|

JIBAR

The Johannesburg Interbank Agreed Rate{{cite web, title=A review of the rate-setting process of the Johannesburg Interbank Agreed Rate (Jibar) as an interest rate benchmark, url=https://www.resbank.co.za/Lists/News%20and%20Publications/Attachments/5292/JibarReview.pdf, publisher=South African Reserve Bank, date=November 2012, page=21 (JIBAR) is the money market rate, used in South Africa. It is calculated as the average interest rate at which banks buy and sell money. This rate is calculated daily by the South African Futures Exchange as the average prime lending rate quoted independently by a number of different banks. The rate is available in one-month, three-month, six-month and twelve-month discount terms. In particular, the three-month JIBAR rate is used as a benchmark of short-term interest rate movements. The rate is calculated daily after all of the rates are received. It is calculated as a yield and then converted into a discounted rate. The JIBAR rate is available d ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

LIBOR

The London Inter-Bank Offered Rate is an interest-rate average calculated from estimates submitted by the leading banks in London. Each bank estimates what it would be charged were it to borrow from other banks. The resulting average rate is usually abbreviated to Libor () or LIBOR, or more officially to ICE LIBOR (for Intercontinental Exchange LIBOR). It was formerly known as BBA Libor (for British Bankers' Association Libor or the trademark bba libor) before the responsibility for the administration was transferred to Intercontinental Exchange. It is the primary benchmark, along with the Euribor, for short-term interest rates around the world. Libor was phased out at the end of 2021, and market participants are being encouraged to transition to risk-free interest rates. As of late 2022, parts of it have been discontinued, and the rest is scheduled to end within 2023; the Secured Overnight Financing Rate ( SOFR) is its replacement. Libor rates are calculated for five cu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Money Market

The money market is a component of the economy that provides short-term funds. The money market deals in short-term loans, generally for a period of a year or less. As short-term securities became a commodity, the money market became a component of the financial market for assets involved in short-term borrowing, lending, buying and selling with original maturities of one year or less. Trading in money markets is done over the counter and is wholesale. There are several money market instruments in most Western countries, including treasury bills, commercial paper, banker's acceptances, deposits, certificates of deposit, bills of exchange, repurchase agreements, federal funds, and short-lived mortgage- and asset-backed securities. The instruments bear differing maturities, currencies, credit risks, and structures. A market can be described as a money market if it is composed of highly liquid, short-term assets. Money market funds typically invest in government securiti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

South Africa

South Africa, officially the Republic of South Africa (RSA), is the southernmost country in Africa. It is bounded to the south by of coastline that stretch along the South Atlantic and Indian Oceans; to the north by the neighbouring countries of Namibia, Botswana, and Zimbabwe; and to the east and northeast by Mozambique and Eswatini. It also completely enclaves the country Lesotho. It is the southernmost country on the mainland of the Old World, and the second-most populous country located entirely south of the equator, after Tanzania. South Africa is a biodiversity hotspot, with unique biomes, plant and animal life. With over 60 million people, the country is the world's 24th-most populous nation and covers an area of . South Africa has three capital cities, with the executive, judicial and legislative branches of government based in Pretoria, Bloemfontein, and Cape Town respectively. The largest city is Johannesburg. About 80% of the population are Black Sou ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

South African Futures Exchange

The South African Futures Exchange (Safex) is the futures exchange subsidiary of JSE Limited, the Johannesburg-based exchange. It consists of two divisions; a financial markets division for trading of equity derivatives and an agricultural markets division (AMD) for trading of agricultural derivatives. Safex was formed in 1990 as an independent exchange and experienced steady growth over the following decade. In 1995 a separate agricultural markets division was formed for trading of agricultural derivatives. The exchange continued to make steady progress despite intensifying competition from international derivative exchanges and over-the-counter alternatives. By 1997 Safex reserves have grown sufficiently to allow a significant reduction in the fees it levies per future or options contract. Consequently, all fees were reduced by 50 per cent that year and in the changes on allocated trades were removed. In 2001 the exchange was acquired by the JSE Securities Exchange, with t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Prime Lending Rate

A prime rate or prime lending rate is an interest rate used by banks, usually the interest rate at which banks lend to customers with good credit. Some variable interest rates may be expressed as a percentage above or below prime rate. Use in different banking systems United States and Canada Historically, in North American banking, the prime rate was the actual interest rate, although this is no longer the case. The prime rate varies little among banks and adjustments are generally made by banks at the same time, although this does not happen frequently. the prime rate is 6.25% in the United States and 5.45% in Canada. In the United States, the prime rate runs approximately 300 basis points (or 3 percentage points) above the federal funds rate, which is the interest rate that banks charge each other for overnight loans made to fulfill reserve funding requirements. The Federal funds rate plus a much smaller increment is frequently used for lending to the most creditworthy bor ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tenor (finance)

A tenor is a type of classical male singing voice whose vocal range lies between the countertenor and baritone voice types. It is the highest male chest voice type. The tenor's vocal range extends up to C5. The low extreme for tenors is widely defined to be B2, though some roles include an A2 (two As below middle C). At the highest extreme, some tenors can sing up to the second F above middle C (F5). The tenor voice type is generally divided into the ''leggero'' tenor, lyric tenor, spinto tenor, dramatic tenor, heldentenor, and tenor buffo or . History The name "tenor" derives from the Latin word '' tenere'', which means "to hold". As Fallows, Jander, Forbes, Steane, Harris and Waldman note in the "Tenor" article at ''Grove Music Online'': In polyphony between about 1250 and 1500, the enor was thestructurally fundamental (or 'holding') voice, vocal or instrumental; by the 15th century it came to signify the male voice that sang such parts. All other voices were normally ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Effective Interest Rate

The effective interest rate (EIR), effective annual interest rate, annual equivalent rate (AER) or simply effective rate is the percentage of interest on a loan or financial product if compound interest accumulates over a year during which no payments are made. It is the compound interest payable annually in arrears, based on the nominal interest rate. It is used to compare the interest rates between loans with different compounding periods, such as weekly, monthly, half-yearly or yearly. Depending on the jurisdictional definition, the effective interest rate may be higher than the annual percentage rate (APR), since the APR method ''does not take compounding into account''. By contrast, the EIR annualizes the periodic rate ''with compounding''. EIR is the standard in the European Union and many other countries, while APR is often used in the United States. The EIR is more relevant for borrowers who are short of income, because it computes the effects of compounding assuming '' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Discounting

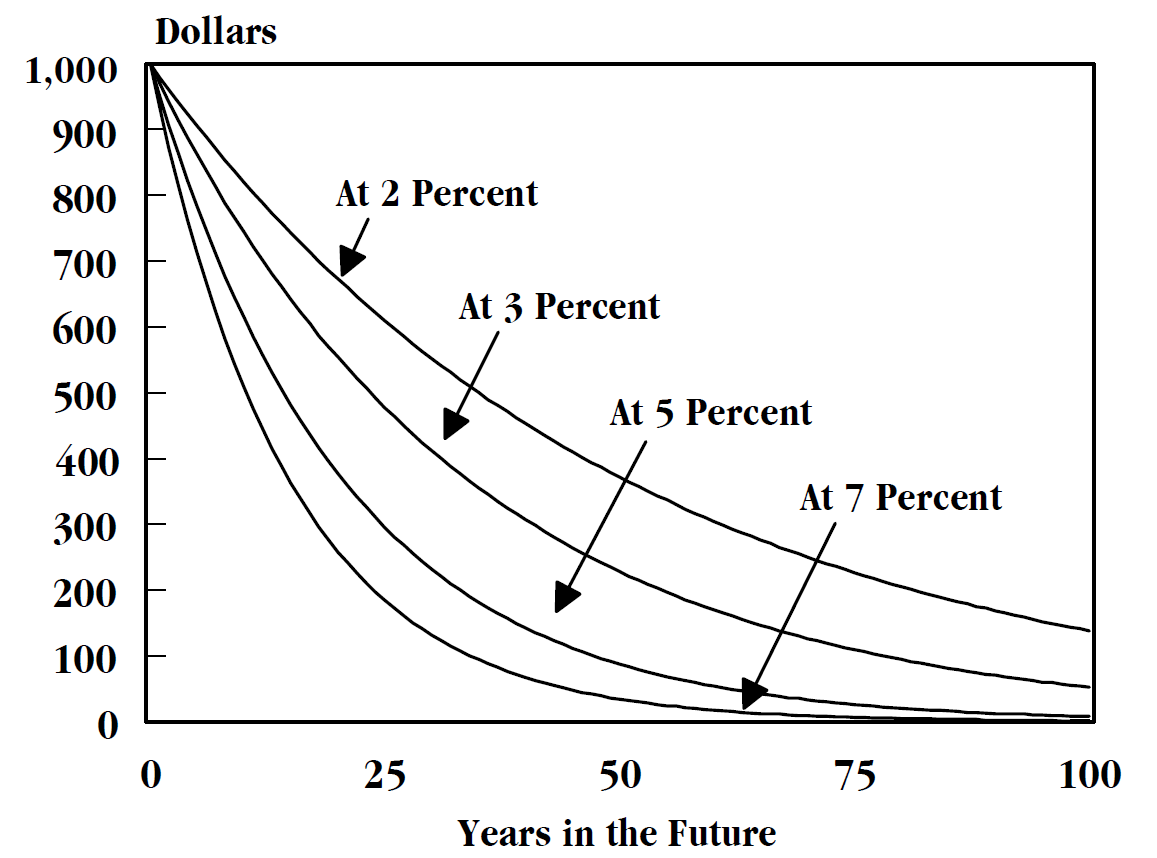

Discounting is a financial mechanism in which a debtor obtains the right to delay payments to a creditor, for a defined period of time, in exchange for a charge or fee.See "Time Value", "Discount", "Discount Yield", "Compound Interest", "Efficient Market", "Market Value" and "Opportunity Cost" in Downes, J. and Goodman, J. E. ''Dictionary of Finance and Investment Terms'', Baron's Financial Guides, 2003. Essentially, the party that owes money in the present purchases the right to delay the payment until some future date.See "Discount", "Compound Interest", "Efficient Markets Hypothesis", "Efficient Resource Allocation", "Pareto-Optimality", "Price", "Price Mechanism" and "Efficient Market" in Black, John, ''Oxford Dictionary of Economics'', Oxford University Press, 2002. This transaction is based on the fact that most people prefer current interest to delayed interest because of mortality effects, impatience effects, and salience effects. The discount, or charge, is the differenc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Thomson Reuters

Thomson Reuters Corporation ( ) is a Canadian multinational media conglomerate. The company was founded in Toronto, Ontario, Canada, where it is headquartered at the Bay Adelaide Centre. Thomson Reuters was created by the Thomson Corporation's purchase of the British company Reuters Group in April 2008. It is majority-owned by The Woodbridge Company, a holding company for the Thomson family. History Thomson Corporation The forerunner of the Thomson company was founded by Roy Thomson in 1934 in Ontario, as the publisher of '' The Timmins Daily Press''. In 1953, Thomson acquired the '' Scotsman'' newspaper and moved to Scotland the following year. He consolidated his media position in Scotland in 1957, when he won the franchise for Scottish Television. In 1959, he bought the Kemsley Group, a purchase that eventually gave him control of the '' Sunday Times''. He separately acquired the '' Times'' in 1967. He moved into the airline business in 1965, when he acquire ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Prime Rate

A prime rate or prime lending rate is an interest rate used by banks, usually the interest rate at which banks lend to customers with good credit. Some variable interest rates may be expressed as a percentage above or below prime rate. Use in different banking systems United States and Canada Historically, in North American banking, the prime rate was the actual interest rate, although this is no longer the case. The prime rate varies little among banks and adjustments are generally made by banks at the same time, although this does not happen frequently. the prime rate is 6.25% in the United States and 5.45% in Canada. In the United States, the prime rate runs approximately 300 basis points (or 3 percentage points) above the federal funds rate, which is the interest rate that banks charge each other for overnight loans made to fulfill reserve funding requirements. The Federal funds rate plus a much smaller increment is frequently used for lending to the most creditworthy bor ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

TED Spread

The TED spread is the difference between the interest rates on interbank loans and on short-term U.S. government debt ("T-bills"). TED is an acronym formed from ''T-Bill'' and ''ED'', the ticker symbol for the Eurodollar futures contract. Initially, the TED spread was the difference between the interest rates for three-month U.S. Treasuries contracts and the three-month Eurodollars contract as represented by the London Interbank Offered Rate (LIBOR). However, since the Chicago Mercantile Exchange dropped T-bill futures after the 1987 crash, the TED spread is now calculated as the difference between the three-month LIBOR and the three-month T-bill interest rate. Formula and reading :\mbox = The size of the spread is usually denominated in basis points (bps). For example, if the T-bill rate is 5.10% and ED trades at 5.50%, the TED spread is 40 . The TED spread fluctuates over time but generally has remained within the range of 10 and 50 (0.1% and 0.5%) except in times of fi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Overnight Indexed Swap

An overnight indexed swap (OIS) is an interest rate swap (''IRS'') over some given term, e.g. 10Y, where the periodic fixed payments are tied to a given fixed rate while the periodic floating payments are tied to a floating rate calculated from a daily compounded overnight rate over the floating coupon period. Note that the OIS term is not overnight; it is the underlying reference rate that is an overnight rate. The exact compounding formula depends on the type of such overnight rate. The index rate is typically the rate for overnight lending between banks, either non-secured or secured, for example the Federal funds rate or SOFR for US dollar, €STR (formerly EONIA) for Euro or SONIA for sterling. The fixed rate of OIS is typically an interest rate considered less risky than the corresponding interbank rate ( LIBOR) because there is limited counterparty risk. The LIBOR–OIS spread is the difference between IRS rates, based on the LIBOR, and OIS rates, based on overnigh ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |