that a buyer (i.e., bidder) is willing to pay for some goods. It is usually referred to simply as the "bid". In bid and ask, the bid price stands in contrast to the ask price or "offer", and the difference between the two is called the bid–ask spread. An unsolicited bid or purchase offer is when a person or company receives a bid even though they are not looking to sell. Bidding war A bidding war is said to occur when a large number of competing bids are placed in rapid succession by two or more entities, especially when the price paid is much greater than the ask price, or greater than the first bid in the case of unsolicited bidding. In other words, a bidding war is a situation where two or more buyers are so interested in an item (such as a house or a business) that they make increasingly higher-priced offers in attempts to outbid others and win the ownership of the item. In real estate, a potential buyer can increase their bid in a numbe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Straight-through Processing

Straight-through processing (STP) is a method used by financial companies to speed up financial transactions by processing without manual intervention (straight-through). It was developed for equities trading in the early 1990s in London for automated processing in the equity markets. Payments Straight-through processing exists in numerous areas of financial services, such as payments processing. Payments may be non-STP due to various reasons such as missing information, information which that is not in a machine "understandable" form (such as name and address rather than a code), or human-readable instructions "Please credit urgently") or simply falls outside of rules for which the bank allows automatic processing (for example, payments of large value or in exotic currencies). Traditionally, making payments involves many departments in a bank. Both initiating a payment to be sent and processing a received payment may take days. In the past, payments were initiated through numer ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |