|

LECOP

The LECOP was a bond issued by Argentine national government. ''LECOP'' (sometimes written as a common word, ''Lecop''), stands for Letra de Cancelación de Obligaciones Provinciales ("Letter of Cancellation of Provincial Obligations"). These bonds were circulated at a substantial discount from their face value, so anybody accepting was bound to experience devaluation (or inflation). While LECOPs were intended as a means to replace legal currency (Argentine pesos) at a time when cash was scarce, there were occasions in which LECOPs were not accepted as valid means of payment — most notably, most taxes could only be paid in pesos, or only partly paid in LECOPs. Public utility companies generally restricted the percentage acceptable to a 70-30 ratio, sometimes further limiting LECOP usage to 15% of the total bill. Other complementary currencies A complementary currency is a currency or medium of exchange that is not necessarily a national currency, but that is thought of as ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Argentine Argentino

The golden Argentino was the only official golden coins made by the argentine Casa de Moneda from 1881 to 1896, according to law N° 1130, sanctioned in 1881 during Julio Argentino Roca's presidency. Gold currency The Argentino was an Argentine currency equal to 5 pesos oro sellado. The argentino coin was issued in 1881 and 1884 and it weighs 4.0322 grams. The argentino coin was issued from 1881 to 1896 and it weighs 8.0645 grams. Both were made of gold 0.900. Planned currency The Argentino was a complementary currency in Argentina announced by then-president Adolfo Rodríguez Saá on December 26, 2001 during the Argentine economic crisis. It would have circulated alongside the peso and the dollar. He resigned on December 30, 2001 and this plan was never implemented. The currency was to replace the Patacón, the LECOP The LECOP was a bond issued by Argentine national government. ''LECOP'' (sometimes written as a common word, ''Lecop''), stands for Letra de Cancelación de ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Crédito

The Crédito was a local currency started on 1 May 1995 in Bernal, province of Buenos Aires, Argentina, on a garage sale, which was the first of many neighbourhood barter markets (''mercados de trueque'') that emerged in Argentina during the economic crisis. The operator of this currency was the ''Red Global de Clubes de Trueque Multirecíproco'' (RGT), literally "Global Network of Multi-Reciprocal Exchange Clubs" or more simply the "Global Exchange Network" (GEN). The currency started as a Local Exchange Trading Systems (LETS) system but was soon replaced by a number of printed currencies and, after further experimentation with a LETS called ''nodine'' (from ''no dinero'', "not money"), finally became the ''Crédito'', a printed currency again. The RGT was organized as a chaordic network of barter clubs, which had a clientele from a well-educated middle class that had fallen into unemployment during the Argentine recession of the late 1990s. The clubs of the RGT had no cent ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bond (finance)

In finance, a bond is a type of security under which the issuer ( debtor) owes the holder ( creditor) a debt, and is obliged – depending on the terms – to repay the principal (i.e. amount borrowed) of the bond at the maturity date as well as interest (called the coupon) over a specified amount of time. The interest is usually payable at fixed intervals: semiannual, annual, and less often at other periods. Thus, a bond is a form of loan or IOU. Bonds provide the borrower with external funds to finance long-term investments or, in the case of government bonds, to finance current expenditure. Bonds and stocks are both securities, but the major difference between the two is that (capital) stockholders have an equity stake in a company (i.e. they are owners), whereas bondholders have a creditor stake in a company (i.e. they are lenders). As creditors, bondholders have priority over stockholders. This means they will be repaid in advance of stockholders, but will rank behind s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Argentina

Argentina (), officially the Argentine Republic ( es, link=no, República Argentina), is a country in the southern half of South America. Argentina covers an area of , making it the second-largest country in South America after Brazil, the fourth-largest country in the Americas, and the eighth-largest country in the world. It shares the bulk of the Southern Cone with Chile to the west, and is also bordered by Bolivia and Paraguay to the north, Brazil to the northeast, Uruguay and the South Atlantic Ocean to the east, and the Drake Passage to the south. Argentina is a federal state subdivided into twenty-three provinces, and one autonomous city, which is the federal capital and largest city of the nation, Buenos Aires. The provinces and the capital have their own constitutions, but exist under a federal system. Argentina claims sovereignty over the Falkland Islands, South Georgia and the South Sandwich Islands, and a part of Antarctica. The earliest recorded human prese ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Devaluation

In macroeconomics and modern monetary policy, a devaluation is an official lowering of the value of a country's currency within a fixed exchange-rate system, in which a monetary authority formally sets a lower exchange rate of the national currency in relation to a foreign reference currency or currency basket. The opposite of devaluation, a change in the exchange rate making the domestic currency more expensive, is called a ''revaluation''. A monetary authority (e.g., a central bank) maintains a fixed value of its currency by being ready to buy or sell foreign currency with the domestic currency at a stated rate; a devaluation is an indication that the monetary authority will buy and sell foreign currency at a lower rate. However, under a floating exchange rate system (in which exchange rates are determined by market forces acting on the foreign exchange market, and not by government or central bank policy actions), a decrease in a currency's value relative to other major curren ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inflation

In economics, inflation is an increase in the general price level of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduction in the purchasing power of money. The opposite of inflation is deflation, a sustained decrease in the general price level of goods and services. The common measure of inflation is the inflation rate, the annualized percentage change in a general price index. As prices do not all increase at the same rate, the consumer price index (CPI) is often used for this purpose. The employment cost index is also used for wages in the United States. Most economists agree that high levels of inflation as well as hyperinflation—which have severely disruptive effects on the real economy—are caused by persistent excessive growth in the money supply. Views on low to moderate rates of inflation are more varied. Low or moderate inflation may be attri ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Argentine Peso

The peso (established as the ''peso convertible'') is the currency of Argentina, identified by the symbol $ preceding the amount in the same way as many countries using peso or dollar currencies. It is subdivided into 100 '' centavos''. Its ISO 4217 code is ARS. The Argentine currency has experienced severe inflation, with periods of hyperinflation, since the mid-20th century, with periodic change of the currency to a new version at a rate ranging from 100:1 to 10,000:1. The peso introduced in 1992 was worth 10,000,000,000,000 (ten trillion) of the pesos in use until 1970. Since the early 21st century, the Argentine peso has experienced a substantial rate of devaluation, reaching over 51% year-on-year inflation rate in 2021. The official exchange rate for the United States dollar commenced at 1:1 at the peso's introduction in 1992; it then hovered around 3:1 from 2002 to 2008, before climbing from 6:1 to 10:1 between 2009 and 2015. In July 2022, the value exchange rate with the U ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

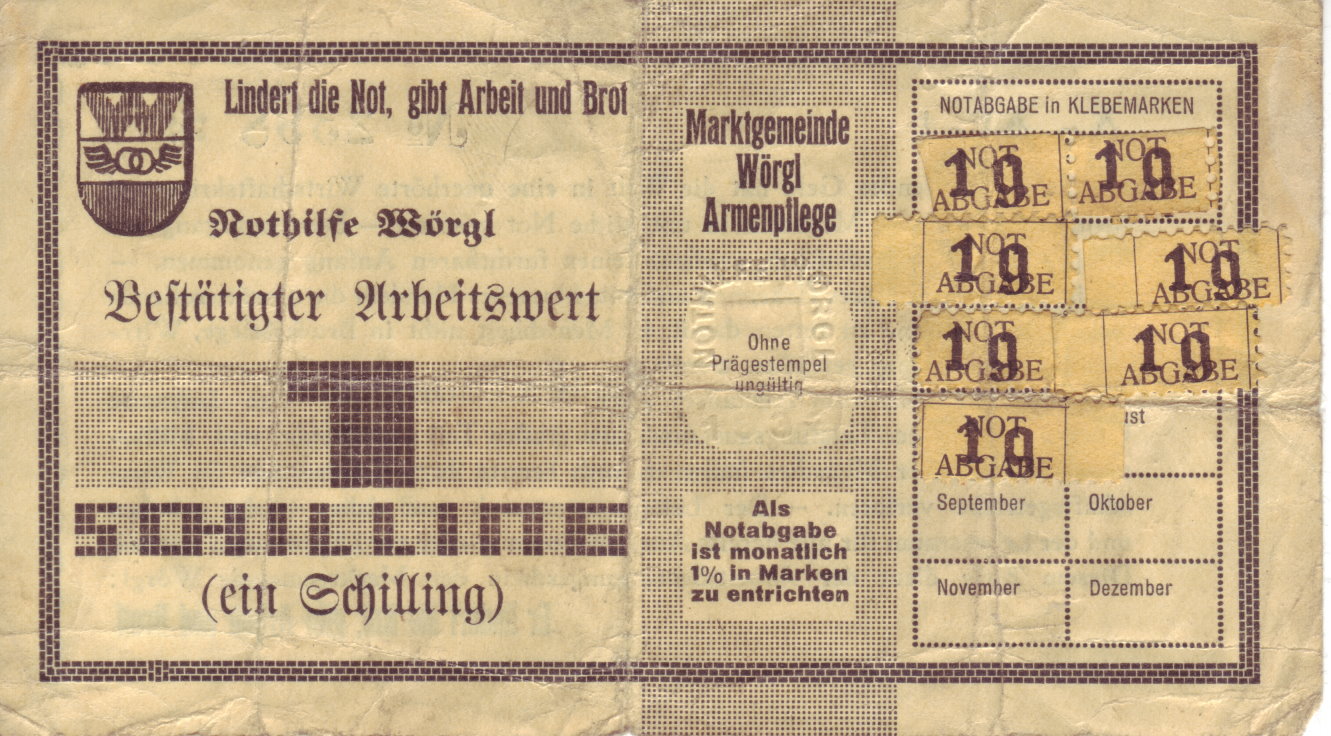

Complementary Currency

A complementary currency is a currency or medium of exchange that is not necessarily a national currency, but that is thought of as supplementing or complementing national currencies. Complementary currencies are usually not legal tender and their use is based on agreement between the parties exchanging the currency. According to Jérôme Blanc of Laboratoire d'Économie de la Firme et des Institutions, complementary currencies aim to protect, stimulate or orientate the economy. They may also be used to advance particular social, environmental, or political goals. When speaking about complementary currencies, a number of overlapping and often interchangeable terms are in use: local or community currencies are complementary currencies used within a locality or other form of community (such as business-based or online communities); regional currencies are similar to local currencies, but are used within a larger geographical region; and sectoral currencies are complementary curren ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Currencies Of Argentina

A currency, "in circulation", from la, currens, -entis, literally meaning "running" or "traversing" is a standardization of money in any form, in use or circulation as a medium of exchange, for example banknotes and coins. A more general definition is that a currency is a ''system of money'' in common use within a specific environment over time, especially for people in a nation state. Under this definition, the British Pound Sterling (£), euros (€), Japanese yen (¥), and U.S. dollars (US$)) are examples of (government-issued) fiat currencies. Currencies may act as stores of value and be traded between nations in foreign exchange markets, which determine the relative values of the different currencies. Currencies in this sense are either chosen by users or decreed by governments, and each type has limited boundaries of acceptance - i.e. legal tender laws may require a particular unit of account for payments to government agencies. Other definitions of the term "curre ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)