|

Investment Company Institute

The Investment Company Institute (ICI) is a global association of regulated funds, including mutual funds, exchange-traded funds, closed-end funds and unit investment trusts in the United States, and similar funds offered to investors in jurisdictions worldwide. ICI encourages adherence to ethical standards, promotes public financial literacy of funds and investing, and advances the interests of investment funds and their shareholders, directors, and advisers. History Following the stock market crash of 1929 that presaged the Great Depression, Congress passed a series of acts related to securities and financial regulation. One of these, the Investment Company Act of 1940, clearly defined the responsibilities of investment companies. This same year, what would become ICI was established in New York as the National Committee of Investment Companies, an organization to aid in the administration of the act. It became the National Association of Investment Companies (NAIC) in 194 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Governmental Organization

A government or state agency, sometimes an appointed commission, is a permanent or semi-permanent organization in the machinery of government that is responsible for the oversight and administration of specific functions, such as an administration. There is a notable variety of agency types. Although usage differs, a government agency is normally distinct both from a department or ministry, and other types of public body established by government. The functions of an agency are normally executive in character since different types of organizations (''such as commissions'') are most often constituted in an advisory role—this distinction is often blurred in practice however, it is not allowed. A government agency may be established by either a national government or a state government within a federal system. Agencies can be established by legislation or by executive powers. The autonomy, independence, and accountability of government agencies also vary widely. History Early exa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Regulation

Financial regulation is a form of regulation or supervision, which subjects financial institutions to certain requirements, restrictions and guidelines, aiming to maintain the stability and integrity of the financial system. This may be handled by either a government or non-government organization. Financial regulation has also influenced the structure of banking sectors by increasing the variety of financial products available. Financial regulation forms one of three legal categories which constitutes the content of financial law, the other two being market practices and case law. History In the early modern period, the Dutch were the pioneers in financial regulation. The first recorded ban (regulation) on short selling was enacted by the Dutch authorities as early as 1610. Aims of regulation The objectives of financial regulators are usually: * market confidence – to maintain confidence in the financial system * financial stability – contributing to the protection and e ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Board Of Governors

A board of directors (commonly referred simply as the board) is an executive committee that jointly supervises the activities of an organization, which can be either a for-profit or a nonprofit organization such as a business, nonprofit organization, or a government agency. The powers, duties, and responsibilities of a board of directors are determined by government regulations (including the jurisdiction's corporate law) and the organization's own constitution and by-laws. These authorities may specify the number of members of the board, how they are to be chosen, and how often they are to meet. In an organization with voting members, the board is accountable to, and may be subordinate to, the organization's full membership, which usually elect the members of the board. In a stock corporation, non-executive directors are elected by the shareholders, and the board has ultimate responsibility for the management of the corporation. In nations with codetermination (such as G ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lobbying

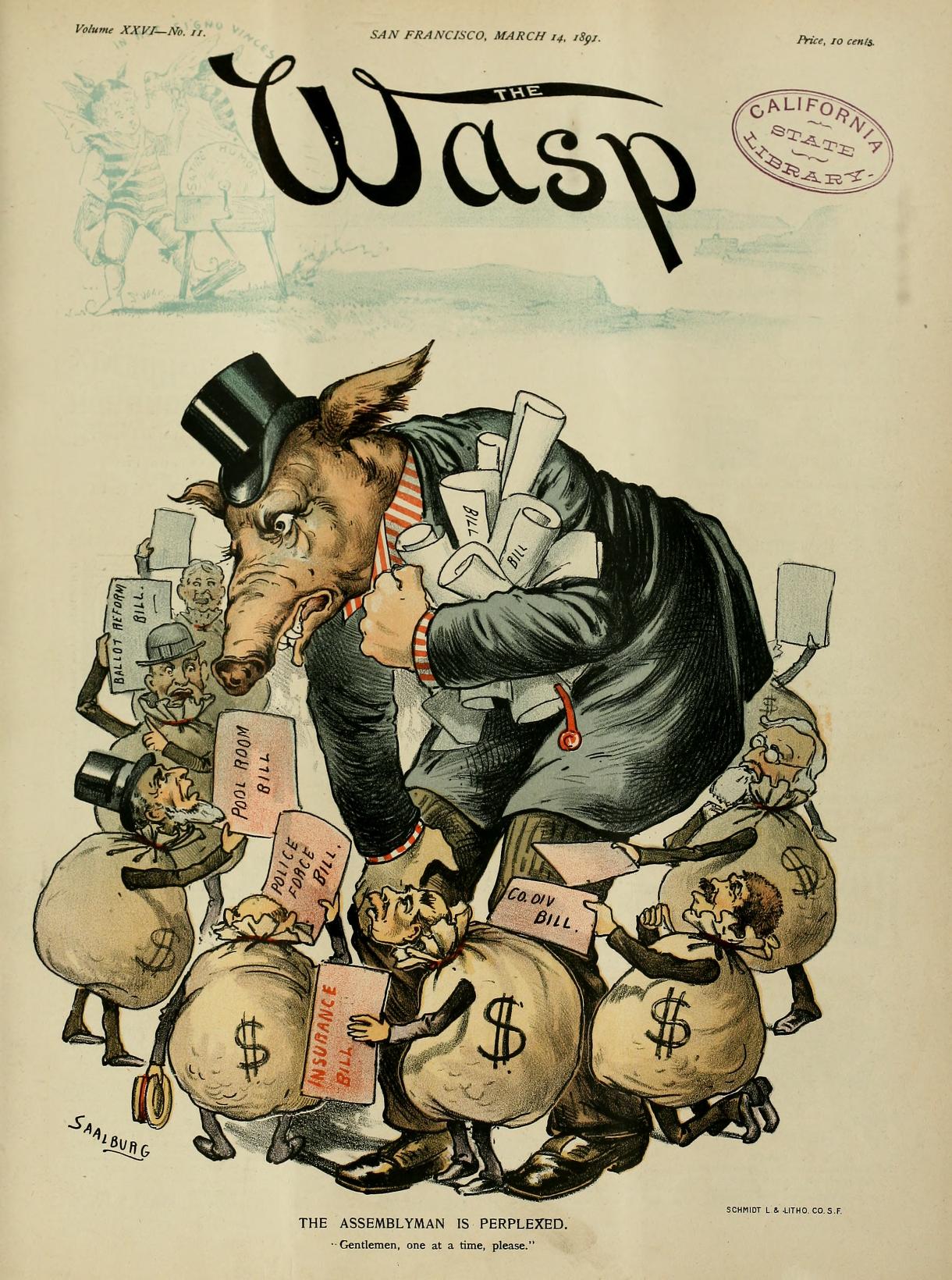

In politics, lobbying, persuasion or interest representation is the act of lawfully attempting to influence the actions, policies, or decisions of government officials, most often legislators or members of regulatory agency, regulatory agencies. Lobbying, which usually involves direct, face-to-face contact, is done by many types of people, associations and organized groups, including individuals in the private sector, corporations, fellow legislators or government officials, or advocacy groups (interest groups). Lobbyists may be among a legislator's Electoral district, constituencies, meaning a Voting, voter or Voting bloc, bloc of voters within their electoral district; they may engage in lobbying as a business. Professional lobbyists are people whose business is trying to influence legislation, regulation, or other government decisions, actions, or policies on behalf of a group or individual who hires them. Individuals and nonprofit organizations can also lobby as an act of vo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Continuing Legal Education

Continuing legal education (CLE), also known as mandatory or minimum continuing legal education (MCLE) or, in some jurisdictions outside the United States, as continuing professional development, consists of professional education for attorneys that takes place after their initial admission to the bar. Within the United States, U.S. attorneys in many states and territories must complete certain required CLE in order to maintain their U.S. licenses to practice law. Outside the United States, lawyers in various jurisdictions, such as British Columbia in Canada, must also complete certain required CLE. However, some jurisdictions, such as the District of Columbia and Israel, recommend, but do not require, that attorneys complete CLE. Australia * In New South Wales continuing legal education is regulated by the Law Society of New South Wales. United States No nationwide rules exist within the United States for CLE requirements or accreditation. Instead, each individual jurisd ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Certified Public Accountant

Certified Public Accountant (CPA) is the title of qualified accountants in numerous countries in the English-speaking world. It is generally equivalent to the title of chartered accountant in other English-speaking countries. In the United States, the CPA is a license to provide accounting services to the public. It is awarded by each of the 50 states for practice in that state. Additionally, all states except Hawaii have passed mobility laws to allow CPAs from other states to practice in their state. State licensing requirements vary, but the minimum standard requirements include passing the Uniform Certified Public Accountant Examination, 150 semester units of college education, and one year of accounting-related experience. Continuing professional education (CPE) is also required to maintain licensure. Individuals who have been awarded the CPA but have lapsed in the fulfillment of the required CPE or who have requested conversion to inactive status are in many states permitt ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Professional Development

Professional development is learning to earn or maintain professional credentials such as academic degrees to formal coursework, attending conferences, and informal learning Informal learning is characterized "by a low degree of planning and organizing in terms of the learning context, learning support, learning time, and learning objectives". It differs from formal learning, non-formal learning, and self-regulated l ... opportunities situated in practice. It has been described as intensive and collaborative, ideally incorporating an evaluative stage. There is a variety of approaches to professional development, including consultation, coaching, community of practice, communities of practice, lesson study, mentoring, reflective supervision and technical assistance.National Professional Development Center on Inclusion. (2008)"What do we mean by professional development in the early childhood field?" Chapel Hill: The University of North Carolina, FPG Child Development Institute. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Securities And Exchange Commission

The U.S. Securities and Exchange Commission (SEC) is an independent agency of the United States federal government, created in the aftermath of the Wall Street Crash of 1929. The primary purpose of the SEC is to enforce the law against market manipulation. In addition to the Securities Exchange Act of 1934, which created it, the SEC enforces the Securities Act of 1933, the Trust Indenture Act of 1939, the Investment Company Act of 1940, the Investment Advisers Act of 1940, the Sarbanes–Oxley Act of 2002, and other statutes. The SEC was created by Section 4 of the Securities Exchange Act of 1934 (now codified as and commonly referred to as the Exchange Act or the 1934 Act). Overview The SEC has a three-part mission: to protect investors; maintain fair, orderly, and efficient markets; and facilitate capital formation. To achieve its mandate, the SEC enforces the statutory requirement that public companies and other regulated companies submit quarterly and annual re ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Convention Of Disclosure

The convention of disclosure requires that all material facts must be Corporation#Financial disclosure, disclosed in the financial statements. For example, in the case of sundry debtors, not only the total amount of sundry debtors should be disclosed, but also the amount of good and secured debtors, the amount of good but unsecured debtors and amount of doubtful debts should be stated.This does not mean disclosure of each and every item of information. It only means disclosure of such information which is of significance to owners, investors and creditors. See also *IFRS 7, ''Financial Instruments: Disclosures'' Financial regulation {{law-term-stub Accounting terminology ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hong Kong

Hong Kong ( (US) or (UK); , ), officially the Hong Kong Special Administrative Region of the People's Republic of China ( abbr. Hong Kong SAR or HKSAR), is a city and special administrative region of China on the eastern Pearl River Delta in South China. With 7.5 million residents of various nationalities in a territory, Hong Kong is one of the most densely populated places in the world. Hong Kong is also a major global financial centre and one of the most developed cities in the world. Hong Kong was established as a colony of the British Empire after the Qing Empire ceded Hong Kong Island from Xin'an County at the end of the First Opium War in 1841 then again in 1842.. The colony expanded to the Kowloon Peninsula in 1860 after the Second Opium War and was further extended when Britain obtained a 99-year lease of the New Territories in 1898... British Hong Kong was occupied by Imperial Japan from 1941 to 1945 during World War II; British administration resume ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investment Company Act Of 1940

The Investment Company Act of 1940 (commonly referred to as the '40 Act) is an act of Congress which regulates investment funds. It was passed as a United States Public Law () on August 22, 1940, and is codified at . Along with the Securities Exchange Act of 1934, the Investment Advisers Act of 1940, and extensive rules issued by the U.S. Securities and Exchange Commission; it is central to financial regulation in the United States. It has been updated by the Dodd-Frank Act of 2010. It is the primary source of regulation for mutual funds and closed-end funds, now a multi-trillion dollar investment industry. The 1940 Act also impacts the operations of hedge funds, private equity funds and even holding companies. History Following the founding of the mutual fund in 1924, investors invested in this new investment vehicle heavily. Five and a half years later, the Wall Street Crash of 1929 occurred in the stock market, followed shortly thereafter by the United States entry into the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |