|

Hang Seng China A Industry Top Index

Hang Seng China A Industry Top Index (HSCAIT) is one of the Hong Kong stock market indexes produced by the Hang Seng Indexes Company Limited. HSCAIT was launched on 21 Sep 2009. It is used to reflect the performance of A-share index that captures all the industry leaders in mainland China. The performance of industry leaders in each of the 11 industries under the Hang Seng Industry Classification System is tracked through this index. Features Key features of HSCATT include the following: *Reflects the performance of leading companies in each of the 11 industries under the Hang Seng Industry Classification System *It is the first A-share index that adopts both market capitalisation and fundamental factors such as revenues and net profits as the constituent stocks selection criteria *Up to a maximum of five companies are selected from each industry *It has a more balanced industry distribution and offers a more diversified exposure to the A-share market *Stocks are freefloat-adjust ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hang Seng Indexes Company Limited

Hang Seng Indexes Company Limited (HSI) is a private company in Hong Kong and wholly owned by Hang Seng Bank. HSI was founded in 1984 and is the major provider of stock market indexes on Hong Kong and China stock markets such as in Shanghai and Shenzhen. Products HSI produces stock market indexes under 5 categories: *Market Cap-weighted Indexes *Factor & Strategy Indexes *Sector Indexes *Sustainability Indexes *Fixed Income Indexes Currently, the HSI produced indexes comprises over 400 real-time and daily indexes. The most famous and popular referenced is the Hang Seng Index. New Index Launch 2011 In February, HSI launched the HSI Volatility index or "VHSI". This index models on the lines of the Chicago Board Options Exchange VIX index. VHSI measures the 30-calendar-day expected volatility of the Hang Seng index using prices of options traded on the index. 2017 In November, HSI has launched three Stock Connect Hong Kong Indexes. 2018 In January, HSI has launched Hang Sen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

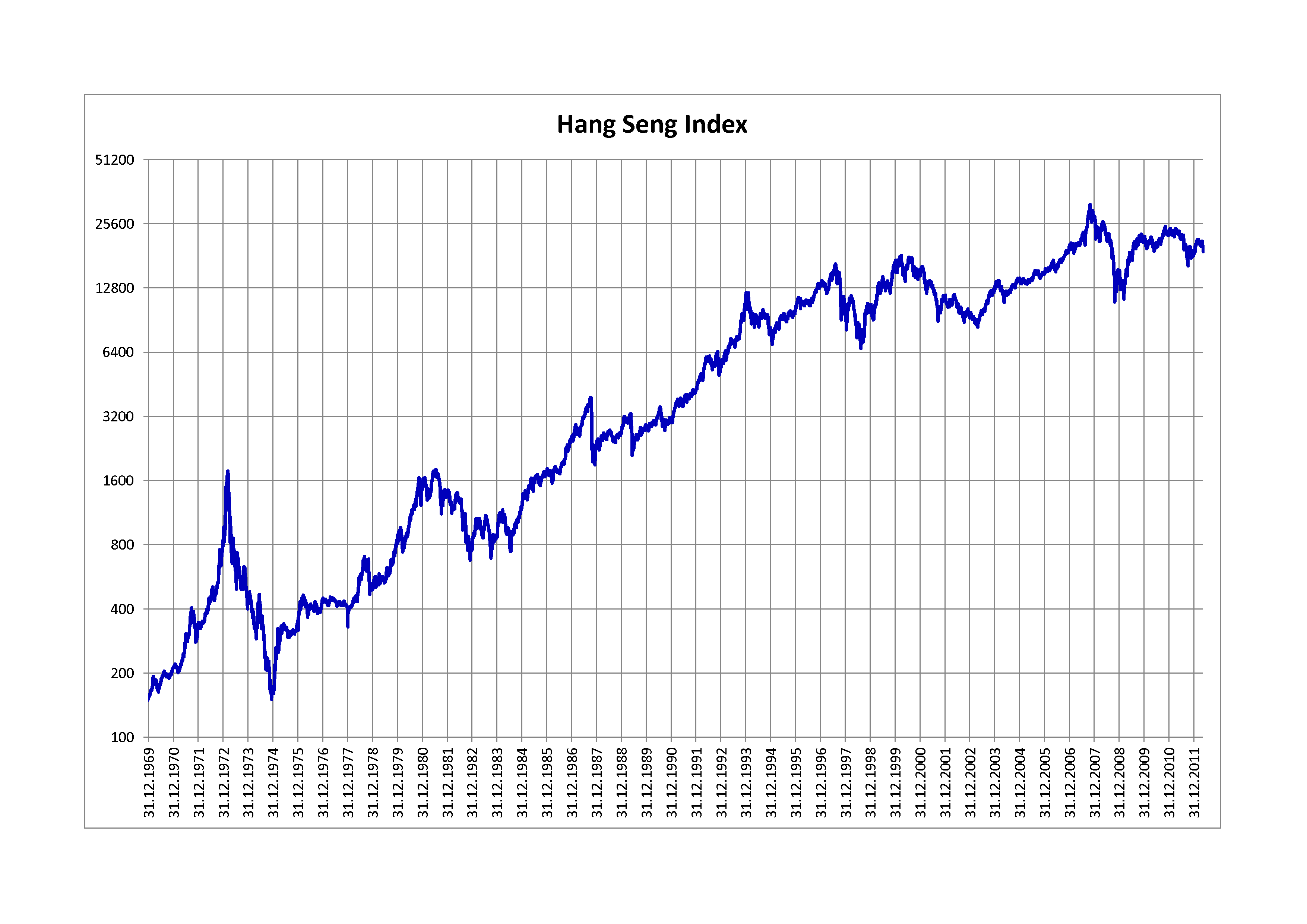

Hang Seng Index

The Hang Seng Index (HSI) is a freefloat-adjusted market- capitalization-weighted stock-market index in Hong Kong. It is used to record and monitor daily changes of the largest companies of the Hong Kong stock market and is the main indicator of the overall market performance in Hong Kong. These 66 constituent companies represent about 58% of the capitalisation of the Hong Kong Stock Exchange. HSI was started on November 24, 1969, and is currently compiled and maintained by Hang Seng Indexes Company Limited, which is a wholly owned subsidiary of Hang Seng Bank, one of the largest banks registered and listed in Hong Kong in terms of market capitalisation. It is responsible for compiling, publishing and managing the Hang Seng Index and a range of other stock indexes, such as ''Hang Seng China Enterprises Index'', ''Hang Seng China AH Index Series'', '' Hang Seng China H-Financials Index'', ''Hang Seng Composite Index Series'', ''Hang Seng China A Industry Top Index'', ''Hang Sen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hang Seng Composite Index

The Hang Seng Composite Index is a stock market index of the Stock Exchange of Hong Kong and was launched in 2001. It offers an equivalent of Hong Kong market benchmark that covers around the top 95th percentile of the total market capitalisation of companies listed on the Main Board of the Stock Exchange of Hong Kong (“SEHK”). Its index calculation adopts the freefloat-adjusted market capitalisation methodology, and can be used as a basis for index funds, mutual funds as well as performance benchmarks. Its arguable that the composite index is a better reflection on the overall market performance than the more popular Hang Seng Index, which only cover 50 stocks as opposed to over 480 stocks in the composite index. Sub-index The Hang Seng Composite Index can be further dividend into 2 group of indexes : 1 on industry sector and 1 on market capitalisation. Industry sector index series There are 11 sub-indexes per industry sector: *Energy *Materials *Industrial Goods *Consumer ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |