|

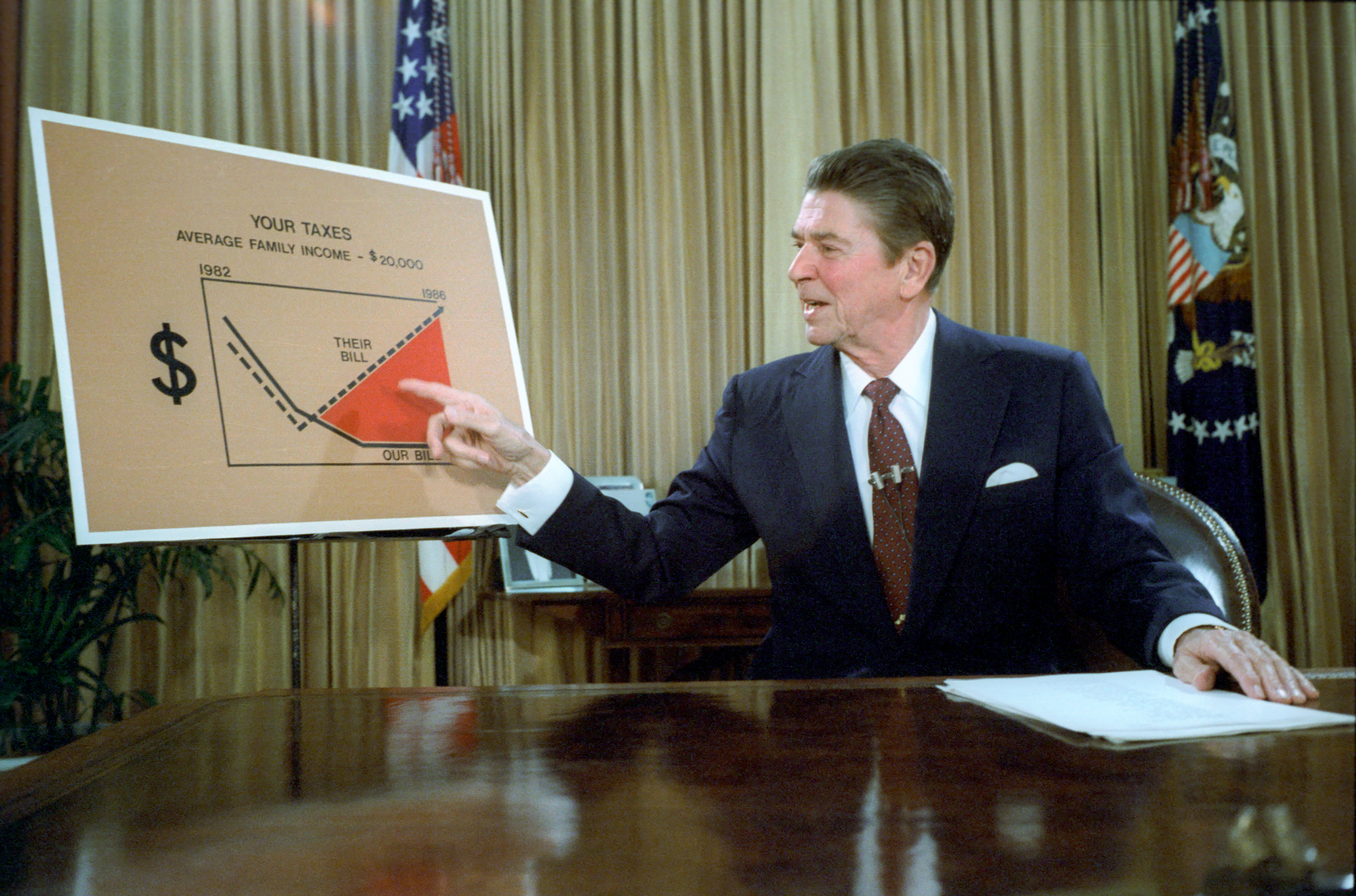

Kansas Experiment

The Kansas experiment refers to Kansas Senate Bill Substitute HB 2117, a bill signed into law in May 2012 by Kansas state Governor Sam Brownback, and its impact on Kansas. It was one of the largest income tax cuts in the state's history. The Kansas experiment has also been called the "Great Kansas Tax Cut Experiment", the "Red-state experiment", "the tax experiment in Kansas", and "one of the cleanest experiments for how tax cuts affect economic growth in the U.S." The cuts were based on model legislation published by the conservative American Legislative Exchange Council (ALEC), supported by supply-side economist Arthur Laffer, and anti-tax leader Grover Norquist. The law cut taxes by 231 million in its first year, and cuts were projected to total 934 million annually after six years, by eliminating taxes on business income for the owners of almost 200,000 businesses and cutting individual income tax rates. Brownback compared his tax policies with those of Ronald Reagan, and des ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Kansas

Kansas () is a state in the Midwestern United States. Its capital is Topeka, and its largest city is Wichita. Kansas is a landlocked state bordered by Nebraska to the north; Missouri to the east; Oklahoma to the south; and Colorado to the west. Kansas is named after the Kansas River, which in turn was named after the Kansa Native Americans who lived along its banks. The tribe's name (natively ') is often said to mean "people of the (south) wind" although this was probably not the term's original meaning. For thousands of years, what is now Kansas was home to numerous and diverse Native American tribes. Tribes in the eastern part of the state generally lived in villages along the river valleys. Tribes in the western part of the state were semi-nomadic and hunted large herds of bison. The first Euro-American settlement in Kansas occurred in 1827 at Fort Leavenworth. The pace of settlement accelerated in the 1850s, in the midst of political wars over the slavery debate. Wh ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Kansas Gubernatorial Election, 2010

The 2010 Kansas gubernatorial election was held on November 2, 2010. Incumbent Governor Mark Parkinson, who assumed office when previous Governor Kathleen Sebelius was sworn in as the United States Secretary of Health and Human Services on April 28, 2009, declined to seek election to a full term. United States Senator Sam Brownback, who unsuccessfully ran for president in 2008, emerged as the Republican nominee, facing off against Democratic State Senator Tom Holland, who was unopposed for his party's nomination. Owing to the large amount of popularity that he had accumulated during his tenure in the United States Senate, Brownback defeated Holland in a landslide to become the 46th Governor of Kansas. Democratic primary Candidates * Tom Holland, Kansas State Senator Results Republican primary Announced * Sam Brownback, United States Senator * Joan Heffington, businesswoman Polling Results General election Predictions Polling Results References ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Washington Post

''The Washington Post'' (also known as the ''Post'' and, informally, ''WaPo'') is an American daily newspaper published in Washington, D.C. It is the most widely circulated newspaper within the Washington metropolitan area and has a large national audience. Daily broadsheet editions are printed for D.C., Maryland, and Virginia. The ''Post'' was founded in 1877. In its early years, it went through several owners and struggled both financially and editorially. Financier Eugene Meyer purchased it out of bankruptcy in 1933 and revived its health and reputation, work continued by his successors Katharine and Phil Graham (Meyer's daughter and son-in-law), who bought out several rival publications. The ''Post'' 1971 printing of the Pentagon Papers helped spur opposition to the Vietnam War. Subsequently, in the best-known episode in the newspaper's history, reporters Bob Woodward and Carl Bernstein led the American press's investigation into what became known as the Watergate scandal, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Morning Joe

''Morning Joe'' is an American morning news and liberal talk show, airing weekdays from 6:00 a.m. to 10:00 a.m. Eastern Time Zone, Eastern Time on the cable news channel MSNBC. It features former Republican Congressman Joe Scarborough reporting and discussing the news of the day in a panel format with co-hosts Mika Brzezinski (whom Scarborough married in November 2018) and Willie Geist, among others. History ''Morning Joe'' began as a fill-in program after Don Imus' ''Imus in the Morning'' was canceled. Former Florida Republican Congressman Joe Scarborough, then host of the primetime MSNBC program ''Scarborough Country'', suggested the idea of doing a morning show instead. He put together what would become ''Morning Joe'' with ''Scarborough Country'' executive producer Chris Licht and screenwriter John Ridley. On April 9, 2007, the show debuted as one of a series of rotating programs auditioning for Imus's former slot, with Scarborough joined by co-hosts Mika Brzezinski ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Kansas Policy Institute

The Kansas Policy Institute (KPI) is a free market American think tank based in Wichita, Kansas. A member of the State Policy Network, it primarily focuses on state and local policy issues in Kansas, including education, budget and spending, health care, and property taxes. The president of the KPI is Dave Trabert and the chairman of the board is George Pearson. History The group's stated mission is to "advocate for free market solutions to public policy issues and the protection of personal freedom for all Kansans." Founded in 1996 as the Kansas Public Policy Institute, the think tank changed its name to the Flint Hills Center for Public Policy, then back to Kansas Policy Institute in 2009. It was founded by a group of Kansans who supported the Cato Institute and wanted to apply that model to Kansas state government. KPI hosts events across the state; publishes studies geared toward policy makers, the general public, and community leaders; and uses traditional and social media ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Kansas City Star

''The Kansas City Star'' is a newspaper based in Kansas City, Missouri. Published since 1880, the paper is the recipient of eight Pulitzer Prizes. ''The Star'' is most notable for its influence on the career of President Harry S. Truman and as the newspaper where a young Ernest Hemingway honed his writing style. The paper is the major newspaper of the Kansas City metropolitan area and has widespread circulation in western Missouri and eastern Kansas. History Nelson family ownership (1880–1926) The paper, originally called ''The Kansas City Evening Star'', was founded September 18, 1880, by William Rockhill Nelson and Samuel E. Morss. The two moved to Missouri after selling the newspaper that became the '' Fort Wayne News Sentinel'' (and earlier owned by Nelson's father) in Nelson's Indiana hometown, where Nelson was campaign manager in the unsuccessful Presidential run of Samuel Tilden. Morss quit the newspaper business within a year and a half because of ill health. At ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Credit

A tax credit is a tax incentive which allows certain taxpayers to subtract the amount of the credit they have accrued from the total they owe the state. It may also be a credit granted in recognition of taxes already paid or a form of state "discount" applied in certain cases. Another way to think of a tax credit is as a rebate. Refundable vs. non-refundable A refundable tax credit is one which, if the credit exceeds the taxes due, the government pays back to the taxpayer the difference. In other words, it makes possible a negative tax liability. For example, if a taxpayer has an initial tax liability of $100 and applies a $300 tax credit, then the taxpayer ends with a liability of –$200 and the government refunds to the taxpayer that $200. With a non-refundable tax credit, if the credit exceeds the taxes due then the taxpayer pays nothing but does not receive the difference. In this case, the taxpayer from the example would end with a tax liability of $0 (i.e. they could mak ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sales Tax

A sales tax is a tax paid to a governing body for the sales of certain goods and services. Usually laws allow the seller to collect funds for the tax from the consumer at the point of purchase. When a tax on goods or services is paid to a governing body directly by a consumer, it is usually called a use tax. Often laws provide for the exemption of certain goods or services from sales and use tax, such as food, education, and medicines. A value-added tax (VAT) collected on goods and services is related to a sales tax. See Comparison with sales tax for key differences. Types Conventional or retail sales tax is levied on the sale of a good to its final end-user and is charged every time that item is sold retail. Sales to businesses that later resell the goods are not charged the tax. A purchaser who is not an end-user is usually issued a "resale certificate" by the taxing authority and required to provide the certificate (or its ID number) to a seller at the point of purchase, al ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

S Corporation

An S corporation, for United States federal income tax, is a closely held corporation (or, in some cases, a limited liability company (LLC) or a partnership) that makes a valid election to be taxed under Subchapter S of Chapter 1 of the Internal Revenue Code. In general, S corporations do not pay any income taxes. Instead, the corporation's income and losses are divided among and passed through to its shareholders. The shareholders must then report the income or loss on their own individual income tax returns. Overview S corporations are ordinary business corporations that elect to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes. The term "S corporation" means a "small business corporation" which has made an election under § 1362(a) to be taxed as an S corporation. The S corporation rules are contained in Subchapter S of Chapter 1 of the Internal Revenue Code (sections 1361 through 1379). The United States Congress, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Limited Liability Companies

A limited liability company (LLC for short) is the US-specific form of a private limited company. It is a business structure that can combine the pass-through taxation of a partnership or sole proprietorship with the limited liability of a corporation. An LLC is not a corporation under state law; it is a legal form of a company that provides limited liability to its owners in many jurisdictions. LLCs are well known for the flexibility that they provide to business owners; depending on the situation, an LLC may elect to use corporate tax rules instead of being treated as a partnership, and, under certain circumstances, LLCs may be organized as not-for-profit. In certain U.S. states (for example, Texas), businesses that provide professional services requiring a state professional license, such as legal or medical services, may not be allowed to form an LLC but may be required to form a similar entity called a professional limited liability company (PLLC). An LLC is a hybrid le ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sole Proprietorships

A sole proprietorship, also known as a sole tradership, individual entrepreneurship or proprietorship, is a type of enterprise owned and run by one person and in which there is no legal distinction between the owner and the business entity. A sole trader does not necessarily work alone and may employ other people. The sole trader receives all profits (subject to taxation specific to the business) and has unlimited responsibility for all losses and debts. Every asset of the business is owned by the proprietor, and all debts of the business are that of the proprietor. It is a "sole" proprietorship in contrast with a partnership, which has at least two owners. Sole proprietors may use a trade name or business name other than their or its legal name. They may have to trademark their business name legally if it differs from their own legal name, with the process varying depending upon country of residence. Advantages and disadvantages Registration of a business name for a sole propri ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Trickle-down Economics

Trickle-down economics is a term used in critical references to economic policies that favor the upper income brackets, corporations, and individuals with substantial wealth or capital. In recent history, the term has been used by critics of supply-side economics. Whereas general supply-side theory favors lowering taxes overall, trickle-down theory more specifically advocates for a lower tax burden on the upper end of the economic spectrum. Major examples of US Republicans supporting what critics call "trickle-down economics" include the Reagan tax cuts, the Bush tax cuts and the Tax Cuts and Jobs Act of 2017. In each of the aforementioned tax reforms, taxes were cut across all income brackets, but the biggest reductions were given to the highest income earners, although the Reagan Era tax reforms also introduced the earned income tax credit which has received bipartisan praise for poverty reduction and is largely why the bottom half of workers pay no federal income tax. Si ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |