|

Crédito

The Crédito was a local currency started on 1 May 1995 in Bernal, Argentina, at a garage sale, which was the first of many neighbourhood barter markets () and barter clubs () that emerged in Argentina during the 1998–2002 Argentine great depression. At the barter clubs, people could exchange goods and services, often using créditos. An estimated 2.5 million Argentinians used the Crédito between 2001 and 2003. The currency started as a local exchange trading system (LETS), but was soon replaced by a number of printed currencies. After further experimentation with a LETS called ''nodine'' (from ''no dinero'', "not money"), it finally became the ''Crédito'' (Spanish for "credit"), a printed currency again. The operator of this currency was the Global Network of Multi-Reciprocal Exchange Clubs (, RGT), or more simply the "Global Exchange Network" (GEN). The RGT was organized as a chaordic network of barter clubs, which had a clientele from a well-educated middle class that ha ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

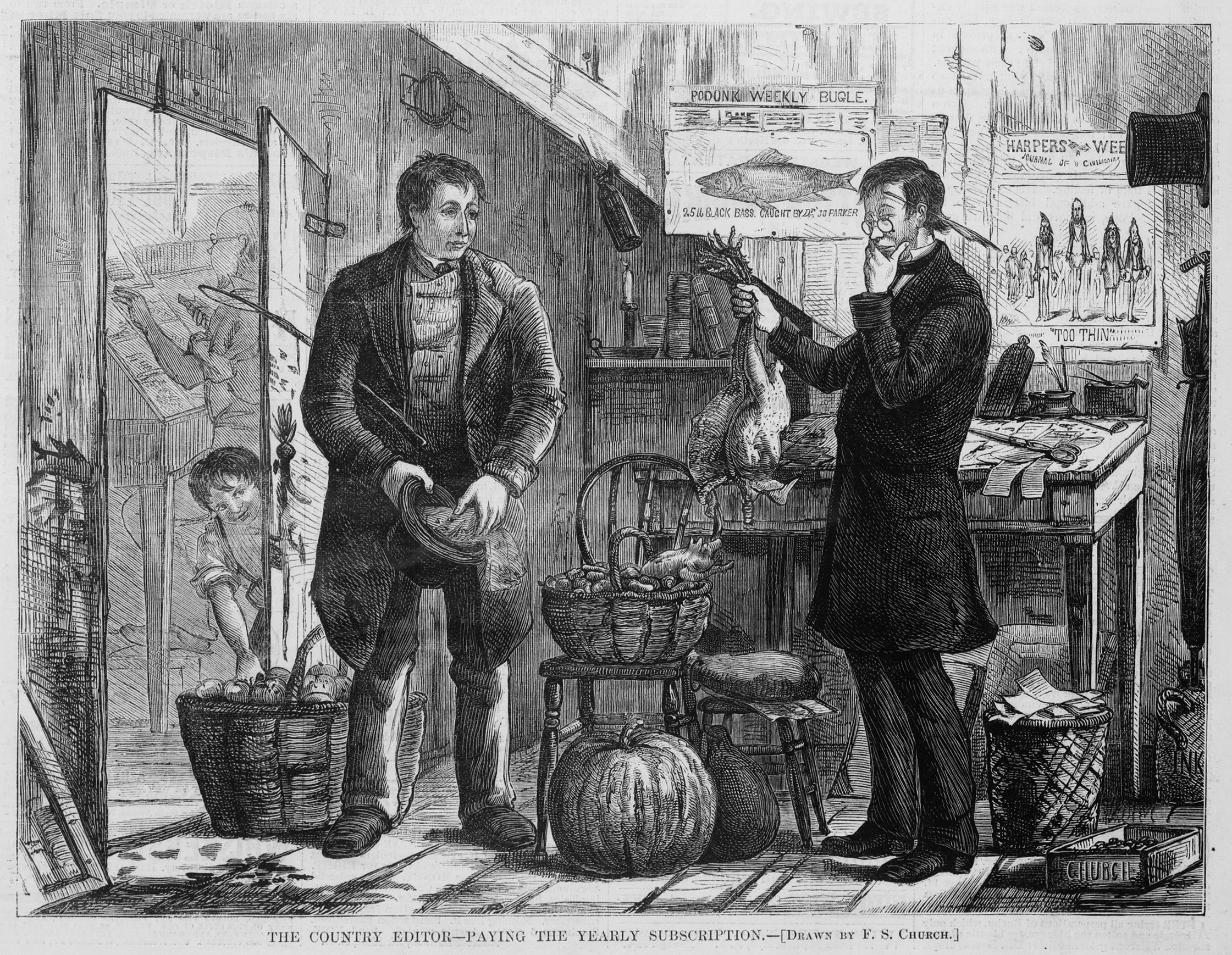

Barter

In trade, barter (derived from ''bareter'') is a system of exchange (economics), exchange in which participants in a financial transaction, transaction directly exchange good (economics), goods or service (economics), services for other goods or services without using a medium of exchange, such as money. Economists usually distinguish barter from gift economy, gift economies in many ways; barter, for example, features immediate reciprocity (cultural anthropology), reciprocal exchange, not one delayed in time. Barter usually takes place on a bilateral trade, bilateral basis, but may be multilateral exchange, multilateral (if it is mediated through a trade exchange). In most developed countries, barter usually exists parallel to monetary systems only to a very limited extent. Market actors use barter as a replacement for money as the method of exchange in times of monetary crisis, such as when currency becomes unstable (such as hyperinflation or a Deflation#Deflationary spiral, de ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

1998–2002 Argentine Great Depression

The 1998–2002 Argentine great depression was an economic depression in Argentina, which began in the third quarter of 1998 and lasted until the second quarter of 2002. It followed fifteen years of Economic history of Argentina#Stagnation (1975–1990), stagnation and a brief period of Economic history of Argentina#Free-market reforms (1990–1995), free-market reforms. The depression, which began after the 1998 Russian financial crisis, Russian and Samba effect, Brazilian financial crises, caused widespread unemployment, December 2001 riots in Argentina, riots, the fall of the government, a Sovereign default, default on the country's foreign debt, the rise of alternative currencies and the end of the Argentine peso, peso's fixed exchange rate to the United States dollar, US dollar. The economy shrank by 28 per cent from 1998 to 2002. In terms of income, over 50 per cent of Argentines lived below the official poverty line and 25 per cent were indigent (their basic needs were unm ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Local Currency

In economics, a local currency is a currency that can be spent in a particular geographical locality at participating organisations. A regional currency is a form of local currency encompassing a larger geographical area, while a community currency might be local or be used for exchange within an online community. A local currency acts as a complementary currency to a national currency, rather than replacing it, and aims to encourage spending within a local community, especially with locally owned businesses. Such currencies may not be backed by a national government nor be legal tender. About 300 complementary currencies, including local currencies, are listed in the Complementary Currency Resource Center worldwide database. Terminology Some definitions: * Complementary currency – is used as a complement to a national currency, as a medium of exchange, which is usually not legal tender. * Community currency – a complementary currency used by a group with a Common bond of ass ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

LECOP

The LECOP was a bond issued by Argentine national government. ''LECOP'' (sometimes written as a common word, ''Lecop''), stands for Letra de Cancelación de Obligaciones Provinciales ("Letter of Cancellation of Provincial Obligations"). These bonds were circulated at a substantial discount from their face value, so anybody accepting was bound to experience devaluation (or inflation). While LECOPs were intended as a means to replace legal currency ( Argentine pesos) at a time when cash was scarce, there were occasions in which LECOPs were not accepted as valid means of payment — most notably, most taxes could only be paid in pesos, or only partly paid in LECOPs. Public utility companies generally restricted the percentage acceptable to a 70-30 ratio, sometimes further limiting LECOP usage to 15% of the total bill. Other complementary currencies in Argentina at that time where the Crédito The Crédito was a local currency started on 1 May 1995 in Bernal, Argentina, at a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

US Dollar

The United States dollar (symbol: $; currency code: USD) is the official currency of the United States and several other countries. The Coinage Act of 1792 introduced the U.S. dollar at par with the Spanish silver dollar, divided it into 100 cents, and authorized the minting of coins denominated in dollars and cents. U.S. banknotes are issued in the form of Federal Reserve Notes, popularly called greenbacks due to their predominantly green color. The U.S. dollar was originally defined under a bimetallic standard of (0.7734375 troy ounces) fine silver or, from 1834, fine gold, or $20.67 per troy ounce. The Gold Standard Act of 1900 linked the dollar solely to gold. From 1934, its equivalence to gold was revised to $35 per troy ounce. In 1971 all links to gold were repealed. The U.S. dollar became an important international reserve currency after the First World War, and displaced the pound sterling as the world's primary reserve currency by the Bretton Woods Ag ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Currencies Of Argentina

A currency is a standardization of money in any form, in use or circulation as a medium of exchange, for example banknotes and coins. A more general definition is that a currency is a ''system of money'' in common use within a specific environment over time, especially for people in a nation state. Under this definition, the British Pound sterling (£), euros (€), Japanese yen (¥), and U.S. dollars (US$) are examples of (government-issued) fiat currencies. Currencies may act as stores of value and be traded between nations in foreign exchange markets, which determine the relative values of the different currencies. Currencies in this sense are either chosen by users or decreed by governments, and each type has limited boundaries of acceptance; i.e., legal tender laws may require a particular unit of account for Payment, payments to government agencies. Other definitions of the term ''currency'' appear in the respective synonymous articles: banknote, coin, and money. This ar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Argentine Argentino

The golden Argentino was the only official golden coins made by the Argentine mint from 1881 to 1896, according to law N° 1130, sanctioned in 1881 during the presidency of Julio Argentino Roca. Gold currency The Argentino was an Argentine currency equal to 5 pesos oro sellado. The argentino coin was issued in 1881 and 1884 and it weighs 4.0322 grams. The argentino coin was issued from 1881 to 1896 and it weighs 8.0645 grams. Both were made of gold 0.900. Planned currency The Argentino was a complementary currency in Argentina announced by then-president Adolfo Rodríguez Saá on December 26, 2001, during the 1998–2002 Argentine great depression The 1998–2002 Argentine great depression was an economic depression in Argentina, which began in the third quarter of 1998 and lasted until the second quarter of 2002. It followed fifteen years of Economic history of Argentina#Stagnation (197 .... It would have circulated alongside the peso and the dollar. He resigned on Dece ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Complementary Currencies

A complementary currency is a currency or medium of exchange that is not necessarily a national currency, but that is thought of as supplementing or complementing national currencies. Complementary currencies are usually not legal tender and their use is based on agreement between the parties exchanging the currency. According to Jérôme Blanc of Laboratoire d'Économie de la Firme et des Institutions, complementary currencies aim to protect, stimulate or orientate the economy. They may also be used to advance particular social, environmental, or political goals. When speaking about complementary currencies, a number of overlapping and often interchangeable terms are in use: local or community currencies are complementary currencies used within a locality or other form of community (such as business-based or online communities); regional currencies are similar to local currencies, but are used within a larger geographical region; and sectoral currencies are complementary curre ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hyperinflation

In economics, hyperinflation is a very high and typically accelerating inflation. It quickly erodes the real versus nominal value (economics), real value of the local currency, as the prices of all goods increase. This causes people to minimize their holdings in that currency as they usually switch to more stable foreign currencies. Effective capital controls and currency substitution ("dollarization") are the orthodox solutions to ending short-term hyperinflation; however, there are significant social and economic costs to these policies. Ineffective implementations of these solutions often exacerbate the situation. Many governments choose to attempt to solve structural issues without resorting to those solutions, with the goal of bringing inflation down slowly while minimizing social costs of further economic shocks; however, this can lead to a prolonged period of high inflation. Unlike low inflation, where the process of rising prices is protracted and not generally noticeab ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Harvard University

Harvard University is a Private university, private Ivy League research university in Cambridge, Massachusetts, United States. Founded in 1636 and named for its first benefactor, the History of the Puritans in North America, Puritan clergyman John Harvard (clergyman), John Harvard, it is the oldest institution of higher learning in the United States. Its influence, wealth, and rankings have made it one of the most prestigious universities in the world. Harvard was founded and authorized by the Massachusetts General Court, the governing legislature of Colonial history of the United States, colonial-era Massachusetts Bay Colony. While never formally affiliated with any Religious denomination, denomination, Harvard trained Congregationalism in the United States, Congregational clergy until its curriculum and student body were gradually secularized in the 18th century. By the 19th century, Harvard emerged as the most prominent academic and cultural institution among the Boston B ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |