|

Inflation Targeting

In macroeconomics, inflation targeting is a monetary policy where a central bank follows an explicit target for the inflation rate for the medium-term and announces this inflation target to the public. The assumption is that the best that monetary policy can do to support long-term growth of the economy is to maintain price stability, and price stability is achieved by controlling inflation. The central bank uses interest rates as its main short-term monetary instrument. An inflation-targeting central bank will raise or lower interest rates based on above-target or below-target inflation, respectively. The conventional wisdom is that raising interest rates usually cools the economy to rein in inflation; lowering interest rates usually accelerates the economy, thereby boosting inflation. The first three countries to implement fully-fledged inflation targeting were New Zealand, Canada and the United Kingdom in the early 1990s, although Germany had adopted many elements of inflatio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Macroeconomics

Macroeconomics (from the Greek prefix ''makro-'' meaning "large" + ''economics'') is a branch of economics dealing with performance, structure, behavior, and decision-making of an economy as a whole. For example, using interest rates, taxes, and government spending to regulate an economy's growth and stability. This includes regional, national, and global economies. According to a 2018 assessment by economists Emi Nakamura and Jón Steinsson, economic "evidence regarding the consequences of different macroeconomic policies is still highly imperfect and open to serious criticism." Macroeconomists study topics such as Gross domestic product, GDP (Gross Domestic Product), unemployment (including Unemployment#Measurement, unemployment rates), national income, price index, price indices, output (economics), output, Consumption (economics), consumption, inflation, saving, investment (macroeconomics), investment, Energy economics, energy, international trade, and international finance. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Exchange Rate Flexibility

In macroeconomics, a flexible exchange-rate system is a monetary system that allows the exchange rate to be determined by supply and demand. Every currency area must decide what type of exchange rate arrangement to maintain. Between permanently fixed and completely flexible, some take heterogeneous approaches. They have different implications for the extent to which national authorities participate in foreign exchange markets. According to their degree of flexibility, post-Bretton Woods-exchange rate regimes are arranged into three categories: *Fixed-rate regime: currency unions, dollarized regimes, currency boards and conventional currency pegs *Intermediate regimes: horizontal bands, crawling pegs and crawling bands *Flexible regimes: managed and independent floats All monetary regimes except for the permanently fixed regime experience the time inconsistency problem and exchange rate volatility, albeit to different degrees. Fixed rate programs In a fixed exchange rate sys ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Harmonised Index Of Consumer Prices

The Harmonised Index of Consumer Prices (HICP) is an indicator of inflation and price stability for the European Central Bank (ECB). It is a consumer price index which is compiled according to a methodology that has been harmonised across EU countries. The euro area HICP is a weighted average of price indices of member states who have adopted the euro. The primary goal of the ECB is to maintain price stability, defined as keeping the year on year increase HICP below but close to 2% for the medium term. In order to do that, the ECB can control the short-term interest rate through Eonia, the European overnight index average, which affects market expectations. The HICP is also used to assess the convergence criteria on inflation which countries must fulfill in order to adopt the euro. In the United Kingdom, the HICP is called the CPI and is used to set the inflation target of the Bank of England. Comparison with the United States The HICP differs from the US CPI in two primary aspect ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Consolidated Version Of The Treaty On The Functioning Of The European Union/Title VIII: Economic And Monetary Policy

{{disambig ...

Consolidated may refer to: *Consolidated (band) **''¡Consolidated!'', a 1989 extended play *Consolidated Aircraft (later Convair), an aircraft manufacturer *Consolidated city-county *Consolidated Communications * Consolidated school district *Consolidated Foods See also * *Consolidation (other) Consolidation may refer to: In science and technology * Consolidation (computing), the act of linkage editing in computing * Memory consolidation, the process in the brain by which recent memories are crystallised into long-term memory * Pulmonar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Eurozone

The euro area, commonly called eurozone (EZ), is a currency union of 19 member states of the European Union (EU) that have adopted the euro (€) as their primary currency and sole legal tender, and have thus fully implemented EMU policies. The 19 eurozone members are Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia, and Spain. The eight non-eurozone members of the EU are Bulgaria, Czech Republic, Croatia, Denmark, Hungary, Poland, Romania, and Sweden. They continue to use their own national currencies, albeit all but Denmark are obliged to join once they meet the euro convergence criteria. Croatia will become the 20th member on 1 January 2023. Among non-EU member states, Andorra, Monaco, San Marino, and Vatican City have formal agreements with the EU to use the euro as their official currency and issue their own coins. In addition, Kosovo and Montenegro h ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

European Central Bank

The European Central Bank (ECB) is the prime component of the monetary Eurosystem and the European System of Central Banks (ESCB) as well as one of seven institutions of the European Union. It is one of the world's Big Four (banking)#International use, most important central banks. The Governing Council of the European Central Bank, ECB Governing Council makes the projects for the monetary policy for the European Union with suggestions and recommendations and to the Eurozone with more direct applications of such policies, it also administers the foreign exchange reserves of EU member states in the Eurozone, engages in foreign exchange operations, and defines the intermediate monetary aims and objectives, and also the common interest rates for the EU. The Executive Board of the European Central Bank, ECB Executive Board makes policies and decisions of the Governing Council, and may give direction to the national central banks, especially when doing so for the Eurozone central ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Euro

The euro ( symbol: €; code: EUR) is the official currency of 19 out of the member states of the European Union (EU). This group of states is known as the eurozone or, officially, the euro area, and includes about 340 million citizens . The euro is divided into 100 cents. The currency is also used officially by the institutions of the European Union, by four European microstates that are not EU members, the British Overseas Territory of Akrotiri and Dhekelia, as well as unilaterally by Montenegro and Kosovo. Outside Europe, a number of special territories of EU members also use the euro as their currency. Additionally, over 200 million people worldwide use currencies pegged to the euro. As of 2013, the euro is the second-largest reserve currency as well as the second-most traded currency in the world after the United States dollar. , with more than €1.3 trillion in circulation, the euro has one of the highest combined values of banknotes and coins in c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Chancellor Of The Exchequer

The chancellor of the Exchequer, often abbreviated to chancellor, is a senior minister of the Crown within the Government of the United Kingdom, and head of His Majesty's Treasury. As one of the four Great Offices of State, the Chancellor is a high-ranking member of the British Cabinet. Responsible for all economic and financial matters, the role is equivalent to that of a finance minister in other countries. The chancellor is now always Second Lord of the Treasury as one of at least six lords commissioners of the Treasury, responsible for executing the office of the Treasurer of the Exchequer the others are the prime minister and Commons government whips. In the 18th and early 19th centuries, it was common for the prime minister also to serve as Chancellor of the Exchequer if he sat in the Commons; the last Chancellor who was simultaneously prime minister and Chancellor of the Exchequer was Stanley Baldwin in 1923. Formerly, in cases when the chancellorship was vacant, the L ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

UK Treasury

His Majesty's Treasury (HM Treasury), occasionally referred to as the Exchequer, or more informally the Treasury, is a department of His Majesty's Government responsible for developing and executing the government's public finance policy and economic policy. The Treasury maintains the Online System for Central Accounting and Reporting (OSCAR), the replacement for the Combined Online Information System (COINS), which itemises departmental spending under thousands of category headings, and from which the Whole of Government Accounts (WGA) annual financial statements are produced. History The origins of the Treasury of England have been traced by some to an individual known as Henry the Treasurer, a servant to King William the Conqueror. This claim is based on an entry in the Domesday Book showing the individual Henry "the treasurer" as a landowner in Winchester, where the royal treasure was stored. The Treasury of the United Kingdom thus traces its origins to the Treasury of the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

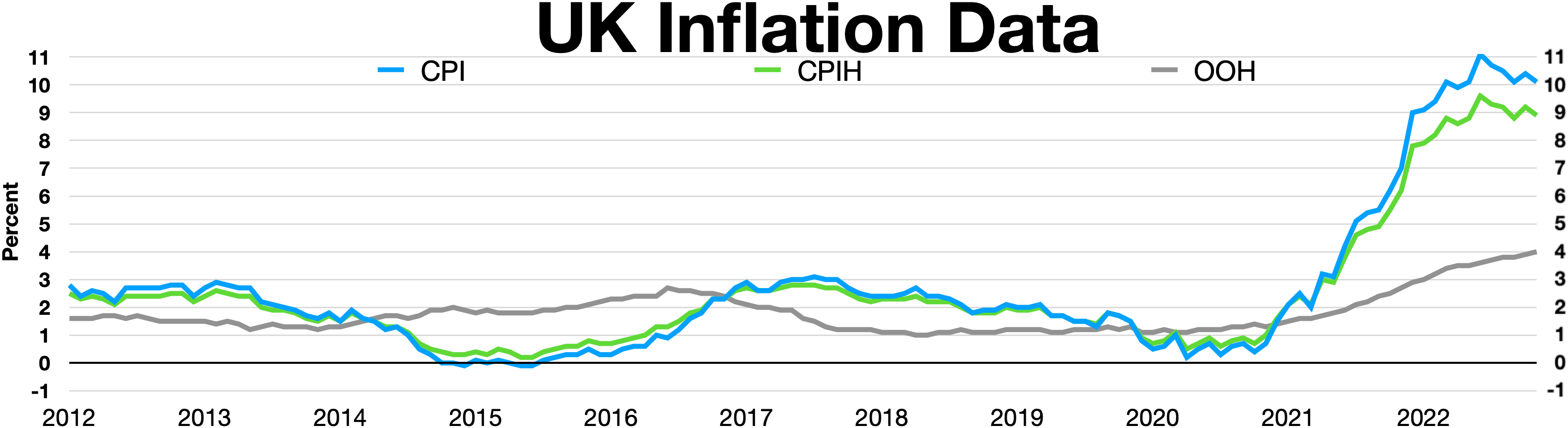

Consumer Price Index (United Kingdom)

The Consumer Price Index (CPI) is the official measure of inflation of consumer prices of the United Kingdom. It is also called the Harmonised Index of Consumer Prices (HICP). History The traditional measure of inflation in the UK for many years was the Retail Prices Index (RPI), which was first calculated in the early 20th century to evaluate the extent to which workers were affected by price changes during the First World War. The main index was described as the Interim Index of Retail Prices from 1947 to 1955. In January 1956, it was rebased and renamed the Index of Retail Prices. In January 1962 this was replaced by the General Index of Retail Prices, which was again rebased at that time. A further rebasing occurred in January 1987, subsequent to the issue of the first index-linked gilts. RPIX An explicit inflation target was first set in October 1992 by Chancellor of the Exchequer Norman Lamont, following the UK's departure from the Exchange Rate Mechanism. Initially, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Retail Prices Index (United Kingdom)

In the United Kingdom, the Retail Prices Index or Retail Price Index (RPI) is a measure of inflation published monthly by the Office for National Statistics. It measures the change in the cost of a representative sample of retail goods and services. As the RPI was held not to meet international statistical standards, since 2013 the Office for National Statistics no longer classifies it as a "national statistic", emphasising the Consumer Price Index instead. However, as of 2018 the UK Treasury still uses the RPI measure of inflation for various index-linked tax rises. History RPI was first introduced in 1956, replacing the previous Interim Index of Retail Prices that had been in use since June 1947. It was once the principal official measure of inflation. It has been superseded in that regard by the Consumer Price Index (CPI). The RPI is still used by the government as a base for various purposes, such as the amounts payable on index-linked securities including index-linked gilt ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monetary Policy Committee (United Kingdom)

The Monetary Policy Committee (MPC) is a committee of the Bank of England, which meets for three and a half days, eight times a year, to decide the official interest rate in the United Kingdom (the Bank of England Base Rate). It is also responsible for directing other aspects of the government's monetary policy framework, such as quantitative easing and forward guidance. The Committee comprises nine members, including the Governor of the Bank of England, and is responsible primarily for keeping the Consumer Price Index (CPI) measure of inflation close to a target set by the government, currently 2% per year (as of 2019). Its secondary aim – to support growth and employment – was reinforced in March 2013. Announced on 6 May 1997, only five days after that year's General Election, and officially given operational responsibility for setting interest rates in the Bank of England Act 1998, the committee was designed to be independent of political interference and thus to add cre ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |