|

Joint Venture Broker

A joint venture (JV) is a business entity created by two or more parties, generally characterized by shared ownership, shared returns and risks, and shared governance. Companies typically pursue joint ventures for one of four reasons: to access a new market, particularly Emerging market; to gain scale efficiencies by combining assets and operations; to share risk for major investments or projects; or to access skills and capabilities. According to Gerard Baynham of Water Street Partners, there has been much negative press about joint ventures, but objective data indicate that they may actually outperform wholly owned and controlled affiliates. He writes, "A different narrative emerged from our recent analysis of U.S. Department of Commerce (DOC) data, collected from more than 20,000 entities. According to the DOC data, foreign joint ventures of U.S. companies realized a 5.5 percent average return on assets (ROA), while those companies’ wholly owned and controlled affiliates ( ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Shared Ownership

Equity sharing is another name for shared ownership or '' co-ownership''. It takes one property, more than one owner, and blends them to maximize profit and tax deductions. Typically, the parties find a home and buy it together as co-owners, but sometimes they join to co-own a property one of them already owns. At the end of an agreed term, they buy one another out or sell the property and split the equity. In England, equity sharing and shared ownership are not the same thing (see the United Kingdom and England sections below). Equity sharing in different countries United States Equity sharing became desirable in the United States when in 1981 Section 280A of the Internal Revenue Code allowed mixed tax use of a single property for the first time permitting the occupier to claim principal residence tax deductions and the investor to claim investment property tax deductions. Since shared ownership is conferred by the federal tax code, this ownership vehicle can be used in any sta ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

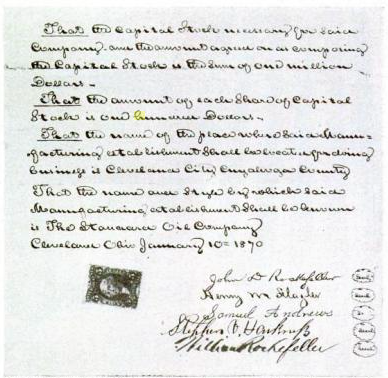

Articles Of Association

In corporate governance, a company's articles of association (AoA, called articles of incorporation in some jurisdictions) is a document which, along with the memorandum of association (in cases where it exists) form the company's constitution, and defines the responsibilities of the directors, the kind of business to be undertaken, and the means by which the shareholders exert control over the board of directors. Articles of association are very critical documents to corporate operations, as they may regulate both internal and external affairs. Articles of incorporation, also referred to as the certificate of incorporation or the corporate charter, is a document or charter that establishes the existence of a corporation in the United States and Canada. They generally are filed with the Secretary of State in the U.S. State where the company is incorporated, or other company registrar. An equivalent term for limited liability companies (LLCs) in the United States is articles ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Proxy Vote

Proxy voting is a form of voting whereby a member of a decision-making body may delegate their voting power to a representative, to enable a vote in absence. The representative may be another member of the same body, or external. A person so designated is called a "proxy" and the person designating them is called a "principal". Proxy appointments can be used to form a voting bloc that can exercise greater influence in deliberations or negotiations. Proxy voting is a particularly important practice with respect to corporations; in the United States, investment advisers often vote proxies on behalf of their client accounts. A related topic is liquid democracy, a family of electoral systems where votes are transferable and grouped by voters, candidates or combination of both to create proportional representation, and delegated democracy. Another related topic is the so-called Proxy Plan, or interactive representation electoral system whereby elected representatives would wield ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Proxy Voting

Proxy voting is a form of voting whereby a member of a decision-making body may delegate their voting power to a representative, to enable a vote in absence. The representative may be another member of the same body, or external. A person so designated is called a "proxy" and the person designating them is called a "principal". Proxy appointments can be used to form a voting bloc that can exercise greater influence in deliberations or negotiations. Proxy voting is a particularly important practice with respect to corporations; in the United States, investment advisers often vote proxies on behalf of their client accounts. A related topic is liquid democracy, a family of electoral systems where votes are transferable and grouped by voters, candidates or combination of both to create proportional representation, and delegated democracy. Another related topic is the so-called Proxy Plan, or interactive representation electoral system whereby elected representatives would wield ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

First Right Of Refusal

Right of first refusal (ROFR or RFR) is a contractual right that gives its holder the option to enter a business transaction with the owner of something, according to specified terms, before the owner is entitled to enter into that transaction with a third party. A first refusal right must have at least three parties: the owner, the third party or buyer, and the option holder. In general, the owner must make the same offer to the option holder ''before'' making the offer to the buyer. The right of first refusal is similar in concept to a call option. An ROFR can cover almost any sort of asset, including real estate, personal property, a patent license, a screenplay, or an interest in a business. It might also cover business transactions that are not strictly assets, such as the right to enter a joint venture or distribution arrangement. In entertainment, a right of first refusal on a concept or a screenplay would give the holder the right to make that movie first while in real ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dividend Policy

Dividend policy is concerned with financial policies regarding paying cash dividend in the present or paying an increased dividend at a later stage. Whether to issue dividends, and what amount, is determined mainly on the basis of the company's unappropriated profit (excess cash) and influenced by the company's long-term earning power. When cash surplus exists and is not needed by the firm, then management is expected to pay out some or all of those surplus earnings in the form of cash dividends or to repurchase the company's stock through a share buyback program. If there are no NPV positive opportunities, i.e. projects where returns exceed the hurdle rate, and excess cash surplus is not needed, then – finance theory suggests – management should return some or all of the excess cash to shareholders as dividends. This is the general case, however there are exceptions. For example, shareholders of a "growth stock", expect that the company will, almost by definition, retain most ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Intellectual Property Rights

Intellectual property (IP) is a category of property that includes intangible creations of the human intellect. There are many types of intellectual property, and some countries recognize more than others. The best-known types are patents, copyrights, trademarks, and trade secrets. The modern concept of intellectual property developed in England in the 17th and 18th centuries. The term "intellectual property" began to be used in the 19th century, though it was not until the late 20th century that intellectual property became commonplace in the majority of the world's legal systems."property as a common descriptor of the field probably traces to the foundation of the World Intellectual Property Organization (WIPO) by the United Nations." in Mark A. Lemley''Property, Intellectual Property, and Free Riding'', Texas Law Review, 2005, Vol. 83:1031, page 1033, footnote 4. The main purpose of intellectual property law is to encourage the creation of a wide variety of intellectual goo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Shareholders' Agreement

A shareholders' agreement (sometimes referred to in the U.S. as a stockholders' agreement) (SHA) is an agreement amongst the shareholders or members of a company. In practical effect, it is analogous to a partnership agreement. It can be said that some jurisdictions fail to give a proper definition to the concept of shareholders' agreement, however particular consequences of this agreements are defined so far. There are advantages of the shareholder's agreement; to be specific, it helps the corporate entity to maintain the absence of publicity and keep the confidentiality. Nonetheless, there are also some disadvantages that should be considered, such as the limited effect to the third parties (especially assignees and share purchasers) and alternation of the stipulated articles can be time consuming. Purpose In strict legal theory, the relationships amongst the shareholders and those between the shareholders and the company are regulated by the constitutional documents of the compa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Shareholder

A shareholder (in the United States often referred to as stockholder) of a corporation is an individual or legal entity (such as another corporation, a body politic, a trust or partnership) that is registered by the corporation as the legal owner of shares of the share capital of a public or private corporation. Shareholders may be referred to as members of a corporation. A person or legal entity becomes a shareholder in a corporation when their name and other details are entered in the corporation's register of shareholders or members, and unless required by law the corporation is not required or permitted to enquire as to the beneficial ownership of the shares. A corporation generally cannot own shares of itself. The influence of a shareholder on the business is determined by the shareholding percentage owned. Shareholders of a corporation are legally separate from the corporation itself. They are generally not liable for the corporation's debts, and the shareholders' liabil ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Articles Of Incorporation

Article often refers to: * Article (grammar), a grammatical element used to indicate definiteness or indefiniteness * Article (publishing), a piece of nonfictional prose that is an independent part of a publication Article may also refer to: Government and law * Article (European Union), articles of treaties of the European Union * Articles of association, the regulations governing a company, used in India, the UK and other countries * Articles of clerkship, the contract accepted to become an articled clerk * Articles of Confederation, the predecessor to the current United States Constitution *Article of Impeachment, a formal document and charge used for impeachment in the United States * Articles of incorporation, for corporations, U.S. equivalent of articles of association * Articles of organization, for limited liability organizations, a U.S. equivalent of articles of association Other uses * Article, an HTML element, delimited by the tags and * Article of clothing, an ite ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Certificate Of Incorporation

A certificate of incorporation is a legal document/license relating to the formation of a company or corporation. It is a license to form a corporation issued by state government or, in some jurisdictions, by non-governmental entity/corporation. Its precise meaning depends upon the legal system in which it is used. Commonwealth systems In the U.S. a certificate of incorporation is usually used as an alternative description of a corporation's articles of incorporation. The certificate of incorporation, or articles of incorporation, form a major constituent part of the constitutional documents of the corporation. In English and Commonwealth legal systems, a certificate of incorporation is usually a simple certificate issued by the relevant government registry as confirmation of the due incorporation and valid existence of the company. In other common law legal systems, the certificate of incorporation has less legal significance. However, it has been held by the House of Lords ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |