|

Islamic Banking

Islamic banking, Islamic finance ( ar, مصرفية إسلامية), or Sharia-compliant finance is banking or financing activity that complies with Sharia (Islamic law) and its practical application through the development of Islamic economics. Some of the modes of Islamic banking/finance include ''Mudarabah'' (profit-sharing and loss-bearing), ''Wadiah'' (safekeeping), ''Musharaka'' (joint venture), ''Murabahah'' (cost-plus), and ''Ijara'' ( leasing). Sharia prohibits ''riba'', or usury, defined as interest paid on all loans of money (although some Muslims dispute whether there is a consensus that interest is equivalent to ''riba''). Investment in businesses that provide goods or services considered contrary to Islamic principles (e.g. pork or alcohol) is also ''haram'' ("sinful and prohibited"). These prohibitions have been applied historically in varying degrees in Muslim countries/communities to prevent un-Islamic practices. In the late 20th century, as part of the revi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banking

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. Because banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of regulation over banks. Most countries have institutionalized a system known as fractional reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but in many ways functioned as a continuation of ideas and concepts of credit and lending that had their roots in the a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mutual Fund

A mutual fund is a professionally managed investment fund that pools money from many investors to purchase securities. The term is typically used in the United States, Canada, and India, while similar structures across the globe include the SICAV in Europe ('investment company with variable capital') and open-ended investment company (OEIC) in the UK. Mutual funds are often classified by their principal investments: money market funds, bond or fixed income funds, stock or equity funds, or hybrid funds. Funds may also be categorized as index funds, which are passively managed funds that track the performance of an index, such as a stock market index or bond market index, or actively managed funds, which seek to outperform stock market indices but generally charge higher fees. Primary structures of mutual funds are open-end funds, closed-end funds, unit investment trusts. Open-end funds are purchased from or sold to the issuer at the net asset value of each share as of the close ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Abul A'la Maududi

Abul A'la al-Maududi ( ur, , translit=Abū al-Aʿlā al-Mawdūdī; – ) was an Islamic scholar, Islamist ideologue, Muslim philosopher, jurist, historian, journalist, activist and scholar active in British India and later, following the partition, in Pakistan. Described by Wilfred Cantwell Smith as "the most systematic thinker of modern Islam", his numerous works, which "covered a range of disciplines such as Qur’anic exegesis, hadith, law, philosophy and history", were written in Urdu, but then translated into English, Arabic, Hindi, Bengali, Tamil, Telugu, Kannada, Burmese, Malayalam and many other languages. He sought to revive Islam, and to propagate what he understood to be "true Islam". He believed that Islam was essential for politics and that it was necessary to institute ''sharia'' and preserve Islamic culture similar to reign of the Rashidun and abandon immorality, from what he viewed as the evils of secularism, nationalism and socialism, which he understood to b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Naeem Siddiqui

Maulana Naeem Siddiqui (1916 – 25 September 2002) was a Pakistani Islamic scholar, writer and politician. He was among the founder-members of the Jamaat-e-Islami and a close associate of Abul A'la Maududi and Amin Ahsan Islahi. Early life and career Naeem Siddiqui was born on 5 June 1916 at Chakwal, Punjab, British India.Dr.Abdulla Hashmi, Naeem Siddiqui ke Ilmi wa Adabi Khidmat (Urdu), Matboo'aat-e-Suleimani, Lahore 2011, p.21, p.34, p.35 He was home-schooled and then from Government High School, Khanpur. He completed ''Molvi Faazil'' at Uloom-e-Islamia (institution for Islamic religious sciences) and then got the degrees of "Munshi" (Graduation) and of ''Munshi Faazil'' (that was equivalent to master's degree at that time) in Arabic and Persian literature from the University of Punjab, Lahore in 1938. Naeem Siddiqui was among the founder members of Jamaat-e-Islami along with its founder Abul A'la Maududi. However, due to irreconcilable differences with its leadership, he ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Syed Ahmad Khan

Sir Syed Ahmad Khan KCSI (17 October 1817 – 27 March 1898; also Sayyid Ahmad Khan) was an Indian Muslim reformer, philosopher, and educationist in nineteenth-century British India. Though initially espousing Hindu-Muslim unity, he became the pioneer of Muslim nationalism in India and is widely credited as the father of the two-nation theory, which formed the basis of the Pakistan movement. Born into a family with strong debts to the Mughal court, Ahmad studied the Quran and Sciences within the court. He was awarded an honorary LLD from the University of Edinburgh in 1889. In 1838, Syed Ahmad entered the service of East India Company and went on to become a judge at a Small Causes Court in 1867, retiring from 1876. During the Indian Mutiny of 1857, he remained loyal to the British Raj and was noted for his actions in saving European lives.Cyril Glasse (2001) ''The New Encyclopedia of Islam'', Altamira Press After the rebellion, he penned the booklet ''The Causes o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

History Of Islam

The history of Islam concerns the political, social, economic, military, and cultural developments of the Islamic civilization. Most historians believe that Islam originated in Mecca and Medina at the start of the 7th century CE. Muslims regard Islam as a return to the original faith of the Abrahamic prophets, such as Adam, Noah, Abraham, Moses, David, Solomon, and Jesus, with the submission (''Islām'') to the will of God. According to the traditional account, the Islamic prophet Muhammad began receiving what Muslims consider to be divine revelations in 610 CE, calling for submission to the one God, the expectation of the imminent Last Judgement, and caring for the poor and needy. Muhammad's message won over a handful of followers (the ''ṣaḥāba'') and was met with increasing opposition from Meccan notables. In 622 CE, a few years after losing protection with the death of his influential uncle ʾAbū Ṭālib ibn ʿAbd al-Muṭṭalib, Muhammad migrated to t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Islamic Modernist

Islamic modernism is a movement that has been described as "the first Muslim ideological response to the Western cultural challenge" attempting to reconcile the Islamic faith with modern values such as democracy, civil rights, rationality, equality, and progress.''Encyclopedia of Islam and the Muslim World'', Thompson Gale (2004) It featured a "critical reexamination of the classical conceptions and methods of jurisprudence" and a new approach to Islamic theology and Quranic exegesis (''Tafsir''). A contemporary definition describes it as an "effort to re-read Islam's fundamental sources—the Qur'an and the Sunna, (the practice of the Prophet) —by placing them in their historical context, and then reinterpreting them, non-literally, in the light of the modern context." It was one of the of several Islamic movements – including Islamic secularism, Islamism, and Salafism – that emerged in the middle of the 19th century in reaction to the rapid changes of the time, especia ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Real Versus Nominal Value

The distinction between real value and nominal value occurs in many fields. From a philosophical viewpoint, nominal value represents an accepted condition, which is a goal or an approximation, as opposed to the real value, which is always present. Measurement In manufacturing, a ''nominal size'' or ''trade size'' is a size "in name only" used for identification. The nominal size may not match any dimension of the product, but within the domain of that product the nominal size may correspond to a large number of highly standardized dimensions and tolerances. Nominal sizes may be well-standardized across an industry, or may be proprietary to one manufacturer. Applying the nominal size across domains requires understanding of the size systems in both areas; for example, someone wishing to select a drill bit to clear a "-inch screw" may consult tables to show the proper drill bit size. Someone wishing to calculate the load capacity of a steel beam would have to consult tables to t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

ḥiyal

''Ḥiyal'' (حيل, singular ''ḥīla'' حيلة "contortion, contrivance; device, subterfuge") is "legalistic trickery" in Islamic jurisprudence. The main purpose of ''ḥiyal'' is to avoid straightforward observance of Islamic law in difficult situations while still obeying the letter of the law. An example of ''hiyal'' is the practice of "dual purchase" (''baiʿatān fī baiʿa'') to avoid the prohibition of usury by making two contracts of purchase and re-purchase (at a higher price), similar to the modern futures contract. A special sub-field of ''ḥiyal'' is "oath-trickery" (''maʿārīḍ'') dedicated to the formulation of ambiguous statements designed to be interpreted as an oath or promise while leaving open loopholes to avoid perjury. Views on its admissibility in Islam have varied by schools of Islamic jurisprudence (''Madhhab''), by time period, and by type of ''ḥiyal''. A substantial literature on such tricks has developed in the Hanafi school of jurisprudence in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Umar

ʿUmar ibn al-Khaṭṭāb ( ar, عمر بن الخطاب, also spelled Omar, ) was the second Rashidun caliph, ruling from August 634 until his assassination in 644. He succeeded Abu Bakr () as the second caliph of the Rashidun Caliphate on 23 August 634. Umar was a senior companion and father-in-law of the Islamic prophet Muhammad. He was also an expert Muslim jurist known for his pious and just nature, which earned him the epithet ''al-Fārūq'' ("the one who distinguishes (between right and wrong)"). Umar initially opposed Muhammad, his distant Qurayshite kinsman and later son-in-law. Following his conversion to Islam in 616, he became the first Muslim to openly pray at the Kaaba. Umar participated in almost all battles and expeditions under Muhammad, who bestowed the title ''al-Fārūq'' ('the Distinguisher') upon Umar, for his judgements. After Muhammad's death in June 632, Umar pledged allegiance to Abu Bakr () as the first caliph and served as the closest adviser t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

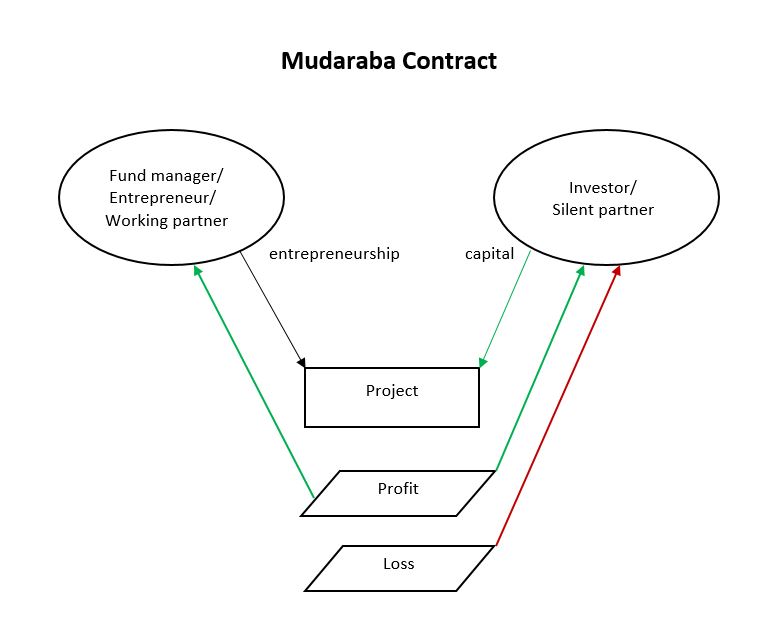

Profit And Loss Sharing

Profit and Loss Sharing (also called PLS or participatory banking) refers to Sharia-compliant forms of equity financing such as mudarabah and musharakah. These mechanisms comply with the religious prohibition on interest on loans that most Muslims subscribe to. ''Mudarabah'' (مضاربة) refers to "trustee finance" or passive partnership contract, while ''Musharakah'' (مشاركة or مشركة) refers to equity participation contract. Other sources include sukuk (also called "Islamic bonds") and direct equity investment (such as purchase of common shares of stock) as types of PLS. Khan, ''Islamic Banking in Pakistan'', 2015: p.91 The profits and losses shared in PLS are those of a business enterprise or person which/who has obtained capital from the Islamic bank/financial institution (the terms "debt", "borrow", "loan" and "lender" are not used). As financing is repaid, the provider of capital collects some agreed upon percentage of the profits (or deducts if there are losses) ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Malaysia

Malaysia ( ; ) is a country in Southeast Asia. The federation, federal constitutional monarchy consists of States and federal territories of Malaysia, thirteen states and three federal territories, separated by the South China Sea into two regions: Peninsular Malaysia and Borneo's East Malaysia. Peninsular Malaysia shares a land and maritime Malaysia–Thailand border, border with Thailand and Maritime boundary, maritime borders with Singapore, Vietnam, and Indonesia. East Malaysia shares land and maritime borders with Brunei and Indonesia, and a maritime border with the Philippines and Vietnam. Kuala Lumpur is the national capital, the country's largest city, and the seat of the Parliament of Malaysia, legislative branch of the Government of Malaysia, federal government. The nearby Planned community#Planned capitals, planned capital of Putrajaya is the administrative capital, which represents the seat of both the Government of Malaysia#Executive, executive branch (the Cabine ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |