|

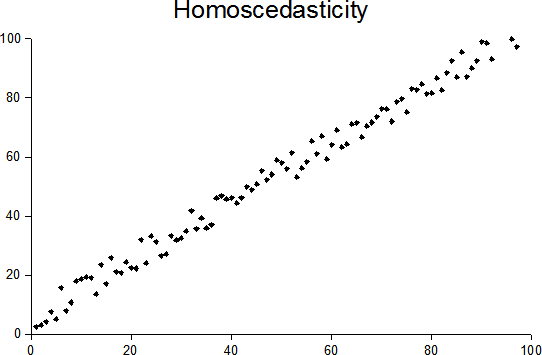

Homoscedasticity And Heteroscedasticity

In statistics, a sequence of random variables is homoscedastic () if all its random variables have the same finite variance; this is also known as homogeneity of variance. The complementary notion is called heteroscedasticity, also known as heterogeneity of variance. The spellings ''homoskedasticity'' and ''heteroskedasticity'' are also frequently used. “Skedasticity” comes from the Ancient Greek word “skedánnymi”, meaning “to scatter”. Assuming a variable is homoscedastic when in reality it is heteroscedastic () results in unbiased but inefficient point estimates and in biased estimates of standard errors, and may result in overestimating the goodness of fit as measured by the Pearson coefficient. The existence of heteroscedasticity is a major concern in regression analysis and the analysis of variance, as it invalidates statistical tests of significance that assume that the modelling errors all have the same variance. While the ordinary least squares est ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ordinary Least Squares

In statistics, ordinary least squares (OLS) is a type of linear least squares method for choosing the unknown parameters in a linear regression In statistics, linear regression is a statistical model, model that estimates the relationship between a Scalar (mathematics), scalar response (dependent variable) and one or more explanatory variables (regressor or independent variable). A mode ... model (with fixed level-one effects of a linear function of a set of explanatory variables) by the principle of least squares: minimizing the sum of the squares of the differences between the observed dependent variable (values of the variable being observed) in the input dataset and the output of the (linear) function of the independent variable. Some sources consider OLS to be linear regression. Geometrically, this is seen as the sum of the squared distances, parallel to the axis of the dependent variable, between each data point in the set and the corresponding point on the regression ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gauss–Markov Theorem

In statistics, the Gauss–Markov theorem (or simply Gauss theorem for some authors) states that the ordinary least squares (OLS) estimator has the lowest sampling variance within the class of linear unbiased estimators, if the errors in the linear regression model are uncorrelated, have equal variances and expectation value of zero. The errors do not need to be normal, nor do they need to be independent and identically distributed (only uncorrelated with mean zero and homoscedastic with finite variance). The requirement that the estimator be unbiased cannot be dropped, since biased estimators exist with lower variance. See, for example, the James–Stein estimator (which also drops linearity), ridge regression, or simply any degenerate estimator. The theorem was named after Carl Friedrich Gauss and Andrey Markov, although Gauss' work significantly predates Markov's. But while Gauss derived the result under the assumption of independence and normality, Markov r ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Scedastic Function

In probability theory and statistics, a conditional variance is the variance of a random variable given the value(s) of one or more other variables. Particularly in econometrics, the conditional variance is also known as the scedastic function or skedastic function. Conditional variances are important parts of autoregressive conditional heteroskedasticity (ARCH) models. Definition The conditional variance of a random variable ''Y'' given another random variable ''X'' is :\operatorname(Y\mid X) = \operatorname\Big(\big(Y - \operatorname(Y\mid X)\big)^\;\Big, \; X\Big). The conditional variance tells us how much variance is left if we use \operatorname(Y\mid X) to "predict" ''Y''. Here, as usual, \operatorname(Y\mid X) stands for the conditional expectation of ''Y'' given ''X'', which we may recall, is a random variable itself (a function of ''X'', determined up to probability one). As a result, \operatorname(Y\mid X) itself is a random variable (and is a function of ''X''). Exp ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Simple Linear Regression

In statistics, simple linear regression (SLR) is a linear regression model with a single explanatory variable. That is, it concerns two-dimensional sample points with one independent variable and one dependent variable (conventionally, the ''x'' and ''y'' coordinates in a Cartesian coordinate system) and finds a linear function (a non-vertical straight line) that, as accurately as possible, predicts the dependent variable values as a function of the independent variable. The adjective ''simple'' refers to the fact that the outcome variable is related to a single predictor. It is common to make the additional stipulation that the ordinary least squares (OLS) method should be used: the accuracy of each predicted value is measured by its squared '' residual'' (vertical distance between the point of the data set and the fitted line), and the goal is to make the sum of these squared deviations as small as possible. In this case, the slope of the fitted line is equal to the corre ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Autoregressive Conditional Heteroscedasticity

In econometrics, the autoregressive conditional heteroskedasticity (ARCH) model is a statistical model for time series data that describes the variance of the current error term or innovation as a function of the actual sizes of the previous time periods' error terms; often the variance is related to the squares of the previous innovations. The ARCH model is appropriate when the error variance in a time series follows an autoregressive (AR) model; if an autoregressive moving average (ARMA) model is assumed for the error variance, the model is a generalized autoregressive conditional heteroskedasticity (GARCH) model. ARCH models are commonly employed in modeling financial time series that exhibit time-varying volatility and volatility clustering, i.e. periods of swings interspersed with periods of relative calm (this is, when the time series exhibits heteroskedasticity). ARCH-type models are sometimes considered to be in the family of stochastic volatility models, although t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Nobel Memorial Prize For Economics

The Nobel Memorial Prize in Economic Sciences, officially the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel (), commonly referred to as the Nobel Prize in Economics(), is an award in the field of economic sciences administered by the Nobel Foundation, established in 1968 by Sveriges Riksbank (Sweden's central bank) to celebrate its 300th anniversary and in memory of Alfred Nobel. Although the Prize in Economic Sciences was not one of the original five Nobel Prizes established by Alfred Nobel's will, it is considered a member of the Nobel Prize system, and is administered and referred to along with the Nobel Prizes by the Nobel Foundation. Winners of the Prize in Economic Sciences are chosen in a similar manner to and announced alongside the Nobel Prize recipients, and receive the Prize in Economic Sciences at the Nobel Prize Award Ceremony. The laureates of the Prize in Economic Sciences are selected by the Royal Swedish Academy of Sciences, which ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Robert Engle

Robert Fry Engle III (born November 10, 1942) is an American economist and statistician. He won the 2003 Nobel Memorial Prize in Economic Sciences, sharing the award with Clive Granger, "for methods of analyzing economic time series with time-varying volatility ( ARCH)". Biography Engle was born in Syracuse, New York into a Quaker family and went on to graduate from Williams College with a BS in physics. He earned an MS in physics and a PhD in economics, both from Cornell University, in 1966 and 1969 respectively. After completing his PhD, Engle became an economics professor at the Massachusetts Institute of Technology from 1969 to 1977. He joined the faculty of the University of California, San Diego (UCSD) in 1975, wherefrom he retired in 2003. He now holds positions of professor emeritus and research professor at UCSD. He currently teaches at New York University, Stern School of Business where he is the Michael Armellino professor in Management of Financial Services. At ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Econometrician

Econometrics is an application of statistical methods to economic data in order to give empirical content to economic relationships. M. Hashem Pesaran (1987). "Econometrics", '' The New Palgrave: A Dictionary of Economics'', v. 2, p. 8 p. 8–22 Reprinted in J. Eatwell ''et al.'', eds. (1990). ''Econometrics: The New Palgrave''p. 1 p. 1–34Abstract ( 2008 revision by J. Geweke, J. Horowitz, and H. P. Pesaran). More precisely, it is "the quantitative analysis of actual economic phenomena based on the concurrent development of theory and observation, related by appropriate methods of inference." An introductory economics textbook describes econometrics as allowing economists "to sift through mountains of data to extract simple relationships." Jan Tinbergen is one of the two founding fathers of econometrics. The other, Ragnar Frisch, also coined the term in the sense in which it is used today. A basic tool for econometrics is the multiple linear regression model. ''Econometr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Statistical Model Specification

In statistics, model specification is part of the process of building a statistical model: specification consists of selecting an appropriate functional form for the model and choosing which variables to include. For example, given personal income y together with years of schooling s and on-the-job experience x, we might specify a functional relationship y = f(s,x) as follows: : \ln y = \ln y_0 + \rho s + \beta_1 x + \beta_2 x^2 + \varepsilon where \varepsilon is the unexplained error term that is supposed to comprise independent and identically distributed Gaussian variables. The statistician Sir David Cox has said, "How hetranslation from subject-matter problem to statistical model is done is often the most critical part of an analysis". Specification error and bias Specification error occurs when the functional form or the choice of independent variables poorly represent relevant aspects of the true data-generating process. In particular, bias (the expected value of th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Moment (mathematics)

In mathematics, the moments of a function are certain quantitative measures related to the shape of the function's graph. If the function represents mass density, then the zeroth moment is the total mass, the first moment (normalized by total mass) is the center of mass, and the second moment is the moment of inertia. If the function is a probability distribution, then the first moment is the expected value, the second central moment is the variance, the third standardized moment is the skewness, and the fourth standardized moment is the kurtosis. For a distribution of mass or probability on a bounded interval, the collection of all the moments (of all orders, from to ) uniquely determines the distribution ( Hausdorff moment problem). The same is not true on unbounded intervals ( Hamburger moment problem). In the mid-nineteenth century, Pafnuty Chebyshev became the first person to think systematically in terms of the moments of random variables. Significance of th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Expected Value

In probability theory, the expected value (also called expectation, expectancy, expectation operator, mathematical expectation, mean, expectation value, or first Moment (mathematics), moment) is a generalization of the weighted average. Informally, the expected value is the arithmetic mean, mean of the possible values a random variable can take, weighted by the probability of those outcomes. Since it is obtained through arithmetic, the expected value sometimes may not even be included in the sample data set; it is not the value you would expect to get in reality. The expected value of a random variable with a finite number of outcomes is a weighted average of all possible outcomes. In the case of a continuum of possible outcomes, the expectation is defined by Integral, integration. In the axiomatic foundation for probability provided by measure theory, the expectation is given by Lebesgue integration. The expected value of a random variable is often denoted by , , or , with a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |