|

Louise McWhirter

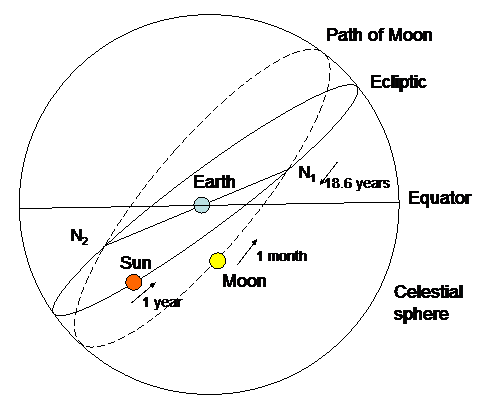

Louise McWhirter (October 19, 1896 – November 1, 1957) was a financial astrologer who purported to use astrology to forecast the financial markets. In 1937, she published her only book, ''Astrology and Stock Market Forecasting''. Some believe that “Louise McWhirter” was only an alias of famous market forecaster W. D. Gann. McWhirter’s theory The Nodal cycle McWhirter's main theory was that the major of primary trend of business volume and finance is clearly pointed out by the 18.6-year cycle of the North Node as it passes through the twelve signs of the zodiac. During a long-term trend, the four crucial points of the stock market are reached when the Node enters the four fixed signs respectively: * Aquarius: This is the extreme low of business activity, the bottom of the cycle. * Pisces: The business activity approaches the bottom of the cycle. * Aries: The business activity starts to fall below the normal level. * Taurus: The business activity reaches a no ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Astrology

Financial astrology (also known as business astrology, economic astrology, and/or astro-economics) is a pseudoscientific practice of relating the movements of celestial bodies to events in financial markets. The use of astrology in any context is not empirically based and its use in predicting financial markets is at plain odds with standard economic and financial theory. As with astrology in general, predictions are vague and hard dates are rarely given. Critics have pointed out that some astrological events that have been used in predictions occur so rarely that they may have never happened before within a human lifetime, thus having no precedent on which to predict results. History In 1992, 1994, and 2008, a magazine by the name of ''Wall Street Forecaster'' was named as one of the top forecasters on Wall Street, as the superstition was being leaned on for luck. It was also rated the second best performing forecaster in 2002. It was reported that some clients asked for th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capricorn (astrology)

Capricorn () is the tenth astrological sign in the zodiac out of twelve total zodiac signs, originating from the constellation of Capricornus, the goat. It spans the 270–300th degree of the zodiac, corresponding to celestial longitude. Under the tropical zodiac, the sun transits this area from about December 22 to January 19. In astrology, Capricorn is considered an earth sign, negative sign, and one of the four cardinal signs. Capricorn is said to be ruled by the planet Saturn. There appears to be a connection between traditional characterizations of Capricorn as a sea goat and the Sumerian god of wisdom and waters, who also had the head and upper body of a goat and the lower body and tail of a fish. Later known as ''Ea'' in Akkadian and Babylonian mythology, Enki was the god of intelligence (''gestú'', literally "ear"), creation, crafts; magic; water, seawater and lake water (''a, aba, ab''). Cultural significance In India, the zodiac sign of Capricorn is celebrat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Panic Of 1847

The Panic of 1847 was a minor British banking crisis associated with the end of the 1840s railway industry boom and the failure of many non-banks. Background As a means of stabilizing the British economy, the ministry of Robert Peel passed the Bank Charter Act of 1844. This Act fixed a maximum quantity of bank notes that could be in circulation at any one time and guaranteed that definite reserve funds of gold and silver would be held in reserve to back up the money in circulation. Furthermore, the Act required that the supply of money in circulation could be increased only when gold or silver reserves were proportionately increased. In 1847, the Act was suspended when the Bank of England was presented with a letter from the Prime Minister and Chancellor of the Exchequer indemnifying the Bank for a breach of the Act. The crisis in the money market ended almost immediately, without any breach of the Act. The panic of 1847 cleared away a vast number of unsound business houses, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Panic Of 1837

The Panic of 1837 was a financial crisis in the United States that touched off a major depression, which lasted until the mid-1840s. Profits, prices, and wages went down, westward expansion was stalled, unemployment went up, and pessimism abounded. The panic had both domestic and foreign origins. Speculative lending practices in the West, a sharp decline in cotton prices, a collapsing land bubble, international specie flows, and restrictive lending policies in Britain were all factors. The lack of a central bank to regulate fiscal matters, which President Andrew Jackson had ensured by not extending the charter of the Second Bank of the United States, was also key. This ailing economy of early 1837 led investors to panic – a bank run ensued – giving the crisis its name. The run came to a head on May 10, 1837, when banks in New York City ran out of gold and silver. They suspended specie payments and would no longer redeem commercial paper in specie at full face value. A signi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Panic Of 1819

The Panic of 1819 was the first widespread and durable financial crisis in the United States that slowed westward expansion in the Cotton Belt and was followed by a general collapse of the American economy that persisted through 1821. The Panic heralded the transition of the nation from its colonial commercial status with Europe toward an independent economy. Though the downturn was driven by global market adjustments in the aftermath of the Napoleonic Wars, its severity was compounded by excessive speculation in public lands, fueled by the unrestrained issue of paper money from banks and business concerns. The Second Bank of the United States (SBUS), itself deeply enmeshed in these inflationary practices, sought to compensate for its laxness in regulating the state bank credit market by initiating a sharp curtailment in loans by its western branches, beginning in 1818. Failing to provide gold specie from their reserves when presented with their own banknotes for redemption by t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Panic Of 1792

The Panic of 1792 was a financial credit crisis that occurred during the months of March and April 1792, precipitated by the expansion of credit by the newly formed Bank of the United States as well as by rampant speculation on the part of William Duer, Alexander Macomb, and other prominent bankers. Duer, Macomb, and their colleagues attempted to drive up prices of United States (U.S) debt securities and bank stocks, but when they defaulted on loans, prices fell, causing a bank run. Simultaneous tightening of credit by the Bank of the United States served to heighten the initial panic. Secretary of the Treasury Alexander Hamilton was able to deftly manage the crisis by providing banks across the Northeast United States with hundreds of thousands of dollars to make open-market purchases of securities, which allowed the market to stabilize by May 1792. Bank of the United States and the crisis of 1791 In December 1790, Hamilton called for the creation of the Bank of the United Sta ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

South Sea Company

The South Sea Company (officially The Governor and Company of the merchants of Great Britain, trading to the South Seas and other parts of America, and for the encouragement of the Fishery) was a British joint-stock company founded in January 1711, created as a public-private partnership to consolidate and reduce the cost of the national debt. To generate income, in 1713 the company was granted a monopoly (the Asiento de Negros) to supply African slaves to the islands in the "South Seas" and South America. When the company was created, Britain was involved in the War of the Spanish Succession and Spain and Portugal controlled most of South America. There was thus no realistic prospect that trade would take place, and as it turned out, the Company never realised any significant profit from its monopoly. However, Company stock rose greatly in value as it expanded its operations dealing in government debt, and peaked in 1720 before suddenly collapsing to little above its ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mississippi Company

The Mississippi Company (french: Compagnie du Mississippi; founded 1684, named the Company of the West from 1717, and the Company of the Indies from 1719) was a corporation holding a business monopoly in French colonies in North America and the West Indies. In 1717, the Mississippi Company received a royal grant with exclusive trading rights for 25 years. The rise and fall of the company is connected with the activities of the Scottish financier and economist John Law (economist), John Law who was then the Controller General of Finances of France. When the speculation in French financial circles, and the land development in the region became frenzied and detached from economic reality, the Mississippi bubble became one of the earliest examples of an economic bubble. History The ''Compagnie du Mississippi'' was originally chartered in 1684 by the request of René-Robert Cavelier, Sieur de La Salle, Renee-Robert Cavelier (La Salle) who sailed in that year from France with a la ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tulip Mania

Tulip mania ( nl, tulpenmanie) was a period during the Dutch Golden Age when contract prices for some bulbs of the recently introduced and fashionable tulip reached extraordinarily high levels. The major acceleration started in 1634 and then dramatically collapsed in February 1637. It is generally considered to have been the first recorded speculative bubble or asset bubble in history. In many ways, the tulip mania was more of a then-unknown socio-economic phenomenon than a significant economic crisis. It had no critical influence on the prosperity of the Dutch Republic, which was one of the world's leading economic and financial powers in the 17th century, with the highest per capita income in the world from about 1600 to about 1720. The term "tulip mania" is now often used metaphorically to refer to any large economic bubble when asset prices deviate from intrinsic values. Forward markets appeared in the Dutch Republic during the 17th century. Among the most notable cent ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Kipper Und Wipper

''Kipper und Wipper'' (german: Kipper- und Wipperzeit, literally "Tipper and See-saw time") was a financial crisis during the start of the Thirty Years' War (1618–1648).Kipper und Wipper'. Rogue Traders, Rogue Princes, Rogue Bishops and the German Financial Meltdown of 1621–23" Mike Dash, ''Smithsonian'', March 29, 2012 Starting around 1621, city-states in the began to heavily debase currency ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

University Of Sydney

The University of Sydney (USYD), also known as Sydney University, or informally Sydney Uni, is a public research university located in Sydney, Australia. Founded in 1850, it is the oldest university in Australia and is one of the country's six sandstone universities. The university comprises eight academic faculties and university schools, through which it offers bachelor, master and doctoral degrees. The university consistently ranks highly both nationally and internationally. QS World University Rankings ranked the university top 40 in the world. The university is also ranked first in Australia and fourth in the world for QS graduate employability. It is one of the first universities in the world to admit students solely on academic merit, and opened their doors to women on the same basis as men. Five Nobel and two Crafoord laureates have been affiliated with the university as graduates and faculty. The university has educated eight Australian prime ministers, including ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gary Previts

Gary John Previts (born 1942) is an American accountant, a Distinguished University Professor at Case Western Reserve University (Cleveland, Ohio USA) and Professor of Accountancy in the Weatherhead School of Management. He is known for his work on the history of the theory and practice of accountancy. Biography Youth, education and military service Previts was born in Cleveland, Ohio, where his father, a graduate from Teachers College, Columbia University worked as an educator. He obtained his BA from John Carroll University, under the guidance of Professor of Accounting F.J. McGurr, in 1963. In 1964 he obtained his MA in accountancy at the Ohio State University, and in 1972 under the guidance of Williard E. Stone, his PhD at the University of Florida.Gary John ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |