|

Hearth Tax

A hearth tax was a property tax in certain countries during the medieval and early modern period, levied on each hearth, thus by proxy on wealth. It was calculated based on the number of hearths, or fireplaces, within a municipal area and is considered among the first types of progressive tax. Hearth tax was levied in the Byzantine Empire from the 9th century, France and England from the 14th century, and finally in Scotland and Ireland in the 17th century. History Byzantine Empire In the Byzantine Empire a tax on hearths, known as ''kapnikon'', was first explicitly mentioned for the reign of Nicephorus I (802–811), although its context implies that it was already then old and established and perhaps it should be taken back to the 7th century AD. Kapnikon was a tax levied on households without exceptions for the poor.Haldon, John F. (1997) ''Byzantium in the Seventh Century: the Transformation of a Culture''. Cambridge University Press. France In the 1340s especially, the Kin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Walraversijde08

Walraversijde is an abandoned medieval fishing village on the Belgian coast, near Ostend. It was rediscovered in 1992 in a dune area, near a medieval dyke. Archeological research showed that it had been occupied, in two phases, between 1200 and 1600. Walraversijde has been studied more thoroughly and more systematically than any other medieval fishing community in Europe. The village has been partially reconstructed, and has a museum, Walraversijde Museum, dedicated to the site. Discovery Walraversijde was discovered in 1992 on the Belgian coast by the archeologist Marnix Pieters. It was found in a dune area near a medieval Dyke (construction), dyke. Prior to discovery, Walraversijde was a lost village, with no obvious remains above ground. Two related sites were excavated, one on a beach and the other on a polder. The beach site was inhabited between 1200 and 1400, and the polder site was inhabited between 1400 and 1600. The excavations also found evidence of activities durin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Peter's Pence

Peter's Pence (or ''Denarii Sancti Petri'' and "Alms of St Peter") are donations or payments made directly to the Holy See of the Catholic Church. The practice began under the Saxons in England and spread through Europe. Both before and after the Norman conquest the practice varied by time and place; initially, it was done as a pious contribution, whereas later it was required by various rulers, and collected, more like a tax. Though formally discontinued in England at the time of the Reformation, a post-Reformation payment of uncertain characteristics is seen in some English manors into the 19th century. In 1871, Pope Pius IX formalized the practice of lay members of the church and "other persons of good will" providing financial support to the Roman See. Modern "Peter's Pence" proceeds are used by the Pope for philanthropic works throughout the world and for administrative costs of the Vatican state. Ancient payment (1031–1555) The term Peter's pence, in its Latin form, first ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lady Day

In the Western liturgical year, Lady Day is the traditional name in some English-speaking countries of the Feast of the Annunciation, which is celebrated on 25 March, and commemorates the visit of the archangel Gabriel to the Virgin Mary, during which he informed her that she would be the mother of Jesus Christ, the Son of God. The event being commemorated is known in the 1549 prayer book of Edward VI and the 1662 ''Book of Common Prayer'' as "The Annunciation of the (Blessed) Virgin Mary" but more accurately (as in the modern Calendar of the Church of England) termed "The Annunciation of our Lord to the Blessed Virgin Mary". It is the first of the four traditional English quarter days. The "(Our) Lady" is the Virgin Mary. The term derives from Middle English, when some nouns lost their genitive inflections. "Lady" would later gain an -s genitive ending, and therefore the name means "(Our) Lady's day". The day commemorates the tradition of archangel Gabriel's announcement t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stove

A stove or range is a device that burns fuel or uses electricity to generate heat inside or on top of the apparatus, to be used for general warming or cooking. It has evolved highly over time, with cast-iron and induction versions being developed. Stoves can be powered with many fuels, such as electricity, gasoline, wood, and coal. Due to concerns about air pollution, efforts have been made to improve stove design. Pellet stoves are a type of clean-burning stove. Air-tight stoves are another type that burn the wood more completely and therefore, reduce the amount of the combustion by-products. Another method of reducing air pollution is through the addition of a device to clean the exhaust gas, for example, a filter or afterburner. Research and development on safer and less emission releasing stoves is continuously evolving. Etymology The term "stove" is derived from the Old English word ''stofa'', indicating any individual enclosed space or room; "stove" may sometimes still ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Shilling

The shilling is a historical coin, and the name of a unit of modern currencies formerly used in the United Kingdom, Australia, New Zealand, other British Commonwealth countries and Ireland, where they were generally equivalent to 12 pence or one-twentieth of a pound before being phased out during the 20th century. Currently the shilling is used as a currency in five east African countries: Kenya, Tanzania, Uganda, Somalia, as well as the ''de facto'' country of Somaliland. The East African Community additionally plans to introduce an East African shilling. History The word ''shilling'' comes from Old English "Scilling", a monetary term meaning twentieth of a pound, from the Proto-Germanic root skiljaną meaning 'to separate, split, divide', from (s)kelH- meaning 'to cut, split.' The word "Scilling" is mentioned in the earliest recorded Germanic law codes, those of Æthelberht of Kent. There is evidence that it may alternatively be an early borrowing of Phoenician ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Michaelmas

Michaelmas ( ; also known as the Feast of Saints Michael, Gabriel, and Raphael, the Feast of the Archangels, or the Feast of Saint Michael and All Angels) is a Christian festival observed in some Western liturgical calendars on 29 September, and on 8 November in the Eastern tradition. Michaelmas has been one of the four quarter days of the English and Irish financial, judicial, and academic year. In Christian angelology, the Archangel Michael is the greatest of all the angels; he is particularly honored for defeating Lucifer in the war in heaven. History In the fifth century, a basilica near Rome was dedicated in honour of Saint Michael the Archangel on 30 September, beginning with celebrations on the eve of that day. 29 September is now kept in honour of Saint Michael and all Angels throughout some western churches. The name Michaelmas comes from a shortening of "Michael's Mass", in the same style as Christmas (Christ's Mass) and Candlemas (Candle Mass, the Mass where tr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Royal Assent

Royal assent is the method by which a monarch formally approves an act of the legislature, either directly or through an official acting on the monarch's behalf. In some jurisdictions, royal assent is equivalent to promulgation, while in others that is a separate step. Under a modern constitutional monarchy, royal assent is considered little more than a formality. Even in nations such as the United Kingdom, Norway, the Netherlands, Liechtenstein and Monaco which still, in theory, permit their monarch to withhold assent to laws, the monarch almost never does so, except in a dire political emergency or on advice of government. While the power to veto by withholding royal assent was once exercised often by European monarchs, such an occurrence has been very rare since the eighteenth century. Royal assent is typically associated with elaborate ceremony. In the United Kingdom the Sovereign may appear personally in the House of Lords or may appoint Lords Commissioners, who announce ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sir Courtenay Pole, 2nd Baronet

Sir Courtenay Pole, 2nd Baronet (1619–1695), of Shute, Devon, was an English politician, who is best remembered as the sponsor of the hearth tax, which earned him the jeering nickname "Sir Chimney Pole". Background He was the second son of Sir John Pole, 1st Baronet and his first wife Elizabeth Howe, daughter of Roger Howe of London. He was educated at Lincoln's Inn. During the Civil War, the family were divided in their loyalties: Sir John supported the Parliamentary cause, whereas both Courtenay and his elder brother William were Cavaliers. Courtenay was at Exeter when the town surrendered to the Parliamentary forces in April 1646, and paid the usual fine imposed on those who fought for the losing side. He spent the next years managing the family estates, his father having gone to live at his second wife's house at Bromley. On his father's death in 1658 (his elder brother having died in 1649) he inherited the family estate at Shute. His father held a large estate in County ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

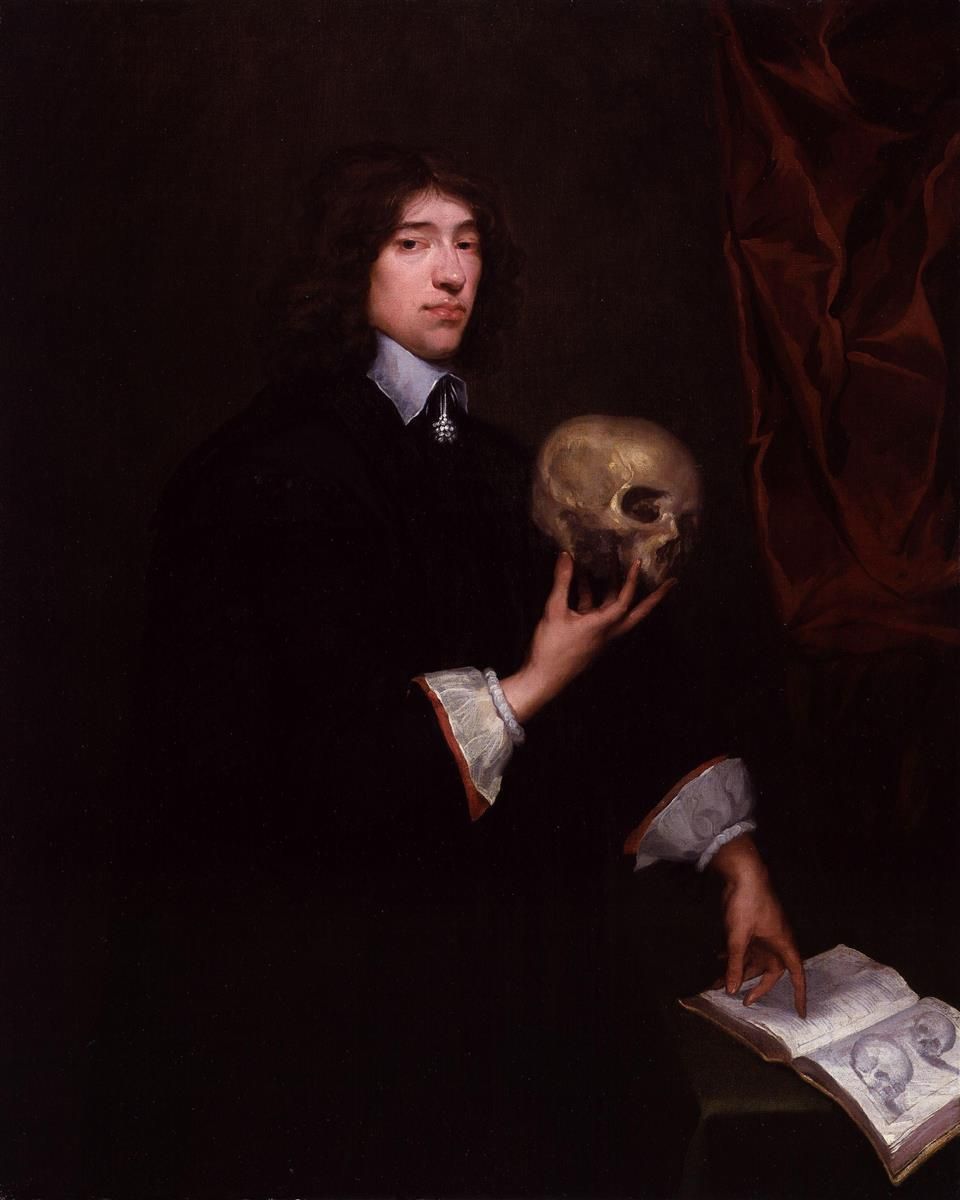

Sir William Petty

Sir William Petty FRS (26 May 1623 – 16 December 1687) was an English economist, physician, scientist and philosopher. He first became prominent serving Oliver Cromwell and the Commonwealth in Ireland. He developed efficient methods to survey the land that was to be confiscated and given to Cromwell's soldiers. He also remained a significant figure under King Charles II and King James II, as did many others who had served Cromwell. Petty was also a scientist, inventor, and merchant, a charter member of the Royal Society, and briefly a Member of the Parliament of England. However, he is best remembered for his theories on economics and his methods of ''political arithmetic''. He is attributed with originating the laissez-faire economic philosophy. He was knighted in 1661. He was the great-grandfather of the 1st Marquess of Lansdowne (better known to history as the 2nd Earl of Shelburne), who served as Prime Minister of Great Britain, 1782–1783. Life Early life Petty ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxation

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal person, legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, or national), and tax compliance refers to policy actions and individual behaviour aimed at ensuring that taxpayers are paying the right amount of tax at the right time and securing the correct tax allowances and tax reliefs. The first known taxation took place in Ancient Egypt around 3000–2800 BC. A failure to pay in a timely manner (Tax noncompliance, non-compliance), along with evasion of or resistance to taxation, is punishable by law. Taxes consist of direct tax, direct or indirect taxes and may be paid in money or as its labor equivalent. Most countries have a tax system in place, in order to pay for public, common societal, or agreed national needs and for the functions of government. Some levy a flat tax, flat percentag ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

English Restoration

The Restoration of the Stuart monarchy in the kingdoms of England, Scotland and Ireland took place in 1660 when King Charles II returned from exile in continental Europe. The preceding period of the Protectorate and the civil wars came to be known as the Interregnum (1649–1660). The term ''Restoration'' is also used to describe the period of several years after, in which a new political settlement was established. It is very often used to cover the whole reign of King Charles II (1660–1685) and often the brief reign of his younger brother King James II (1685–1688). In certain contexts it may be used to cover the whole period of the later Stuart monarchs as far as the death of Queen Anne and the accession of the Hanoverian King George I in 1714. For example, Restoration comedy typically encompasses works written as late as 1710. The Protectorate After Richard Cromwell, Lord Protector from 1658 to 1659, ceded power to the Rump Parliament, Charles Fleetwood and J ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Charles II Of England

Charles II (29 May 1630 – 6 February 1685) was King of Scotland from 1649 until 1651, and King of England, Scotland and Ireland from the 1660 Restoration of the monarchy until his death in 1685. Charles II was the eldest surviving child of Charles I of England, Scotland and Ireland and Henrietta Maria of France. After Charles I's execution at Whitehall on 30 January 1649, at the climax of the English Civil War, the Parliament of Scotland proclaimed Charles II king on 5 February 1649. But England entered the period known as the English Interregnum or the English Commonwealth, and the country was a de facto republic led by Oliver Cromwell. Cromwell defeated Charles II at the Battle of Worcester on 3 September 1651, and Charles fled to mainland Europe. Cromwell became virtual dictator of England, Scotland and Ireland. Charles spent the next nine years in exile in France, the Dutch Republic and the Spanish Netherlands. The political crisis that followed Cromwell's death in 1 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |