|

Inclusive

Inclusive may refer to: * Inclusive disjunction, A or B or both * Inclusive fitness, in evolutionary theory, how many kin are supported including non-descendants * Inclusive tax, includes taxes owed as part of the base * Inclusivism Inclusivism is one of several approaches in religious studies, anthropology, or civics to understand the relationship between different religions, societies, cultures, political factions etc. It asserts that there is beauty in the variety of diff ..., a form of religious pluralism * Inclusive first person, in linguistics See also * Inclusion (other) {{disambiguation ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inclusivism

Inclusivism is one of several approaches in religious studies, anthropology, or civics to understand the relationship between different religions, societies, cultures, political factions etc. It asserts that there is beauty in the variety of different schools of thoughts, and that they can coexist. It stands in contrast to exclusivism, which asserts that only one way is true and all others are erroneous. Within religious studies and theology, inclusivism is the belief that, although only one belief system is true, aspects of its truth can be found in other religions. This is contrasted from religious pluralism, which asserts that all beliefs are equally valid within a believer's particular context. Broadly speaking, there are two schools of Inclusivist thought: * Relativistic inclusivism, which asserts that the believer's own views are true only in their particular context, and believers of other traditions have their own validity. * Absolutist inclusivism, which asserts that an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inclusive Fitness

Inclusive fitness is a conceptual framework in evolutionary biology first defined by W. D. Hamilton in 1964. It is primarily used to aid the understanding of how social traits are expected to evolve in structured populations. It involves partitioning an individual's expected fitness returns into two distinct components: direct fitness returns - the component of a focal individual’s fitness that is independent of who it interacts with socially; indirect fitness returns - the component that is dependent on who it interacts with socially. The direct component of an individual's fitness is often called its personal fitness, while an individual’s direct and indirect fitness components taken together are often called its inclusive fitness. Under an inclusive fitness framework direct fitness returns are realised through the offspring a focal individual produces independent of who it interacts with, while indirect fitness returns are realised by adding up all the effects our focal ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inclusive First Person

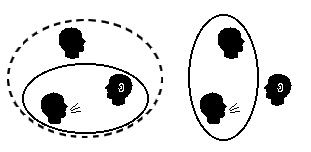

In linguistics, clusivity is a grammatical distinction between ''inclusive'' and ''exclusive'' first-person pronouns and verbal morphology, also called ''inclusive " we"'' and ''exclusive "we"''. Inclusive "we" specifically includes the addressee, while exclusive "we" specifically excludes the addressee; in other words, two (or more) words that both translate to "we", one meaning "you and I, and possibly someone else", the other meaning "me and some other person or persons, but not you". While imagining that this sort of distinction could be made in other persons (particularly the second) is straightforward, in fact the existence of second-person clusivity (you vs. you and they) in natural languages is controversial and not well attested. While clusivity is not a feature of the English language, it is found in many languages around the world. The first published description of the inclusive-exclusive distinction by a European linguist was in a description of languages of Peru in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inclusive Tax

In a tax system, the tax rate is the ratio (usually expressed as a percentage) at which a business or person is taxed. The tax rate that is applied to an individual's or corporation's income is determined by tax laws of the country and can be influenced by many factors such as income level, type of income, and so on. There are several methods used to present a tax rate: statutory, average, marginal, flat, and effective. These rates can also be presented using different definitions applied to a tax base: inclusive and exclusive. Statutory A statutory tax rate is the legally imposed rate. An income tax could have multiple statutory rates for different income levels, where a sales tax may have a flat statutory rate. The statutory tax rate is expressed as a percentage and will always be higher than the effective tax rate. Average An average tax rate is the ratio of the total amount of taxes paid to the total tax base (taxable income or spending), expressed as a percentage. Averag ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inclusive Disjunction

In logic, disjunction (also known as logical disjunction, logical or, logical addition, or inclusive disjunction) is a logical connective typically notated as \lor and read aloud as "or". For instance, the English language sentence "it is sunny or it is warm" can be represented in logic using the disjunctive formula S \lor W , assuming that S abbreviates "it is sunny" and W abbreviates "it is warm". In classical logic, disjunction is given a truth functional semantics according to which a formula \phi \lor \psi is true unless both \phi and \psi are false. Because this semantics allows a disjunctive formula to be true when both of its disjuncts are true, it is an ''inclusive'' interpretation of disjunction, in contrast with exclusive disjunction. Classical proof theoretical treatments are often given in terms of rules such as disjunction introduction and disjunction elimination. Disjunction has also been given numerous non-classical treatments, motivated by problems incl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |