|

Long Term Capital Management

Long-Term Capital Management L.P. (LTCM) was a highly-leveraged hedge fund. In 1998, it received a $3.6 billion bailout from a group of 14 banks, in a deal brokered and put together by the Federal Reserve Bank of New York. LTCM was founded in 1994 by John Meriwether, the former vice-chairman and head of bond trading at Salomon Brothers. Members of LTCM's board of directors included Myron Scholes and Robert C. Merton, who three years later in 1997 shared the Nobel Prize in Economics for having developed the Black–Scholes model of financial dynamics.''A financial History of the United States Volume II: 1970–2001'', Jerry W. Markham, Chapter 5: "Bank Consolidation", M. E. Sharpe, Inc., 2002 LTCM was initially successful, with annualized returns (after fees) of around 21% in its first year, 43% in its second year and 41% in its third year. However, in 1998 it lost $4.6 billion in less than four months due to a combination of high leverage and exposure to the 1997 Asian fina ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

1998 Russian Financial Crisis

The Russian financial crisis (also called the ruble crisis or the Russian flu) began in Russia on 17 August 1998. It resulted in the Russian government and the Russian Central Bank devaluing the ruble and defaulting on its debt. The crisis had severe impacts on the economies of many neighboring countries. Background and course of events The Russian economy had set up a path for improvement after the Soviet Union had split into different countries. Russia was supposed to provide assistance to the former Soviet states and, as a result, imported heavily from them. In Russia, foreign loans financed domestic investments. When it was unable to pay back those foreign borrowings, the ruble devalued. In mid-1997 Russia had finally found a way out of inflation. The economic supervisors were happy about inflation coming to a standstill. Then the crisis hit and supervisors had to implement a new policy. Both Russia and the countries that exported to it experienced fiscal deficits. The cou ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Greg Hawkins

Gregory Dale Hawkins was a trader and principal in the hedge fund Long-Term Capital Management that after four spectacularly successful years lost most of its clients' money in 1998 when the Russian government defaulted on its debt payments on August 17, 1998, triggering a devaluation of the Russian ruble. Long-Term Capital had $4.6 billion in portfolio losses in a few months and only avoided outright bankruptcy because the U.S. central bank prompted a consortium of large global investment banks and counter-parties of LTCM to provide an equity bailout. LTCM shutdown in early 2000. Hawkins lives in New Rochelle in Westchester County, New York. Early life Hawkins earned an S.B. in economics from MIT in 1976 and a Ph.D. in management from the MIT Sloan School of Management in 1982. Career On 27 February 2008, Hawkins was put in control of Risk Oversight of Real Estate and Mortgage Exposure for Citibank. See also *1998 Russian financial crisis *Long-Term Capital Management Lo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Alan Greenspan

Alan Greenspan (born March 6, 1926) is an American economist who served as the 13th chairman of the Federal Reserve from 1987 to 2006. He works as a private adviser and provides consulting for firms through his company, Greenspan Associates LLC. First nominated to the Federal Reserve by President Ronald Reagan in August 1987, he was reappointed at successive four-year intervals until retiring on January 31, 2006, after the second-longest tenure in the position, behind only William McChesney Martin. President George W. Bush appointed Ben Bernanke as his successor. Greenspan came to the Federal Reserve Board from a consulting career. Although he was subdued in his public appearances, favorable media coverage raised his profile to a point that several observers likened him to a "rock star". Democratic leaders of Congress criticized him for politicizing his office because of his support for Social Security privatization and tax cuts. Many have argued that the "easy-money" poli ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Reserve

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States of America. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a series of financial panics (particularly the panic of 1907) led to the desire for central control of the monetary system in order to alleviate financial crises. Over the years, events such as the Great Depression in the 1930s and the Great Recession during the 2000s have led to the expansion of the roles and responsibilities of the Federal Reserve System. U.S. Congress, Congress established three key objectives for monetary policy in the Federal Reserve Act: maximizing employment, stabilizing prices, and moderating long-term interest rates. The first two objectives are sometimes referred to as the Federal Reserve's dual mandate. Its duties have expanded over the years, and currently also include supervising and bank regulation, regulating ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

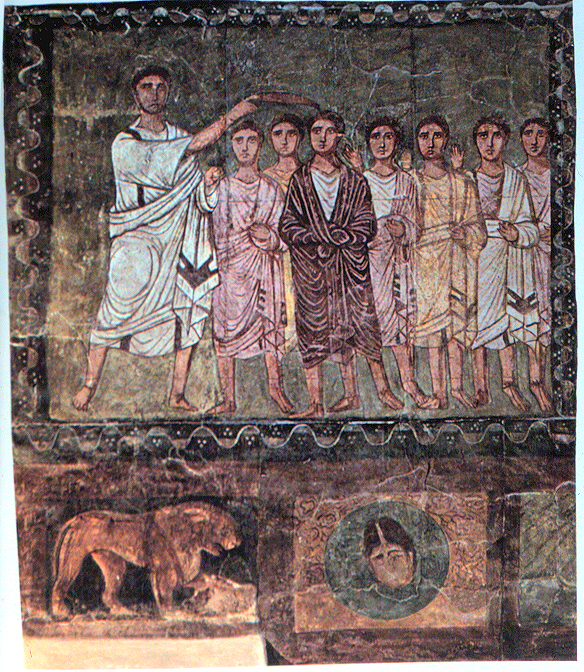

David W

David (; , "beloved one") (traditional spelling), , ''Dāwūd''; grc-koi, Δαυΐδ, Dauíd; la, Davidus, David; gez , ዳዊት, ''Dawit''; xcl, Դաւիթ, ''Dawitʿ''; cu, Давíдъ, ''Davidŭ''; possibly meaning "beloved one". was, according to the Hebrew Bible, the third king of the United Kingdom of Israel. In the Books of Samuel, he is described as a young shepherd and harpist who gains fame by slaying Goliath, a champion of the Philistines, in southern Canaan. David becomes a favourite of Saul, the first king of Israel; he also forges a notably close friendship with Jonathan, a son of Saul. However, under the paranoia that David is seeking to usurp the throne, Saul attempts to kill David, forcing the latter to go into hiding and effectively operate as a fugitive for several years. After Saul and Jonathan are both killed in battle against the Philistines, a 30-year-old David is anointed king over all of Israel and Judah. Following his rise to power, Dav ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stanford University

Stanford University, officially Leland Stanford Junior University, is a Private university, private research university in Stanford, California. The campus occupies , among the largest in the United States, and enrolls over 17,000 students. Stanford is considered among the most prestigious universities in the world. Stanford was founded in 1885 by Leland Stanford, Leland and Jane Stanford in memory of their only child, Leland Stanford Jr., who had died of typhoid fever at age 15 the previous year. Leland Stanford was a List of United States senators from California, U.S. senator and former List of governors of California, governor of California who made his fortune as a Big Four (Central Pacific Railroad), railroad tycoon. The school admitted its first students on October 1, 1891, as a Mixed-sex education, coeducational and non-denominational institution. Stanford University struggled financially after the death of Leland Stanford in 1893 and again after much of the campus was ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Harvard University

Harvard University is a private Ivy League research university in Cambridge, Massachusetts. Founded in 1636 as Harvard College and named for its first benefactor, the Puritan clergyman John Harvard, it is the oldest institution of higher learning in the United States and one of the most prestigious and highly ranked universities in the world. The university is composed of ten academic faculties plus Harvard Radcliffe Institute. The Faculty of Arts and Sciences offers study in a wide range of undergraduate and graduate academic disciplines, and other faculties offer only graduate degrees, including professional degrees. Harvard has three main campuses: the Cambridge campus centered on Harvard Yard; an adjoining campus immediately across Charles River in the Allston neighborhood of Boston; and the medical campus in Boston's Longwood Medical Area. Harvard's endowment is valued at $50.9 billion, making it the wealthiest academic institution in the world. Endo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Massachusetts Institute Of Technology

The Massachusetts Institute of Technology (MIT) is a Private university, private Land-grant university, land-grant research university in Cambridge, Massachusetts. Established in 1861, MIT has played a key role in the development of modern technology and science, and is one of the most prestigious and highly ranked academic institutions in the world. Founded in response to the increasing Technological and industrial history of the United States, industrialization of the United States, MIT adopted a European History of European universities, polytechnic university model and stressed laboratory instruction in applied science and engineering. MIT is one of three private land grant universities in the United States, the others being Cornell University and Tuskegee University. The institute has an Campus of the Massachusetts Institute of Technology, urban campus that extends more than a mile (1.6 km) alongside the Charles River, and encompasses a number of major off-campus fa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

University Of Chicago

The University of Chicago (UChicago, Chicago, U of C, or UChi) is a private university, private research university in Chicago, Illinois. Its main campus is located in Chicago's Hyde Park, Chicago, Hyde Park neighborhood. The University of Chicago is consistently ranked among the best universities in the world and it is among the most selective in the United States. The university is composed of College of the University of Chicago, an undergraduate college and five graduate research divisions, which contain all of the university's graduate programs and interdisciplinary committees. Chicago has eight professional schools: the University of Chicago Law School, Law School, the Booth School of Business, the Pritzker School of Medicine, the Crown Family School of Social Work, Policy, and Practice, the Harris School of Public Policy, the University of Chicago Divinity School, Divinity School, the Graham School of Continuing Liberal and Professional Studies, and the Pritzker School of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Absolute Return

The absolute return or simply return is a measure of the gain or loss on an investment portfolio expressed as a percentage of invested capital. The adjective "absolute" is used to stress the distinction with the relative return measures often used by long-only stock funds that are not allowed to take part in short selling. The hedge fund business is defined by absolute returns. Unlike traditional asset managers, who try to track and outperform a benchmark (a reference index such as the Dow Jones and S&P 500), hedge fund managers employ different strategies in order to produce a positive return regardless of the direction and the fluctuations of capital markets. This is one reason why hedge funds are referred to as alternative investment vehicles (see hedge funds for more details). Absolute return managers tend to be characterised by their use of short selling, leverage and high turnover in their portfolios. Benchmark Although absolute return funds are sometimes considered no ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)