|

Inverse Exchange-traded Fund

An inverse exchange-traded fund is an exchange-traded fund (ETF), traded on a public stock market, which is designed to perform as the ''inverse'' of whatever index or benchmark it is designed to track. These funds work by using short selling, trading derivatives such as futures contracts, and other leveraged investment techniques. By providing over short investing horizons and excluding the impact of fees and other costs, performance opposite to their benchmark, inverse ETFs give a result similar to short selling the stocks in the index. An inverse S&P 500 ETF, for example, seeks a daily percentage movement opposite that of the S&P. If the S&P 500 rises by 1%, the inverse ETF is designed to fall by 1%; and if the S&P falls by 1%, the inverse ETF should rise by 1%. Because their value rises in a declining market environment, they are popular investments in bear markets. Short sales have the potential to expose an investor to unlimited losses, whether or not the sale involves ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Exchange-traded Fund

An exchange-traded fund (ETF) is a type of investment fund and exchange-traded product, i.e. they are traded on stock exchanges. ETFs are similar in many ways to mutual funds, except that ETFs are bought and sold from other owners throughout the day on stock exchanges whereas mutual funds are bought and sold from the issuer based on their price at day's end. An ETF holds assets such as stocks, bonds, currencies, futures contracts, and/or commodities such as gold bars, and generally operates with an arbitrage mechanism designed to keep it trading close to its net asset value, although deviations can occasionally occur. Most ETFs are index funds: that is, they hold the same securities in the same proportions as a certain stock market index or bond market index. The most popular ETFs in the U.S. replicate the S&P 500, the total market index, the NASDAQ-100 index, the price of gold, the "growth" stocks in the Russell 1000 Index, or the index of the largest technology companies. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Yahoo! Finance

Yahoo! Finance is a media property that is part of the Yahoo! network. It provides financial news, data and commentary including stock quotes, press releases, financial reports, and original content. It also offers some online tools for personal finance management. In addition to posting partner content from other web sites, it posts original stories by its team of staff journalists. It is ranked 20th by SimilarWeb on the list of largest news and media websites. In 2017 Yahoo! Finance added the feature to look at news surrounding cryptocurrency. It lists over 9,000 unique coins including Bitcoin and Ethereum. See also * Google Finance * MSN Money References * https://finance.yahoo.com/portfolios External links Yahoo! Finance Economics websites Finance Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and serv ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

BetaShares

Betashares is an Australian provider of exchange-traded funds (ETFs) and other ASX-traded funds. The company introduced a range of products into the Australian ETF landscape, including Australia's first currency hedged ETF, Australia's first range of commodity ETFs, Australia's first range of currency ETFs, Australia's first ETF using fundamentally based indexes and a range of short exchange traded products. BetaShares is based in Sydney, Australia with offices in Melbourne and Brisbane. Betashares is owned and managed by its Australian based management team and has a strategic shareholding from TA Associates, a US Private Equity firm. Up until March 8th, 2021, Betashares was partly owned by Mirae Asset Financial Group. History Currently, Betashares offers exchange-traded funds across several asset classes, including equities, cash, fixed income, hybrids, currencies and commodities. The organisation is actively involved in researching and commenting on ETF investing for A ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

ProShares

ProShares is an issuer of exchange-traded funds, including inverse exchange-traded funds, and similar products. History ProFunds Group was founded in 1997 with $100,000 by former Rydex employees Louis Mayberg and Michael Sapir. That year, it introduced bear market inverse mutual funds. In 2006, ProFunds Group launched ProShares and its first inverse exchange-traded fund. In October 2021, the company launched an exchange-traded fund that invests in Bitcoin futures contract In finance, a futures contract (sometimes called a futures) is a standardized legal contract to buy or sell something at a predetermined price for delivery at a specified time in the future, between parties not yet known to each other. The asset ...s. References External links * {{Official website 2006 establishments in Maryland Companies based in Bethesda, Maryland Financial services companies of the United States Financial services companies established in 2006 Investment management companies of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

IShares

iShares is a collection of exchange-traded funds (ETFs) managed by BlackRock, which acquired the brand and business from Barclays in 2009. The first iShares ETFs were known as World Equity Benchmark Shares (WEBS) but have since been rebranded. Most iShares funds track a bond or stock market index, although some are actively managed. Stock exchanges listing iShares funds include the London Stock Exchange, American Stock Exchange, New York Stock Exchange, BATS Exchange, Hong Kong Stock Exchange, Mexican Stock Exchange, Toronto Stock Exchange, Australian Securities Exchange, B³ Brasil Bolsa Balcão and a number of European and Asian stock exchanges. iShares is the largest issuer of ETFs in the US and globally. History In 1993, State Street, in cooperation with American Stock Exchange, launched Standard & Poor's Depositary Receipts () (now the 'SPDR S&P 500'), which was traded in real time and tracked the S&P 500 index. This was the first ETF to trade in the United States ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Robert Pozen

Robert Charles Pozen known as "Bob" (born 1946) is an American financial executive with a strong interest in public policy. Pozen currently teaches executives about how to be more productive and serves as an executive coach and mentor, www.bobpozen.co He is the former chairman of MFS Investment Management, the oldest mutual fund company in the United States. Previously, Pozen was the President of Fidelity Investments. As of 2020 he is a senior lecturer at MIT Sloan School of Management, and a senior fellow at the Brookings Institution. Education and family Pozen grew up in Bridgeport, Connecticut, where he attended public high school and won a scholarship to attend Harvard College. In 1968, he graduated summa cum laude and Phi Beta Kappa from Harvard, which awarded him a Knox Traveling Fellowship. In 1972, Pozen received a J.D. degree from Yale Law School, where he served on the editorial board of the '' Yale Law Journal''. He received a JSD from Yale in 1973 for his doctoral t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Palgrave Macmillan

Palgrave Macmillan is a British academic and trade publishing company headquartered in the London Borough of Camden. Its programme includes textbooks, journals, monographs, professional and reference works in print and online. It maintains offices in London, New York, Shanghai, Melbourne, Sydney, Hong Kong, Delhi, and Johannesburg. Palgrave Macmillan was created in 2000 when St. Martin's Press in the US united with Macmillan Publishers in the UK to combine their worldwide academic publishing operations. The company was known simply as Palgrave until 2002, but has since been known as Palgrave Macmillan. It is a subsidiary of Springer Nature. Until 2015, it was part of the Macmillan Group and therefore wholly owned by the German publishing company Holtzbrinck Publishing Group (which still owns a controlling interest in Springer Nature). As part of Macmillan, it was headquartered at the Macmillan campus in Kings Cross London with other Macmillan companies including Pan Macmil ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

London

London is the capital and largest city of England and the United Kingdom, with a population of just under 9 million. It stands on the River Thames in south-east England at the head of a estuary down to the North Sea, and has been a major settlement for two millennia. The City of London, its ancient core and financial centre, was founded by the Romans as '' Londinium'' and retains its medieval boundaries.See also: Independent city § National capitals The City of Westminster, to the west of the City of London, has for centuries hosted the national government and parliament. Since the 19th century, the name "London" has also referred to the metropolis around this core, historically split between the counties of Middlesex, Essex, Surrey, Kent, and Hertfordshire, which largely comprises Greater London, governed by the Greater London Authority.The Greater London Authority consists of the Mayor of London and the London Assembly. The London Mayor is distinguished fr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gamma (of Options)

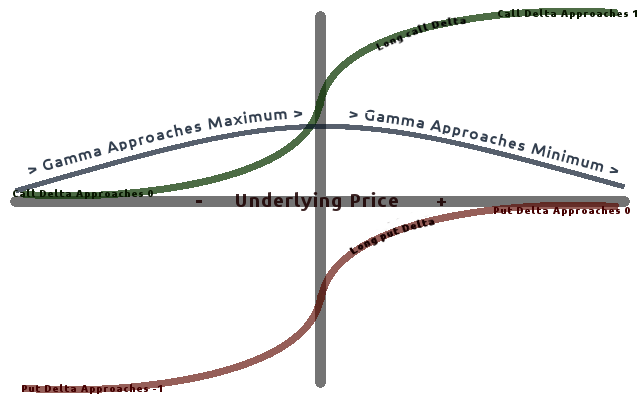

In mathematical finance, the Greeks are the quantities representing the sensitivity of the price of derivatives such as options to a change in underlying parameters on which the value of an instrument or portfolio of financial instruments is dependent. The name is used because the most common of these sensitivities are denoted by Greek letters (as are some other finance measures). Collectively these have also been called the risk sensitivities, risk measures or hedge parameters. Use of the Greeks The Greeks are vital tools in risk management. Each Greek measures the sensitivity of the value of a portfolio to a small change in a given underlying parameter, so that component risks may be treated in isolation, and the portfolio rebalanced accordingly to achieve a desired exposure; see for example delta hedging. The Greeks in the Black–Scholes model are relatively easy to calculate, a desirable property of financial models, and are very useful for derivatives traders, espec ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Delta (finance)

In mathematical finance, the Greeks are the quantities representing the sensitivity of the price of derivatives such as options to a change in underlying parameters on which the value of an instrument or portfolio of financial instruments is dependent. The name is used because the most common of these sensitivities are denoted by Greek letters (as are some other finance measures). Collectively these have also been called the risk sensitivities, risk measures or hedge parameters. Use of the Greeks The Greeks are vital tools in risk management. Each Greek measures the sensitivity of the value of a portfolio to a small change in a given underlying parameter, so that component risks may be treated in isolation, and the portfolio rebalanced accordingly to achieve a desired exposure; see for example delta hedging. The Greeks in the Black–Scholes model are relatively easy to calculate, a desirable property of financial models, and are very useful for derivatives traders, especially ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Synthetic Option Position

In finance, a synthetic position is a way to create the payoff of a financial instrument using other financial instruments. A synthetic position can be created by buying or selling the underlying financial instruments and/or derivatives. If several instruments which have the same payoff as investing in a share are bought, there is a synthetic underlying position. In a similar way, a synthetic option position can be created. For example, a position which is long a 60-strike call and short a 60-strike put will always result in purchasing the underlying asset for 60 at exercise or expiration. If the underlying asset is above 60, the call is in the money and will be exercised; if the underlying asset is below 60 then the short put position will be assigned, resulting in a (forced) purchase of the underlying at 60. One advantage of a synthetic position over buying or shorting the underlying stock is that there is no need to borrow the stock if selling it short. Another advantag ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Exchange-traded Fund

An exchange-traded fund (ETF) is a type of investment fund and exchange-traded product, i.e. they are traded on stock exchanges. ETFs are similar in many ways to mutual funds, except that ETFs are bought and sold from other owners throughout the day on stock exchanges whereas mutual funds are bought and sold from the issuer based on their price at day's end. An ETF holds assets such as stocks, bonds, currencies, futures contracts, and/or commodities such as gold bars, and generally operates with an arbitrage mechanism designed to keep it trading close to its net asset value, although deviations can occasionally occur. Most ETFs are index funds: that is, they hold the same securities in the same proportions as a certain stock market index or bond market index. The most popular ETFs in the U.S. replicate the S&P 500, the total market index, the NASDAQ-100 index, the price of gold, the "growth" stocks in the Russell 1000 Index, or the index of the largest technology companies. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |