|

Insight Partners

Insight Partners (previously Insight Venture Partners) is an American venture capital and private equity firm based in New York City. The firm invests in growth-stage technology, software and Internet businesses. History Insight Partners was founded in 1995 by Jeff Horing and Jerry Murdock. Insight Partners raised more than $90 billion in capital commitments, including $20 billion in its Fund XII in 2021. In March 2019, Insight Venture Partners changed its name to Insight Partners. In October 2019, the firm established an office in Tel Aviv. In 2020, Insight Partners joined Diligent Corporation's initiative and pledged to create five new board roles among its portfolio companies for racially diverse candidates. In 2020, Insight Partners backed software startup JFrog's initial public offering (IPO), followed by 1stdibs' IPO in 2021. In April 2021, Insight Partners raised $1.56 billion for the Insight Partners Opportunities Fund I LP, a new fund outside of its flagship growth-inve ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Privately Held Company

A privately held company (or simply a private company) is a company whose shares and related rights or obligations are not offered for public subscription or publicly negotiated in the respective listed markets, but rather the company's stock is offered, owned, traded, exchanged privately, or Over-the-counter (finance), over-the-counter. In the case of a closed corporation, there are a relatively small number of shareholders or company members. Related terms are closely-held corporation, unquoted company, and unlisted company. Though less visible than their public company, publicly traded counterparts, private companies have major importance in the world's economy. In 2008, the 441 list of largest private non-governmental companies by revenue, largest private companies in the United States accounted for ($1.8 trillion) in revenues and employed 6.2 million people, according to ''Forbes''. In 2005, using a substantially smaller pool size (22.7%) for comparison, the 339 companies on ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

1stdibs

1stdibs (stylized as 1stDibs) is an e-commerce company. It has an online marketplace, which sells luxury items such as high-end furniture for interior design, fine art and jewelry. The company has been recognized for "pushing the antiques business into the 21st century." Originally founded in Paris, it is currently headquartered in New York City. History 1stDibs was founded in 2000 by Michael Bruno as an online luxury marketplace for antiques after he visited the Marché aux Puces in Paris, France. 1stDibs.com started as a listings site for art dealers to sell offline, but the site was redesigned in 2013 to give buyers the option to purchase items online. The company has received praise for restricting its listings to authorized dealers for authenticity, and scrutiny for preventing dealers from completing a negotiation offline to avoid the company's commission fees. In 2015, 1stDibs raised $50 million from venture capital firm Insight Partners. Part of that funding went to buy ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Venture Capital Firms Of The United States

Venture may refer to: Arts and entertainment Music *The Ventures, an American instrumental rock band formed in 1958 *"A Venture", 1971 song by the band Yes *''Venture'', a 2010 EP by AJR Games * ''Venture'' (video game), a 1981 arcade game *''Venture'', a strategic card game by Sid Sackson Film * SS ''Venture'', a ship in ''King Kong'' and its 2005 remake * SS ''Venture'', an InGen-owned ship featured in '' The Lost World: Jurassic Park'' Other uses * ''Venture'' (TV series), a Canadian business television show Magazines * ''Venture Science Fiction'', defunct US science fiction magazine * ''Venture'' (magazine), a management magazine Business * Business venture * Venture (department store), a defunct discount department store operating across Australia * Venture Corporation, a Singapore firm * Venture Stores, a former retail chain Transportation * Chevrolet Venture, a General Motors minivan * Yamaha Venture, Yamaha touring motorcycles * Siemens Venture, fam ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Private Equity Firms Of The United States

Private or privates may refer to: Music * "In Private", by Dusty Springfield from the 1990 album ''Reputation'' * Private (band), a Denmark-based band * "Private" (Ryōko Hirosue song), from the 1999 album ''Private'', written and also recorded by Ringo Sheena * "Private" (Vera Blue song), from the 2017 album ''Perennial'' Literature * ''Private'' (novel), 2010 novel by James Patterson * ''Private'' (novel series), young-adult book series launched in 2006 Film and television * ''Private'' (film), 2004 Italian film * ''Private'' (web series), 2009 web series based on the novel series * ''Privates'' (TV series), 2013 BBC One TV series * Private, a penguin character in ''Madagascar'' Other uses * Private (rank), a military rank * ''Privates'' (video game), 2010 video game * Private (rocket), American multistage rocket * Private Media Group, Swedish adult entertainment production and distribution company * ''Private (magazine)'', flagship magazine of the Private Media Group ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Academic Partnerships

Academic Partnerships (AP) is a major for-profit online program manager (OPM) owned by Vistria Group, a private equity firm. Established in 2007 by entrepreneur Randy Best, it claims to serve more than 50 colleges and universities, providing technology, marketing services, and student support services to mid-level brands. Because of its early start as an OPM, it has been considered "a pioneer" in the business. APs clients, which are mostly regional public universities, are lower in price than elite colleges, but face significant financial and enrollment challenges. According to Academic Partnerships, the company has served 270,000 students and converted more than 4000 campus-based classes to online courses. History In 2007, Academic Partnerships was created by entrepreneur Randy Best as Higher Ed Holdings. In 2007, Education Holdings helped Lamar University establish online programs, and quickly expanded to other universities including the University of Texas system and Arkansas ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Kaseya VSA Ransomware Attack

On 2 July 2021, a number of managed service providers (MSPs) and their customers became victims of a ransomware attack perpetrated by the REvil group, causing widespread downtime for over 1,000 companies. Company Kaseya Limited is an American software company founded in 2001. It develops software for managing networks, systems, and information technology infrastructure. Owned by Insight Partners, Kaseya is headquartered in Miami, Florida with branch locations across the US, Europe, and Asia Pacific. Since its founding in 2000, it has acquired 13 companies, which have in most cases continued to operate as their own brands (under the "a Kaseya company" tagline), including Unitrends. Timeline and impact Researchers of the Dutch Institute for Vulnerability Disclosure identified the first vulnerabilities in the software on April 1. They warned Kaseya and worked together with company experts to solve four of the seven reported vulnerabilities. Despite the efforts, Kaseya could not ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Kohlberg Kravis Roberts

KKR & Co. Inc., also known as Kohlberg Kravis Roberts & Co., is an American global investment company that manages multiple alternative asset classes, including private equity, energy, infrastructure, real estate, credit, and, through its strategic partners, hedge funds. , the firm had completed more than 650 private equity investments in portfolio companies with approximately $675 billion of total enterprise value. , assets under management ("AUM") and fee paying assets under management ("FPAUM") were $471 billion and $357 billion, respectively. The firm was founded in 1976 by Jerome Kohlberg Jr., and cousins Henry Kravis and George R. Roberts, all of whom had previously worked together at Bear Stearns, where they completed some of the earliest leveraged buyout transactions. Since its founding, KKR has completed a number of transactions, including the 1989 leveraged buyout of RJR Nabisco, which was the largest buyout in history to that point, as well as the 200 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Saks Fifth Avenue

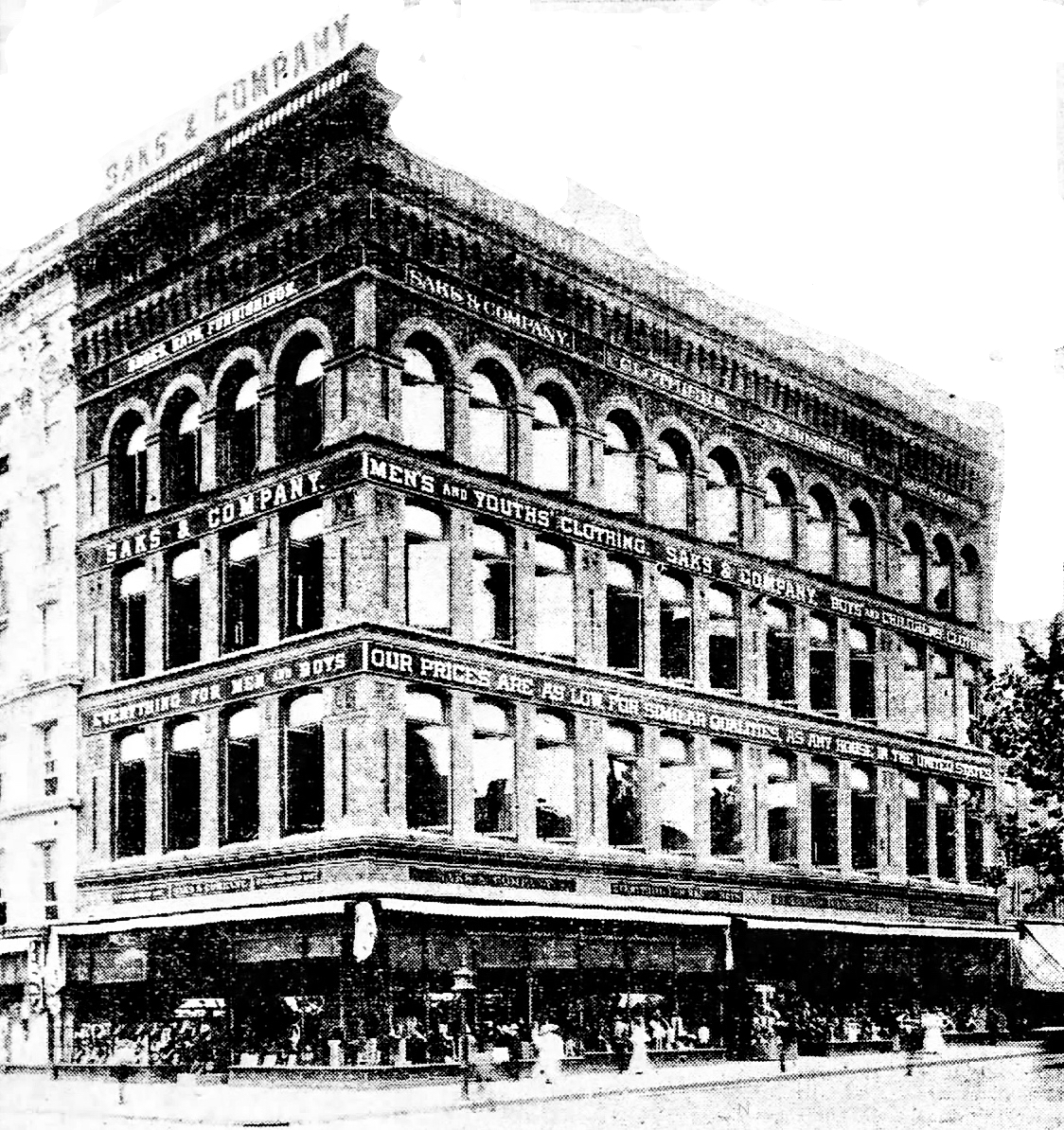

Saks Fifth Avenue (originally Saks & Company; Colloquialism, colloquially Saks) is an American Luxury goods, luxury department store chain headquartered in New York City and founded by Andrew Saks. The original store opened in the F Street and 7th Street shopping districts, F Street shopping district of Washington, D.C. in 1867. Saks expanded into Manhattan with its Herald Square store in 1902 and Saks Fifth Avenue flagship store, flagship store on Fifth Avenue in 1924. The chain was acquired by Tennessee-based Proffitt's, Inc. (renamed Saks, Inc.) in 1998, and Saks, Inc. was acquired by the Canadian-founded Hudson's Bay Company (HBC) in 2013. Subsidiary Saks Off 5th, originally a clearance store for Saks Fifth Avenue, is now a large off-price retailer in its own right managed independently from Saks Fifth Avenue under HBC. History Early history Andrew Saks was born to a German Jewish family, in Baltimore. He worked as a peddler and paper boy before moving to Washington, D ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

WalkMe

WalkMe is an American multinational software-as-a-service (SaaS) company, with headquarters in San Francisco, California. Its Digital Adoption Platform (DAP) was recognized in Everest Group's PEAK Matrix Assessment of DAP vendors as the leading DAP product. Alongside its headquarters in San Francisco, the company has offices in Raleigh, North Carolina, Tel Aviv, Israel, and a global footprint including the United Kingdom, Australia, and Japan. WalkMe has more than 2,000 corporate customers and has been recognized on the ''Forbes'' Cloud 100 for five consecutive years. As of December 2019, WalkMe has raised more than 307 million in venture capital funding and is valued at 2 billion, making it a unicorn company. The company's initial public offering (IPO) took place on June 16, 2021, and resulted in a valuation of 2.56 billion. History WalkMe Inc. was founded in 2011 by Dan Adika, Rafael Sweary, Eyal Cohen and Yuval Shalom Ozanna. In April 2012, they launched the product WalkMe. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monday

Monday is the day of the week between Sunday and Tuesday. According to the International Organization for Standardization's ISO 8601 standard, it is the first day of the week and in countries that adopt the "Sunday-first" convention, it is the second day of the week. The name of Monday is derived from Old English ''Mōnandæg'' and Middle English ''Monenday'', originally a translation of Latin ''dies lunae'' "day of the Moon". Names The names of the day of the week were coined in the Roman era, in Greek and Latin, in the case of Monday as ἡμέρᾱ Σελήνης, ''diēs Lūnae'' "day of the Moon". Many languages use terms either directly derived from these names or loan translations based on them. The English noun ''Monday'' derived sometime before 1200 from ''monedæi'', which itself developed from Old English (around 1000) ''mōnandæg'' and ''mōndæg'' (literally meaning "moon's day"), which has cognates in other Germanic languages, including Old Frisian ''mōna ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Initial Public Offering

An initial public offering (IPO) or stock launch is a public offering in which shares of a company are sold to institutional investors and usually also to retail (individual) investors. An IPO is typically underwritten by one or more investment banks, who also arrange for the shares to be listed on one or more stock exchanges. Through this process, colloquially known as ''floating'', or ''going public'', a privately held company is transformed into a public company. Initial public offerings can be used to raise new equity capital for companies, to monetize the investments of private shareholders such as company founders or private equity investors, and to enable easy trading of existing holdings or future capital raising by becoming publicly traded. After the IPO, shares are traded freely in the open market at what is known as the free float. Stock exchanges stipulate a minimum free float both in absolute terms (the total value as determined by the share price multiplied by the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |