|

Gjensidige People

Gjensidige Forsikring ASA is a Norwegian insurance company. The company traces its roots back to 1816 when a fire mutual was founded as ''Land Gjensidige Brandkasse'' in what is today Innlandet county. Gjensidige demutualised and listed on the Oslo Stock Exchange in December 2010. The firm, headquartered in Oslo, has a market share of some 26% (2021) in the Norwegian insurance market. The company has 36 branch offices in Norway, not including affiliated fire mutuals, and 1 million customers. Gjensidige has subsidiaries in Denmark, Sweden and The Baltics. The company offers all kinds of insurance for retail customers, agriculture and business. It also offers pensions and savings products. History Although the company traces its roots back to 1816, the brand name Gjensidige originates from the life insurance company Christiania almindelige gjensidige forsørgelsesanstalt that was established in 1847. In the early 1970s the p&c-company traded under the name Samtrygd, whereas th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Allmennaksjeselskap

''Aksjeselskap'' is the Norwegian term for a stock-based company. It is usually abbreviated AS, historically often written as A/S. An AS is always a limited company, i.e. the owners cannot be held liable for any debt beyond the stock capital. Public companies are called Allmennaksjeselskap (ASA), while companies without limited liability are called ''Ansvarlig selskap'' (ANS). All AS companies must have a stock capital of at least NOK 30,000. In addition, they must have a board of directors, depending on the size of turnover, balance sheet total or number of employees, an auditor. They may appoint a managing director (MD) or chief executive (CEO). If the company has assets exceeding NOK 3 million, the board must have at least three members and cannot be chaired by the MD/CEO. Practically all Norwegian companies have a fiscal year from January to December, but some foreign subsidiaries may have a different fiscal year, as is allowed, to match the parent corporation. The A ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Property Insurance

Property insurance provides protection against most risks to property, such as fire, theft and some weather damage. This includes specialized forms of insurance such as fire insurance, flood insurance, earthquake insurance, home insurance, or boiler insurance. Property is insured in two main ways—open perils and named perils. Open perils cover all the causes of loss not specifically excluded in the policy. Common exclusions on open peril policies include damage resulting from earthquakes, floods, nuclear incidents, acts of terrorism, and war. Named perils require the actual cause of loss to be listed in the policy for insurance to be provided. The more common named perils include such damage-causing events as fire, lightning, explosion, cyber-attack, and theft. History Property insurance can be traced to the Great Fire of London, which in 1666 devoured more than 13,000 houses. The devastating effects of the fire converted the development of insurance "from a matter of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gjensidige NOR

Gjensidige NOR was a Norwegian bank and insurance company that was in existence between 1999 and 2003. The company was created when the two savings banks Sparebanken NOR (bank) and Gjensidige (insurance) were merged in 1999. In 2002 Norwegian savings banks were allowed to become public limited company and was listed on the Oslo Stock Exchange. In 2003 the company was merged with Den norske Bank to form DnB NOR DNB ASA (formerly DnB NOR ASA) is Norway's largest financial services group with total combined assets of more than NOK 1.9 trillion and a market capitalisation NOK 164 billion as of 20 May 2016. DNB's head office is located in Oslo. The two l ..., while the original insurance company Gjensidige was demerged and again became a separate company in 2005. When the company was made a public limited company, a foundation was created to own part of the corporation, which still exists as Sparebankstiftelsen DnB NOR and owns 10.95% of DnB NOR. After the demerger, Gjensidige ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sparebanken NOR

Union Bank of Norway branded as Sparebanken NOR was Norway's largest savings bank between 1990 and 1999. The bank was created as a merger between Sparebanken ABC and four other regional savings banks. The new bank had its headquarters in Oslo and was in existence until 1999 when it merged with Gjensidige to form Gjensidige NOR. Today the bank is part of DnB NOR. The bank was primarily concentrated around Eastern Norway where the original five banks had branches in Akershus, Buskerud, Oslo, Vestfold and Østfold in addition to offices in Bergen, Bodø, Kristiansand, Tromsø, Trondheim and Vadsø in addition to Luxembourg Luxembourg ( ; lb, Lëtzebuerg ; french: link=no, Luxembourg; german: link=no, Luxemburg), officially the Grand Duchy of Luxembourg, ; french: link=no, Grand-Duché de Luxembourg ; german: link=no, Großherzogtum Luxemburg is a small land .... External links DnB NOR corporate web site Defunct banks of Norway Companies formerly listed on the Oslo S ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. Because banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of regulation over banks. Most countries have institutionalized a system known as fractional reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but in many ways functioned as a continuation of ideas and concepts of credit and lending that had their roots in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Samtrygd

Samtrygd was an insurance company based in Oslo, Norway. It was founded as Samtrygd, Norsk Gjensidige Forsikringsforening in 1922 as a reinsurance company for 260 smaller fire treasuries. From 1958 it developed several types of general insurance General insurance or non-life insurance policy, including automobile and homeowners policies, provide payments depending on the loss from a particular financial event. General insurance is typically defined as any insurance that is not determine .... It shared manager with the car insurance Norsk Bilforsikring Gjensidige for many years, merging in 1974. In the same year, it started a cooperation with the life insurance company Livsforsikringsselskapet Gjensidige, and in 1976 the Gjensidige name and logo became the sole in use. CEOs and chairs The chief executives and board chairmen of Samtrygd were: ;Chief executives *1922-1941: Hjalmar Steenstrup *1941-1958: A. H. Andersen *1958: Rolf Løchen (acting) *1958-1984: Jæger Dokk (from ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Savings

Wealth is the abundance of valuable financial assets or physical possessions which can be converted into a form that can be used for transactions. This includes the core meaning as held in the originating Old English word , which is from an Indo-European word stem. The modern concept of wealth is of significance in all areas of economics, and clearly so for growth economics and development economics, yet the meaning of wealth is context-dependent. An individual possessing a substantial net worth is known as ''wealthy''. Net worth is defined as the current value of one's assets less liabilities (excluding the principal in trust accounts). At the most general level, economists may define wealth as "the total of anything of value" that captures both the subjective nature of the idea and the idea that it is not a fixed or static concept. Various definitions and concepts of wealth have been asserted by various individuals and in different contexts.Denis "Authentic Development: Is ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pensions

A pension (, from Latin ''pensiō'', "payment") is a fund into which a sum of money is added during an employee's employment years and from which payments are drawn to support the person's retirement from work in the form of periodic payments. A pension may be a "defined benefit plan", where a fixed sum is paid regularly to a person, or a "defined contribution plan", under which a fixed sum is invested that then becomes available at retirement age. Pensions should not be confused with severance pay; the former is usually paid in regular amounts for life after retirement, while the latter is typically paid as a fixed amount after involuntary termination of employment before retirement. The terms "retirement plan" and "superannuation" tend to refer to a pension granted upon retirement of the individual. Retirement plans may be set up by employers, insurance companies, the government, or other institutions such as employer associations or trade unions. Called ''retirement plans'' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Insurance

Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss. An entity which provides insurance is known as an insurer, insurance company, insurance carrier, or underwriter. A person or entity who buys insurance is known as a policyholder, while a person or entity covered under the policy is called an insured. The insurance transaction involves the policyholder assuming a guaranteed, known, and relatively small loss in the form of a payment to the insurer (a premium) in exchange for the insurer's promise to compensate the insured in the event of a covered loss. The loss may or may not be financial, but it must be reducible to financial terms. Furthermore, it usually involves something in which the insured has an insurable interest established by ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

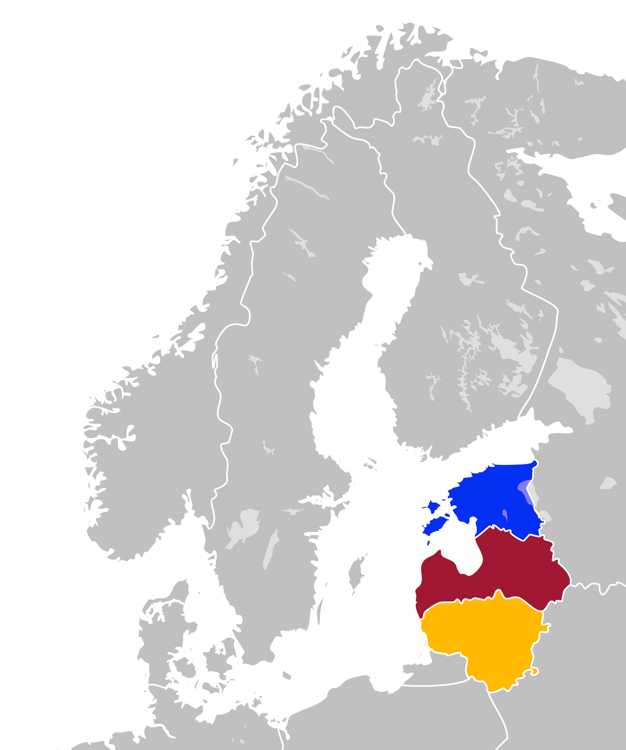

The Baltics

The Baltic states, et, Balti riigid or the Baltic countries is a geopolitical term, which currently is used to group three countries: Estonia, Latvia, and Lithuania. All three countries are members of NATO, the European Union, the Eurozone, and the OECD. The three sovereign states on the eastern coast of the Baltic Sea are sometimes referred to as the "Baltic nations", less often and in historical circumstances also as the "Baltic republics", the "Baltic lands", or simply the Baltics. All three Baltic countries are classified as high-income economies by the World Bank and maintain a very high Human Development Index. The three governments engage in intergovernmental and parliamentary cooperation. There is also frequent cooperation in foreign and security policy, defence, energy, and transportation. The term "Baltic states" ("countries", "nations", or similar) cannot be used unambiguously in the context of cultural areas, national identity, or language. While the majority ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Headquarters

Headquarters (commonly referred to as HQ) denotes the location where most, if not all, of the important functions of an organization are coordinated. In the United States, the corporate headquarters represents the entity at the center or the top of a corporation taking full responsibility for managing all business activities. In the United Kingdom, the term head office (or HO) is most commonly used for the headquarters of large corporations. The term is also used regarding military organizations. Corporate A headquarters is the entity at the top of a corporation that takes full responsibility for the overall success of the corporation, and ensures corporate governance. The corporate headquarters is a key element of a corporate structure and covers different corporate functions such as strategic planning, corporate communications, tax, legal, marketing, finance, human resources, information technology, and procurement. This entity includes the chief executive officer ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |