|

Healthcare Travel Costs Scheme

The Healthcare Travel Costs Scheme was established across the United Kingdom National Health Service in 1988. Patients and their children in receipt of means tested benefits, or on a low income, could get help with the cost of travel to hospital appointments. It does not apply to primary care or community services and it does not apply to visitors. History The legal basis was the National Health Service (Travelling Expenses and Remission of Charges) Regulations SI no 551 of 1988. Before 1988 there was a scheme but there was no statutory basis and the costs incurred were met centrally. From 1988 Health Authorities met the cost of expenditure. Subsequently costs were transferred to NHS trusts. New regulations were introduced by the National Health Service (Travel Expenses and Remission of Charges) Regulations 2003. People who qualified for Income Support or Family Credit qualified for payment of full fares. Others could apply for remission with a means test based on the Income Su ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

National Health Service

The National Health Service (NHS) is the umbrella term for the publicly funded healthcare systems of the United Kingdom (UK). Since 1948, they have been funded out of general taxation. There are three systems which are referred to using the "NHS" name ( NHS England, NHS Scotland and NHS Wales). Health and Social Care in Northern Ireland was created separately and is often locally referred to as "the NHS". The four systems were established in 1948 as part of major social reforms following the Second World War. The founding principles were that services should be comprehensive, universal and free at the point of delivery—a health service based on clinical need, not ability to pay. Each service provides a comprehensive range of health services, free at the point of use for people ordinarily resident in the United Kingdom apart from dental treatment and optical care. In England, NHS patients have to pay prescription charges; some, such as those aged over 60 and certain state ben ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pension Credit

Pension Credit is the principal element of the UK welfare system for people of pension age. It is intended to supplement the UK State Pension, or to replace it (for example, if the claimant did not meet the conditions to claim a State Pension). It was introduced in the UK in 2003 by Gordon Brown, then Chancellor of the Exchequer. It has been subject to a number of changes over its existence, but has the core aim of lifting retired people of limited means out of poverty. Eligibility may be estimated on a government website. Original core elements The scheme was introduced to replace the ''Minimum Income Guarantee'', which had been introduced in 1997, also by Gordon Brown. This combined the existing ''applicable amount'' (of benefit) in Income Support, together with the ''Pensioner Premium'', which was itself substantially increased; these changes gave the impression of a new, more generous benefit package aimed at pensioners. Pension Credit has two elements: *Guarantee Credit i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

National Health Service Hospital Parking

In the United Kingdom, various NHS hospitals charge patients and staff for parking. In Scotland and Wales car parking fees were largely abolished in 2008. , NHS organisations in England may optionally charge patients, visitors or staff for parking, the temporary suspension of fees during COVID-19 having been lifted. The cost of hospital parking is a controversial topic, with opponents in England criticising the charges. Rationale for parking charges The cost of running secure car parking is substantial. If a surplus is generated it is used to pay for healthcare. In many hospital sites there is a shortage of car parking space and making it free will encourage people to come to hospital by car without generating any extra space. Where hospital parking is already free it may be used by people who are not visiting the hospital, and it does nothing to discourage the inappropriate use of cars. Many NHS car park have been funded under PFI arrangements, with a private operator funding ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Poor Law

In English and British history, poor relief refers to government and ecclesiastical action to relieve poverty. Over the centuries, various authorities have needed to decide whose poverty deserves relief and also who should bear the cost of helping the poor. Alongside ever-changing attitudes towards poverty, many methods have been attempted to answer these questions. Since the early 16th century legislation on poverty enacted by the English Parliament, poor relief has developed from being little more than a systematic means of punishment into a complex system of government-funded support and protection, especially following the creation in the 1940s of the welfare state. Tudor era In the late 15th century, parliament took action on the growing problem of poverty, focusing on punishing people for being "vagabonds" and for begging. In 1495, during the reign of King Henry VII, Parliament enacted the Vagabond Act. This provided for officers of the law to arrest and hold "all such ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Clinical Commissioning Group

Clinical commissioning groups (CCGs) were NHS organisations set up by the Health and Social Care Act 2012 to organise the delivery of NHS services in each of their local areas in England. On 1 July 2022 they were abolished and replaced by Integrated care systems as a result of the Health and Care Act 2022. Establishment The announcement that GPs would take over this commissioning role was made in the 2010 white paper "Equity and Excellence: Liberating the NHS". This was part of the government's stated desire to create a clinically-driven commissioning system that was more sensitive to the needs of patients. The 2010 white paper became law under the Health and Social Care Act 2012 in March 2012. At the end of March 2013 there were 211 CCGs, but a series of mergers had reduced the number to 135 by April 2020. To a certain extent they replaced primary care trusts (PCTs), though some of the staff and responsibilities moved to local authority public health teams when PCTs ceased to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

NHS England

NHS England, officially the NHS Commissioning Board, is an executive non-departmental public body of the Department of Health and Social Care. It oversees the budget, planning, delivery and day-to-day operation of the commissioning side of the National Health Service in England as set out in the Health and Social Care Act 2012. It directly commissions NHS general practitioners, dentists, optometrists and some specialist services. The Secretary of State publishes annually a document known as the ''NHS mandate'' which specifies the objectives which the Board should seek to achieve. National Health Service (Mandate Requirements) Regulations are published each year to give legal force to the mandate. In 2018 it was announced that the organisation, while maintaining its statutory independence, would be merged with NHS Improvement, and seven "single integrated regional teams" would be jointly established. History NHS England is the operating name of the NHS Commissioning Board and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

NHS Low Income Scheme

The NHS Low Income Scheme is intended to reduce the cost of NHS prescription charges, NHS dentistry, sight tests, glasses and contact lenses, necessary costs of travel to receive NHS treatment, NHS wigs and fabric supports, i.e. spinal or abdominal supports or surgical brassieres supplied through a hospital. It is administered by the NHS Business Services Authority. It is not necessary to be in receipt of any benefits in order to qualify. An online application system was under trial in 2022. It is restricted to people who do not have capital or savings of over £6,000. Tax credits People entitled to most means-tested benefits do not need to use the scheme as they are exempt from these charges. People who receive working tax credit or child tax credit are automatically assessed and, if entitled, issued with an NHS Tax Credit Exemption Certificate. Tax credit beneficiaries with an income of less than £15,276 (2013 figure), people who receive working tax credit and child tax cre ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Universal Credit

Universal Credit is a United Kingdom social security payment. It is means-tested and is replacing and combining six benefits for working-age households with a low income: income-related Employment and Support Allowance, income-based Jobseeker's Allowance, and Income Support; Child Tax Credit and Working Tax Credit; and Housing Benefit. An award of UC is made up of different elements, which become payable to the claimant if relevant criteria apply: a standard allowance for singles or couples, child elements and disabled child elements for children in the household, housing cost element, childcare costs element, as well as elements for being a carer or having an illness or disability and therefore having limited capability to work. The new policy was announced in 2010 at the Conservative Party annual conference by the Work and Pensions Secretary, Iain Duncan Smith, who said it would make the social security system fairer to claimants and taxpayers. At the same venue the Welfare R ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Child Tax Credit

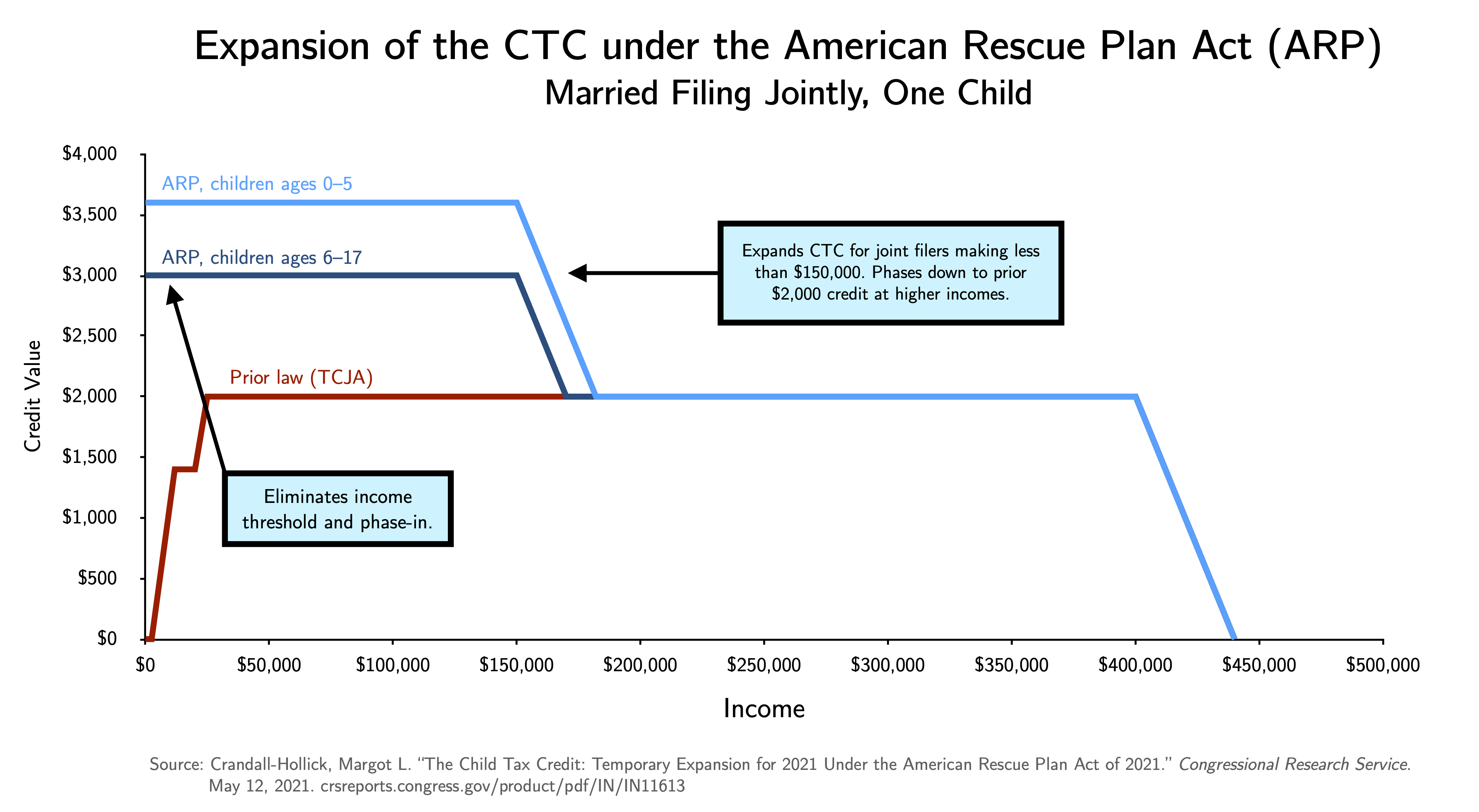

A child tax credit (CTC) is a tax credit for parents with dependent children given by various countries. The credit is often linked to the number of dependent children a taxpayer has and sometimes the taxpayer's income level. For example, in the United States, only families making less than $400,000 per year may claim the full CTC. Similarly, in the United Kingdom, the tax credit is only available for families making less than £42,000 per year. Germany Germany has a programme called the which, despite technically being a tax exemption and not a tax credit, functions similarly. The child allowance is an allowance in German tax law, in which a certain amount of money is tax-free in the taxation of parents. In the income tax fee paid, child benefit and tax savings through the child tax credit are compared against each other, and the parents pay whichever results in the lesser amount of tax. United Kingdom In the United Kingdom, a family with children and an income below about ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

District Health Authority

A district health authority was an administrative territorial entity of the National Health Service in England and Wales introduced by the National Health Service Reorganisation Act 1973. District health authorities existed in Britain from 1974 to 1996. Until 1982 there was a tier above them – the area health authority. There were 205 when they were established in 1974, but some were later amalgamated. In 1979 there were 199. The districts were a third-tier below the regional health authority and the area health authority (which generally corresponded to non-metropolitan counties, metropolitan boroughs or groups of London boroughs) and the district management teams that ran the hospitals on a day-to-day basis. The most common complaint in evidence about the reorganisation of the NHS made to the Royal Commission on the National Health Service in 1979 was that it added an extra and unnecessary tier of management. Each district health authority worked alongside a family health s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Working Tax Credit

Working Tax Credit (WTC) is a state benefit in the United Kingdom made to people who work and have a low income. It was introduced in April 2003 and is a means-tested benefit. Despite their name, tax credits are not to be confused with tax credits linked to a person's tax bill, because they are used to top-up wages. Unlike most other benefits, it is paid by HM Revenue and Customs (HMRC). WTC can be claimed by working individuals, childless couples and working families with dependent children. In addition, people may also be entitled to Child Tax Credit (CTC) if they are responsible for any children. WTC and CTC are assessed jointly and families remain eligible for CTC even if where no adult is working or they have too much income to receive WTC. In 2010 the coalition government announced that the Working Tax Credit would, by 2017, be integrated into and replaced by the new Universal Credit. However implementation of this has been repeatedly delayed and will not be finished unt ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Employment And Support Allowance

Employment is a relationship between two parties regulating the provision of paid labour services. Usually based on a contract, one party, the employer, which might be a corporation A corporation is an organization—usually a group of people or a company—authorized by the state to act as a single entity (a legal entity recognized by private and public law "born out of statute"; a legal person in legal context) and r ..., a not-for-profit organization, a co-operative, or any other entity, pays the other, the employee, in return for carrying out assigned work. Employees work in return for wages, which can be paid on the basis of an hourly rate, by piecework or an annual salary, depending on the type of work an employee does, the prevailing conditions of the sector and the bargaining power between the parties. Employees in some sectors may receive gratuity, gratuities, bonus payments or employee stock option, stock options. In some types of employment, employees may re ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |