|

Interac E-Transfer

Interac e-Transfer (formerly Interac Email Money Transfer or EMT) is a Canadian funds transfer service between personal and business accounts in participating Canadian banks and other financial institutions, offered through Interac Corporation. From inception until early 2018, the service was provided by Acxsys, a for-profit consortium backed by most of the major partners of the nonprofit Interac Association, and using the Interac brand under licence. In February 2018, the activities of both organizations were combined into a single for-profit organization under the Interac name. Participating institutions Most Canadians who use online banking can send funds. These include personal deposit account holders with the big five banks (Bank of Montreal (BMO), Bank of Nova Scotia (Scotiabank), Canadian Imperial Bank of Commerce (CIBC), Royal Bank of Canada (RBC), and TD Bank Group (Toronto Dominion-Bank)), Desjardins, Tangerine, National Bank, HSBC Bank Canada, President's Choice ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

City

A city is a human settlement of notable size.Goodall, B. (1987) ''The Penguin Dictionary of Human Geography''. London: Penguin.Kuper, A. and Kuper, J., eds (1996) ''The Social Science Encyclopedia''. 2nd edition. London: Routledge. It can be defined as a permanent and densely settled place with administratively defined boundaries whose members work primarily on non-agricultural tasks. Cities generally have extensive systems for housing, transportation, sanitation, utilities, land use, production of goods, and communication. Their density facilitates interaction between people, government organisations and businesses, sometimes benefiting different parties in the process, such as improving efficiency of goods and service distribution. Historically, city-dwellers have been a small proportion of humanity overall, but following two centuries of unprecedented and rapid urbanization, more than half of the world population now lives in cities, which has had profound consequences for g ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tangerine Bank

Tangerine Bank (operating as Tangerine) is a Canadian direct bank that is a subsidiary of Scotiabank. It offers no-fee chequing and savings accounts, Guaranteed Investment Certificates (GICs), mortgages and mutual funds (through a subsidiary). Many savings and investment products are eligible for registration under a Tax-Free Savings Account (TFSA), Registered Retirement Savings Plan (RRSP) or Registered Retirement Income Fund (RRIF). The bank was founded by ING Group in April 1997 as ING Bank of Canada (operating as ING Direct). In November 2012, it was acquired by Scotiabank. The new name for the bank was revealed in November 2013, and the Tangerine branding was rolled out beginning in April 2014. Although now wholly owned by Scotiabank, Tangerine remains a separate legal entity and thus kept its unique Institution Number (614), with all accounts being under a single transit number (00152). History The predecessor of Tangerine, ING Bank of Canada (using the trade name ING ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Payment Systems

A payment system is any system used to settle financial transactions through the transfer of monetary value. This includes the institutions, instruments, people, rules, procedures, standards, and technologies that make its exchange possible.Biago Bossone and Massimo Cirasino, "The Oversight of the Payment Systems: A Framework for the Development and Governance of Payment Systems in Emerging Economies"The World Bank, July 2001, p.7 A common type of payment system, called an operational network, links bank accounts and provides for monetary exchange using bank deposits. Some payment systems also include credit mechanisms, which are essentially a different aspect of payment. Payment systems are used in lieu of tendering cash in domestic and international transactions. This consists of a major service provided by banks and other financial institutions. Traditional payment systems include negotiable instruments such as drafts (e.g., cheques) and documentary credits such as letters of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Services Companies Of Canada

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of financial economics bridges the two). Finance activities take place in financial systems at various scopes, thus the field can be roughly divided into personal, corporate, and public finance. In a financial system, assets are bought, sold, or traded as financial instruments, such as currencies, loans, bonds, shares, stocks, options, futures, etc. Assets can also be banked, invested, and insured to maximize value and minimize loss. In practice, risks are always present in any financial action and entities. A broad range of subfields within finance exist due to its wide scope. Asset, money, risk and investment management aim to maximize value and minimize volatility. Financial analysis is viability, stability, and profitability assessm ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Electronic Funds Transfer

Electronic funds transfer (EFT) is the electronic transfer of money from one bank account to another, either within a single financial institution or across multiple institutions, via computer-based systems, without the direct intervention of bank staff. According to the United States Electronic Fund Transfer Act of 1978 it is "a funds transfer initiated through an electronic terminal, telephone, computer (including on-line banking) or magnetic tape for the purpose of ordering, instructing, or authorizing a financial institution to debit or credit a consumer's account". EFT transactions are known by a number of names across countries and different payment systems. For example, in the United States, they may be referred to as "electronic checks" or "e-checks". In the United Kingdom, the term "bank transfer" and "bank payment" are used, in Canada, " e-transfer" is used, while in several other European countries " giro transfer" is the common term. Types EFTs include, but ar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Phishing

Phishing is a type of social engineering where an attacker sends a fraudulent (e.g., spoofed, fake, or otherwise deceptive) message designed to trick a person into revealing sensitive information to the attacker or to deploy malicious software on the victim's infrastructure like ransomware. Phishing attacks have become increasingly sophisticated and often transparently mirror the site being targeted, allowing the attacker to observe everything while the victim is navigating the site, and transverse any additional security boundaries with the victim. As of 2020, phishing is by far the most common attack performed by cybercriminals, the FBI's Internet Crime Complaint Centre recording over twice as many incidents of phishing than any other type of computer crime. The first recorded use of the term "phishing" was in the cracking toolkit AOHell created by Koceilah Rekouche in 1995; however, it is possible that the term was used before this in a print edition of the hacker magazin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

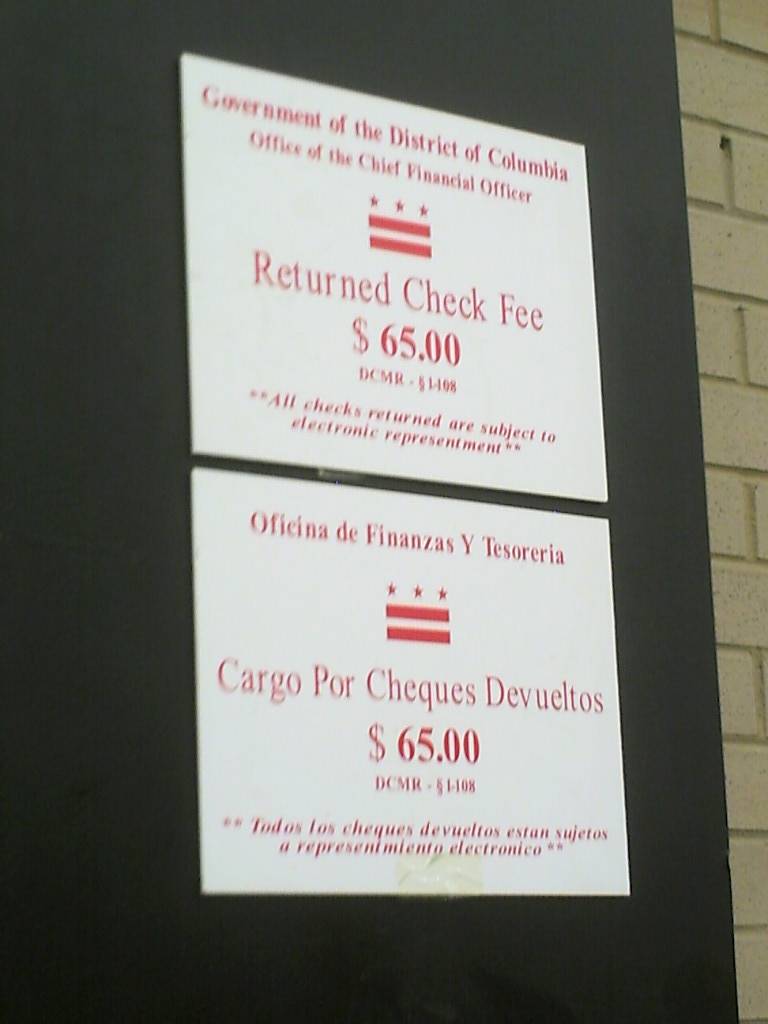

Non-sufficient Funds

Dishonoured cheques (also spelled check) are cheques that a bank on which is drawn declines to pay (“honour”). There are a number of reasons why a bank would refuse to honour a cheque, with non-sufficient funds (NSF) being the most common one, indicating that there are insufficient cleared funds in the account on which the cheque was drawn. An NSF check may be referred to as a bad check, dishonored check, bounced check, cold check, rubber check, returned item, or hot check. In England and Wales and Australia, such cheques are typically returned endorsed "Refer to drawer", an instruction to contact the person issuing the cheque for an explanation as to why it was not paid. If there are funds in an account, but insufficient cleared funds, the cheque is normally endorsed “Present again”, by which time the funds should have cleared. When more than one cheque is presented for payment on the same day, and the payment of both would result in the account becoming overdrawn (or be ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cheque

A cheque, or check (American English; see spelling differences) is a document that orders a bank (or credit union) to pay a specific amount of money from a person's account to the person in whose name the cheque has been issued. The person writing the cheque, known as the ''drawer'', has a transaction banking account (often called a current, cheque, chequing, checking, or share draft account) where the money is held. The drawer writes various details including the monetary amount, date, and a payee on the cheque, and signs it, ordering their bank, known as the ''drawee'', to pay the amount of money stated to the payee. Although forms of cheques have been in use since ancient times and at least since the 9th century, they became a highly popular non-cash method for making payments during the 20th century and usage of cheques peaked. By the second half of the 20th century, as cheque processing became automated, billions of cheques were issued annually; these volumes peaked ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Canadian Dollar

The Canadian dollar ( symbol: $; code: CAD; french: dollar canadien) is the currency of Canada. It is abbreviated with the dollar sign $, there is no standard disambiguating form, but the abbreviation Can$ is often suggested by notable style guides for distinction from other dollar-denominated currencies. It is divided into 100 cents (¢). Owing to the image of a common loon on its reverse, the dollar coin, and sometimes the unit of currency itself, are sometimes referred to as the ''loonie'' by English-speaking Canadians and foreign exchange traders and analysts. Accounting for approximately 2% of all global reserves, the Canadian dollar is the fifth-most held reserve currency in the world, behind the U.S. dollar, the euro, the yen and sterling. The Canadian dollar is popular with central banks because of Canada's relative economic soundness, the Canadian government's strong sovereign position, and the stability of the country's legal and political systems. Histo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Text Message

Text messaging, or texting, is the act of composing and sending electronic messages, typically consisting of alphabetic and numeric characters, between two or more users of mobile devices, desktops/ laptops, or another type of compatible computer. Text messages may be sent over a cellular network, or may also be sent via an Internet connection. The term originally referred to messages sent using the Short Message Service (SMS). It has grown beyond alphanumeric text to include multimedia messages using the Multimedia Messaging Service (MMS) containing digital images, videos, and sound content, as well as ideograms known as emoji ( happy faces, sad faces, and other icons), and instant messenger applications (usually the term is used when on mobile devices). Text messages are used for personal, family, business and social purposes. Governmental and non-governmental organizations use text messaging for communication between colleagues. In the 2010s, the sending of short informa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

E-cheque

Electronic funds transfer (EFT) is the electronic transfer of money from one bank account to another, either within a single financial institution or across multiple institutions, via computer-based systems, without the direct intervention of bank staff. According to the United States Electronic Fund Transfer Act of 1978 it is "a funds transfer initiated through an electronic terminal, telephone, computer (including on-line banking) or magnetic tape for the purpose of ordering, instructing, or authorizing a financial institution to debit or credit a consumer's account". EFT transactions are known by a number of names across countries and different payment systems. For example, in the United States, they may be referred to as "electronic checks" or "e-checks". In the United Kingdom, the term "bank transfer" and "bank payment" are used, in Canada, " e-transfer" is used, while in several other European countries " giro transfer" is the common term. Types EFTs include, but a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Union

A credit union, a type of financial institution similar to a commercial bank, is a member-owned nonprofit organization, nonprofit financial cooperative. Credit unions generally provide services to members similar to retail banks, including deposit accounts, provision of Credit (finance), credit, and other financial services. In several African countries, credit unions are commonly referred to as SACCOs (Savings and Credit Co-Operative Societies). Worldwide, credit union systems vary significantly in their total assets and average institution asset size, ranging from volunteer operations with a handful of members to institutions with hundreds of thousands of members and assets worth billions of US dollars. In 2018, the number of members in credit unions worldwide was 274 million, with nearly 40 million members having been added since 2016. Leading up to the financial crisis of 2007–2008, commercial banks engaged in approximately five times more subprime lending relative t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)