|

IRS Whistleblower Office

The IRS Whistleblower Office is a branch of the United States Internal Revenue Service that will "process tips received from individuals, who spot tax problems in their workplace, while conducting day-to-day personal business or anywhere else they may be encountered." Tipsters should use IRForm 211to make a claim. History and operations The program has existed since the 1800s in various forms and is intended to uncover companies and individuals who are underpaying their taxes or otherwise committing tax fraud. To motivate people to notify the IRS of first-hand knowledge of tax-evasion schemes, such as improper tax shelters or transfer pricing abuse, the U.S. Congress directed the IRS to pay tipsters at least 15% and as much as 30% of taxes, penalties, and interest collected in cases where $2 million or more is at stake. 2006 Amendments Establishing the Whistleblower Office Section 406 of the Tax Relief and Health Care Act of 2006 and Section 7623(b) of the Internal Revenue Code f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Government Of The United States

The federal government of the United States (U.S. federal government or U.S. government) is the national government of the United States, a federal republic located primarily in North America, composed of 50 states, a city within a federal district (the city of Washington in the District of Columbia, where most of the federal government is based), five major self-governing territories and several island possessions. The federal government, sometimes simply referred to as Washington, is composed of three distinct branches: legislative, executive, and judicial, whose powers are vested by the U.S. Constitution in the Congress, the president and the federal courts, respectively. The powers and duties of these branches are further defined by acts of Congress, including the creation of executive departments and courts inferior to the Supreme Court. Naming The full name of the republic is "United States of America". No other name appears in the Constitution, and this i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Section 7623

Section, Sectioning or Sectioned may refer to: Arts, entertainment and media * Section (music), a complete, but not independent, musical idea * Section (typography), a subdivision, especially of a chapter, in books and documents ** Section sign (§), typographical characters * Section (bookbinding), a group of sheets, folded in the middle, bound into the binding together * The Section (band), a 1970s American instrumental rock band * ''The Outpost'' (1995 film), also known as ''The Section'' * Section, an instrumental group within an orchestra * "Section", a song by 2 Chainz from the 2016 album ''ColleGrove'' * "Sectioning", a ''Peep Show'' episode * David "Section" Mason, a fictional character in '' Call of Duty: Black Ops II'' Organisations * Section (Alpine club) * Section (military unit) * Section (Scouting) Science, technology and mathematics Science * Section (archaeology), a view in part of the archaeological sequence showing it in the vertical plane * Section (bio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Reform In The United States

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal person, legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, or national), and tax compliance refers to policy actions and individual behaviour aimed at ensuring that taxpayers are paying the right amount of tax at the right time and securing the correct tax allowances and tax reliefs. The first known taxation took place in Ancient Egypt around 3000–2800 BC. A failure to pay in a timely manner (Tax noncompliance, non-compliance), along with evasion of or resistance to taxation, is punishable by law. Taxes consist of direct tax, direct or indirect taxes and may be paid in money or as its labor equivalent. Most countries have a tax system in place, in order to pay for public, common societal, or agreed national needs and for the functions of government. Some levy a flat tax, flat percentag ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Whistleblower

A whistleblower (also written as whistle-blower or whistle blower) is a person, often an employee, who reveals information about activity within a private or public organization that is deemed illegal, immoral, illicit, unsafe or fraudulent. Whistleblowers can use a variety of internal or external channels to communicate information or allegations. Over 83% of whistleblowers report internally to a supervisor, human resources, compliance, or a neutral third party within the company, hoping that the company will address and correct the issues. A whistleblower can also bring allegations to light by communicating with external entities, such as the media, government, or law enforcement. Whistleblowing can occur in either the private sector or the public sector. Retaliation is a real risk for whistleblowers, who often pay a heavy price for blowing the whistle. The most common form of retaliation is abrupt termination of employment. However, several other actions may also be conside ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Brad Birkenfeld

Bradley Charles Birkenfeld (born February 26, 1965) is an American private banker, convicted felon, and whistleblower. During the mid- to late-2000s, he made a series of disclosures about UBS Group AG clients, in violation of Swiss banking secrecy laws, to the U.S. government alleging possible tax evasion. Known as the 2007 " Birkenfeld Disclosure", the U.S. Department of Justice (DOJ) announced it had reached a deferred prosecution agreement with UBS that resulted in a US$780 million fine and the release of previously privileged information on American tax evaders. In the United States, he was convicted by the DOJ for a single charge of fraud conspiracy and served 40 months in a federal penitentiary from 2010 to 2012 with a fine of $30,000. After he applied for whistleblower status and protection, the Internal Revenue Service (IRS) awarded him a settlement of $104 million through their Whistleblower Office. Early life and education Birkenfeld was born on February 26, 1965, i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Gains

Capital gain is an economic concept defined as the profit earned on the sale of an asset which has increased in value over the holding period. An asset may include tangible property, a car, a business, or intangible property such as shares. A capital gain is only possible when the selling price of the asset is greater than the original purchase price. In the event that the purchase price exceeds the sale price, a capital loss occurs. Capital gains are often subject to taxation, of which rates and exemptions may differ between countries. The history of capital gain originates at the birth of the modern economic system and its evolution has been described as complex and multidimensional by a variety of economic thinkers. The concept of capital gain may be considered comparable with other key economic concepts such as profit and rate of return, however its distinguishing feature is that individuals, not just businesses, can accrue capital gains through everyday acquisition an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ordinary Income

Under the United States Internal Revenue Code, the ''type'' of income is defined by its character. Ordinary income is usually characterized as income other than long-term capital gains. Ordinary income can consist of income from wages, salaries, tips, commissions, bonuses, and other types of compensation from employment, interest, dividends, or net income from a sole proprietorship, partnership or LLC. Rents and royalties, after certain deductions, depreciation or depletion allowances, and gambling winnings are also treated as ordinary income. A "short term capital gain", or gain on the sale of an asset held for less than one year of the capital gains holding period, is taxed as ordinary income. Ordinary income stands in contrast to capital gain, which is defined as gain from the sale or exchange of a capital asset. A personal residence is a capital asset to the homeowner. By contrast, a land developer who had many houses for sale on many lots would treat each of those l ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

American Bar Association

The American Bar Association (ABA) is a voluntary bar association of lawyers and law students, which is not specific to any jurisdiction in the United States. Founded in 1878, the ABA's most important stated activities are the setting of academic standards for law schools, and the formulation of model ethical codes related to the legal profession. As of fiscal year 2017, the ABA had 194,000 dues-paying members, constituting approximately 14.4% of American attorneys. In 1979, half of all lawyers in the U.S. were members of the ABA. The organization's national headquarters are in Chicago, Illinois, and it also maintains a significant branch office in Washington, D.C. History The ABA was founded on August 21, 1878, in Saratoga Springs, New York, by 75 lawyers from 20 states and the District of Columbia. According to the ABA website: The purpose of the original organization, as set forth in its first constitution, was "the advancement of the science of jurisprudence, the pro ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internal Revenue Manual

The Internal Revenue Manual (IRM) is an official compendium of internal guidelines for personnel of the United States Internal Revenue Service (IRS). History The IRM was made publicly available through the Freedom of Information Act (United States), Freedom of Information Act. Legal status According to CCH (formerly known as Commerce Clearing House, Inc.): ::The IRS Internal Revenue Manual is the official source of instructions to IRS personnel relating to the organization, administration and operation of the IRS. The IRM contains directions IRS employees need to carry out their responsibilities in administering IRS obligations, such as detailed procedures for processing and examining tax returns. ::Procedures set forth in the IRM are not mandatory and are not binding on the IRS. The provisions are not issued pursuant to a mandate or delegation of authority by Congress and do not have the effect of a rule of law. Nonetheless, IRM offers insights into IRS procedures, and many tax ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internal Revenue Bulletin

The ''Internal Revenue Bulletin'' (also known as the ''IRB''), is a weekly publication of the U.S. Internal Revenue Service that announces "official rulings and procedures of the Internal Revenue Service and for publishing Treasury Decisions, Executive Orders, Tax Conventions, legislation, court decisions, and other items of general interest." It began publication in 1919. The proper citation for an item in the IRB is "YYYY-II I.R.B. PPP." The IRS ceased publication of the Cumulative Bulletin with the 2008–2 edition. All the Cumulative Bulletins are posted on the United States Government Printing Office Federal Digital System GovInfo is an official website of the United States government that houses U.S. government information. GovInfo replaces the Federal Digital System (FDsys), which in turn replaces GPOAccess, an information storage system to house electronic governm .... References External links''Internal Revenue Bulletin'' Internal Revenue Service Publications of the U ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Secretary Of The Treasury

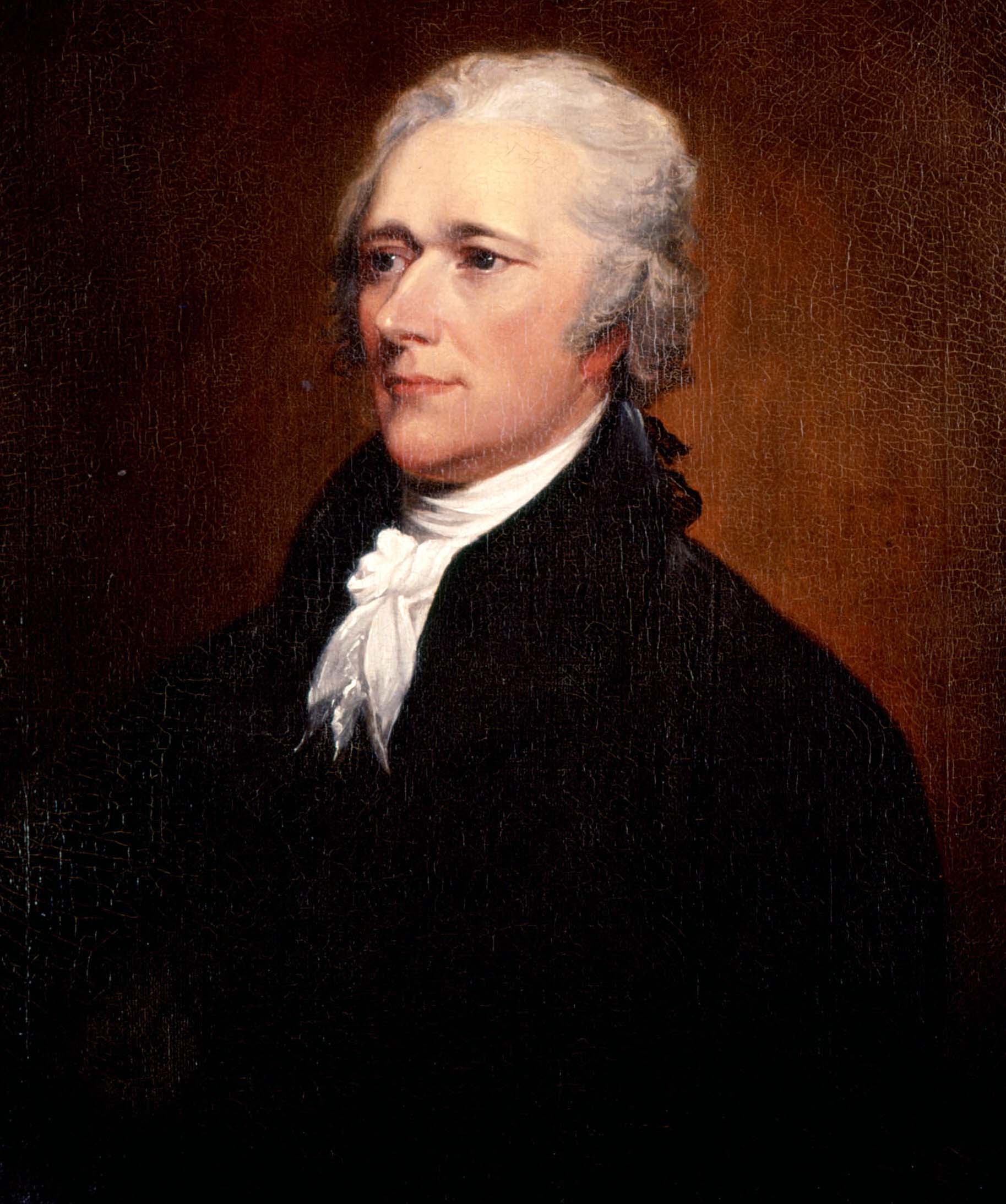

The United States secretary of the treasury is the head of the United States Department of the Treasury, and is the chief financial officer of the federal government of the United States. The secretary of the treasury serves as the principal advisor to the president of the United States on all matters pertaining to economic and fiscal policy. The secretary is a statutory member of the Cabinet of the United States, and is fifth in the presidential line of succession. Under the Appointments Clause of the United States Constitution, the officeholder is nominated by the president of the United States, and, following a confirmation hearing before the Senate Committee on Finance, is confirmed by the United States Senate. The secretary of state, the secretary of the treasury, the secretary of defense, and the attorney general are generally regarded as the four most important Cabinet officials, due to the size and importance of their respective departments. The current secretary ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)