|

Lucas V. Earl

''Lucas v. Earl'', 281 U.S. 111 (1930), is a United States Supreme Court case concerning U.S. Federal income taxation, about a man who reported only half of his earnings for years 1920 and 1921. Guy C. Earl and his wife had entered into a contract that would potentially save a lot of tax. The contract specified that earnings were owned by the couple as joint tenants. It is unlikely that it was tax-motivated, since there was no income tax in 1901 when they executed the contract. Justice Oliver Wendell Holmes, Jr. delivered the Court’s opinion which generally stands for the proposition that income from services is taxed to the party who performed the services.. The case is used to support the proposition that the substance of the transaction, rather than the form, is controlling for tax purposes. Facts and procedural history Guy C. Earl was an attorney who entered into a contract with his wife whereby all property and earnings were to be "treated and considered . . . to be . . . ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Robert H

The name Robert is an ancient Germanic given name, from Proto-Germanic "fame" and "bright" (''Hrōþiberhtaz''). Compare Old Dutch ''Robrecht'' and Old High German ''Hrodebert'' (a compound of '' Hruod'' ( non, Hróðr) "fame, glory, honour, praise, renown" and ''berht'' "bright, light, shining"). It is the second most frequently used given name of ancient Germanic origin. It is also in use as a surname. Another commonly used form of the name is Rupert. After becoming widely used in Continental Europe it entered England in its Old French form ''Robert'', where an Old English cognate form (''Hrēodbēorht'', ''Hrodberht'', ''Hrēodbēorð'', ''Hrœdbœrð'', ''Hrœdberð'', ''Hrōðberχtŕ'') had existed before the Norman Conquest. The feminine version is Roberta. The Italian, Portuguese, and Spanish form is Roberto. Robert is also a common name in many Germanic languages, including English, German, Dutch, Norwegian, Swedish, Scots, Danish, and Icelandic. It can be use ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

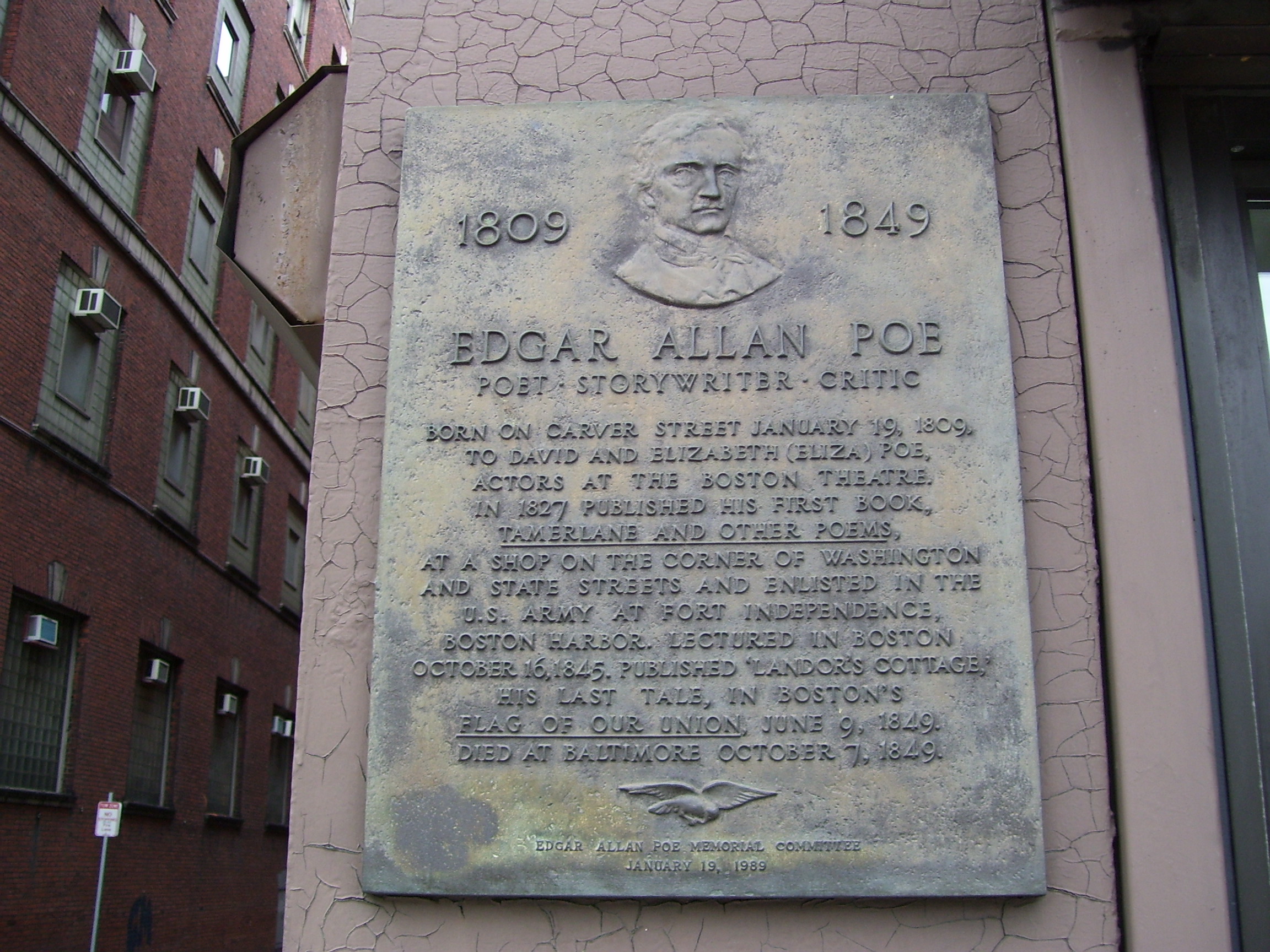

Poe V

Edgar Allan Poe (; Edgar Poe; January 19, 1809 – October 7, 1849) was an American writer, poet, editor, and literary critic. Poe is best known for his poetry and short stories, particularly his tales of mystery and the macabre. He is widely regarded as a central figure of Romanticism in the United States, and of American literature. Poe was one of the country's earliest practitioners of the short story, and considered to be the inventor of the detective fiction genre, as well as a significant contributor to the emerging genre of science fiction. Poe is the first well-known American writer to earn a living through writing alone, resulting in a financially difficult life and career. Poe was born in Boston, the second child of actors David and Elizabeth "Eliza" Poe. His father abandoned the family in 1810, and when his mother died the following year, Poe was taken in by John and Frances Allan of Richmond, Virginia. They never formally adopted him, but he was with them we ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Supreme Court Cases Of The Hughes Court

United may refer to: Places * United, Pennsylvania, an unincorporated community * United, West Virginia, an unincorporated community Arts and entertainment Films * ''United'' (2003 film), a Norwegian film * ''United'' (2011 film), a BBC Two film Literature * ''United!'' (novel), a 1973 children's novel by Michael Hardcastle Music * United (band), Japanese thrash metal band formed in 1981 Albums * ''United'' (Commodores album), 1986 * ''United'' (Dream Evil album), 2006 * ''United'' (Marvin Gaye and Tammi Terrell album), 1967 * ''United'' (Marian Gold album), 1996 * ''United'' (Phoenix album), 2000 * ''United'' (Woody Shaw album), 1981 Songs * "United" (Judas Priest song), 1980 * "United" (Prince Ital Joe and Marky Mark song), 1994 * "United" (Robbie Williams song), 2000 * "United", a song by Danish duo Nik & Jay featuring Lisa Rowe Television * ''United'' (TV series), a 1990 BBC Two documentary series * ''United!'', a soap opera that aired on BBC One from 1965-19 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Marriage Law In The United States

Marriage, also called matrimony or wedlock, is a culturally and often legally recognized union between people called spouses. It establishes rights and obligations between them, as well as between them and their children, and between them and their in-laws. It is considered a cultural universal, but the definition of marriage varies between cultures and religions, and over time. Typically, it is an institution in which interpersonal relationships, usually sexual, are acknowledged or sanctioned. In some cultures, marriage is recommended or considered to be compulsory before pursuing any sexual activity. A marriage ceremony is called a wedding. Individuals may marry for several reasons, including legal, social, libidinal, emotional, financial, spiritual, and religious purposes. Whom they marry may be influenced by gender, socially determined rules of incest, prescriptive marriage rules, parental choice, and individual desire. In some areas of the world, arranged marr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

1930 In United States Case Law

Year 193 ( CXCIII) was a common year starting on Monday (link will display the full calendar) of the Julian calendar. At the time, it was known as the Year of the Consulship of Sosius and Ericius (or, less frequently, year 946 '' Ab urbe condita''). The denomination 193 for this year has been used since the early medieval period, when the Anno Domini calendar era became the prevalent method in Europe for naming years. Events By place Roman Empire * January 1 – Year of the Five Emperors: The Roman Senate chooses Publius Helvius Pertinax, against his will, to succeed the late Commodus as Emperor. Pertinax is forced to reorganize the handling of finances, which were wrecked under Commodus, to reestablish discipline in the Roman army, and to suspend the food programs established by Trajan, provoking the ire of the Praetorian Guard. * March 28 – Pertinax is assassinated by members of the Praetorian Guard, who storm the imperial palace. The Empire is auctioned o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

List Of United States Supreme Court Cases, Volume 281

This is a list of cases reported in volume 281 of ''United States Reports'', decided by the Supreme Court of the United States in 1930. Justices of the Supreme Court at the time of volume 281 U.S. The Supreme Court is established by Article III, Section 1 of the Constitution of the United States, which says: "The judicial Power of the United States, shall be vested in one supreme Court . . .". The size of the Court is not specified; the Constitution leaves it to Congress to set the number of justices. Under the Judiciary Act of 1789 Congress originally fixed the number of justices at six (one chief justice and five associate justices). Since 1789 Congress has varied the size of the Court from six to seven, nine, ten, and back to nine justices (always including one chief justice). When the cases in volume 281 were decided the Court comprised the following members (Chief Justice Taft retired in February 1930, and former Associate Justice Charles Evans Hughes rejoined ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Revenue Act Of 1948

The United States Revenue Act of 1948 reduced individual income tax rates 5-13 percent, increased the personal exemption amount from $500 to $600, permitted married couples to split their incomes for tax purposes, made the distinction between community property jurisdictions and non-community property jurisdictions less relevant in the administration of the income, estate, and gift taxes, and provided additional exemption for taxpayers age 65 and older. The Revenue Act of 1948 was vetoed by President Harry S. Truman Harry S. Truman (May 8, 1884December 26, 1972) was the 33rd president of the United States, serving from 1945 to 1953. A leader of the Democratic Party, he previously served as the 34th vice president from January to April 1945 under Franklin ..., but his veto was overridden on April 2, 1948, by a two-thirds vote of each House of the Republican-controlled Eightieth Congress of the United States. United States federal taxation legislation 1948 in law 1948 i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Assignment Of Income Doctrine

The assignment of income doctrine is a judicial doctrine developed in United States case law by courts trying to limit tax evasion. The assignment of income doctrine seeks to "preserve the progressive rate structure of the Code by prohibiting the splitting of income among taxable entities." History The United States Supreme Court created the assignment of income doctrine in the ''Lucas v. Earl ''Lucas v. Earl'', 281 U.S. 111 (1930), is a United States Supreme Court case concerning U.S. Federal income taxation, about a man who reported only half of his earnings for years 1920 and 1921. Guy C. Earl and his wife had entered into a contract ...'' decision. The Supreme Court held that income from services is taxed to the party who performed the services.''Lucas v. Earl,'' 281 U.S. at 115. To elaborate on this principle, the decision used the metaphor that "the fruits cannot be attributed to a different tree from that on which they grew." The case is used to support the propositio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lawyers' Edition

The ''United States Supreme Court Reports, Lawyers' Edition'', or ''Lawyers' Edition'' (L. Ed. and L. Ed. 2d in case citations) is an unofficial reporter of Supreme Court of the United States opinions. The ''Lawyers' Edition'' was established by the Lawyers Cooperative Publishing Company of Rochester, New York in 1882, and features coverage of Supreme Court decisions going back to 1790. The first ''Lawyers' Edition'' series corresponds to the official ''United States Reports'' from volume 1 to volume 351, whereas the second series contains cases starting from the official reporter volume 352. It is currently published by LexisNexis. The ''Lawyers' Edition'' differs from the official reporter in that the editors write headnotes and case summaries, as well as provide annotations to some cases, and decisions are published far in advance of the official reporter. As such, it is similar to West's unofficial ''Supreme Court Reporter'' (S. Ct.). ''Lawyers' Edition'' case reports dif ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Tax Court

The United States Tax Court (in case citations, T.C.) is a federal trial court of record established by Congress under Article I of the U.S. Constitution, section 8 of which provides (in part) that the Congress has the power to "constitute Tribunals inferior to the supreme Court". The Tax Court specializes in adjudicating disputes over federal income tax, generally prior to the time at which formal tax assessments are made by the Internal Revenue Service. Though taxpayers may choose to litigate tax matters in a variety of legal settings, outside of bankruptcy, the Tax Court is the only forum in which taxpayers may do so without having first paid the disputed tax in full. Parties who contest the imposition of a tax may also bring an action in any United States District Court, or in the United States Court of Federal Claims; however these venues require that the tax be paid first, and that the party then file a lawsuit to recover the contested amount paid (the "full payment rule" ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internal Revenue Service

The Internal Revenue Service (IRS) is the revenue service for the United States federal government, which is responsible for collecting U.S. federal taxes and administering the Internal Revenue Code, the main body of the federal statutory tax law. It is an agency of the Department of the Treasury and led by the Commissioner of Internal Revenue, who is appointed to a five-year term by the President of the United States. The duties of the IRS include providing tax assistance to taxpayers; pursuing and resolving instances of erroneous or fraudulent tax filings; and overseeing various benefits programs, including the Affordable Care Act. The IRS originates from the Commissioner of Internal Revenue, a federal office created in 1862 to assess the nation's first income tax to fund the American Civil War. The temporary measure provided over a fifth of the Union's war expenses before being allowed to expire a decade later. In 1913, the Sixteenth Amendment to the U.S. Constitutio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |