|

Group Exemption Letter

A Group Exemption Letter or (GEL) is a special letter that is issued by the United States Internal Revenue Service The Internal Revenue Service (IRS) is the revenue service for the United States federal government, which is responsible for collecting U.S. federal taxes and administering the Internal Revenue Code, the main body of the federal statutory ta ... (IRS). A GEL pertains to organizations that have been recognized by the IRS as tax exempt organizations. Many organizations in the United States maintain a GEL and obtaining one can be of benefit to an organization. Overview According to the IRS, a Group Exemption Letter is a ruling or determination letter that is issued to a central organization recognizing, on a group basis, the exemption from Federal income tax under of subordinate organizations on whose behalf the central organization has applied for recognition of exemption. To obtain a GEL, the central organization must have first applied for and received its ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country primarily located in North America. It consists of 50 states, a federal district, five major unincorporated territories, nine Minor Outlying Islands, and 326 Indian reservations. The United States is also in free association with three Pacific Island sovereign states: the Federated States of Micronesia, the Marshall Islands, and the Republic of Palau. It is the world's third-largest country by both land and total area. It shares land borders with Canada to its north and with Mexico to its south and has maritime borders with the Bahamas, Cuba, Russia, and other nations. With a population of over 333 million, it is the most populous country in the Americas and the third most populous in the world. The national capital of the United States is Washington, D.C. and its most populous city and principal financial center is New York City. Paleo-Americ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internal Revenue Service

The Internal Revenue Service (IRS) is the revenue service for the United States federal government, which is responsible for collecting U.S. federal taxes and administering the Internal Revenue Code, the main body of the federal statutory tax law. It is an agency of the Department of the Treasury and led by the Commissioner of Internal Revenue, who is appointed to a five-year term by the President of the United States. The duties of the IRS include providing tax assistance to taxpayers; pursuing and resolving instances of erroneous or fraudulent tax filings; and overseeing various benefits programs, including the Affordable Care Act. The IRS originates from the Commissioner of Internal Revenue, a federal office created in 1862 to assess the nation's first income tax to fund the American Civil War. The temporary measure provided over a fifth of the Union's war expenses before being allowed to expire a decade later. In 1913, the Sixteenth Amendment to the U.S. Constitutio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Tax In The United States

Income taxes in the United States are imposed by the federal government, and most states. The income taxes are determined by applying a tax rate, which may increase as income increases, to taxable income, which is the total income less allowable deductions. Income is broadly defined. Individuals and corporations are directly taxable, and estates and trusts may be taxable on undistributed income. Partnerships are not taxed (with some exceptions in the case of Federal income taxation), but their partners are taxed on their shares of partnership income. Residents and citizens are taxed on worldwide income, while nonresidents are taxed only on income within the jurisdiction. Several types of credits reduce tax, and some types of credits may exceed tax before credits. An alternative tax applies at the federal and some state levels. In the United States, the term "payroll tax" usually refers to FICA taxes that are paid to fund Social Security and Medicare, while "income tax" re ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

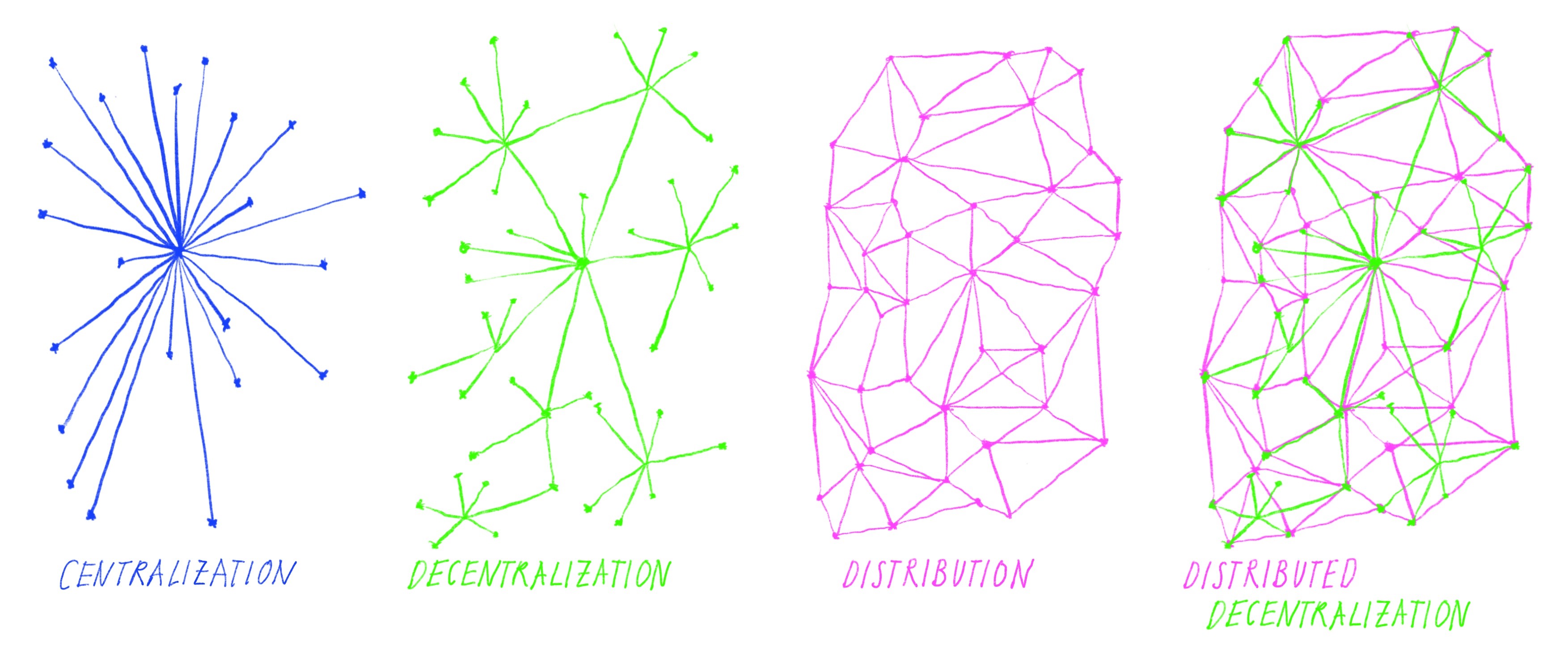

Central Organization

Centralisation or centralization (see spelling differences) is the process by which the activities of an organisation, particularly those regarding planning and decision-making, framing strategy and policies become concentrated within a particular geographical location group. This moves the important decision-making and planning powers within the center of the organisation. The term has a variety of meanings in several fields. In political science, centralisation refers to the concentration of a government's power—both geographically and politically—into a centralised government. An antonym of ''centralisation'' is ''decentralisation''. Centralisation in politics History of the centralisation of authority ''Centralisation of authority'' is the systematic and consistent concentration of authority at a central point or in a person within the organization. This idea was first introduced in the Qin Dynasty of China. The Qin government was highly bureaucratic and was administe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |