|

Indenture

An indenture is a legal contract that reflects or covers a debt or purchase obligation. It specifically refers to two types of practices: in historical usage, an indentured servant status, and in modern usage, it is an instrument used for commercial debt or real estate transaction. Historical usage An indenture is a legal contract between two parties, particularly for indentured labour or a term of apprenticeship but also for certain land transactions. The term comes from the medieval English "indenture of retainer"—a legal contract written in duplicate on the same sheet, with the copies separated by cutting along a jagged (toothed, hence the term "indenture") line so that the teeth of the two parts could later be refitted to confirm authenticity ( chirograph). Each party to the deed would then retain a part. When the agreement was made before a court of law a ''tripartite'' indenture was made, with the third piece kept at the court. The term is used for any kind of deed exe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Indentured Servant

Indentured servitude is a form of labor in which a person is contracted to work without salary for a specific number of years. The contract, called an " indenture", may be entered "voluntarily" for purported eventual compensation or debt repayment, or it may be imposed as a judicial punishment. Historically, it has been used to pay for apprenticeships, typically when an apprentice agreed to work for free for a master tradesman to learn a trade (similar to a modern internship but for a fixed length of time, usually seven years or less). Later it was also used as a way for a person to pay the cost of transportation to colonies in the Americas. Like any loan, an indenture could be sold; most employers had to depend on middlemen to recruit and transport the workers so indentures (indentured workers) were commonly bought and sold when they arrived at their destinations. Like prices of slaves, their price went up or down depending on supply and demand. When the indenture (loan) was p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

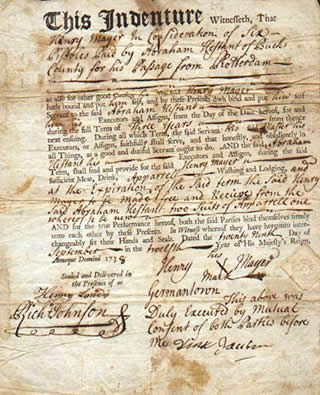

Indenture 1723

An indenture is a legal contract that reflects or covers a debt or purchase obligation. It specifically refers to two types of practices: in historical usage, an indentured servant status, and in modern usage, it is an instrument used for commercial debt or real estate transaction. Historical usage An indenture is a legal contract between two parties, particularly for indentured labour or a term of apprenticeship but also for certain land transactions. The term comes from the medieval English "indenture of retainer"—a legal contract written in duplicate on the same sheet, with the copies separated by cutting along a jagged (toothed, hence the term "indenture") line so that the teeth of the two parts could later be refitted to confirm authenticity (chirograph). Each party to the deed would then retain a part. When the agreement was made before a court of law a ''tripartite'' indenture was made, with the third piece kept at the court. The term is used for any kind of deed execu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Trust Indenture Act Of 1939

The Trust Indenture Act of 1939 (TIA), codified at , supplements the Securities Act of 1933 in the case of the distribution of debt securities in the United States. Generally speaking, the TIA requires the appointment of a suitably independent and qualified trustee to act for the benefit of the holders of the securities, and specifies various substantive provisions for the trust indenture that must be entered into by the issuer and the trustee. The TIA is administered by the U.S. Securities and Exchange Commission (SEC), which has made various regulations under the act. History Section 211 of The Securities Exchange Act of 1934 mandated that the SEC conduct various studies. Although not expressly required to study the trustee system then in use for the issuance of debt securities, William O. Douglas, who would later become a Commissioner and then Chair of the SEC, was convinced by November 1934 that the system needed legislative reform. In June 1936, the Protective Committee Stu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Apprenticeship

Apprenticeship is a system for training a new generation of practitioners of a trade or profession with on-the-job training and often some accompanying study (classroom work and reading). Apprenticeships can also enable practitioners to gain a license to practice in a regulated occupation. Most of their training is done while working for an employer who helps the apprentices learn their trade or profession, in exchange for their continued labor for an agreed period after they have achieved measurable competencies. Apprenticeship lengths vary significantly across sectors, professions, roles and cultures. In some cases, people who successfully complete an apprenticeship can reach the "journeyman" or professional certification level of competence. In other cases, they can be offered a permanent job at the company that provided the placement. Although the formal boundaries and terminology of the apprentice/journeyman/master system often do not extend outside guilds and trade unions ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bond (finance)

In finance, a bond is a type of security under which the issuer ( debtor) owes the holder ( creditor) a debt, and is obliged – depending on the terms – to repay the principal (i.e. amount borrowed) of the bond at the maturity date as well as interest (called the coupon) over a specified amount of time. The interest is usually payable at fixed intervals: semiannual, annual, and less often at other periods. Thus, a bond is a form of loan or IOU. Bonds provide the borrower with external funds to finance long-term investments or, in the case of government bonds, to finance current expenditure. Bonds and stocks are both securities, but the major difference between the two is that (capital) stockholders have an equity stake in a company (i.e. they are owners), whereas bondholders have a creditor stake in a company (i.e. they are lenders). As creditors, bondholders have priority over stockholders. This means they will be repaid in advance of stockholders, but will rank b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bankruptcy

Bankruptcy is a legal process through which people or other entities who cannot repay debts to creditors may seek relief from some or all of their debts. In most jurisdictions, bankruptcy is imposed by a court order, often initiated by the debtor. Bankrupt is not the only legal status that an insolvent person may have, and the term ''bankruptcy'' is therefore not a synonym for insolvency. Etymology The word ''bankruptcy'' is derived from Italian language, Italian ''banca rotta'', literally meaning "broken bank". The term is often described as having originated in renaissance Italy, where there allegedly existed the tradition of smashing a banker's bench if he defaulted on payment so that the public could see that the banker, the owner of the bench, was no longer in a condition to continue his business, although some dismiss this as a false etymology. History In Ancient Greece, bankruptcy did not exist. If a man owed and he could not pay, he and his wife, children or servants ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Deed Poll

A deed poll (plural: deeds poll) is a legal document binding on a single person or several persons acting jointly to express an intention or create an obligation. It is a deed, and not a contract because it binds only one party A party is a gathering of people who have been invited by a host for the purposes of socializing, conversation, recreation, or as part of a festival or other commemoration or celebration of a special occasion. A party will often feature .... Etymology The term "deed", also known in this context as a "specialty", is common to signed written undertakings not supported by consideration: the seal (even if not a literal wax seal but only a notional one referred to by the execution formula, "signed, sealed and delivered", or even merely "executed as a deed") is deemed to be the consideration necessary to support the obligation. "Poll" is an archaic legal term referring to documents with straight edges; these distinguished a deed binding only one pe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Deed

In common law, a deed is any legal instrument in writing which passes, affirms or confirms an interest, right, or property and that is signed, attested, delivered, and in some jurisdictions, sealed. It is commonly associated with transferring (conveyancing) title to property. The deed has a greater presumption of validity and is less rebuttable than an instrument signed by the party to the deed. A deed can be unilateral or bilateral. Deeds include conveyances, commissions, licenses, patents, diplomas, and conditionally powers of attorney if executed as deeds. The deed is the modern descendant of the medieval charter, and delivery is thought to symbolically replace the ancient ceremony of livery of seisin. The traditional phrase ''signed, sealed and delivered'' refers to the practice of seals; however, attesting witnesses have replaced seals to some extent. Agreements under seal are also called contracts by deed or ''specialty''; in the United States, a specialty is enf ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Chirograph

A chirograph is a medieval document, which has been written in duplicate, triplicate or very occasionally quadruplicate (four copies) on a single piece of parchment, with the Latin word ''chirographum'' (occasionally replaced by some other term) written across the middle, and then cut through to separate the parts. The term also refers to a papal decree whose circulation is limited to the Roman curia. Etymology The Latin word ''chirographum'', often spelled ''cirographum'' or ''cyrographum'' in the medieval period, is derived from the Greek χειρόγραφον, and simply means "handwritten". Description The intention of the chirograph was to produce two (or more) identical written copies of a legal agreement, that could be retained by each party to the transaction, and if necessary verified at a later date through comparison with one another. Whereas Charters were typically used for titles of property and did not give each party a copy, chirographs could be used for almo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Interest Rate

An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum). The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, the compounding frequency, and the length of time over which it is lent, deposited, or borrowed. The annual interest rate is the rate over a period of one year. Other interest rates apply over different periods, such as a month or a day, but they are usually annualized. The interest rate has been characterized as "an index of the preference . . . for a dollar of present ncomeover a dollar of future income." The borrower wants, or needs, to have money sooner rather than later, and is willing to pay a fee—the interest rate—for that privilege. Influencing factors Interest rates vary according to: * the government's directives to the central bank to accomplish the government's goals * the currency of the principal sum lent or borrowed * ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fiduciary

A fiduciary is a person who holds a legal or ethical relationship of trust with one or more other parties (person or group of persons). Typically, a fiduciary prudently takes care of money or other assets for another person. One party, for example, a corporate trust company or the trust department of a bank, acts in a fiduciary capacity to another party, who, for example, has entrusted funds to the fiduciary for safekeeping or investment. Likewise, financial advisers, financial planners, and asset managers, including managers of pension plans, endowments, and other tax-exempt assets, are considered fiduciaries under applicable statutes and laws. In a fiduciary relationship, one person, in a position of vulnerability, justifiably vests confidence, good faith, reliance, and trust in another whose aid, advice, or protection is sought in some matter... In such a relation, good conscience requires the fiduciary to act at all times for the sole benefit and interest of the one who ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)

.png)