|

Kolmogorov's Zero–one Law

In probability theory, Kolmogorov's zero–one law, named in honor of Andrey Nikolaevich Kolmogorov, specifies that a certain type of event, namely a ''tail event of independent σ-algebras'', will either almost surely happen or almost surely not happen; that is, the probability of such an event occurring is zero or one. Tail events are defined in terms of countably infinite families of σ-algebras. For illustrative purposes, we present here the special case in which each sigma algebra is generated by a random variable X_k for k\in\mathbb N. Let \mathcal be the sigma-algebra generated jointly by all of the X_k. Then, a tail event F \in \mathcal is an event which is probabilistically independent of each finite subset of these random variables. (Note: F belonging to \mathcal implies that membership in F is uniquely determined by the values of the X_k, but the latter condition is strictly weaker and does not suffice to prove the zero-one law.) For example, the event that ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Probability Theory

Probability theory is the branch of mathematics concerned with probability. Although there are several different probability interpretations, probability theory treats the concept in a rigorous mathematical manner by expressing it through a set of axioms. Typically these axioms formalise probability in terms of a probability space, which assigns a measure taking values between 0 and 1, termed the probability measure, to a set of outcomes called the sample space. Any specified subset of the sample space is called an event. Central subjects in probability theory include discrete and continuous random variables, probability distributions, and stochastic processes (which provide mathematical abstractions of non-deterministic or uncertain processes or measured quantities that may either be single occurrences or evolve over time in a random fashion). Although it is not possible to perfectly predict random events, much can be said about their behavior. Two major results in probab ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bernoulli Automorphism

In mathematics, the Bernoulli scheme or Bernoulli shift is a generalization of the Bernoulli process to more than two possible outcomes. Bernoulli schemes appear naturally in symbolic dynamics, and are thus important in the study of dynamical systems. Many important dynamical systems (such as Axiom A systems) exhibit a repellor that is the product of the Cantor set and a smooth manifold, and the dynamics on the Cantor set are isomorphic to that of the Bernoulli shift. This is essentially the Markov partition. The term ''shift'' is in reference to the shift operator, which may be used to study Bernoulli schemes. The Ornstein isomorphism theorem shows that Bernoulli shifts are isomorphic when their entropy is equal. Definition A Bernoulli scheme is a discrete-time stochastic process where each independent random variable may take on one of ''N'' distinct possible values, with the outcome ''i'' occurring with probability p_i, with ''i'' = 1, ..., ''N'', and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Springer Science+Business Media

Springer Science+Business Media, commonly known as Springer, is a German multinational publishing company of books, e-books and peer-reviewed journals in science, humanities, technical and medical (STM) publishing. Originally founded in 1842 in Berlin, it expanded internationally in the 1960s, and through mergers in the 1990s and a sale to venture capitalists it fused with Wolters Kluwer and eventually became part of Springer Nature in 2015. Springer has major offices in Berlin, Heidelberg, Dordrecht, and New York City. History Julius Springer founded Springer-Verlag in Berlin in 1842 and his son Ferdinand Springer grew it from a small firm of 4 employees into Germany's then second largest academic publisher with 65 staff in 1872.Chronology ". Springer Science+Business Media. In 1964, Springer expanded its business internationa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cambridge University Press

Cambridge University Press is the university press of the University of Cambridge. Granted letters patent by King Henry VIII in 1534, it is the oldest university press in the world. It is also the King's Printer. Cambridge University Press is a department of the University of Cambridge and is both an academic and educational publisher. It became part of Cambridge University Press & Assessment, following a merger with Cambridge Assessment in 2021. With a global sales presence, publishing hubs, and offices in more than 40 countries, it publishes over 50,000 titles by authors from over 100 countries. Its publishing includes more than 380 academic journals, monographs, reference works, school and university textbooks, and English language teaching and learning publications. It also publishes Bibles, runs a bookshop in Cambridge, sells through Amazon, and has a conference venues business in Cambridge at the Pitt Building and the Sir Geoffrey Cass Sports and Social Centre. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tail Risk

Tail risk, sometimes called "fat tail risk," is the financial risk of an asset or portfolio of assets moving more than three standard deviations from its current price, above the risk of a normal distribution. Tail risks include low-probability events arising at both ends of a normal distribution curve, also known as tail events. However, as investors are generally more concerned with unexpected losses rather than gains, a debate about tail risk is focused on the left tail. Prudent asset managers are typically cautious with the tail involving losses which could damage or ruin portfolios, and not the beneficial tail of outsized gains. The common technique of theorizing a normal distribution of price changes underestimates tail risk when market data exhibit fat tails, thus understating asset prices, stock returns and subsequent risk management strategies. Tail risk is sometimes defined less strictly: as merely the risk (or probability) of rare events. The arbitrary definition o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Long Tail

In statistics and business, a long tail of some distributions of numbers is the portion of the distribution having many occurrences far from the "head" or central part of the distribution. The distribution could involve popularities, random numbers of occurrences of events with various probabilities, etc. The term is often used loosely, with no definition or an arbitrary definition, but precise definitions are possible. In statistics, the term ''long-tailed distribution'' has a narrow technical meaning, and is a subtype of heavy-tailed distribution. Intuitively, a distribution is (right) long-tailed if, for any fixed amount, when a quantity exceeds a high level, it almost certainly exceeds it by at least that amount: large quantities are probably even larger. Note that there is no sense of ''the'' "long tail" of a distribution, but only the ''property'' of a distribution being long-tailed. In business, the term ''long tail'' is applied to rank-size distributions or rank-freq ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lévy's Zero–one Law

In mathematicsspecifically, in the theory of stochastic processesDoob's martingale convergence theorems are a collection of results on the limits of supermartingales, named after the American mathematician Joseph L. Doob. Informally, the martingale convergence theorem typically refers to the result that any supermartingale satisfying a certain boundedness condition must converge. One may think of supermartingales as the random variable analogues of non-increasing sequences; from this perspective, the martingale convergence theorem is a random variable analogue of the monotone convergence theorem, which states that any bounded monotone sequence converges. There are symmetric results for submartingales, which are analogous to non-decreasing sequences. Statement for discrete-time martingales A common formulation of the martingale convergence theorem for discrete-time martingales is the following. Let X_1, X_2, X_3, \dots be a supermartingale. Suppose that the supermartingale is b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hewitt–Savage Zero–one Law

The Hewitt–Savage zero–one law is a theorem in probability theory, similar to Kolmogorov's zero–one law and the Borel–Cantelli lemma, that specifies that a certain type of event will either almost surely happen or almost surely not happen. It is sometimes known as the Savage-Hewitt law for symmetric events. It is named after Edwin Hewitt and Leonard Jimmie Savage. Statement of the Hewitt-Savage zero-one law Let \left\_^\infty be a sequence of independent and identically-distributed random variables taking values in a set \mathbb. The Hewitt-Savage zero–one law says that any event whose occurrence or non-occurrence is determined by the values of these random variables and whose occurrence or non-occurrence is unchanged by finite permutations of the indices, has probability either 0 or 1 (a "finite" permutation is one that leaves all but finitely many of the indices fixed). Somewhat more abstractly, define the ''exchangeable sigma algebra'' or ''sigma algebra of symmetric ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Borel–Cantelli Lemma

In probability theory, the Borel–Cantelli lemma is a theorem about sequences of events. In general, it is a result in measure theory. It is named after Émile Borel and Francesco Paolo Cantelli, who gave statement to the lemma in the first decades of the 20th century. A related result, sometimes called the second Borel–Cantelli lemma, is a partial converse of the first Borel–Cantelli lemma. The lemma states that, under certain conditions, an event will have probability of either zero or one. Accordingly, it is the best-known of a class of similar theorems, known as zero-one laws. Other examples include Kolmogorov's zero–one law and the Hewitt–Savage zero–one law. Statement of lemma for probability spaces Let ''E''1,''E''2,... be a sequence of events in some probability space. The Borel–Cantelli lemma states: Here, "lim sup" denotes limit supremum of the sequence of events, and each event is a set of outcomes. That is, lim sup ''E''''n'' is th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Percolation Theory

In statistical physics and mathematics, percolation theory describes the behavior of a network when nodes or links are added. This is a geometric type of phase transition, since at a critical fraction of addition the network of small, disconnected clusters merge into significantly larger connected, so-called spanning clusters. The applications of percolation theory to materials science and in many other disciplines are discussed here and in the articles network theory and percolation. Introduction A representative question (and the source of the name) is as follows. Assume that some liquid is poured on top of some porous material. Will the liquid be able to make its way from hole to hole and reach the bottom? This physical question is modelled mathematically as a three-dimensional network of vertices, usually called "sites", in which the edge or "bonds" between each two neighbors may be open (allowing the liquid through) with probability , or closed with probability , ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Kolmogorov Automorphism

In mathematics, a Kolmogorov automorphism, ''K''-automorphism, ''K''-shift or ''K''-system is an invertible, measure-preserving automorphism defined on a standard probability space that obeys Kolmogorov's zero–one law.Peter Walters, ''An Introduction to Ergodic Theory'', (1982) Springer-Verlag All Bernoulli automorphisms are ''K''-automorphisms (one says they have the ''K''-property), but not vice versa. Many ergodic dynamical systems have been shown to have the ''K''-property, although more recent research has shown that many of these are in fact Bernoulli automorphisms. Although the definition of the ''K''-property seems reasonably general, it stands in sharp distinction to the Bernoulli automorphism. In particular, the Ornstein isomorphism theorem does not apply to ''K''-systems, and so the entropy is not sufficient to classify such systems – there exist uncountably many non-isomorphic ''K''-systems with the same entropy. In essence, the collection of ''K''-systems is lar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

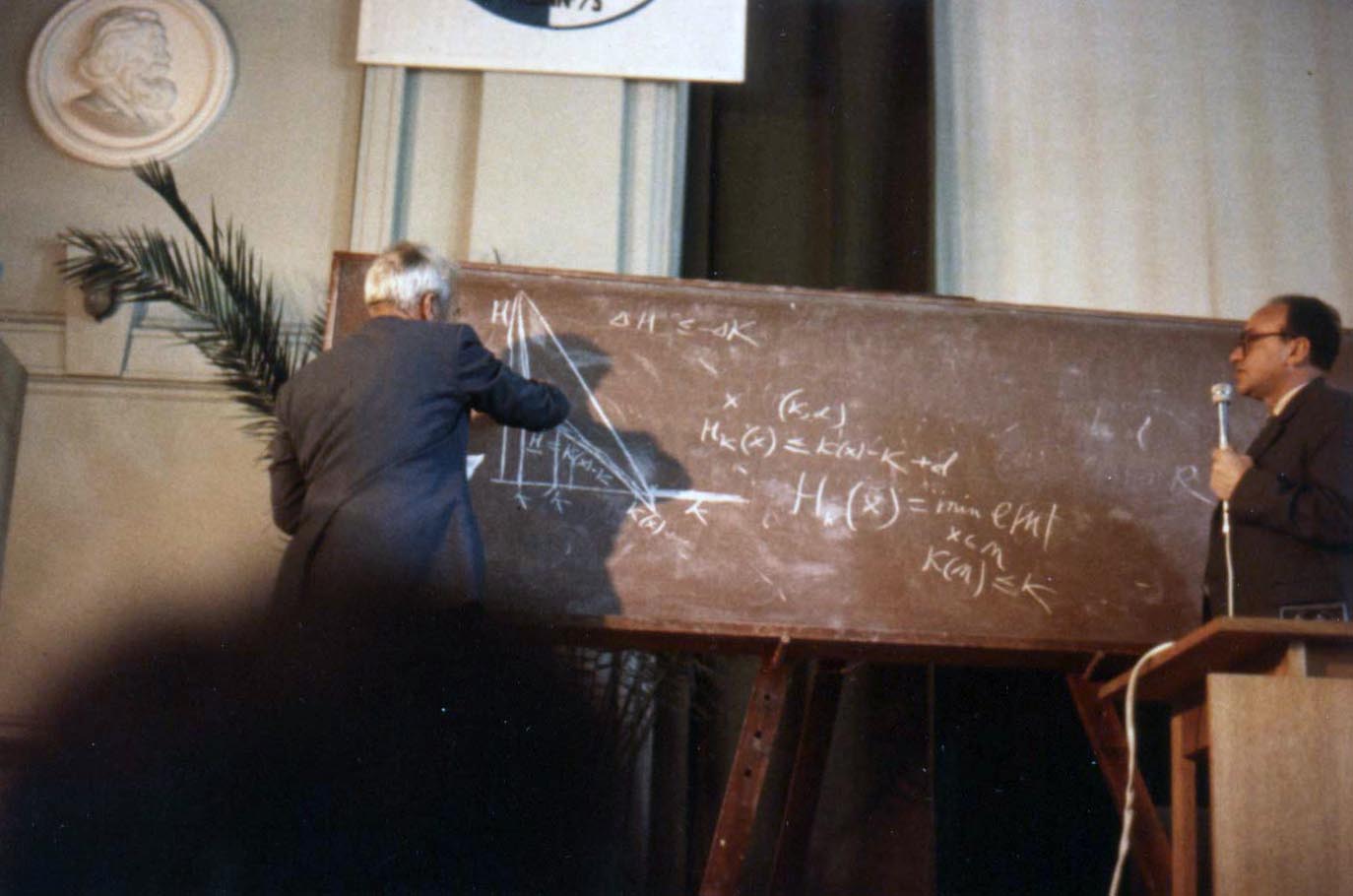

Andrey Nikolaevich Kolmogorov

Andrey Nikolaevich Kolmogorov ( rus, Андре́й Никола́евич Колмого́ров, p=ɐnˈdrʲej nʲɪkɐˈlajɪvʲɪtɕ kəlmɐˈɡorəf, a=Ru-Andrey Nikolaevich Kolmogorov.ogg, 25 April 1903 – 20 October 1987) was a Soviet mathematician who contributed to the mathematics of probability theory, topology, intuitionistic logic, turbulence, classical mechanics, algorithmic information theory and computational complexity. Biography Early life Andrey Kolmogorov was born in Tambov, about 500 kilometers south-southeast of Moscow, in 1903. His unmarried mother, Maria Y. Kolmogorova, died giving birth to him. Andrey was raised by two of his aunts in Tunoshna (near Yaroslavl) at the estate of his grandfather, a well-to-do nobleman. Little is known about Andrey's father. He was supposedly named Nikolai Matveevich Kataev and had been an agronomist. Kataev had been exiled from St. Petersburg to the Yaroslavl province after his participation in the revolutionary move ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |