|

Low-volatility Investing

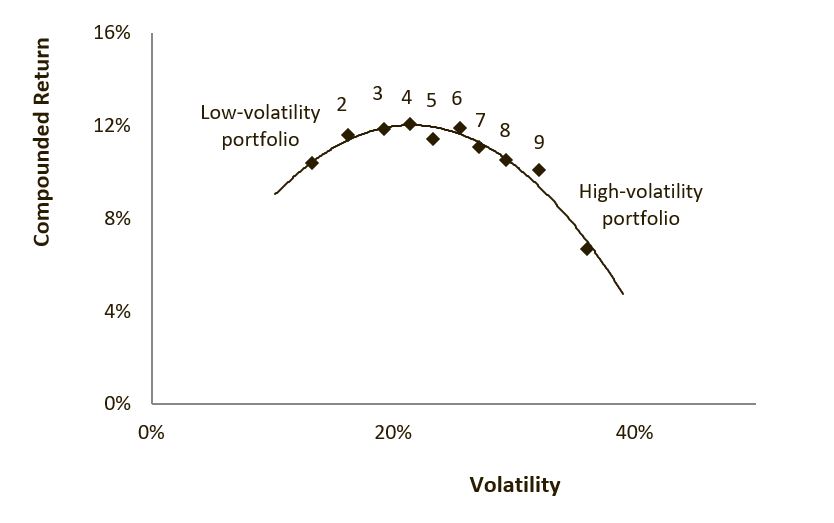

Low-volatility investing is an investment style that buys stocks or securities with low volatility and avoids those with high volatility. This investment style exploits the low-volatility anomaly. According to financial theory risk and return should be positively related, however in practice this is not true. Low-volatility investors aim to achieve market-like returns, but with lower risk. This investment style is also referred to as minimum volatility, minimum variance, managed volatility, smart beta, defensive and conservative investing. History The low-volatility anomaly was already discovered in the early 1970s, yet it only became a popular investment style after the 2008 global financial crises. The first tests of the Capital Asset Pricing Model (CAPM) showed that the risk-return relation was too flat. Two decades later, in 1992 the seminal study by Fama and French clearly showed that market beta (risk) and return were not related when controlling for firm size. Fishe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investment Style

Investment style refers to different style characteristics of equities, bonds or financial derivatives within a given investment philosophy. Theory would favor a combination of big capitalization, passive and value. Of course one could almost get that when investing in an important Index like S&P 500, EURO STOXX or the like. Also the degree of financial leverage and diversification are also factors Investor traits The style is determined by * the temper and the beliefs of the investor. * some personal or social traits ( investor profile) such as age, gender, income, wealth, family, tax situation... * generally, its financial return / risk objectives, assuming they are precisely set and fully rational. Some styles Active vs. Passive Active investors believe in their ability to outperform the overall market by picking stocks they believe may perform well. Passive investors, on the other hand, feel that simply investing in a market index fund may produce potentially higher ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

MSCI

MSCI Inc. is an American finance company headquartered in New York City. MSCI is a global provider of equity, fixed income, real estate indexes, multi-asset portfolio analysis tools, ESG and climate products. It operates the MSCI World, MSCI All Country World Index (ACWI), MSCI Emerging Markets Indexes. The company is headquartered at 7 World Trade Center in Manhattan, New York City, U.S. History In 1968, Capital International published indexes covering the global stock market for non-U.S. markets. In 1986, Morgan Stanley licensed the rights to the indexes from Capital International and branded the indexes as the Morgan Stanley Capital International (MSCI) indexes. By the 1980s, the MSCI indexes were the primary benchmark indexes outside of the U.S. before being joined by FTSE, Citibank, and Standard & Poor's. After Dow Jones started float weighting its index funds, MSCI followed. In 2004, MSCI acquired Barra, Inc., to form MSCI Barra. In mid-2007, parent company Morgan Stanl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Eric Falkenstein

Eric Falkenstein (born 14 August 1965) is an American financial economist and an expert in the field of low-volatility investing. He is an academic researcher, blogger, quant portfolio manager, and book author. Education Falkenstein received his economics PhD from Northwestern University in 1994, and wrote his dissertation on the low return to high volatility stocks. Career He was a teaching assistant for Hyman Minsky at Washington University in St. Louis. He set up a value at risk system for trading operations at KeyCorp bank, then a firm-wide economic risk capital allocation methodology. He was a founding researcher of RiskCalc, Moody's private firm default probability model, the premier private firm default model in the world. He has been an equity portfolio manager at Pine River Capital Management and developed trading algorithms for Walleye Software. He is currently working on Ethereum contracts. Writing Falkenstein has blogged for many years and was among the top in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Momentum Investing

Momentum investing is a system of buying stocks or other securities that have had high returns over the past three to twelve months, and selling those that have had poor returns over the same period. While momentum investing is well-established as a phenomenon no consensus exists about the explanation for this strategy, and economists have trouble reconciling momentum with the efficient market hypothesis and random walk hypothesis. Two main hypotheses have been submitted to explain the momentum effect in terms of an efficient market. In the first, it is assumed that momentum investors bear significant risk for assuming this strategy, and, therefore, the high returns are a compensation for the risk. Momentum strategies often involve disproportionately trading in stocks with high bid-ask spreads and so it is important to take transactions costs into account when evaluating momentum profitability. The second theory assumes that momentum investors are exploiting behavioral shortcomings ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investment Style

Investment style refers to different style characteristics of equities, bonds or financial derivatives within a given investment philosophy. Theory would favor a combination of big capitalization, passive and value. Of course one could almost get that when investing in an important Index like S&P 500, EURO STOXX or the like. Also the degree of financial leverage and diversification are also factors Investor traits The style is determined by * the temper and the beliefs of the investor. * some personal or social traits ( investor profile) such as age, gender, income, wealth, family, tax situation... * generally, its financial return / risk objectives, assuming they are precisely set and fully rational. Some styles Active vs. Passive Active investors believe in their ability to outperform the overall market by picking stocks they believe may perform well. Passive investors, on the other hand, feel that simply investing in a market index fund may produce potentially higher ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Low-volatility Anomaly

In investing and finance, the low-volatility anomaly is the observation that low-volatility stocks have higher returns than high-volatility stocks in most markets studied. This is an example of a stock market anomaly since it contradicts the central prediction of many financial theories that taking higher risk must be compensated with higher returns. Furthermore, the Capital Asset Pricing Model (CAPM) predicts a positive relation between the systematic risk-exposure of a stock (also known as the stock beta) and its expected future returns. However, some narratives of the low-volatility anomaly falsify this prediction of the CAPM by showing that stocks with higher beta have historically under-performed the stocks with lower beta. Other narratives of this anomaly show that even stocks with higher idiosyncratic risk are compensated with lower returns in comparison to stocks with lower idiosyncratic risk. The low-volatility anomaly has also been referred to as the low-beta, min ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Interest Rate Risk

In finance and economics, interest is payment from a borrower or deposit-taking financial institution to a lender or depositor of an amount above repayment of the principal sum (that is, the amount borrowed), at a particular rate. It is distinct from a fee which the borrower may pay the lender or some third party. It is also distinct from dividend which is paid by a company to its shareholders (owners) from its profit or reserve, but not at a particular rate decided beforehand, rather on a pro rata basis as a share in the reward gained by risk taking entrepreneurs when the revenue earned exceeds the total costs. For example, a customer would usually pay interest to borrow from a bank, so they pay the bank an amount which is more than the amount they borrowed; or a customer may earn interest on their savings, and so they may withdraw more than they originally deposited. In the case of savings, the customer is the lender, and the bank plays the role of the borrower. Interest dif ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dot-com Bubble

The dot-com bubble (dot-com boom, tech bubble, or the Internet bubble) was a stock market bubble in the late 1990s, a period of massive growth in the use and adoption of the Internet. Between 1995 and its peak in March 2000, the Nasdaq Composite stock market index rose 400%, only to fall 78% from its peak by October 2002, giving up all its gains during the bubble. During the dot-com crash, many online shopping companies, such as Pets.com, Webvan, and Boo.com, as well as several communication companies, such as Worldcom, NorthPoint Communications, and Global Crossing, failed and shut down. Some companies that survived, such as Amazon, lost large portions of their market capitalization, with Cisco Systems alone losing 80% of its stock value. Background Historically, the dot-com boom can be seen as similar to a number of other technology-inspired booms of the past including railroads in the 1840s, automobiles in the early 20th century, radio in the 1920s, television in the 19 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Value Investing

Value investing is an investment paradigm that involves buying securities that appear underpriced by some form of fundamental analysis. The various forms of value investing derive from the investment philosophy first taught by Benjamin Graham and David Dodd at Columbia Business School in 1928, and subsequently developed in their 1934 text ''Security Analysis''. The early value opportunities identified by Graham and Dodd included stock in public companies trading at discounts to book value or tangible book value, those with high dividend yields, and those having low price-to-earning multiples, or low price-to-book ratios. High-profile proponents of value investing, including Berkshire Hathaway chairman Warren Buffett, have argued that the essence of value investing is buying stocks at less than their intrinsic value. The discount of the market price to the intrinsic value is what Benjamin Graham called the " margin of safety". For the last 25 years, under the influence of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

David C

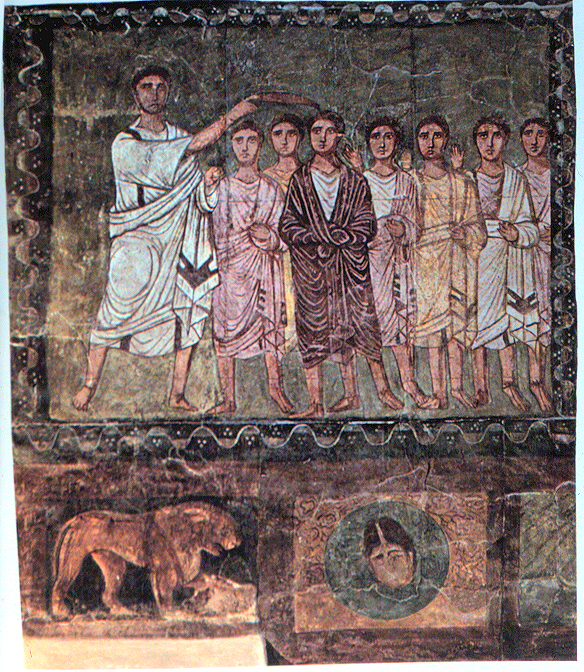

David (; , "beloved one") (traditional spelling), , ''Dāwūd''; grc-koi, Δαυΐδ, Dauíd; la, Davidus, David; gez , ዳዊት, ''Dawit''; xcl, Դաւիթ, ''Dawitʿ''; cu, Давíдъ, ''Davidŭ''; possibly meaning "beloved one". was, according to the Hebrew Bible, the third king of the United Kingdom of Israel. In the Books of Samuel, he is described as a young shepherd and Lyre, harpist who gains fame by slaying Goliath, a champion of the Philistines, in southern Canaan. David becomes a favourite of Saul, the first king of Israel; he also forges David and Jonathan, a notably close friendship with Jonathan (1 Samuel), Jonathan, a son of Saul. However, under the paranoia that David is seeking to usurp the throne, Saul attempts to kill David, forcing the latter to go into hiding and effectively operate as a fugitive for several years. After Saul and Jonathan are both killed in battle against the Philistines, a 30-year-old David is anointed king over all of History of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Arbitrage Pricing Theory

In finance, arbitrage pricing theory (APT) is a multi-factor model for asset pricing which relates various macro-economic (systematic) risk variables to the pricing of financial assets. Proposed by economist Stephen Ross in 1976, it is widely believed to be an improved alternative to its predecessor, the Capital Asset Pricing Model (CAPM). APT is founded upon the law of one price, which suggests that within an equilibrium market, rational investors will implement arbitrage such that the equilibrium price is eventually realised. As such, APT argues that when opportunities for arbitrage are exhausted in a given period, then the expected return of an asset is a linear function of various factors or theoretical market indices, where sensitivities of each factor is represented by a factor-specific beta coefficient or factor loading. Consequently, it provides traders with an indication of ‘true’ asset value and enables exploitation of market discrepancies via arbitrage. The linear fac ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Jensen's Alpha

In finance, Jensen's alpha (or Jensen's Performance Index, ex-post alpha) is used to determine the abnormal return of a security or portfolio of securities over the theoretical expected return. It is a version of the standard alpha based on a theoretical performance instead of a market index. The security could be any asset, such as stocks, bonds, or derivatives. The theoretical return is predicted by a market model, most commonly the capital asset pricing model (CAPM). The market model uses statistical methods to predict the appropriate risk-adjusted return of an asset. The CAPM for instance uses beta as a multiplier. History Jensen's alpha was first used as a measure in the evaluation of mutual fund managers by Michael Jensen in 1968. The CAPM return is supposed to be 'risk adjusted', which means it takes account of the relative riskiness of the asset. This is based on the concept that riskier assets should have higher expected returns than less risky assets. If an asset's ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |