|

Kansas Senate Bill Substitute HB 2117

The Kansas experiment refers to Kansas Senate Bill Substitute HB 2117, a bill signed into law in May 2012 by Kansas state Governor Sam Brownback, and its impact on Kansas. It was one of the largest income tax cuts in the state's history. The Kansas experiment has also been called the "Great Kansas Tax Cut Experiment", the "Red-state experiment", "the tax experiment in Kansas", and "one of the cleanest experiments for how tax cuts affect economic growth in the U.S." The cuts were based on model legislation published by the conservative American Legislative Exchange Council (ALEC), supported by supply-side economist Arthur Laffer, and anti-tax leader Grover Norquist. The law cut taxes by 231 million in its first year, and cuts were projected to total 934 million annually after six years, by eliminating taxes on business income for the owners of almost 200,000 businesses and cutting individual income tax rates. Brownback compared his tax policies with those of Ronald Reagan, and des ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Kansas

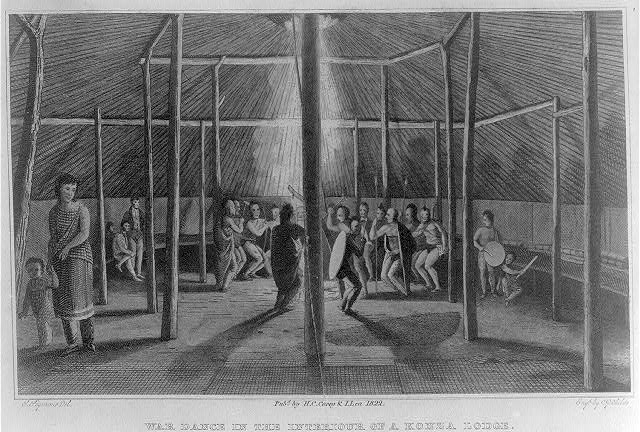

Kansas () is a state in the Midwestern United States. Its capital is Topeka, and its largest city is Wichita. Kansas is a landlocked state bordered by Nebraska to the north; Missouri to the east; Oklahoma to the south; and Colorado to the west. Kansas is named after the Kansas River, which in turn was named after the Kansa Native Americans who lived along its banks. The tribe's name (natively ') is often said to mean "people of the (south) wind" although this was probably not the term's original meaning. For thousands of years, what is now Kansas was home to numerous and diverse Native American tribes. Tribes in the eastern part of the state generally lived in villages along the river valleys. Tribes in the western part of the state were semi-nomadic and hunted large herds of bison. The first Euro-American settlement in Kansas occurred in 1827 at Fort Leavenworth. The pace of settlement accelerated in the 1850s, in the midst of political wars over the slavery debate. Wh ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |