|

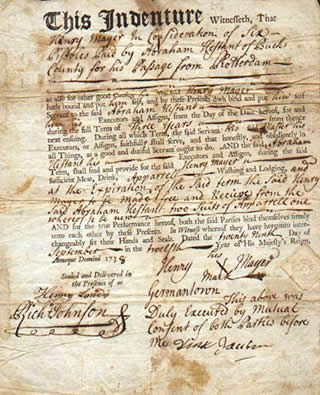

Indenture

An indenture is a legal contract that reflects an agreement between two parties. Although the term is most familiarly used to refer to a labor contract between an employer and a laborer with an indentured servant status, historically indentures were used for a variety of contracts, including transfers and rents of land and even peace agreements between rulers. Historical usage An indenture is a legal contract between two parties, whether for Indentured servant, indentured labour or a term of apprenticeship or for certain real estate, land transactions. The term comes from the medieval English "indenture of retainer"—a legal contract written in duplicate on the same sheet, with the copies separated by cutting along a jagged (toothed, hence the term "indenture") line so that the teeth of the two parts could later be refitted to confirm authenticity (chirograph). Each party to the deed would then retain a part. When the agreement was made before a court of law a ''tripartite'' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Indentured Servant

Indentured servitude is a form of Work (human activity), labor in which a person is contracted to work without salary for a specific number of years. The contract called an "indenture", may be entered voluntarily for a prepaid lump sum, as payment for some good or service (e.g. travel), purported eventual compensation, or debt repayment. An indenture may also be imposed involuntarily as a Sentence (law), judicial punishment. The practice has been compared to the similar institution of slavery, although there are differences. Historically, in an apprenticeship, an apprentice worked with no pay for a master tradesman to learn a craft, trade. This was often for a fixed length of time, usually seven years or less. Apprenticeship was not the same as indentureship, although many apprentices were tricked into falling into debt and thus having to indenture themselves for years more to pay off such sums. Like any loan, an indenture could be sold. Most masters had to depend on middlemen o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Indenture 1723

An indenture is a legal contract that reflects an agreement between two parties. Although the term is most familiarly used to refer to a labor contract between an employer and a laborer with an indentured servant status, historically indentures were used for a variety of contracts, including transfers and rents of land and even peace agreements between rulers. Historical usage An indenture is a legal contract between two parties, whether for indentured labour or a term of apprenticeship or for certain land transactions. The term comes from the medieval English "indenture of retainer"—a legal contract written in duplicate on the same sheet, with the copies separated by cutting along a jagged (toothed, hence the term "indenture") line so that the teeth of the two parts could later be refitted to confirm authenticity ( chirograph). Each party to the deed would then retain a part. When the agreement was made before a court of law a ''tripartite'' indenture was made, with the t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Trust Indenture Act Of 1939

The Trust Indenture Act of 1939 (TIA), codified at , supplements the Securities Act of 1933 in the case of the distribution of debt securities in the United States. Generally speaking, the TIA requires the appointment of a suitably independent and qualified trustee to act for the benefit of the holders of the securities, and specifies various substantive provisions for the trust indenture that must be entered into by the issuer and the trustee. The TIA is administered by the U.S. Securities and Exchange Commission (SEC), which has made various regulations under the act. History Section 211 of The Securities Exchange Act of 1934 mandated that the SEC conduct various studies. Although not expressly required to study the trustee system then in use for the issuance of debt securities, William O. Douglas, who would later become a Commissioner and then Chair of the SEC, was convinced by November 1934 that the system needed legislative reform. In June 1936, the Protective Committee S ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Apprenticeship

Apprenticeship is a system for training a potential new practitioners of a trade or profession with on-the-job training and often some accompanying study. Apprenticeships may also enable practitioners to gain a license to practice in a regulated occupation. Most of their training is done while working for an employer who helps the apprentices learn their trade or profession, in exchange for their continued labor for an agreed period after they have achieved measurable competencies. Apprenticeship lengths vary significantly across sectors, professions, roles and cultures. In some cases, people who successfully complete an apprenticeship can reach the " journeyman" or professional certification level of competence. In other cases, they can be offered a permanent job at the company that provided the placement. Although the formal boundaries and terminology of the apprentice/journeyman/master system often do not extend outside guilds and trade unions, the concept of on-the-job trai ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bond (finance)

In finance, a bond is a type of Security (finance), security under which the issuer (debtor) owes the holder (creditor) a debt, and is obliged – depending on the terms – to provide cash flow to the creditor (e.g. repay the principal (i.e. amount borrowed) of the bond at the Maturity (finance), maturity date and interest (called the coupon (bond), coupon) over a specified amount of time.) The timing and the amount of cash flow provided varies, depending on the economic value that is emphasized upon, thus giving rise to different types of bonds. The interest is usually payable at fixed intervals: semiannual, annual, and less often at other periods. Thus, a bond is a form of loan or IOU. Bonds provide the borrower with external funds to finance long-term investments or, in the case of government bonds, to finance current expenditure. Bonds and Share capital, stocks are both Security (finance), securities, but the major difference between the two is that (capital) stockholders h ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Deed Poll

A deed poll (plural: deeds poll) is a legal document binding on a single person or several persons acting jointly to express an intention or create an obligation. It is a deed, and not a contract, because it binds only one party. Etymology The term "deed", also known in this context as a "specialty", is common to signed written undertakings not supported by consideration: the seal (even if not a literal wax seal but only a notional one referred to by the execution formula, "signed, sealed and delivered", or even merely "executed as a deed") is deemed to be the consideration necessary to support the obligation. "Poll" is an archaic legal term referring to documents with straight edges; these distinguished a deed binding only one person from one affecting more than a single person (an " indenture", so named during the time when such agreements would be written out repeatedly on a single sheet, then the copies separated by being irregularly torn or cut, i.e. "indented", so that ea ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bankruptcy

Bankruptcy is a legal process through which people or other entities who cannot repay debts to creditors may seek relief from some or all of their debts. In most jurisdictions, bankruptcy is imposed by a court order, often initiated by the debtor. Bankrupt is not the only legal status that an insolvent person may have, meaning the term ''bankruptcy'' is not a synonym for insolvency. Etymology The word ''bankruptcy'' is derived from Italian language, Italian , literally meaning . The term is often described as having originated in Renaissance Italy, where there allegedly existed the tradition of smashing a banker's bench if he defaulted on payment. However, the existence of such a ritual is doubted. History In Ancient Greece, bankruptcy did not exist. If a man owed and he could not pay, he and his wife, children or servants were forced into "debt slavery" until the creditor recouped losses through their Manual labour, physical labour. Many city-states in ancient Greece lim ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Deed

A deed is a legal document that is signed and delivered, especially concerning the ownership of property or legal rights. Specifically, in common law, a deed is any legal instrument in writing which passes, affirms or confirms an interest, right, or property and that is signed, attested, delivered, and in some jurisdictions, sealed. It is commonly associated with transferring (conveyancing) title to property. The deed has a greater presumption of validity and is less rebuttable than an instrument signed by the party to the deed. A deed can be unilateral or bilateral. Deeds include conveyances, commissions, licenses, patents, diplomas, and conditionally powers of attorney if executed as deeds. The deed is the modern descendant of the medieval charter, and delivery is thought to symbolically replace the ancient ceremony of livery of seisin. The traditional phrase ''signed, sealed and delivered'' refers to the practice of using seals; however, attesting witnesses have repla ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Chirograph

A chirograph is a medieval document, which has been written in duplicate, triplicate or very occasionally quadruplicate (four copies) on a single piece of parchment, with the Latin word ''chirographum'' (occasionally replaced by some other term) written across the middle, and then cut through to separate the parts. The term also refers to a papal decree whose circulation is limited to the Roman curia. Etymology The Latin word ''chirographum'', often spelled ''cirographum'' or ''cyrographum'' in the medieval period, is derived from the Greek χειρόγραφον, and simply means "handwritten". Description The intention of the chirograph was to produce two (or more) identical written copies of a legal agreement, that could be retained by each party to the transaction, and if necessary verified at a later date through comparison with one another. Whereas Charters were typically used for titles of property and did not give each party a copy, chirographs could be used for almo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Legal Document

Legal instrument is a legal term of art that is used for any formally executed written document that can be formally attributed to its author, records and formally expresses a legally enforceable act, process, or contractual duty, obligation, or right, and therefore evidences that act, process, or agreement.''Barron's Law Dictionary'', s.v. "instrument". Examples include a certificate, deed, bond, contract, will, legislative act, notarial act, court writ or process, or any law passed by a competent legislative body in domestic or international law. Many legal instruments were written ''under seal'' by affixing a wax or paper seal to the document in evidence of its legal execution and authenticity (which often removed the need for consideration in contract law). However, today many jurisdictions have done away with the requirement of documents being under seal in order to give them legal effect. Electronic legal documents With the onset of the Internet and electronic e ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Arm's Length Principle

The arm's length principle (ALP) is the condition or the fact that the parties of a transaction are independent and on an equal footing. Such a transaction is known as an "arm's-length transaction". It is used specifically in contract law to arrange an agreement that will stand up to legal scrutiny, even though the parties may have shared interests (e.g., employer-employee) or are too closely related to be seen as completely independent (e.g., the parties have familial ties). An arm's length relationship is distinguished from a fiduciary relationship, where the parties are not on an equal footing, but rather, power and information asymmetries exist. It is also one of the key elements in international taxation as it allows an adequate allocation of profit taxation rights among countries that conclude double tax conventions, through transfer pricing, among each other. Transfer pricing and the arm's length principle were one of the focal points of the base erosion and profit s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |