|

Grow The Pie (phrase)

"Growing the pie" is an expression used in macroeconomics to refer to the assertion that growing the economy of a nation as a whole creates more availability of wealth and work opportunities than does redistribution of wealth. Summary Growing the pie could be called "more for everyone." This is as opposed to centrally controlled economic theory, where some give up some of their slice of the pie, that others might have more. Growing the Pie refers to a theory that free market economics grow the size of every slice, and thus raises the standard of living for all participants. This theory proposes that growing the pie is better than redistribution of pie through a centrally controlled economy. Growing the pie is related to the concept of economic liberalism. Economic Liberalism was first fully formulated by Adam Smith, who advocated minimal interference of government in a market economy, as opposed to Keynesian and centrally planned economic views which support taxing and de ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Macroeconomics

Macroeconomics (from the Greek prefix ''makro-'' meaning "large" + ''economics'') is a branch of economics dealing with performance, structure, behavior, and decision-making of an economy as a whole. For example, using interest rates, taxes, and government spending to regulate an economy's growth and stability. This includes regional, national, and global economies. According to a 2018 assessment by economists Emi Nakamura and Jón Steinsson, economic "evidence regarding the consequences of different macroeconomic policies is still highly imperfect and open to serious criticism." Macroeconomists study topics such as Gross domestic product, GDP (Gross Domestic Product), unemployment (including Unemployment#Measurement, unemployment rates), national income, price index, price indices, output (economics), output, Consumption (economics), consumption, inflation, saving, investment (macroeconomics), investment, Energy economics, energy, international trade, and international finance. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economy

An economy is an area of the production, distribution and trade, as well as consumption of goods and services. In general, it is defined as a social domain that emphasize the practices, discourses, and material expressions associated with the production, use, and management of scarce resources'. A given economy is a set of processes that involves its culture, values, education, technological evolution, history, social organization, political structure, legal systems, and natural resources as main factors. These factors give context, content, and set the conditions and parameters in which an economy functions. In other words, the economic domain is a social domain of interrelated human practices and transactions that does not stand alone. Economic agents can be individuals, businesses, organizations, or governments. Economic transactions occur when two groups or parties agree to the value or price of the transacted good or service, commonly expressed in a certain currency. Ho ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Redistribution Of Wealth

Redistribution of income and wealth is the transfer of income and wealth (including physical property) from some individuals to others through a social mechanism such as taxation, welfare, public services, land reform, monetary policies, confiscation, divorce or tort law. The term typically refers to redistribution on an economy-wide basis rather than between selected individuals. Interpretations of the phrase vary, depending on personal perspectives, political ideologies and the selective use of statistics. It is frequently used in politics, where it is used to refer to perceived redistribution from those who have more to those who have less. Occasionally, however, the term is used to describe laws or policies that cause redistribution in the opposite direction, from the poor to the rich. The phrase is often coupled with the term ''class warfare'', with high-income earners and the wealthy portrayed as victims of unfairness and discrimination. Redistribution tax policy should ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Free Market

In economics, a free market is an economic system in which the prices of goods and services are determined by supply and demand expressed by sellers and buyers. Such markets, as modeled, operate without the intervention of government or any other external authority. Proponents of the free market as a normative ideal contrast it with a regulated market, in which a government intervenes in supply and demand by means of various methods such as taxes or regulations. In an idealized free market economy, prices for goods and services are set solely by the bids and offers of the participants. Scholars contrast the concept of a free market with the concept of a coordinated market in fields of study such as political economy, new institutional economics, economic sociology and political science. All of these fields emphasize the importance in currently existing market systems of rule-making institutions external to the simple forces of supply and demand which create space for those ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Liberalism

Economic liberalism is a political and economic ideology that supports a market economy based on individualism and private property in the means of production. Adam Smith is considered one of the primary initial writers on economic liberalism, and his writing is generally regarded as representing the economic expression of 19th-century liberalism up until the Great Depression and rise of Keynesianism in the 20th century. Historically, economic liberalism arose in response to feudalism and mercantilism. Economic liberalism is associated with markets and private ownership of capital assets. Economic liberals tend to oppose government intervention and protectionism in the market economy when it inhibits free trade and competition, but tend to support government intervention where it protects property rights, opens new markets or funds market growth, and resolves market failures. An economy that is managed according to these precepts may be described as a liberal economy or oper ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Adam Smith

Adam Smith (baptized 1723 – 17 July 1790) was a Scottish economist and philosopher who was a pioneer in the thinking of political economy and key figure during the Scottish Enlightenment. Seen by some as "The Father of Economics"——— or "The Father of Capitalism",———— he wrote two classic works, ''The Theory of Moral Sentiments'' (1759) and ''The Wealth of Nations, An Inquiry into the Nature and Causes of the Wealth of Nations'' (1776). The latter, often abbreviated as ''The Wealth of Nations'', is considered his ''magnum opus'' and the first modern work that treats economics as a comprehensive system and as an academic discipline. Smith refuses to explain the distribution of wealth and power in terms of God's will, God’s will and instead appeals to natural, political, social, economic and technological factors and the interactions between them. Among other economic theories, the work introduced Smith's idea of absolute advantage. Smith studied social philos ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Keynesian

Keynesian economics ( ; sometimes Keynesianism, named after British economist John Maynard Keynes) are the various macroeconomic theories and models of how aggregate demand (total spending in the economy) strongly influences economic output and inflation. In the Keynesian view, aggregate demand does not necessarily equal the productive capacity of the economy. Instead, it is influenced by a host of factors – sometimes behaving erratically – affecting production, employment, and inflation. Keynesian economists generally argue that aggregate demand is volatile and unstable and that, consequently, a market economy often experiences inefficient macroeconomic outcomes – a recession, when demand is low, or inflation, when demand is high. Further, they argue that these economic fluctuations can be mitigated by economic policy responses coordinated between government and central bank. In particular, fiscal policy actions (taken by the government) and monetary policy actions (tak ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Socialism

Market socialism is a type of economic system involving the public, cooperative, or social ownership of the means of production in the framework of a market economy, or one that contains a mix of worker-owned, nationalized, and privately owned enterprises. The central idea is that, as in capitalism, businesses compete for profits, however they will be "owned, or at least governed," by those who work in them. Market socialism differs from non-market socialism in that the market mechanism is utilized for the allocation of capital goods and the means of production. Depending on the specific model of market socialism, profits generated by socially owned firms (i.e., net revenue not reinvested into expanding the firm) may variously be used to directly remunerate employees, accrue to society at large as the source of public finance, or be distributed amongst the population in a social dividend. Market socialism is not exclusive, but can be distinguished from the concept of the mixed ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Deficit Spending

Within the budgetary process, deficit spending is the amount by which spending exceeds revenue over a particular period of time, also called simply deficit, or budget deficit; the opposite of budget surplus. The term may be applied to the budget of a government, private company, or individual. Government deficit spending was first identified as a necessary economic tool by John Maynard Keynes in the wake of the Great Depression. It is a central point of controversy in economics, as discussed below. Controversy Government deficit spending is a central point of controversy in economics, with prominent economists holding differing views. The mainstream economics position is that deficit spending is desirable and necessary as part of countercyclical fiscal policy, but that there should not be a structural deficit (i.e., permanent deficit): The government should run deficits during recessions to compensate for the shortfall in aggregate demand, but should run surpluses in boom ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Consumption (economics)

Consumption is the act of using resources to satisfy current needs and wants. It is seen in contrast to investing, which is spending for acquisition of ''future'' income. Consumption is a major concept in economics and is also studied in many other social sciences. Different schools of economists define consumption differently. According to mainstream economists, only the final purchase of newly produced goods and services by individuals for immediate use constitutes consumption, while other types of expenditure — in particular, fixed investment, intermediate consumption, and government spending — are placed in separate categories (see consumer choice). Other economists define consumption much more broadly, as the aggregate of all economic activity that does not entail the design, production and marketing of goods and services (e.g. the selection, adoption, use, disposal and recycling of goods and services). Economists are particularly interested in the relationship betwee ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

A Rising Tide Lifts All Boats

"A rising tide lifts all boats" is an aphorism associated with the idea that an improved economy will benefit all participants and that economic policy, particularly government economic policy, should therefore focus on broad economic efforts. Origins The phrase is commonly attributed to John F. Kennedy, who used it in a 1963 speech to combat criticisms that a dam project he was inaugurating was a pork barrel project.. However, in his 2009 memoir ''Counselor: A Life At The Edge Of History'', Kennedy's speechwriter, Ted Sorensen, revealed that the phrase was not one of his or the President's own fashioning. It was in Sorensen's first year working for him, during Kennedy's tenure in the Senate, while Sorensen was trying to tackle economic problems in New England, that he happened upon the phrase. He wrote that he noticed that "the regional chamber of commerce, the New England Council, had a thoughtful slogan: 'A rising tide lifts all the boats.'" From then on, Kennedy would borrow ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

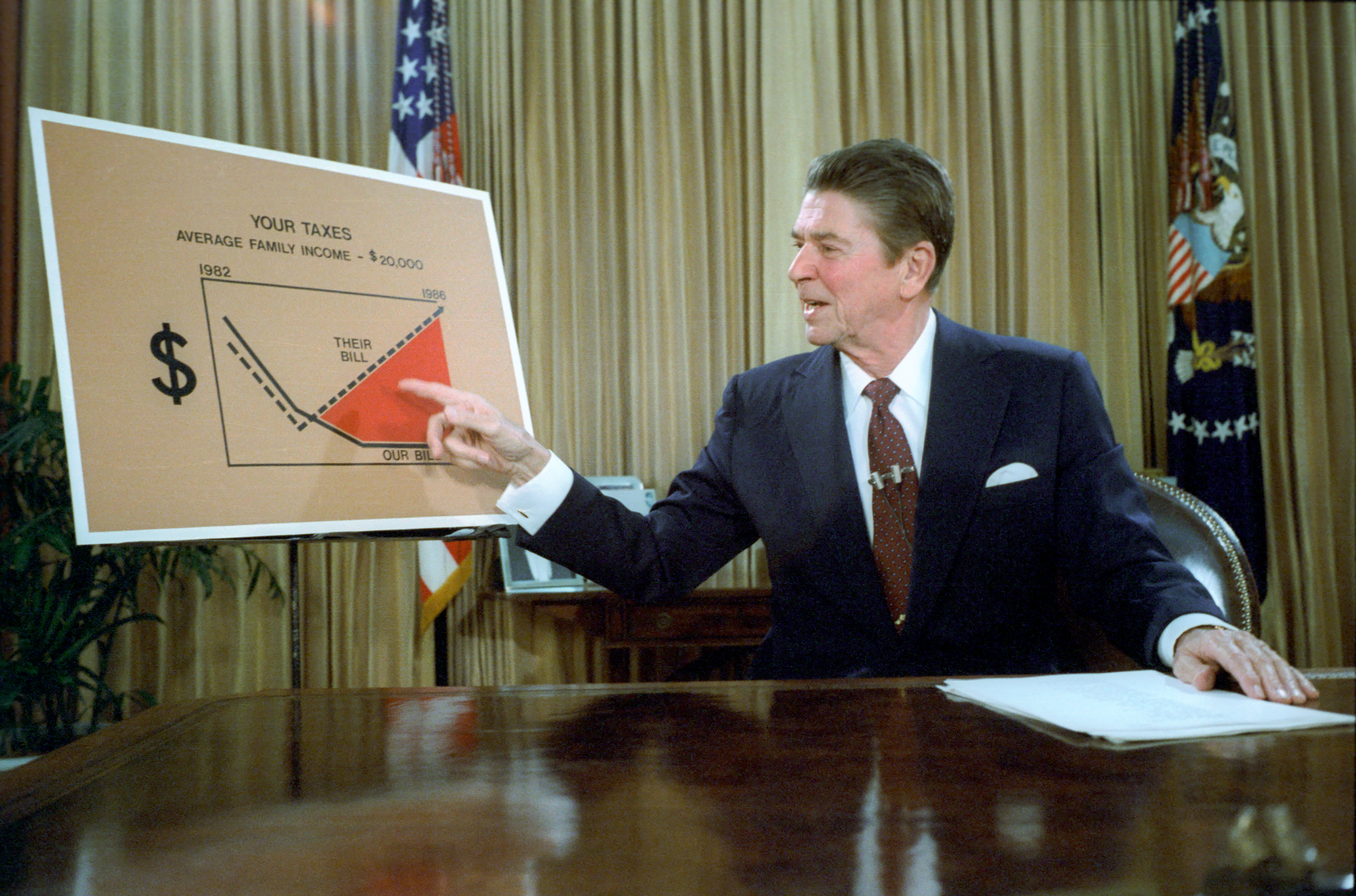

Trickle-down Economics

Trickle-down economics is a term used in critical references to economic policies that favor the upper income brackets, corporations, and individuals with substantial wealth or capital. In recent history, the term has been used by critics of supply-side economics. Whereas general supply-side theory favors lowering taxes overall, trickle-down theory more specifically advocates for a lower tax burden on the upper end of the economic spectrum. Major examples of US Republicans supporting what critics call "trickle-down economics" include the Reagan tax cuts, the Bush tax cuts and the Tax Cuts and Jobs Act of 2017. In each of the aforementioned tax reforms, taxes were cut across all income brackets, but the biggest reductions were given to the highest income earners, although the Reagan Era tax reforms also introduced the earned income tax credit which has received bipartisan praise for poverty reduction and is largely why the bottom half of workers pay no federal income tax. Si ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

_per_capita_in_2020.png)