|

List Of Economic Expansions In The United States

In the United States the unofficial beginning and ending dates of national economic expansions have been defined by an American private non-profit research organization known as the National Bureau of Economic Research (NBER). The NBER defines an expansion as a period when economic activity rises substantially, spreads across the economy, and typically lasts for several years. During the 19th century, the United States experienced frequent boom and bust cycles. This period was characterized by short, frequent periods of expansion, typically punctuated by periods of sharp recession. This cyclical pattern continued through the Great Depression. Economic growth since 1945 has been more stable with fewer recessions when compared to previous eras. Great Depression onward Following the end of World War II and the large adjustment as the economy adjusted from wartime to peacetime in 1945, the collection of many economic indicators, such as unemployment and gross domestic product ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Unofficial

{{Short pages monitor ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

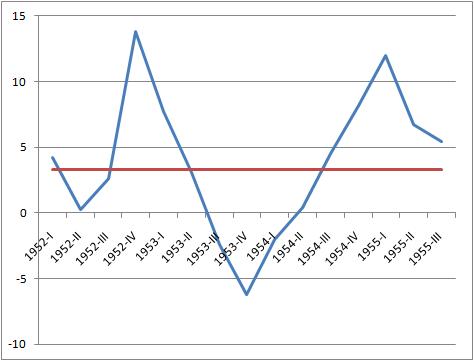

Recession Of 1953

The Recession of 1953 was a recession in the United States that began in the second quarter of 1953 and lasted until the first quarter of 1954. The total recession cost roughly $56 billion. It has been described by James L. Sundquist, a staff member of the Bureau of the Budget and speech-writer for President Harry S. Truman as "relatively mild and brief."James L. Sundquist, ''Politics and Policy: The Eisenhower, Kennedy, and Johnson Years'', 1969, pg. 431, IBAN 0815782225 Preceding the recession The recession from 1953 to 1954 occurred because of a combination of events during the earliest parts of the 1950s. In 1951, there was a post-Korean War inflationary period and later in the year more funds were transferred into national security. Further inflation was expected into 1952 and the Federal Reserve set in motion restrictive monetary policy. Causes The expected inflation never happened, but the policy was still implemented. During this time, the Treasury also lengthened the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dot-com Bubble

The dot-com bubble (dot-com boom, tech bubble, or the Internet bubble) was a stock market bubble in the late 1990s, a period of massive growth in the use and adoption of the Internet. Between 1995 and its peak in March 2000, the Nasdaq Composite stock market index rose 400%, only to fall 78% from its peak by October 2002, giving up all its gains during the bubble. During the dot-com crash, many online shopping companies, such as Pets.com, Webvan, and Boo.com, as well as several communication companies, such as Worldcom, NorthPoint Communications, and Global Crossing, failed and shut down. Some companies that survived, such as Amazon, lost large portions of their market capitalization, with Cisco Systems alone losing 80% of its stock value. Background Historically, the dot-com boom can be seen as similar to a number of other technology-inspired booms of the past including railroads in the 1840s, automobiles in the early 20th century, radio in the 1920s, television in the 19 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cold War

The Cold War is a term commonly used to refer to a period of geopolitical tension between the United States and the Soviet Union and their respective allies, the Western Bloc and the Eastern Bloc. The term '' cold war'' is used because there was no large-scale fighting directly between the two superpowers, but they each supported major regional conflicts known as proxy wars. The conflict was based around the ideological and geopolitical struggle for global influence by these two superpowers, following their temporary alliance and victory against Nazi Germany and Imperial Japan in 1945. Aside from the nuclear arsenal development and conventional military deployment, the struggle for dominance was expressed via indirect means such as psychological warfare, propaganda campaigns, espionage, far-reaching embargoes, rivalry at sports events, and technological competitions such as the Space Race. The Western Bloc was led by the United States as well as a number of other First W ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Early 1990s Recession In The United States

The United States entered recession in 1990, which lasted 8 months through March 1991. Although the recession was mild relative to other post-war recessions, it was characterized by a sluggish employment recovery, most commonly referred to as a jobless recovery. Unemployment continued to rise through June 1992, even though a positive economic growth rate had returned the previous year. Belated recovery from the 1990–1991 recession contributed to Bill Clinton's victory in the 1992 presidential election. Background Throughout 1989 and 1990, the economy was weakening as a result of restrictive monetary policy enacted by the Federal Reserve. At the time, the stated policy of the Fed was to reduce inflation, a process which limited economic expansion. The immediate cause of the recession was a loss of consumer and business confidence as a result of the 1990 oil price shock, coupled with an already weak economy. Another factor that may have contributed to the weakening of the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Reserve Bank Of San Francisco

The Federal Reserve Bank of San Francisco (informally referred to as the San Francisco Fed) is the federal bank for the twelfth district in the United States. The twelfth district is made up of nine western states—Alaska, Arizona, California, Hawaii, Idaho, Nevada, Oregon, Utah, and Washington—plus the Northern Mariana Islands, American Samoa, and Guam. The San Francisco Fed has branch offices in Los Angeles, Portland, Salt Lake City, and Seattle. It also has a cash processing center in Phoenix. The twelfth district is the nation's largest by area and population, covering , or 36% of the nation's area, and 60 million people. The Federal Reserve Bank of San Francisco is the second-largest by assets held, after New York. In 2004 the San Francisco Fed processed 20.8 billion currency notes and 1.5 billion commercial checks. The Federal Reserve Bank in San Francisco has one of the largest collections of US paper money in the United States, which is displayed in the American Curr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Double-dip Recession

Recession shapes or recovery shapes are used by economists to describe different types of recessions and their subsequent recoveries. There is no specific academic theory or classification system for recession shapes; rather the terminology is used as an informal shorthand to characterize recessions and their recoveries. The most commonly used terms are V-shaped (with variations of square-root shaped, and Nike-swoosh shaped), U-shaped, W-shaped (also known as a double-dip recession), and L-shaped recessions, with the COVID-19 pandemic leading to the K-shaped recession (also known as a two-stage recession). The names derive from the shape the economic data – particularly GDP – takes during the recession and recovery. V-shaped In a V-shaped recession, the economy suffers a sharp but brief period of economic decline with a clearly defined trough, followed by a strong recovery. V-shapes are the normal shape for a recession, as the strength of the economic recovery is typicall ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

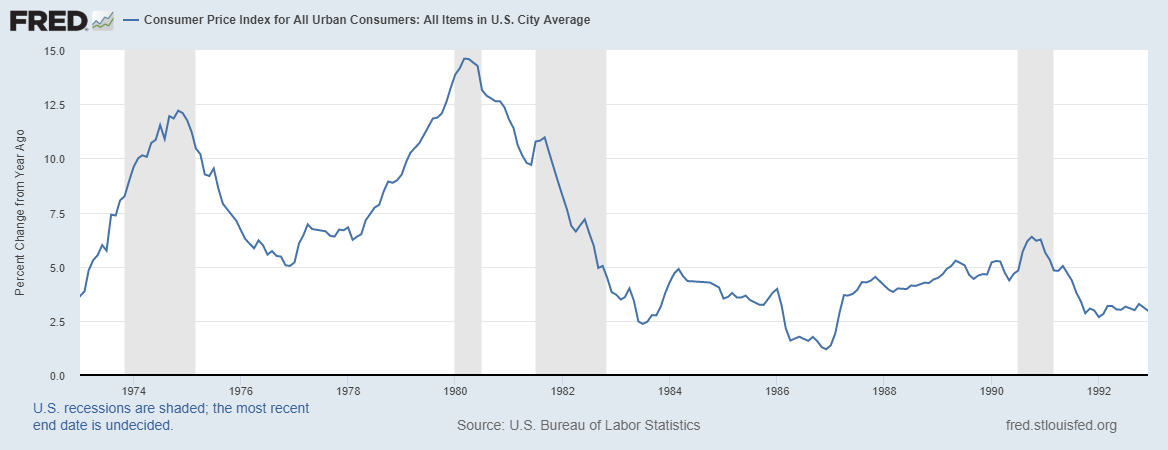

Early 1980s Recession In The United States

The United States entered recession in January 1980 and returned to growth six months later in July 1980. Although recovery took hold, the unemployment rate remained unchanged through the start of a second recession in July 1981. The downturn ended 16 months later, in November 1982. The economy entered a strong recovery and experienced a lengthy expansion through 1990. Principal causes of the 1980 recession included contractionary monetary policy undertaken by the Federal Reserve to combat double digit inflation and residual effects of the energy crisis. Manufacturing and construction failed to recover before more aggressive inflation reducing policy was adopted by the Federal Reserve in 1981, causing a second downturn. Due to their proximity and compounded effects, they are commonly referred to as the early 1980s recession, an example of a W-shaped or " double dip" recession; it remains the most recent example of such a recession in the United States. The recession marked a sh ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

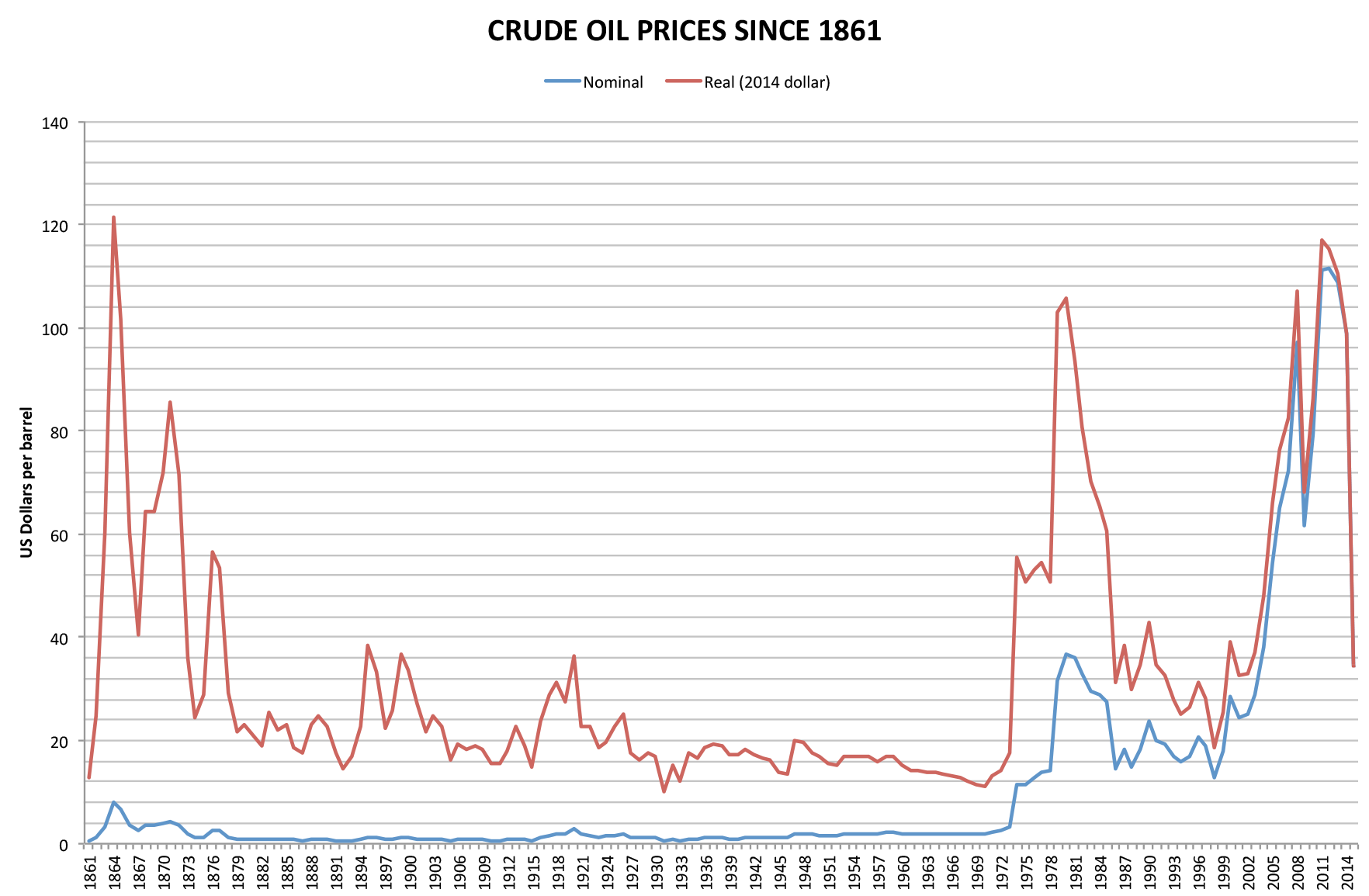

1979 Energy Crisis

The 1979 oil crisis, also known as the 1979 Oil Shock or Second Oil Crisis, was an energy crisis caused by a drop in oil production in the wake of the Iranian Revolution. Although the global oil supply only decreased by approximately four percent, the oil markets' reaction raised the price of crude oil drastically over the next 12 months, more than doubling it to . The sudden increase in price was connected with fuel shortages and long lines at gas stations similar to the 1973 oil crisis. In 1980, following the onset of the Iran–Iraq War, oil production in Iran fell drastically. Iraq's oil production also dropped significantly, triggering economic recessions worldwide. Oil prices did not return to pre-crisis levels until the mid-1980s. Oil prices after 1980 began a steady decline over the next 20 years, except for a brief uptick during the Gulf War, which then reached a 60% fall-off in the 1990s. Mexico, Nigeria, and Venezuela's major oil exporters expanded their produc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inflation

In economics, inflation is an increase in the general price level of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduction in the purchasing power of money. The opposite of inflation is deflation, a sustained decrease in the general price level of goods and services. The common measure of inflation is the inflation rate, the annualized percentage change in a general price index. As prices do not all increase at the same rate, the consumer price index (CPI) is often used for this purpose. The employment cost index is also used for wages in the United States. Most economists agree that high levels of inflation as well as hyperinflation—which have severely disruptive effects on the real economy—are caused by persistent excessive growth in the money supply. Views on low to moderate rates of inflation are more varied. Low or moderate inflation may be attri ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

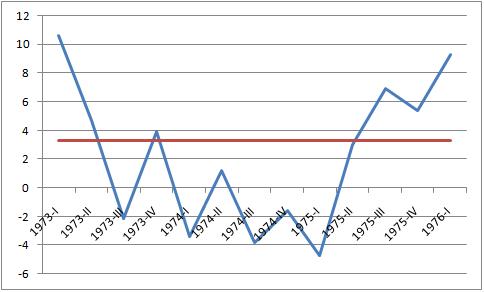

1973 Oil Crisis

The 1973 oil crisis or first oil crisis began in October 1973 when the members of the Organization of Arab Petroleum Exporting Countries (OAPEC), led by Saudi Arabia, proclaimed an oil embargo. The embargo was targeted at nations that had supported Israel during the Yom Kippur War. The initial nations targeted were Canada, Japan, the Netherlands, the United Kingdom and the United States, though the embargo also later extended to Portugal, Rhodesia and South Africa. By the end of the embargo in March 1974, the price of oil had risen nearly 300%, from US to nearly globally; US prices were significantly higher. The embargo caused an oil crisis, or "shock", with many short- and long-term effects on global politics and the global economy. It was later called the "first oil shock", followed by the 1979 oil crisis, termed the "second oil shock". Background Arab-Israeli conflict Ever since the recreation of the State of Israel in 1948 there has been Arab–Israeli conflict in the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Recession Of 1969–70

In economics, a recession is a business cycle contraction when there is a general decline in economic activity. Recessions generally occur when there is a widespread drop in spending (an adverse demand shock). This may be triggered by various events, such as a financial crisis, an external trade shock, an adverse supply shock, the bursting of an economic bubble, or a large-scale anthropogenic or natural disaster (e.g. a pandemic). In the United States, a recession is defined as "a significant decline in economic activity spread across the market, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales." The European Union has adopted a similar definition. In the United Kingdom, a recession is defined as negative economic growth for two consecutive quarters. Governments usually respond to recessions by adopting expansionary macroeconomic policies, such as increasing money supply and decreasing int ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.png)