|

Hammer Price

In auctions, the buyer's premium is a charge in addition to the hammer price (i.e. the winning bid announced) of an auction item, or lot. The winning bidder is required to pay both the hammer price and the percentage of that price called for by the buyer's premium. It is charged by the auctioneer in addition to the commission which has always been charged by auction houses to sellers. One hundred per cent of the "buyer's premium" is retained by the auction house and is not shared with the item's seller. Major auction houses have levied the buyer's premium for several decades, particularly in fine art auctions, with percentages in the region of 10–30%. In real estate auctions in many European countries, the buyer's premium, if charged at all, is much less (2–2.5%). More recently in the UK, however, foreclosure properties have been offered without fee to the seller, but with a buyer's premium of 10%. The buyer's premium has been characterized by auction houses as a necessary co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Auctions

An auction is usually a process of buying and selling goods or services by offering them up for bids, taking bids, and then selling the item to the highest bidder or buying the item from the lowest bidder. Some exceptions to this definition exist and are described in the section about different types. The branch of economic theory dealing with auction types and participants' behavior in auctions is called auction theory. The open ascending price auction is arguably the most common form of auction and has been used throughout history. Participants bid openly against one another, with each subsequent bid being higher than the previous bid. An auctioneer may announce prices, while bidders submit bids vocally or electronically. Auctions are applied for trade in diverse contexts. These contexts include antiques, paintings, rare collectibles, expensive wines, commodities, livestock, radio spectrum, used cars, real estate, online advertising, vacation packages, emission trading ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Commission (remuneration)

Commissions are a form of variable-pay remuneration for services rendered or products sold. Commissions are a common way to motivate and reward salespeople. Commissions can also be designed to encourage specific sales behaviors. For example, commissions may be reduced when granting large discounts. Or commissions may be increased when selling certain products the organization wants to promote. Commissions are usually implemented within the framework on a sales incentive program, which can include one or multiple commission plans (each typically based on a combination of territory, position, or products). Payments are often calculated using a percentage of revenue, a way for firms to solve the principal–agent problem by attempting to realign employees' interests with those of the firm. However, models other than percentages are possible, such as profit-based approaches, or bonus-based approaches. Commissions allow sales personnel to be paid (in part or entirely) based on products o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Real Estate

Real estate is property consisting of land and the buildings on it, along with its natural resources such as crops, minerals or water; immovable property of this nature; an interest vested in this (also) an item of real property, (more generally) buildings or housing in general."Real estate": Oxford English Dictionary online: Retrieved September 18, 2011 In terms of law, ''real'' is in relation to land property and is different from personal property while ''estate'' means the "interest" a person has in that land property. Real estate is different from personal property, which is not permanently attached to the land, such as vehicles, boats, jewelry, furniture, tools and the rolling stock of a farm. In the United States, the transfer, owning, or acquisition of real estate can be through business corporations, individuals, nonprofit corporations, fiduciaries, or any legal entity as seen within the law of each U.S. state. History of real estate The natural right of a person t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

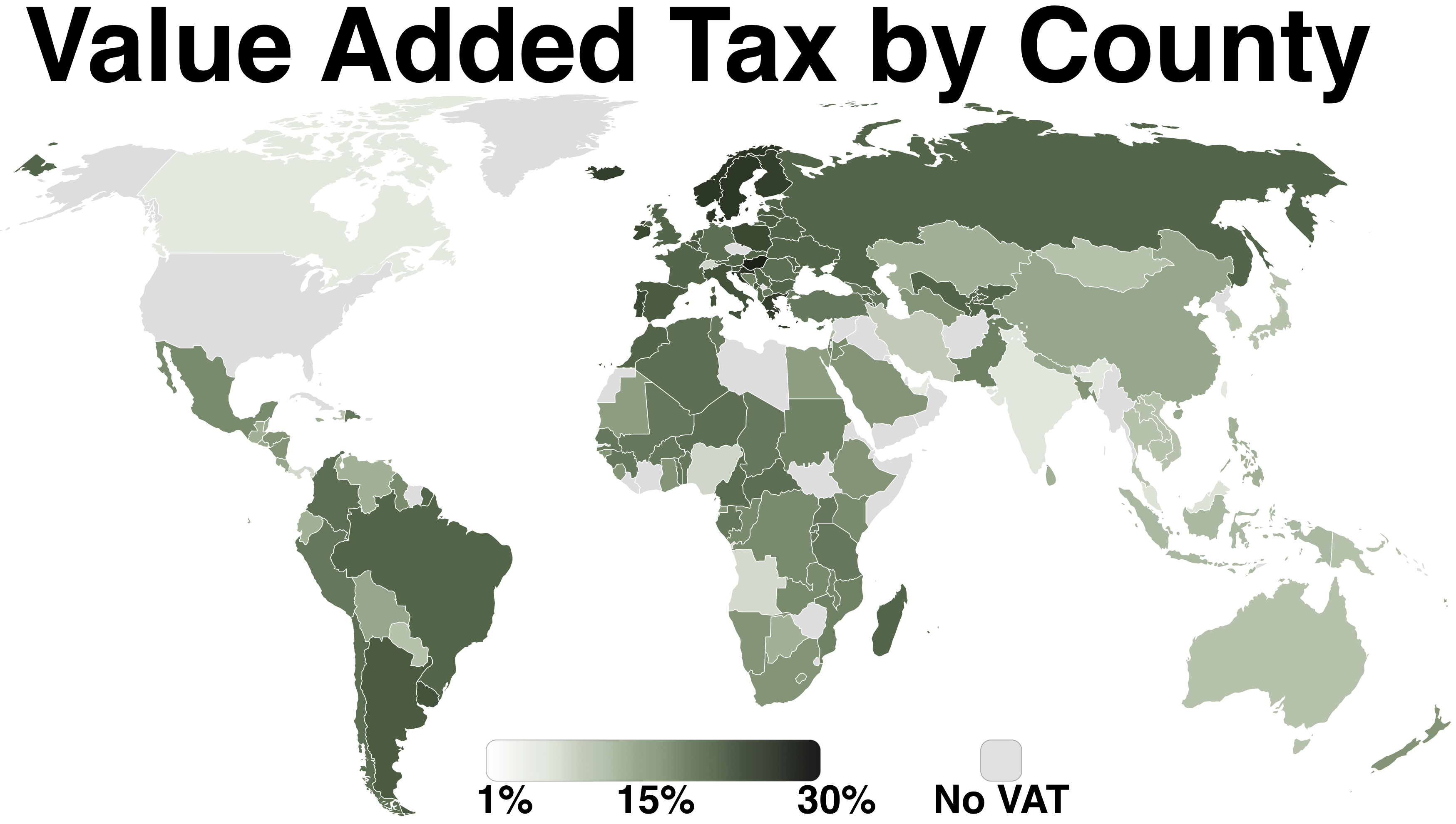

Value-added Tax

A value-added tax (VAT), known in some countries as a goods and services tax (GST), is a type of tax that is assessed incrementally. It is levied on the price of a product or service at each stage of production, distribution, or sale to the end consumer. If the ultimate consumer is a business that collects and pays to the government VAT on its products or services, it can reclaim the tax paid. It is similar to, and is often compared with, a sales tax. VAT is an indirect tax because the person who ultimately bears the burden of the tax is not necessarily the same person as the one who pays the tax to the tax authorities. Not all localities require VAT to be charged, and exports are often exempt. VAT is usually implemented as a destination-based tax, where the tax rate is based on the location of the consumer and applied to the sales price. The terms VAT, GST, and the more general consumption tax are sometimes used interchangeably. VAT raises about a fifth of total tax revenues bo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sales Tax

A sales tax is a tax paid to a governing body for the sales of certain goods and services. Usually laws allow the seller to collect funds for the tax from the consumer at the point of purchase. When a tax on goods or services is paid to a governing body directly by a consumer, it is usually called a use tax. Often laws provide for the exemption of certain goods or services from sales and use tax, such as food, education, and medicines. A value-added tax (VAT) collected on goods and services is related to a sales tax. See Comparison with sales tax for key differences. Types Conventional or retail sales tax is levied on the sale of a good to its final end-user and is charged every time that item is sold retail. Sales to businesses that later resell the goods are not charged the tax. A purchaser who is not an end-user is usually issued a "resale certificate" by the taxing authority and required to provide the certificate (or its ID number) to a seller at the point of purchase, al ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Augustus

Caesar Augustus (born Gaius Octavius; 23 September 63 BC – 19 August AD 14), also known as Octavian, was the first Roman emperor; he reigned from 27 BC until his death in AD 14. He is known for being the founder of the Roman Principate, which is the first phase of the Roman Empire, and Augustus is considered one of the greatest leaders in human history. The reign of Augustus initiated an imperial cult as well as an era associated with imperial peace, the ''Pax Romana'' or ''Pax Augusta''. The Roman world was largely free from large-scale conflict for more than two centuries despite continuous wars of imperial expansion on the empire's frontiers and the year-long civil war known as the "Year of the Four Emperors" over the imperial succession. Originally named Gaius Octavius, he was born into an old and wealthy equestrian branch of the plebeian ''gens'' Octavia. His maternal great-uncle Julius Caesar was assassinated in 44 BC, and Octavius was named in Caesar' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Christie's

Christie's is a British auction house founded in 1766 by James Christie (auctioneer), James Christie. Its main premises are on King Street, St James's in London, at Rockefeller Center in New York City and at Alexandra House in Hong Kong. It is owned by Groupe Artémis, the holding company of François-Henri Pinault. Sales in 2015 totalled £4.8 billion (US$7.4 billion). In 2017, the ''Salvator Mundi (Leonardo), Salvator Mundi'' was sold for $400 million at Christie's in New York, at the time List of most expensive paintings, the highest price ever paid for a single painting at an auction. History Founding The official company literature states that founder James Christie (auctioneer), James Christie (1730–1803) conducted the first sale in London, England, on 5 December 1766, and the earliest auction catalogue the company retains is from December 1766. However, other sources note that James Christie rented auction rooms from 1762, and newspaper advertisements for Christi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sotheby's

Sotheby's () is a British-founded American multinational corporation with headquarters in New York City. It is one of the world's largest brokers of fine and decorative art, jewellery, and collectibles. It has 80 locations in 40 countries, and maintains a significant presence in the UK. Sotheby's was established on 11 March 1744 in London by Samuel Baker, a bookseller. In 1767 the firm became Baker & Leigh, after George Leigh became a partner, and was renamed to Leigh and Sotheby in 1778 after Baker's death when Leigh's nephew, John Sotheby, inherited Leigh's share. Other former names include: Leigh, Sotheby and Wilkinson; Sotheby, Wilkinson and Hodge (1864–1924); Sotheby and Company (1924–83); Mssrs Sotheby; Sotheby & Wilkinson; Sotheby Mak van Waay; and Sotheby's & Co. The American holding company was initially incorporated in August 1983 in Michigan as Sotheby's Holdings, Inc. In June 2006, it was reincorporated in the State of Delaware and was renamed Sotheby's. In Ju ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

_001.jpg)