|

History Of Taxation In The UK

The history of taxation in the United Kingdom includes the history of all collections by governments under law, in money or in kind, including collections by monarchs and lesser feudal lords, levied on persons or property subject to the government, with the primary purpose of raising revenue. Background Prior to the formation of the United Kingdom in 1707, taxation had been levied in the countries that joined to become the UK. For example, in England, King John introduced an export tax on wool in 1203 and King Edward I introduced taxes on wine in 1275. Also in England, a Poor Law tax was established in 1572 to help the deserving poor, and then changed from a local tax to a national tax in 1601. In June 1628, England's Parliament passed the Petition of Right which among other measures, prohibited the use of taxes without its agreement. This prevented the Crown from creating arbitrary taxes and imposing them upon subjects without consultation. One of the key taxes introduced by ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

John, King Of England

John (24 December 1166 – 19 October 1216) was King of England from 1199 until his death in 1216. He lost the Duchy of Normandy and most of his other French lands to King Philip II of France, resulting in the collapse of the Angevin Empire and contributing to the subsequent growth in power of the French Capetian dynasty during the 13th century. The baronial revolt at the end of John's reign led to the sealing of , a document considered an early step in the evolution of the constitution of the United Kingdom. John was the youngest of the four surviving sons of King Henry II of England and Duchess Eleanor of Aquitaine. He was nicknamed John Lackland because he was not expected to inherit significant lands. He became Henry's favourite child following the failed revolt of 1173–1174 by his brothers Henry the Young King, Richard, and Geoffrey against the King. John was appointed Lord of Ireland in 1177 and given lands in England and on the continent. He unsuccessfully atte ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Prime Minister

A prime minister, premier or chief of cabinet is the head of the cabinet and the leader of the ministers in the executive branch of government, often in a parliamentary or semi-presidential system. Under those systems, a prime minister is not the head of state, but rather the head of government, serving under either a monarch in a democratic constitutional monarchy or under a president in a republican form of government. In parliamentary systems fashioned after the Westminster system, the prime minister is the presiding and actual head of government and head/owner of the executive power. In such systems, the head of state or their official representative (e.g., monarch, president, governor-general) usually holds a largely ceremonial position, although often with reserve powers. Under some presidential systems, such as South Korea and Peru, the prime minister is the leader or most senior member of the cabinet, not the head of government. In many systems, the prime minister ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

John Major

Sir John Major (born 29 March 1943) is a British former politician who served as Prime Minister of the United Kingdom and Leader of the Conservative Party (UK), Leader of the Conservative Party from 1990 to 1997, and as Member of Parliament (United Kingdom), Member of Parliament (MP) for Huntingdon (UK Parliament constituency), Huntingdon, formerly Huntingdonshire (UK Parliament constituency), Huntingdonshire, from 1979 to 2001. Prior to becoming prime minister, he served as Foreign Secretary and Chancellor of the Exchequer in the third Thatcher government. Having left school a day before turning sixteen, Major was elected to Lambeth London Borough Council in 1968, and a decade later to parliament, where he held several junior government positions, including Parliamentary Private Secretary and Whip (politics), assistant whip. Following Margaret Thatcher's resignation in 1990, Major stood in the 1990 Conservative Party leadership election to replace her and emerged victorious, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

National Review

''National Review'' is an American conservative editorial magazine, focusing on news and commentary pieces on political, social, and cultural affairs. The magazine was founded by the author William F. Buckley Jr. in 1955. Its editor-in-chief is Rich Lowry, while the editor is Ramesh Ponnuru. Since its founding, the magazine has played a significant role in the development of conservatism in the United States, helping to define its boundaries and promoting fusionism while establishing itself as a leading voice on the American right. The online version, ''National Review Online'', is edited by Philip Klein and includes free content and articles separate from the print edition. The free content is limited, but National Review Plus allows ad-free and unlimited access to both online and print articles. History Background Before ''National Review''s founding in 1955, the American right was a largely unorganized collection of people who shared intertwining philosophies but h ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Margaret Thatcher

Margaret Hilda Thatcher, Baroness Thatcher (; 13 October 19258 April 2013) was Prime Minister of the United Kingdom from 1979 to 1990 and Leader of the Conservative Party (UK), Leader of the Conservative Party from 1975 to 1990. She was the first female British prime minister and the longest-serving British prime minister of the 20th century. As prime minister, she implemented economic policies that became known as Thatcherism. A Soviet journalist dubbed her the "Iron Lady", a nickname that became associated with her uncompromising politics and leadership style. Thatcher studied chemistry at Somerville College, Oxford, and worked briefly as a research chemist, before becoming a barrister. She was List of MPs elected in the 1959 United Kingdom general election, elected Member of Parliament for Finchley (UK Parliament constituency), Finchley in 1959 United Kingdom general election, 1959. Edward Heath appointed her Secretary of State for Education and Science in his H ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Schedular System

The schedular system of taxation is the system of how the charge to United Kingdom corporation tax is applied. It also applied to United Kingdom income tax before legislation was rewritten by the Tax Law Rewrite Project. Similar systems apply in other jurisdictions that are or were closely related to the United Kingdom, such as Ireland and Jersey. The levies to tax on income were originally set out in Schedules to the Income Tax Act. In the case of United Kingdom corporation tax, they remain for companies charged to that tax, and in the case of United Kingdom income tax, many, but not all remain. In the United Kingdom the ''source rule'' applies. This means that something is taxed only if there is a specific provision bringing it within the charge to tax. Accordingly, profits are only charged to corporation tax if they fall within one of the following, and are not otherwise exempted by an explicit provision of the Taxes Acts: The Schedules Notes: #The heads of charge listed ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Tax (Trading And Other Income) Act 2005

The Income Tax (Trading and Other Income) Act 2005 (c 5) is an Act of the Parliament of the United Kingdom. It restated certain legislation relating to income tax, with minor changes that were mainly intended "to clarify existing provisions, make them consistent or bring the law into line with well established practice." The Bill was the work of the Tax Law Rewrite Project team at the Inland Revenue.Explanatory notesparagraph 10 (and see paragraph 1 for their name)/ref> Part 1 Section 1 Section 1(2) was repealed by Part 1 of Schedule 3 to the Income Tax Act 2007. Part 2 Chapter 4 Section 51 This section was repealed by Part 1 of Schedule 3 to the Income Tax Act 2007. Section 75 Section 75(5) was repealed by paragraph 42 of the Schedule to the Finance Act 2009, Schedule 47 (Consequential Amendments) Order 2009 (SI 2009/2035). Section 79 Section 79(2) was repealed by Part 1 of Schedule 3 to the Corporation Tax Act 2009. Chapter 5 Section 88 Section 88(4)(a) was repealed by se ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income And Corporation Taxes Act 1970

Income is the consumption and saving opportunity gained by an entity within a specified timeframe, which is generally expressed in monetary terms. Income is difficult to define conceptually and the definition may be different across fields. For example, a person's income in an economic sense may be different from their income as defined by law. An extremely important definition of income is Haig–Simons income, which defines income as ''Consumption + Change in net worth'' and is widely used in economics. For households and individuals in the United States, income is defined by tax law as a sum that includes any wage, salary, profit, interest payment, rent, or other form of earnings received in a calendar year.Case, K. & Fair, R. (2007). ''Principles of Economics''. Upper Saddle River, NJ: Pearson Education. p. 54. Discretionary income is often defined as gross income minus taxes and other deductions (e.g., mandatory pension contributions), and is widely used as a basis to comp ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United Kingdom Corporation Tax

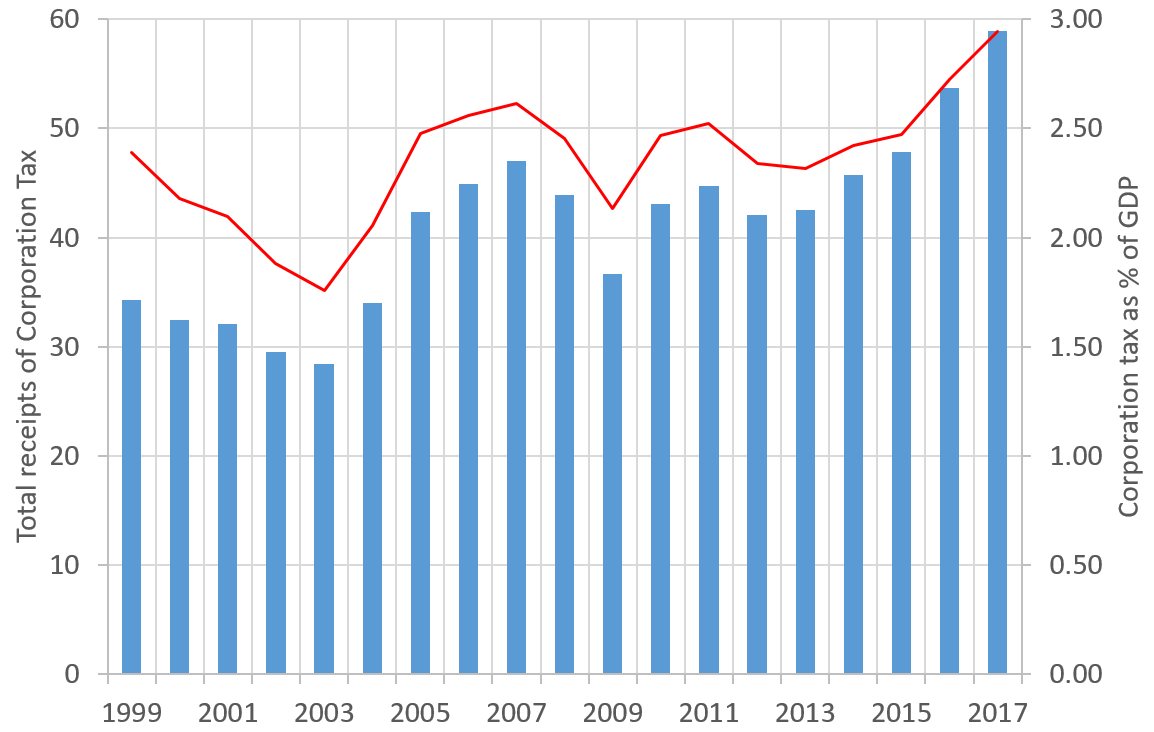

: ''Throughout this article, the term "pound" and the £ symbol refer to the Pound sterling.'' Corporation tax in the United Kingdom is a corporate tax levied in on the profits made by UK-resident companies and on the profits of entities registered overseas with permanent establishments in the UK. Until 1 April 1965, companies were taxed at the same income tax rates as individual taxpayers, with an additional profits tax levied on companies. Finance Act 1965 replaced this structure for companies and associations with a single corporate tax, which took its basic structure and rules from the income tax system. Since 1997, the UK's Tax Law Rewrite ProjectTax Law Rewrite , |

King's Remembrancer

The King's Remembrancer (or Queen's Remembrancer) is an ancient judicial post in the legal system of England and Wales. Since the Lord Chancellor no longer sits as a judge, the Remembrancer is the oldest judicial position in continual existence. The post was created in 1154 by King Henry II as the chief official in the Exchequer Court, whose purpose was "to put the Lord Treasurer and the Barons of Court in remembrance of such things as were to be called upon and dealt with for the benefit of the Crown", a primary duty being to keep records of the taxes, paid and unpaid. The first King's Remembrancer was Richard of Ilchester, a senior servant of the Crown and later Bishop of Winchester. The King's Remembrancer continued to sit in the Court of the Exchequer until its abolition in 1882. The post of King's Remembrancer is held by the Senior Master of the King's Bench Division of the High Court. Quit Rents ceremonies The Exchequer Court is reconstituted every year for the three ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)