|

Jobs And Growth Tax Relief Reconciliation Act Of 2003

The Jobs and Growth Tax Relief Reconciliation Act of 2003 ("JGTRRA", , ), was passed by the United States Congress on May 23, 2003 and signed into law by President George W. Bush on May 28, 2003. Nearly all of the cuts (individual rates, capital gains, dividends, estate tax) were set to expire after 2010. Among other provisions, the act accelerated certain tax changes passed in the Economic Growth and Tax Relief Reconciliation Act of 2001, increased the exemption amount for the individual Alternative Minimum Tax, and lowered taxes of income from dividends and capital gains. The 2001 and 2003 acts are known together as the "Bush tax cuts". Description of cuts JGTRRA continued on the precedent established by the 2001 EGTRRA, while increasing tax reductions on investment income from dividends and capital gains. Accelerated credits and rate reductions JGTRRA accelerated the gradual rate reduction and increase in credits passed in EGTRRA. The maximum tax rate decreases originall ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States House Of Representatives

The United States House of Representatives, often referred to as the House of Representatives, the U.S. House, or simply the House, is the Lower house, lower chamber of the United States Congress, with the United States Senate, Senate being the Upper house, upper chamber. Together they comprise the national Bicameralism, bicameral legislature of the United States. The House's composition was established by Article One of the United States Constitution. The House is composed of representatives who, pursuant to the Uniform Congressional District Act, sit in single member List of United States congressional districts, congressional districts allocated to each U.S. state, state on a basis of population as measured by the United States Census, with each district having one representative, provided that each state is entitled to at least one. Since its inception in 1789, all representatives have been directly elected, although universal suffrage did not come to effect until after ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Alternative Minimum Tax

The alternative minimum tax (AMT) is a tax imposed by the United States federal government in addition to the regular income tax for certain individuals, estates, and trusts. As of tax year 2018, the AMT raises about $5.2 billion, or 0.4% of all federal income tax revenue, affecting 0.1% of taxpayers, mostly in the upper income ranges. An alternative minimum taxable income (AMTI) is calculated by taking the ordinary income and adding disallowed items and credits such as state and local tax deductions, interest on private-activity municipal bonds, the bargain element of incentive stock options, foreign tax credits, and home equity loan interest deductions. This broadens the base of taxable items. Many deductions, such as mortgage home loan interest and charitable deductions, are still allowed under AMT. The AMT is then imposed on this AMTI at a rate of 26% or 28%, with a much higher exemption than the regular income tax. The Tax Cuts and Jobs Act of 2017 (TCJA) reduced the fracti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

University Of Tennessee

The University of Tennessee (officially The University of Tennessee, Knoxville; or UT Knoxville; UTK; or UT) is a public land-grant research university in Knoxville, Tennessee. Founded in 1794, two years before Tennessee became the 16th state, it is the flagship campus of the University of Tennessee system, with ten undergraduate colleges and eleven graduate colleges. It hosts more than 30,000 students from all 50 states and more than 100 foreign countries. It is classified among "R1: Doctoral Universities – Very high research activity". UT's ties to nearby Oak Ridge National Laboratory, established under UT President Andrew Holt and continued under the UT–Battelle partnership, allow for considerable research opportunities for faculty and students. Also affiliated with the university are the Howard H. Baker Jr. Center for Public Policy, the University of Tennessee Anthropological Research Facility, and the University of Tennessee Arboretum, which occupies of nearby Oak R ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

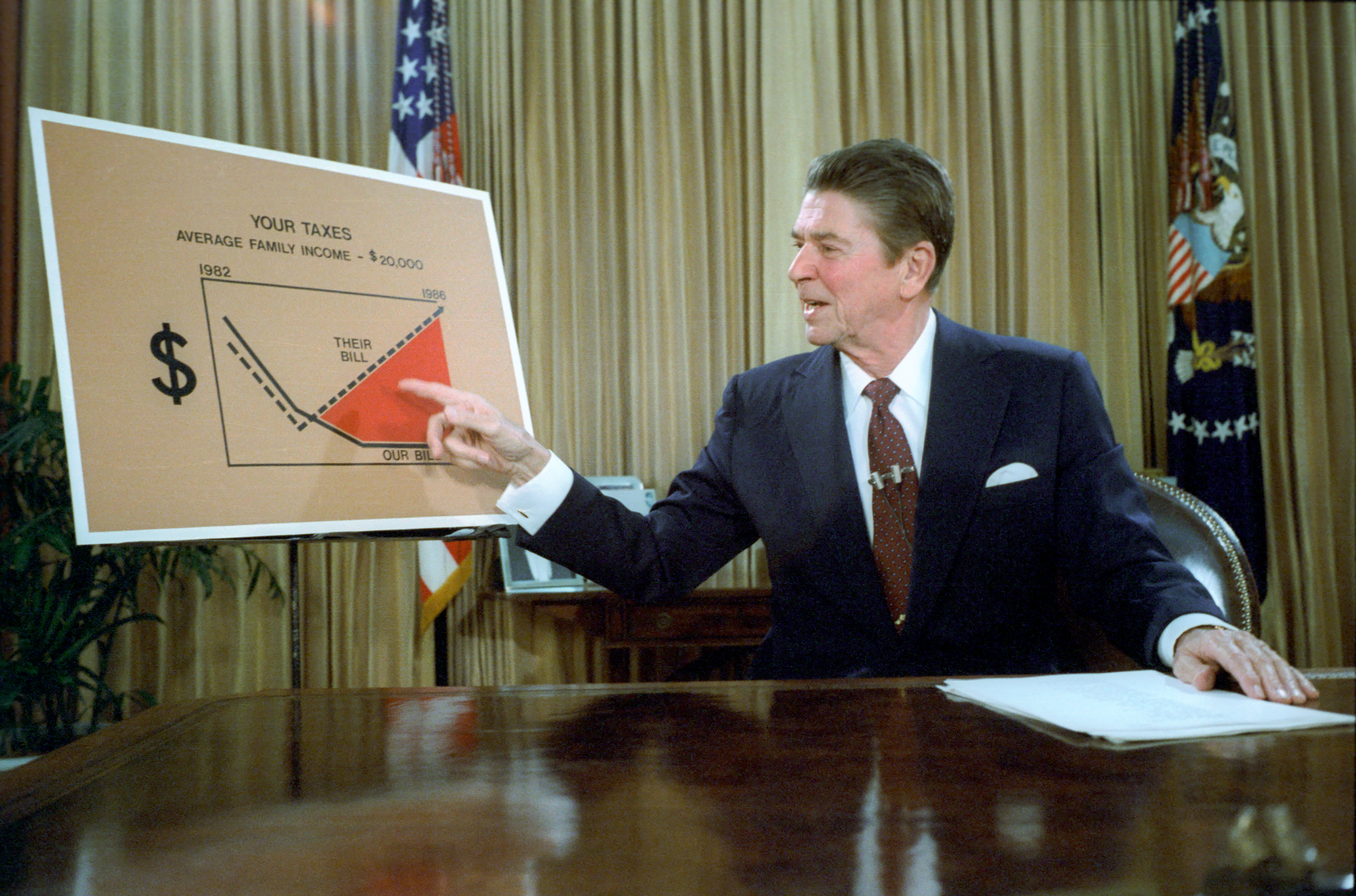

Starve The Beast

"Starve the beast" is a political strategy employed by American conservatives to limit government spending by cutting taxes, to deprive the federal government of revenue in a deliberate effort to force it to reduce spending. The term "the beast", in this context, refers to the United States federal government and the programs it funds, using mainly American taxpayer dollars, particularly social programs such as education, welfare, Social Security, Medicare, and Medicaid. On July 14, 1978, economist and future Federal Reserve chairman Alan Greenspan testified to the Senate Finance Committee: "Let us remember that the basic purpose of any tax cut program in today's environment is to reduce the momentum of expenditure growth by restraining the amount of revenue available and trust that there is a political limit to deficit spending." Before his election as President, then-candidate Ronald Reagan foreshadowed the strategy during the 1980 US Presidential debates, saying "John An ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxation In The United States

The United States, United States of America has separate Federal government of the United States, federal, U.S. state, state, and Local government in the United States, local governments with taxes imposed at each of these levels. Taxes are levied on income, payroll, property, sales, Capital gains tax in the United States, capital gains, dividends, imports, estates and gifts, as well as various fees. In 2020, taxes collected by federal, state, and local governments amounted to 25.5% of GDP, below the OECD average of 33.5% of GDP. The United States had the seventh-lowest tax revenue-to-GDP ratio among OECD countries in 2020, with a higher ratio than Mexico, Colombia, Chile, Ireland, Costa Rica, and Turkey. Taxes fall much more heavily on labor income than on capital income. Divergent taxes and subsidies for different forms of income and spending can also constitute a form of indirect taxation of some activities over others. For example, individual spending on higher education can ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Filing Status (federal Income Tax)

Under United States federal income tax law, filing status determines which tax return form an individual will use and is an important factor in computing taxable income. Filing status is based on marital status and family situation. There are five possible filing status categories: single individual, married person filing jointly or surviving spouse, married person filing separately, head of household and a qualifying widow(er) with dependent children. A taxpayer who qualifies for more than one filing status may choose the most advantageous status.26 U.S.C. 1, Section 1 Determining filing status Generally, the marital status on the last day of the year determines the status for the entire year.26 U.S.C. 1, Section 2 Single Generally, if someone is unmarried, divorced, a registered domestic partner, or legally separated according to state law on December 31, that person must file as a single person for that year because the marital status at year-end applies for the entire ta ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Interest

In finance and economics, interest is payment from a borrower or deposit-taking financial institution to a lender or depositor of an amount above repayment of the principal sum (that is, the amount borrowed), at a particular rate. It is distinct from a fee which the borrower may pay the lender or some third party. It is also distinct from dividend which is paid by a company to its shareholders (owners) from its profit or reserve, but not at a particular rate decided beforehand, rather on a pro rata basis as a share in the reward gained by risk taking entrepreneurs when the revenue earned exceeds the total costs. For example, a customer would usually pay interest to borrow from a bank, so they pay the bank an amount which is more than the amount they borrowed; or a customer may earn interest on their savings, and so they may withdraw more than they originally deposited. In the case of savings, the customer is the lender, and the bank plays the role of the borrower. Interest diff ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. Because banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of regulation over banks. Most countries have institutionalized a system known as fractional reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but in many ways functioned as a continuation of ideas and concepts of credit and lending that had their roots in the a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Union

A credit union, a type of financial institution similar to a commercial bank, is a member-owned nonprofit organization, nonprofit financial cooperative. Credit unions generally provide services to members similar to retail banks, including deposit accounts, provision of Credit (finance), credit, and other financial services. In several African countries, credit unions are commonly referred to as SACCOs (Savings and Credit Co-Operative Societies). Worldwide, credit union systems vary significantly in their total assets and average institution asset size, ranging from volunteer operations with a handful of members to institutions with hundreds of thousands of members and assets worth billions of US dollars. In 2018, the number of members in credit unions worldwide was 274 million, with nearly 40 million members having been added since 2016. Leading up to the financial crisis of 2007–2008, commercial banks engaged in approximately five times more subprime lending relative t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Real Estate Investment Trust

A real estate investment trust (REIT) is a company that owns, and in most cases operates, income-producing real estate. REITs own many types of commercial real estate, including office and apartment buildings, warehouses, hospitals, shopping centers, hotels and commercial forests. Some REITs engage in financing real estate. Most countries' laws on REITs entitle a real estate company to pay less in corporation tax and capital gains tax. REITs have been criticised as enabling speculation on housing, and reducing housing affordability, without increasing finance for building. REITs can be publicly traded on major exchanges, publicly registered but non-listed, or private. The two main types of REITs are equity REITs and mortgage REITs (mREITs). In November 2014, equity REITs were recognized as a distinct asset class in the Global Industry Classification Standard by S&P Dow Jones Indices and MSCI. The key statistics to examine the financial position and operation of a REIT include n ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Qualified Dividend

Qualified dividends, as defined by the United States Internal Revenue Code, are ordinary dividends that meet specific criteria to be taxed at the lower long-term capital gains tax rate rather than at higher tax rate for an individual's ordinary income. The rates on qualified dividends range from 0 to 23.8%. The category of qualified dividend (as opposed to an ordinary dividend) was created in the Jobs and Growth Tax Relief Reconciliation Act of 2003 - previously, there was no distinction and all dividends were either untaxed or taxed together at the same rate. To qualify for the qualified dividend rate, the payee must own the stock for a long enough time, generally 60 days for common stock and 90 days for preferred stock. To qualify for the qualified dividend rate, the dividend must also be paid by a corporation in the U.S. or with certain ties to the U.S. Requirements To be taxed at the qualified dividend rate, the dividend must: * be paid after December 31, 2002 * be paid by ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Qualified Dividend

Qualified dividends, as defined by the United States Internal Revenue Code, are ordinary dividends that meet specific criteria to be taxed at the lower long-term capital gains tax rate rather than at higher tax rate for an individual's ordinary income. The rates on qualified dividends range from 0 to 23.8%. The category of qualified dividend (as opposed to an ordinary dividend) was created in the Jobs and Growth Tax Relief Reconciliation Act of 2003 - previously, there was no distinction and all dividends were either untaxed or taxed together at the same rate. To qualify for the qualified dividend rate, the payee must own the stock for a long enough time, generally 60 days for common stock and 90 days for preferred stock. To qualify for the qualified dividend rate, the dividend must also be paid by a corporation in the U.S. or with certain ties to the U.S. Requirements To be taxed at the qualified dividend rate, the dividend must: * be paid after December 31, 2002 * be paid by ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |