|

ISDS

Investor-state dispute settlement (ISDS) or investment court system (ICS) is a system through which countries can be sued by foreign investors for certain state actions affecting foreign direct investment (FDI). This system most often takes the form of international arbitration between a foreign investor and the nation receiving the FDI. ISDS is a unique instrument of public international law, granting private parties (the foreign investors) the right to sue a sovereign nation in a forum other than that nation's domestic courts. Investors are granted this right through international investment agreements between the investor's home nation and the host nation. Such agreements can be found in bilateral investment treaties (BITs), certain international trade treaties (such as the United States–Mexico–Canada Agreement), or other treaties like the Energy Charter Treaty. To bring an ISDS claim before an arbitral tribunal, an investor from one country must have an investment i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States–Mexico–Canada Agreement

The Agreement between the United States of America, the United Mexican States, and Canada (USMCA) Commonly known as the United States–Mexico–Canada Agreement (USMCA) in the United States and the Canada–United States–Mexico Agreement (CUSMA) in Canada. is a free trade agreement between Canada, Mexico, and the United States. It replaced the North American Free Trade Agreement (NAFTA) implemented in 1994, and is sometimes characterized as "NAFTA 2.0", or "New NAFTA", since it largely maintains or updates the provisions of its predecessor. USMCA created one of the world's largest free trade zones, spanning roughly 500 million people and totaling over $26 trillion in GDP (PPP). USMCA resulted from renegotiations between the NAFTA member states beginning in 2017; characterized as "tumultuous", these centered primarily on "auto exports, steel and aluminum tariffs, and the dairy, egg, and poultry markets". All sides came to a formal agreement on October 1, 2018, and U.S. Pres ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

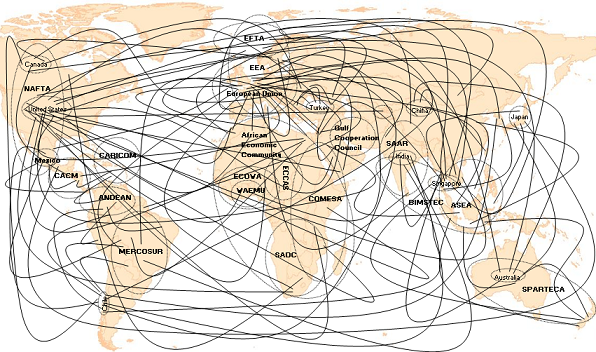

International Investment Agreement

An international investment agreement (IIA) is a type of treaty between countries that addresses issues relevant to cross-border investments, usually for the purpose of protection, promotion and liberalization of such investments. Most IIAs cover foreign direct investment (FDI) and portfolio investment, but some exclude the latter. Countries concluding IIAs commit themselves to adhere to specific standards on the treatment of foreign investments within their territory. IIAs further define procedures for the resolution of disputes should these commitments not be met. The most common types of IIAs are bilateral investment treaties (BITs) and preferential trade and investment agreements (PTIAs). International taxation agreements and double taxation treaties (DTTs) are also considered IIAs, as taxation commonly has an important impact on foreign investment. Bilateral investment treaties deal primarily with the admission, treatment and protection of foreign investment. They usually co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bilateral Investment Treaty

A bilateral investment treaty (BIT) is an bilateral treaty, agreement establishing the terms and conditions for private investment by nationals and companies of one Sovereign state, state in another state. This type of investment is called foreign direct investment (FDI). BITs are established through trade pacts. A nineteenth-century forerunner of the BIT is the "friendship, commerce and navigation treaty" (FCN). This kind of treaty came in to prominence after World Wars when the developed countries wanted to guard their investments in developing countries against expropriation. Most BITs grant investments—made by an investor of one Contracting State in the territory of the other—a number of guarantees, which typically include fair and equitable treatment, protection from expropriation, free transfer of means and full protection and security. The distinctive feature of many BITs is that they allow for an alternative dispute resolution mechanism, whereby an investor whose rights ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Energy Charter Treaty

The Energy Charter Treaty (ECT) is an international agreement that establishes a multilateral framework for cross-border cooperation in the energy industry, principally the fossil fuel industry. The treaty covers all aspects of commercial energy activities including trade, transit, investments and energy efficiency. The treaty contains dispute resolution procedures both for States Parties to the Treaty (vis-à-vis other States) and as between States and the investors of other States, who have made investments in the territory of the former. Initially, the Energy Charter process aimed to integrate the energy sectors of the Soviet Union and Eastern Europe at the end of the Cold War into the broader European and world markets. Its role, however, extends beyond east–west cooperation and, through legally binding instruments, free trade in global energy markets and non-discrimination to stimulate foreign direct investments and global cross-border trade. Awards and settlements of the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bilateral Investment Treaty

A bilateral investment treaty (BIT) is an bilateral treaty, agreement establishing the terms and conditions for private investment by nationals and companies of one Sovereign state, state in another state. This type of investment is called foreign direct investment (FDI). BITs are established through trade pacts. A nineteenth-century forerunner of the BIT is the "friendship, commerce and navigation treaty" (FCN). This kind of treaty came in to prominence after World Wars when the developed countries wanted to guard their investments in developing countries against expropriation. Most BITs grant investments—made by an investor of one Contracting State in the territory of the other—a number of guarantees, which typically include fair and equitable treatment, protection from expropriation, free transfer of means and full protection and security. The distinctive feature of many BITs is that they allow for an alternative dispute resolution mechanism, whereby an investor whose rights ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Foreign Direct Investment

A foreign direct investment (FDI) is an investment in the form of a controlling ownership in a business in one country by an entity based in another country. It is thus distinguished from a foreign portfolio investment by a notion of direct control. The origin of the investment does not impact the definition, as an FDI: the investment may be made either "inorganically" by buying a company in the target country or "organically" by expanding the operations of an existing business in that country. Definitions Broadly, foreign direct investment includes "mergers and acquisitions, building new facilities, reinvesting profits earned from overseas operations, and intra company loans". In a narrow sense, foreign direct investment refers just to building new facility, and a lasting management interest (10 percent or more of voting stock) in an enterprise operating in an economy other than that of the investor. FDI is the sum of equity capital, long-term capital, and short-term capital ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

NAFTA

The North American Free Trade Agreement (NAFTA ; es, Tratado de Libre Comercio de América del Norte, TLCAN; french: Accord de libre-échange nord-américain, ALÉNA) was an agreement signed by Canada, Mexico, and the United States that created a trilateral trade bloc in North America. The agreement came into force on January 1, 1994, and superseded the 1988 Canada–United States Free Trade Agreement between the United States and Canada. The NAFTA trade bloc formed one of the largest trade blocs in the world by gross domestic product. The impetus for a North American free trade zone began with U.S. president Ronald Reagan, who made the idea part of his 1980 presidential campaign. After the signing of the Canada–United States Free Trade Agreement in 1988, the administrations of U.S. president George H. W. Bush, Mexican President Carlos Salinas de Gortari, and Canadian prime minister Brian Mulroney agreed to negotiate what became NAFTA. Each submitted the agreement for rati ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Iran–United States Claims Tribunal

The Iran–United States Claims Tribunal (IUSCT) is an international arbitral tribunal established by the Algiers Accords, an international agreement between the U.S. and Iran embodied in two Declarations by the Government of the Democratic and Popular Republic of Algeria issued on 19 January 1981, to resolve the Iran Hostage Crisis created by the seizure of the U.S. Embassy in Tehran on November 4, 1979. The Khomeini regime held 52 American diplomats hostage for 444 days. In response, the United States froze billions of dollars of Iranian assets, imposed sweeping sanctions on transactions with Iran, and authorized judicial attachment of Iranian assets in the United States. The settlement with Iran, mediated by senior Algerian officials, called for the release of the American hostages, termination of litigation against Iran in U.S. courts, return of frozen assets, payment of outstanding bank loans, and settlement of outstanding property and contract claims of U.S. nationals by a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

American-Mexican Claims Commission

The American-Mexican Claims Commission, officially known as the General Claims Commission (Mexico and United States,) was a commission set up by treaty that adjudicated claims by citizens of the United States and Mexico for losses suffered due to the acts of one government against nationals of the other. The General Commission lasted from 1924–1934, when the mixed U.S.-Mexico commission was abandoned. There was a Special Commission that was set up to deal with claims arising from the era of the Mexican Revolution. Neither commission was successful and in 1934 the two governments engaged in direct bilateral negotiations and came to a settlement. History Since Mexico's independence in 1821, the US and Mexico on a number of occasions had disputes over territory, taxation, and claims by US private citizens. Claims between 1825 and 1839 were arbitrated by a claims convention, on the suggestion of the Mexican government. The convention was established on April 11, 1839. Subsequent comm ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Foreign Direct Investment

A foreign direct investment (FDI) is an investment in the form of a controlling ownership in a business in one country by an entity based in another country. It is thus distinguished from a foreign portfolio investment by a notion of direct control. The origin of the investment does not impact the definition, as an FDI: the investment may be made either "inorganically" by buying a company in the target country or "organically" by expanding the operations of an existing business in that country. Definitions Broadly, foreign direct investment includes "mergers and acquisitions, building new facilities, reinvesting profits earned from overseas operations, and intra company loans". In a narrow sense, foreign direct investment refers just to building new facility, and a lasting management interest (10 percent or more of voting stock) in an enterprise operating in an economy other than that of the investor. FDI is the sum of equity capital, long-term capital, and short-term capital ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Office Of The United States Trade Representative

The Office of the United States Trade Representative (USTR) is an agency of the Federal government of the United States, United States federal government responsible for developing and promoting Trade policy of the United States, American trade policy. Part of the Executive Office of the President of the United States, Executive Office of the President, it is headed by the U.S. Trade Representative, a Cabinet of the United States, Cabinet-level position that serves as the U.S. President's primary advisor, negotiator, and spokesperson on trade matters. USTR has more than two hundred employees, with offices in Geneva, Switzerland, and Brussels, Belgium. USTR was established as the Office of the Special Trade Representative (STR) by the Trade Expansion Act of 1962, leads trade negotiations at bilateral and multilateral levels, and coordinates trade policy with other government agencies through the Trade Policy Committee (TPC), Trade Policy Committee Review Group (TPCRG), and Trade ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

NAFTA Logo

The North American Free Trade Agreement (NAFTA ; es, Tratado de Libre Comercio de América del Norte, TLCAN; french: Accord de libre-échange nord-américain, ALÉNA) was an agreement signed by Canada, Mexico, and the United States that created a trilateral trade bloc in North America. The agreement came into force on January 1, 1994, and superseded the 1988 Canada–United States Free Trade Agreement between the United States and Canada. The NAFTA trade bloc formed one of the largest trade blocs in the world by gross domestic product. The impetus for a North American free trade zone began with U.S. president Ronald Reagan, who made the idea part of his 1980 presidential campaign. After the signing of the Canada–United States Free Trade Agreement in 1988, the administrations of U.S. president George H. W. Bush, Mexican President Carlos Salinas de Gortari, and Canadian prime minister Brian Mulroney agreed to negotiate what became NAFTA. Each submitted the agreement for ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)