|

Leakage (economics)

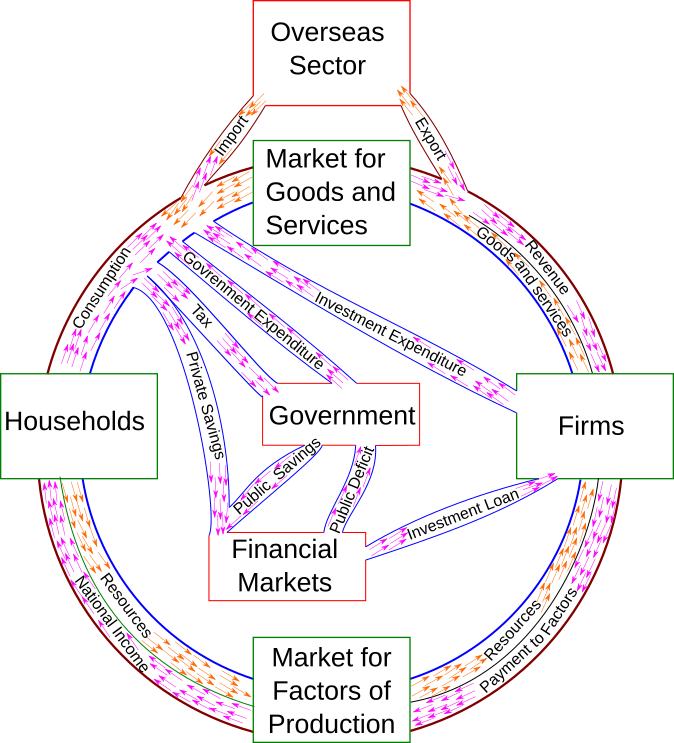

In economics, a leakage is a diversion of funds from some iterative process. For example, in the Keynesian depiction of the circular flow of income and expenditure, leakages are the non-consumption uses of income, including saving, taxes, and imports. In this model, leakages are equal in quantity to injections of spending from outside the flow at the equilibrium aggregate output. The model is best viewed as a circular flow between national income, output, consumption, and factor payments. Savings, taxes, and imports are "leaked" out of the main flow, reducing the money available in the rest of the economy. Imported goods are one way this may happen, transferring money earned in the country to another one. The simplest possible model of credit creation assumes all loans borrowed from banks in a fractional-reserve banking system are re-deposited to the system. This allows simple calculation of the amount of credit created. In practice, though, cash leakages occur in the form of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economics

Economics () is the social science that studies the Production (economics), production, distribution (economics), distribution, and Consumption (economics), consumption of goods and services. Economics focuses on the behaviour and interactions of Agent (economics), economic agents and how economy, economies work. Microeconomics analyzes what's viewed as basic elements in the economy, including individual agents and market (economics), markets, their interactions, and the outcomes of interactions. Individual agents may include, for example, households, firms, buyers, and sellers. Macroeconomics analyzes the economy as a system where production, consumption, saving, and investment interact, and factors affecting it: employment of the resources of labour, capital, and land, currency inflation, economic growth, and public policies that have impact on glossary of economics, these elements. Other broad distinctions within economics include those between positive economics, desc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Keynesian

Keynesian economics ( ; sometimes Keynesianism, named after British economist John Maynard Keynes) are the various macroeconomic theories and models of how aggregate demand (total spending in the economy) strongly influences economic output and inflation. In the Keynesian view, aggregate demand does not necessarily equal the productive capacity of the economy. Instead, it is influenced by a host of factors – sometimes behaving erratically – affecting production, employment, and inflation. Keynesian economists generally argue that aggregate demand is volatile and unstable and that, consequently, a market economy often experiences inefficient macroeconomic outcomes – a recession, when demand is low, or inflation, when demand is high. Further, they argue that these economic fluctuations can be mitigated by economic policy responses coordinated between government and central bank. In particular, fiscal policy actions (taken by the government) and monetary policy actions (tak ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Circular Flow

The circular flow of income or circular flow is a model of the economy in which the major exchanges are represented as flows of money, goods and services, etc. between economic agents. The flows of money and goods exchanged in a closed circuit correspond in value, but run in the opposite direction. The circular flow analysis is the basis of national accounts and hence of macroeconomics. The idea of the circular flow was already present in the work of Richard Cantillon.Antoin E. Murphy. "John Law and Richard Cantillon on the circular flow of income." ''Journal of the History of Economic Thought.'' 1.1 (1993): 47-62. François Quesnay developed and visualized this concept in the so-called Tableau économique.Backhouse, Roger E., and Yann Giraud. "Circular flow diagrams." in: ''Famous Figures and Diagrams in Economics'' (2010): 221-230. Chapter 23. Important developments of Quesnay's tableau were Karl Marx's reproduction schemes in the second volume of '' Capital: Critique of Po ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Money Creation

Money creation, or money issuance, is the process by which the money supply of a country, or of an economic or monetary region,Such as the Eurozone or ECCAS is increased. In most modern economies, money creation is controlled by the central banks. Money issued by central banks is termed base money. Central banks can increase the quantity of base money directly, by engaging in open market operations. However, the majority of the money supply is created by the commercial banking system in the form of bank deposits. Bank loans issued by commercial banks that practice fractional reserve banking expands the quantity of broad money to more than the original amount of base money issued by the central bank. Central banks monitor the amount of money in the economy by measuring monetary aggregates (termed broad money), consisting of cash and bank deposits. Money creation occurs when the quantity of monetary aggregates increase.For example, in the United States, money supply measured as M2 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. Because banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of regulation over banks. Most countries have institutionalized a system known as fractional reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but in many ways functioned as a continuation of ideas and concepts of credit and lending that had their roots in the a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fractional-reserve Banking

Fractional-reserve banking is the system of banking operating in almost all countries worldwide, under which banks that take deposits from the public are required to hold a proportion of their deposit liabilities in liquid assets as a reserve, and are at liberty to lend the remainder to borrowers. Bank reserves are held as cash in the bank or as balances in the bank's account at the central bank. The country's central bank determines the minimum amount that banks must hold in liquid assets, called the "reserve requirement" or "reserve ratio". Most commercial banks hold more than this minimum amount as excess reserves. Bank deposits are usually of a relatively short-term duration, and may be "at call", while loans made by banks tend to be longer-term, resulting in a risk that customers may at any time collectively wish to withdraw cash out of their accounts in excess of the bank reserves. The reserves only provide liquidity to cover withdrawals within the normal pattern. Banks a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Transnational Corporation

A transnational corporation is an enterprise that is involved with the international production of goods or services, foreign investments, or income and asset management in more than one country. It sets up factories in developing countries as land and labor are cheaper there. Characteristics Transnational corporations share many qualities with multinational corporations, with the subtle difference being that multinational corporations consist of a centralized management structure, whereas transnational corporations generally are decentralized, with many bases in various countries where the corporation operates. While traditional multinational corporations are national companies with foreign subsidiaries, transnational corporations spread out their operations in many countries to sustain high levels of local responsiveness. A transnational corporation operates substantial facilities, does business in more than one country, and does not consider any particular country its corpora ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Carbon Leakage

Carbon leakage occurs when there is an increase in greenhouse gas emissions in one country as a result of an emissions reduction by a second country with a strict climate policy. Carbon leakage may occur for a number of reasons: * If the emissions policy of a country raises local costs, then another country with a more relaxed policy may have a trading advantage. If demand for these goods remains the same, production may move offshore to the cheaper country with lower standards, and global emissions will not be reduced. * If environmental policies in one country add a premium to certain fuels or commodities, then the demand may decline and their price may fall. Countries that do not place a premium on those items may then take up the demand and use the same supply, negating any benefit. There is no consensus over the magnitude of long-term leakage effects. This is important for the problem of climate change. Carbon leakage is one type of spill-over effect. Spill-over effects ca ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Leakage Effect

In the study of tourism, the leakage is the way in which revenue generated by tourism is lost to other countries' economies. Leakage may be so significant in some developing countries that it partially neutralizes the money generated by tourism. Methods Leakage occurs through seven different mechanisms. It is an intrinsic component of international tourism and thus is present in every country, to widely varying degrees. Goods and services Many countries must purchase goods and services to satisfy their visitors. This includes the cost of raw materials used to make tourism-related goods, such as souvenirs. For starting tourism industries, this is a significant problem, as some countries must import as much as 50% of tourism-related products. Infrastructure Some less economically developed countries do not have the domestic ability to build tourism-related infrastructure (hotels, airports, etc.). The cost of such infrastructure is then leaked out of the country. Foreign factors of p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Keynesian Economics

Keynesian economics ( ; sometimes Keynesianism, named after British economist John Maynard Keynes) are the various macroeconomic theories and models of how aggregate demand (total spending in the economy) strongly influences economic output and inflation. In the Keynesian view, aggregate demand does not necessarily equal the productive capacity of the economy. Instead, it is influenced by a host of factors – sometimes behaving erratically – affecting production, employment, and inflation. Keynesian economists generally argue that aggregate demand is volatile and unstable and that, consequently, a market economy often experiences inefficient macroeconomic outcomes – a recession, when demand is low, or inflation, when demand is high. Further, they argue that these economic fluctuations can be mitigated by economic policy responses coordinated between government and central bank. In particular, fiscal policy actions (taken by the government) and monetary policy actions (t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |